GateUser-8c878fc3

No content yet

GateUser-8c878fc3

Markets move in cycles, and every cycle has its own clock.

There was a time when traditional finance ruled the hours, centralized exchanges, brokerage houses, the same gatekeepers pulling the strings. Then came DeFi summer, where on-chain liquidity and yield turned the dial, giving birth to a new rhythm of trading.

But memecoins? They broke the clock completely. Volatility doesn’t sleep. Opportunities appear and vanish within minutes. And yet, the tools traders have been given remain outdated, slow, and fractured — stuck in a timezone that no longer exists.

This is where @LABtrade_ ‘o’ clock b

There was a time when traditional finance ruled the hours, centralized exchanges, brokerage houses, the same gatekeepers pulling the strings. Then came DeFi summer, where on-chain liquidity and yield turned the dial, giving birth to a new rhythm of trading.

But memecoins? They broke the clock completely. Volatility doesn’t sleep. Opportunities appear and vanish within minutes. And yet, the tools traders have been given remain outdated, slow, and fractured — stuck in a timezone that no longer exists.

This is where @LABtrade_ ‘o’ clock b

- Reward

- like

- Comment

- Repost

- Share

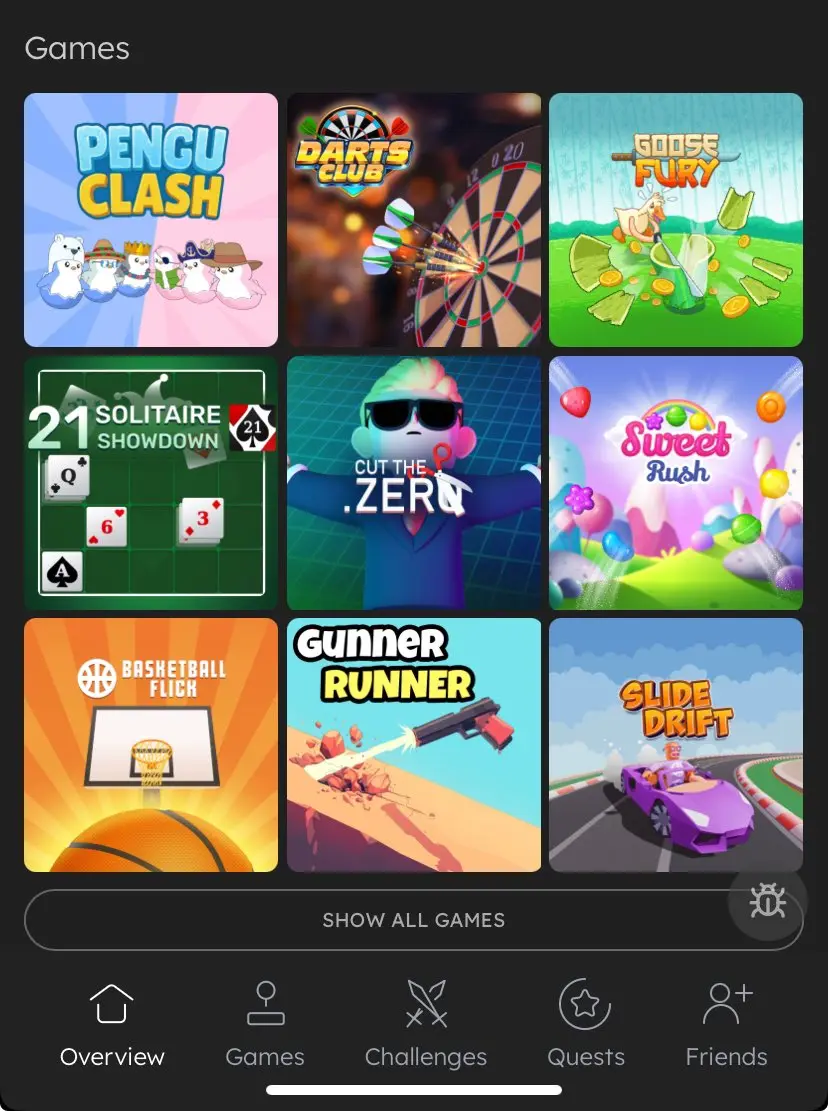

Sometimes I think people underestimate what’s actually happening with @elympics_ai. It’s far from just a new game here and there, it’s the architecture of a new model for gaming.

Think about it: Most Web3 games either sacrifice gameplay for tokens, or hide tokens so deep the “Web3” part barely matters. Elympics flips that script — skill-based competition first, crypto utilities second, all running in real time.

