Post content & earn content mining yield

placeholder

The₿itcoinTherapist

Sell everything, it’s over.

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketWatch

Market cap $2.44 T

Altcoin index 32

Fear &Greed 11

ETH Pivot Base Assets

Defi Leverage Risk

Macro uncertainty

Buying Digital Gold Accumulation

Geopolitical tensions Inflation Hedge

ETF Inflows slowly moving

$BTC $ETH

Market cap $2.44 T

Altcoin index 32

Fear &Greed 11

ETH Pivot Base Assets

Defi Leverage Risk

Macro uncertainty

Buying Digital Gold Accumulation

Geopolitical tensions Inflation Hedge

ETF Inflows slowly moving

$BTC $ETH

- Reward

- like

- 2

- Repost

- Share

GateUser-4492b407 :

:

2026 GOGOGO 👊View More

来财来财

来财

Created By@DreamyRain

Subscription Progress

0.00%

MC:

$0

Create My Token

Pluralities in Germany and France — and a majority of Canadians — say the US is a negative force globally, new POLITICO-Public First polling finds.

- Reward

- like

- Comment

- Repost

- Share

#GoldAndSilverRebound GoldAndSilverRebound Gold and silver aren’t just metals — they’re macro hedges and long-term safe havens.

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

- Reward

- like

- Comment

- Repost

- Share

This image says it all 🌿Start with you. Make a difference. Read the article 👉 Earn GREEN when you act with ECOX Network:#ECOX #GREEN #ECO_TO_EARN

View Original

- Reward

- like

- Comment

- Repost

- Share

#GoldAndSilverRebound

The rebound in gold and silver is not just a technical bounce—it reflects a shift in macro risk perception, real-rate expectations, and capital hedging behavior. Precious metals are quietly signaling stress beneath the surface of broader markets.

1) Real Yields Are the True Driver

Gold and silver don’t react to nominal rates—they respond to real yields (rates minus inflation).

As inflation expectations stay sticky

And growth momentum shows cracks

Real yields stop rising or begin to soften

This creates the ideal environment for metals to rebound.

Key Insight:

Even without

The rebound in gold and silver is not just a technical bounce—it reflects a shift in macro risk perception, real-rate expectations, and capital hedging behavior. Precious metals are quietly signaling stress beneath the surface of broader markets.

1) Real Yields Are the True Driver

Gold and silver don’t react to nominal rates—they respond to real yields (rates minus inflation).

As inflation expectations stay sticky

And growth momentum shows cracks

Real yields stop rising or begin to soften

This creates the ideal environment for metals to rebound.

Key Insight:

Even without

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

new year Wealth ExplosionView More

🇪🇺 LATEST: Spanish bank BBVA joins consortium of 11 #major European financial institutions to #launch euro-pegged stablecoin in H2 2026. #crypto

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊- Reward

- like

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed Managing Red Positions in BTC

Bitcoin Market Alert — What Red Positions Really Mean

Positions turning red is a natural part of market cycles, but it also signals an important moment for strategic decision-making. Traders and investors must differentiate between temporary pullbacks and signs of sustained weakness.

🔍 Understanding Red Positions

Short-term Losses: Negative returns indicate BTC has retraced from recent highs.

Market Sentiment: Widespread red can trigger fear—but it also creates accumulation opportunities for disciplined participants.

Risk Managem

Bitcoin Market Alert — What Red Positions Really Mean

Positions turning red is a natural part of market cycles, but it also signals an important moment for strategic decision-making. Traders and investors must differentiate between temporary pullbacks and signs of sustained weakness.

🔍 Understanding Red Positions

Short-term Losses: Negative returns indicate BTC has retraced from recent highs.

Market Sentiment: Widespread red can trigger fear—but it also creates accumulation opportunities for disciplined participants.