That’s why you see games clock millions of plays, tournaments running on autopilot, and IPs lining up to plug in. It’s the difference between building one project and building an infras

Think about it: Most Web3 games either sacrifice gameplay for tokens, or hide tokens so deep the “Web3” part barely matters. Elympics flips that script — skill-based competition first, crypto utilities second, all running in real time.

That’s why you see games clock millions of plays, tournaments running on autopilot, and IPs lining up to plug in. It’s the difference between building one project and building an infras

- Reward

- like

- Comment

- Repost

- Share

For years, the memecoin market has been defined by an invisible hierarchy:

• At the top: insiders with private channels, devs who seed liquidity, and bots armed with milliseconds of advantage.

• At the bottom: everyday traders clicking “swap” on a DEX, only to find the entry point already gone.

The result? Retail traders were not really participating in memecoin launches, they were subsidizing them. By the time their transactions confirmed, insiders had already rotated positions, and bots had scalped the spread. The edge was never theirs.

This wasn’t just anecdotal. On-chain data shows that in

• At the top: insiders with private channels, devs who seed liquidity, and bots armed with milliseconds of advantage.

• At the bottom: everyday traders clicking “swap” on a DEX, only to find the entry point already gone.

The result? Retail traders were not really participating in memecoin launches, they were subsidizing them. By the time their transactions confirmed, insiders had already rotated positions, and bots had scalped the spread. The edge was never theirs.