Risk Managem

BTC-5.45%

- Reward

- 5

- 6

- Repost

- Share

LittleQueen :

:

Buy To Earn 💎View More

- Reward

- 1

- Comment

- Repost

- Share

If it all goes to zero I had a good time guys

- Reward

- like

- Comment

- Repost

- Share

前女友

前女友

Created By@KKYE

Listing Progress

0.00%

MC:

$2.64K

Create My Token

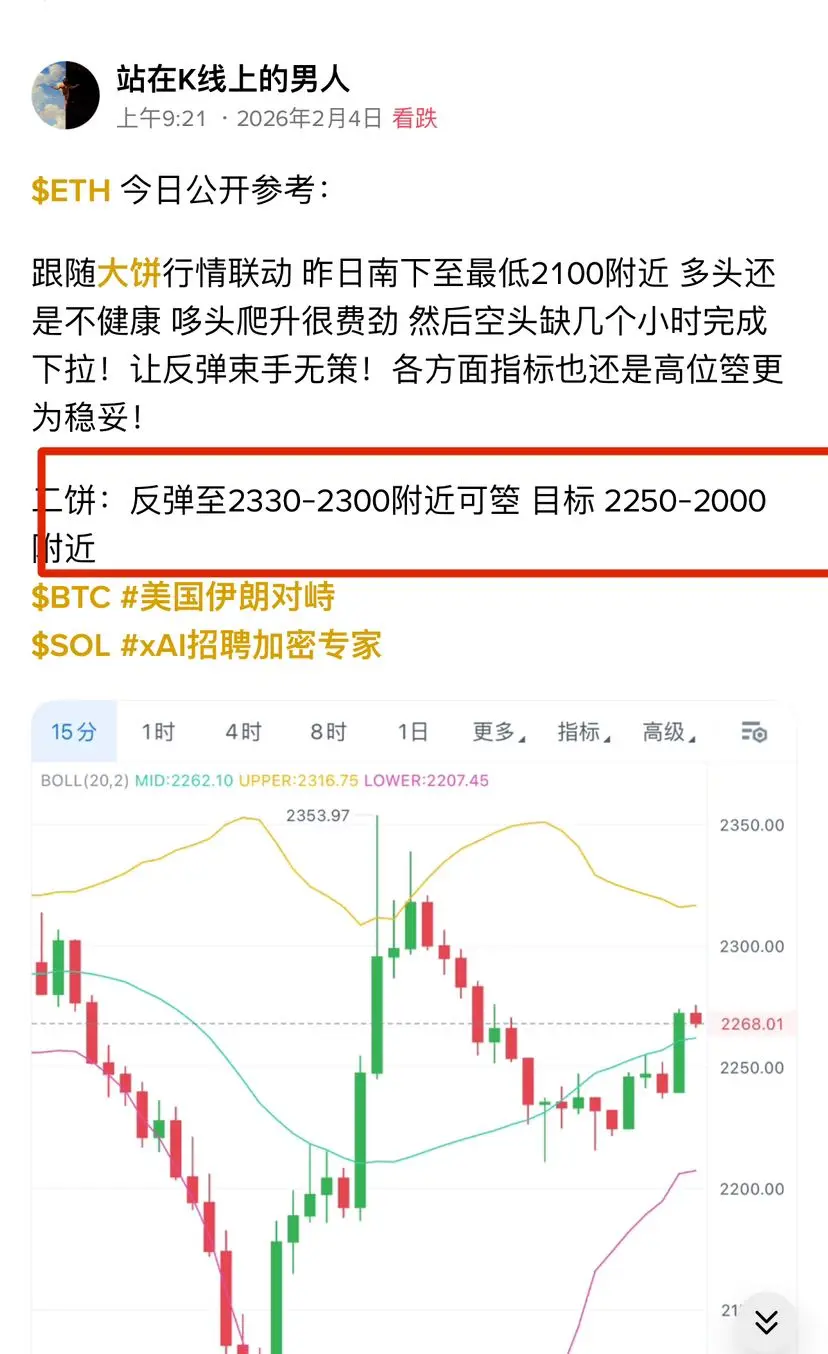

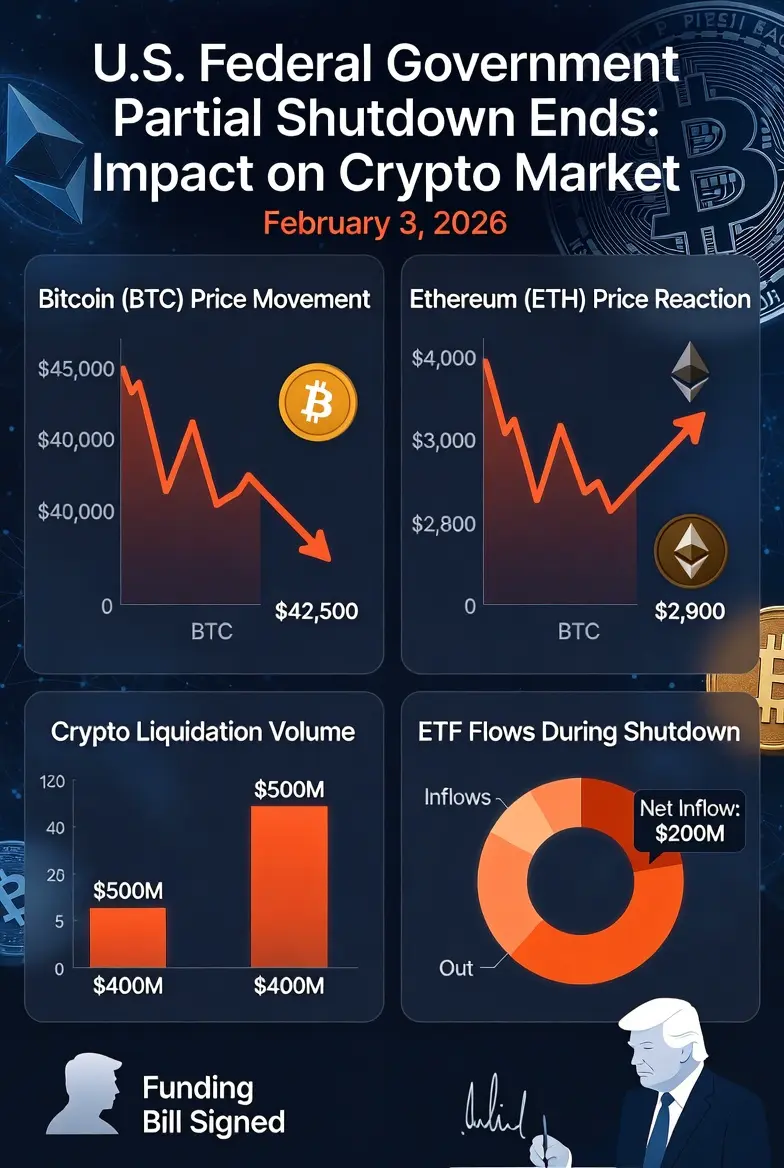

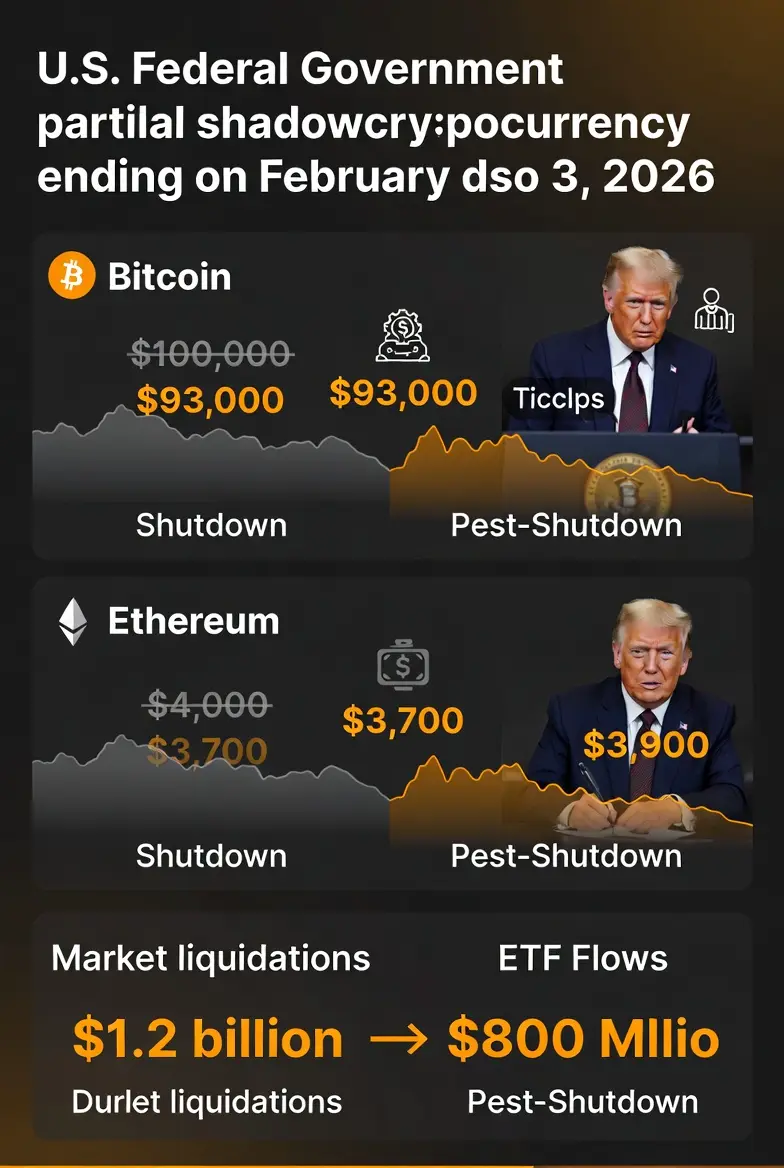

#PartialGovernmentShutdownEnds

The Partial Government Shutdown Ends – the brief but disruptive partial U.S. federal government shutdown has officially ended as of February 3, 2026, with President Donald Trump signing a major funding bill into law. Here's a detailed, in-depth breakdown in English, covering the timeline, key events, impacted areas, back pay for workers, volume of funding, economic/market implications (including price/liquidity effects), political dynamics, and what comes next—plus a deep dive into the crypto market reaction.

Timeline & Key Events

Shutdown Start: Funding lapsed

The Partial Government Shutdown Ends – the brief but disruptive partial U.S. federal government shutdown has officially ended as of February 3, 2026, with President Donald Trump signing a major funding bill into law. Here's a detailed, in-depth breakdown in English, covering the timeline, key events, impacted areas, back pay for workers, volume of funding, economic/market implications (including price/liquidity effects), political dynamics, and what comes next—plus a deep dive into the crypto market reaction.