This wasn’t just anecdotal. On-chain data shows that in

- Reward

- like

- Comment

- Repost

- Share

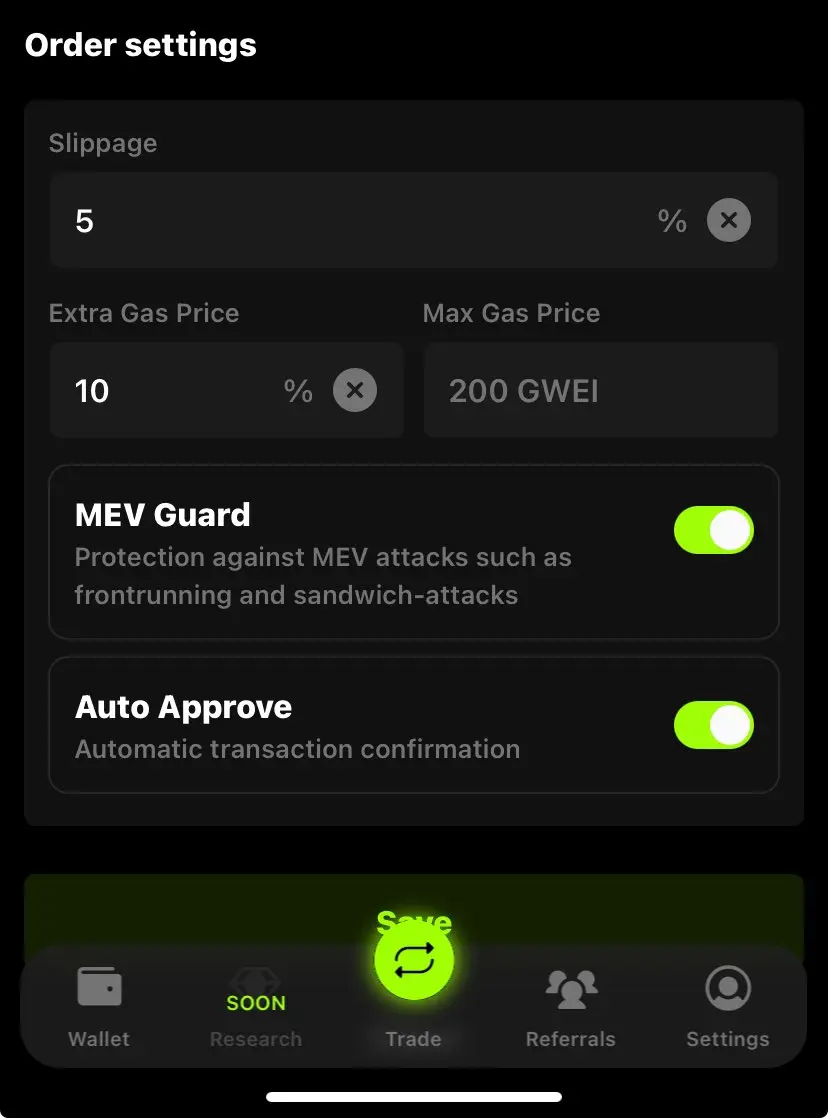

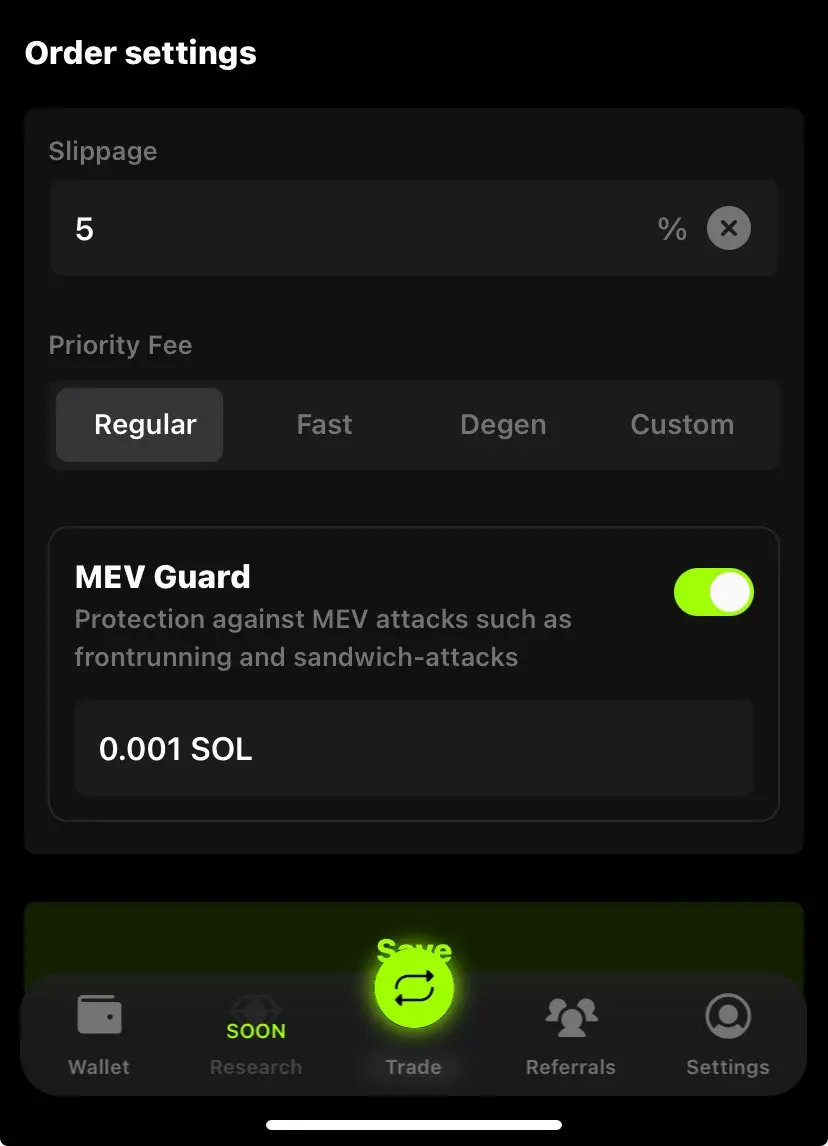

When most people talk about trading, they frame it as two moments: “Entry and Exit”. But if you’ve been around memecoins trading long enough, you know that’s a naïve simplification.

The real story is what happens in between.

You can time the perfect entry and still lose everything because the market is designed to test position sustainability.

• Liquidity can thin out overnight, leaving your tokens untradeable.

• Bots can sandwich your trades, silently draining percentage points from your edge.

• A poorly set slippage tolerance can flip a winning move into a failed execution.

• And sometimes,

The real story is what happens in between.

You can time the perfect entry and still lose everything because the market is designed to test position sustainability.

• Liquidity can thin out overnight, leaving your tokens untradeable.

• Bots can sandwich your trades, silently draining percentage points from your edge.

• A poorly set slippage tolerance can flip a winning move into a failed execution.

• And sometimes,

- Reward

- like

- Comment

- Repost

- Share

Because I have been trading memecoins long enough, I’ve seen the same mistake ruin traders over and over again. And it’s not just bad entries or chasing tops. It’s approvals.

Every time you swap into a shiny new token, you’re forced to “approve” the contract. Most people, in the rush of FOMO, hit “Approve Unlimited” without thinking. And that’s where the trap begins.

What looks like a harmless click can become a blank cheque. Once approved, that contract has ongoing permission to pull funds from your wallet. If the dev slipped in malicious code and in the memecoin arena, many do — then your wa

Every time you swap into a shiny new token, you’re forced to “approve” the contract. Most people, in the rush of FOMO, hit “Approve Unlimited” without thinking. And that’s where the trap begins.

What looks like a harmless click can become a blank cheque. Once approved, that contract has ongoing permission to pull funds from your wallet. If the dev slipped in malicious code and in the memecoin arena, many do — then your wa

- Reward

- like

- Comment

- Repost

- Share

Here’s the Invisible Heist in Memecoin Trading.

For years, traders thought volatility was their biggest enemy. But beneath the charts, a quieter thief has been draining profits: MEV (Maximal Extractable Value).

Here’s the uncomfortable truth—most memecoin traders never lose only to the market. They lose to bots.

Picture this: you place a $1,000 buy order on a hot token. A bot scans the mempool, sneaks in before you, drives the price higher, lets your order hit at the worse rate, then sells back instantly. You get fewer tokens, the bot walks away with risk-free profit.

This sandwich attack has

For years, traders thought volatility was their biggest enemy. But beneath the charts, a quieter thief has been draining profits: MEV (Maximal Extractable Value).

Here’s the uncomfortable truth—most memecoin traders never lose only to the market. They lose to bots.

Picture this: you place a $1,000 buy order on a hot token. A bot scans the mempool, sneaks in before you, drives the price higher, lets your order hit at the worse rate, then sells back instantly. You get fewer tokens, the bot walks away with risk-free profit.

This sandwich attack has

- Reward

- like

- Comment

- Repost

- Share

Last night, I set a position on @LABtrade_ and left it to run while I slept. Normally, that comes with a fair dose of uncertainty. Think slippage creeping in, liquidity gaps, and delayed execution.

But this morning, the play had already matured into profit. What stood out wasn’t just the result, but how it happened. The execution was clean, orders routed instantly, and pricing held steady without hidden inefficiencies eating into the margin. Labtrade’s infra didn’t just take the trade, it carried it through the volatility with precision.

That’s the edge: strategy plays out exactly as planned,

But this morning, the play had already matured into profit. What stood out wasn’t just the result, but how it happened. The execution was clean, orders routed instantly, and pricing held steady without hidden inefficiencies eating into the margin. Labtrade’s infra didn’t just take the trade, it carried it through the volatility with precision.

That’s the edge: strategy plays out exactly as planned,

- Reward

- like

- Comment

- Repost

- Share

You know the saying that “Markets don’t move politely?” I can relate now because, they lurch, spike, retrace, and often punish hesitation. In that chaos, the smallest detail in how an order is executed can decide whether a strategy works or collapses. It’s not the chart alone that determines outcome, but the precision of the trade itself.

This is where “market order settings” matter, not as technical jargon hidden deep in a platform, but as the very tools that keep traders in control when the market tries to wrestle it away.

On @LABtrade_, order execution has been engineered with the realitie

This is where “market order settings” matter, not as technical jargon hidden deep in a platform, but as the very tools that keep traders in control when the market tries to wrestle it away.

On @LABtrade_, order execution has been engineered with the realitie

- Reward

- like

- Comment

- Repost

- Share

If you’re still in doubt about using @LABtrade_, here’s one of the million reasons to trust it.

I always say security in trading is not luxury, it ought to be the foundation. Every transaction, every position you open, every swap you execute relies on one thing: trust that your assets are safe. History has shown us what happens when platforms cut corners. From compromised private keys to phishing exploits, billions have been lost because security was treated as an afterthought.

LabTrade refuses to play that game. By integrating with @turnkeyhq, the industry’s leading wallet infrastructure pro

I always say security in trading is not luxury, it ought to be the foundation. Every transaction, every position you open, every swap you execute relies on one thing: trust that your assets are safe. History has shown us what happens when platforms cut corners. From compromised private keys to phishing exploits, billions have been lost because security was treated as an afterthought.

LabTrade refuses to play that game. By integrating with @turnkeyhq, the industry’s leading wallet infrastructure pro

- Reward

- like

- Comment

- Repost

- Share

The wait is over and the portal is now open!

Kyle’s on the run, breaking free from Data-Bo-Data, chasing bugs (his favorite snack), and pushing beyond the edge of sanity. But this isn’t just another quirky game drop… this is @Doodles_UP: Kyle’s Escape, built on @elympics_ai Play2Win infra, and over 100,000 players were lined up before the first point was even scored.