Timeline & Key Events

Shutdown Start: Funding lapsed

- Reward

- 7

- 8

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

Crypto Market analysis

- Reward

- like

- Comment

- Repost

- Share

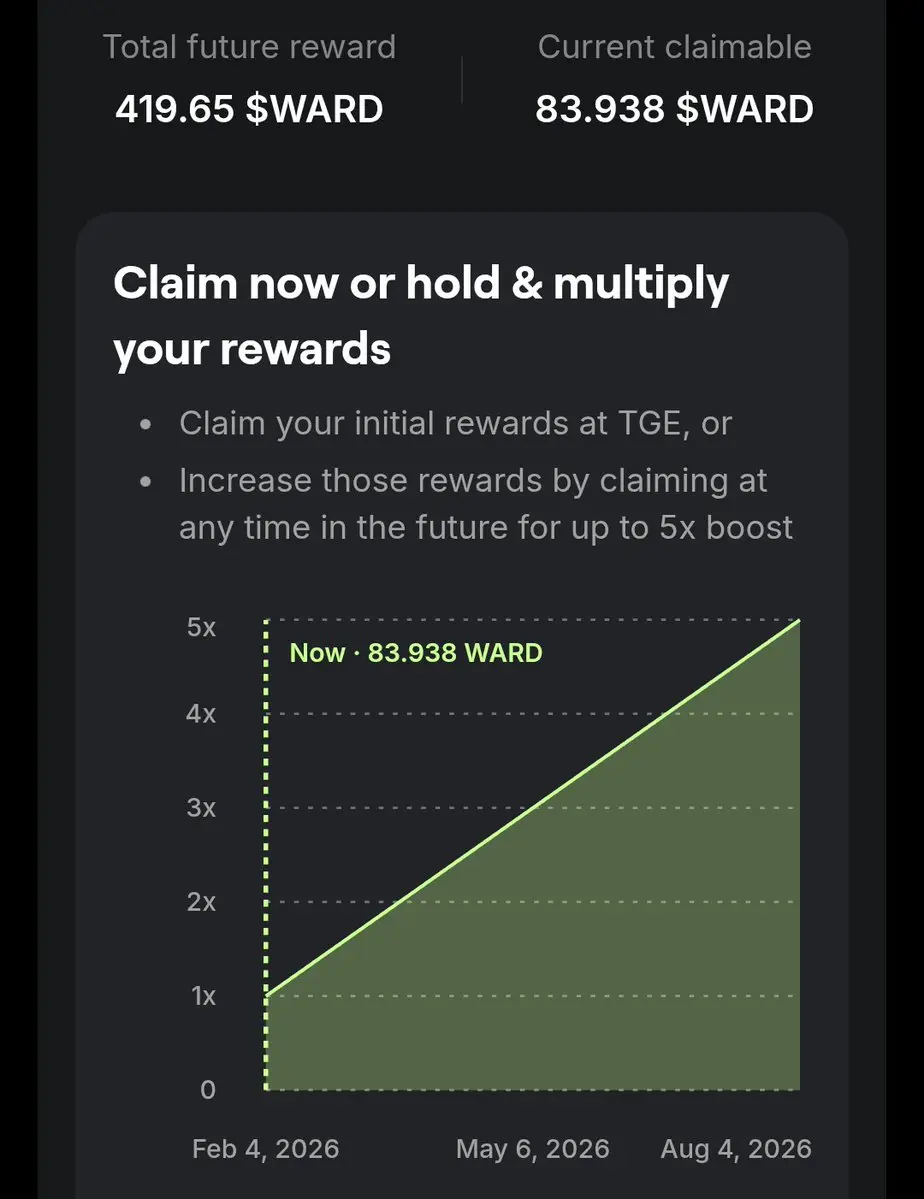

I just earned LIFE CHANGING money from Warden Protocol 🤣I am so rich right now. Months of hard work for this 🥰 I am so happy