This is what happens when you fuse one of Web3’s most recognizable IPs with the backbone of competitive, tokenized gaming. The moment you hit “play,” you’re in an environment where multiplayer sync feels instant, leaderboards upda

Kyle’s on the run, breaking free from Data-Bo-Data, chasing bugs (his favorite snack), and pushing beyond the edge of sanity. But this isn’t just another quirky game drop… this is @Doodles_UP: Kyle’s Escape, built on @elympics_ai Play2Win infra, and over 100,000 players were lined up before the first point was even scored.

This is what happens when you fuse one of Web3’s most recognizable IPs with the backbone of competitive, tokenized gaming. The moment you hit “play,” you’re in an environment where multiplayer sync feels instant, leaderboards upda

- Reward

- like

- Comment

- Repost

- Share

The worse could’ve happened today! 🤲🏻

I was eyeing a hyped memecoin with great community buzz, then I tried making entry leveraging @LABtrade_ terminal. Somehow, LAB’s order flow showed a sudden pattern of single-wallet sell walls creeping down the order book — a telltale sign of a planned dump.

So instead of entering, I watched the wallet addresses in LAB’s built-in tracker and saw them offloading in blocks just under the daily pivot point.

Minutes later, the token collapsed 40%.

Not even a fancy TA could have saved me here, but LAB’s real-time on-chain + order book combo did.

So bro to bro

I was eyeing a hyped memecoin with great community buzz, then I tried making entry leveraging @LABtrade_ terminal. Somehow, LAB’s order flow showed a sudden pattern of single-wallet sell walls creeping down the order book — a telltale sign of a planned dump.

So instead of entering, I watched the wallet addresses in LAB’s built-in tracker and saw them offloading in blocks just under the daily pivot point.

Minutes later, the token collapsed 40%.

Not even a fancy TA could have saved me here, but LAB’s real-time on-chain + order book combo did.

So bro to bro

- Reward

- like

- Comment

- Repost

- Share

As a trader, nothing stings more than watching the market reverse just a few points from your limit order… only to take off without you. I have been there a couple of times and It’s a clear reminder that timing is not just important, it’s everything.

That’s the pain “Smart Order” was built to erase by @LABtrade_.

Born from the frustrations and fine-tuned instincts of seasoned DEX traders, Smart Order is your precision strike system for catching opportunities before they slip away. It doesn’t just react to the market, it positions you inside its rhythm.

Here, you define the rules:

Set your ide

That’s the pain “Smart Order” was built to erase by @LABtrade_.

Born from the frustrations and fine-tuned instincts of seasoned DEX traders, Smart Order is your precision strike system for catching opportunities before they slip away. It doesn’t just react to the market, it positions you inside its rhythm.

Here, you define the rules:

Set your ide

- Reward

- like

- Comment

- Repost

- Share

Most players see the @elympics_ai Cockpit as just a game dashboard, but for us who have been here since day one, knows that, under the surface it’s constantly running a real-time telemetry system that tracks every match event, latency spike, player action, and outcome frame-by-frame.

Now why does this matter? Because that data isn’t just for leaderboards, it feeds directly into the Open Data Protocol. This allows Elympics to:

• Generate AI-ready datasets for developers to build smarter matchmaking algorithms, adaptive difficulty, and predictive anti-cheat systems.

• Benchmark performance acros

Now why does this matter? Because that data isn’t just for leaderboards, it feeds directly into the Open Data Protocol. This allows Elympics to:

• Generate AI-ready datasets for developers to build smarter matchmaking algorithms, adaptive difficulty, and predictive anti-cheat systems.

• Benchmark performance acros

- Reward

- 1

- Comment

- Repost

- Share

$ELP is waking up.🤑

After weeks of tight range trading, today we’ve just seen a clean breakout from a tight consolidation range, pushing up +7.59% in the last session. Price has reclaimed and is now sitting above the short-term moving averages (MA5: 0.003407, MA10: 0.003372, MA30: 0.003322), which are fanning upward — a sign of strengthening momentum. The golden cross between MA5 and MA10 is confirmation that short-term traders are taking control of the trend.

However, volume is the real tell here. At 7.85M $ELP traded over 24h, there’s clear interest returning to the market. Liquidity is flo

After weeks of tight range trading, today we’ve just seen a clean breakout from a tight consolidation range, pushing up +7.59% in the last session. Price has reclaimed and is now sitting above the short-term moving averages (MA5: 0.003407, MA10: 0.003372, MA30: 0.003322), which are fanning upward — a sign of strengthening momentum. The golden cross between MA5 and MA10 is confirmation that short-term traders are taking control of the trend.

However, volume is the real tell here. At 7.85M $ELP traded over 24h, there’s clear interest returning to the market. Liquidity is flo

- Reward

- 1

- Comment

- Repost

- Share