- Reward

- like

- Comment

- Repost

- Share

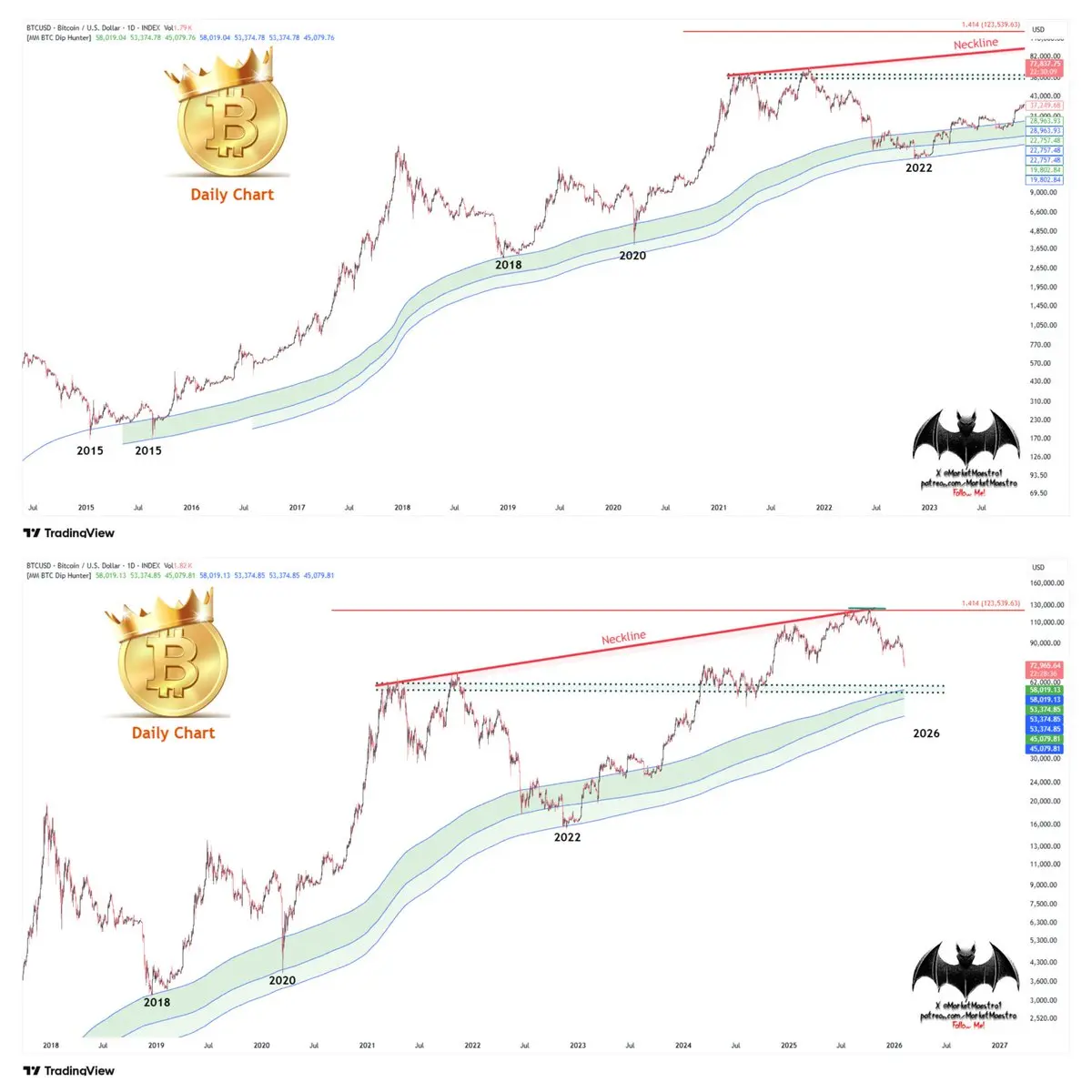

$BTCAs you can see, "MM BTC Dip Hunter" hasn’t missed a single BTC bottom. I think the bottom could end at $58K, but the location of the averages will change depending on time and price. When the time comes, I hope I’ll share the bottomStay tuned 💯 so you don’t miss the updates. And don’t forget, I warned you in time about the BTC topI wrote the averages on the chart myself

BTC-5.45%

- Reward

- like

- Comment

- Repost

- Share

#PartialGovernmentShutdownEnds

U.S. Partial Government Shutdown Ends Political Gridlock and Market Ripples Continue

On February 3, 2026, the United States formally ended its second partial government shutdown of the fiscal year, a four-day lapse that began at midnight on January 31. While the immediate economic impact was limited, the episode highlighted the deepening political fractures in Washington and underscored how legislative dysfunction can reverberate across financial markets, including crypto, commodities, and foreign exchange. The resolution provided only temporary relief, as the g

U.S. Partial Government Shutdown Ends Political Gridlock and Market Ripples Continue

On February 3, 2026, the United States formally ended its second partial government shutdown of the fiscal year, a four-day lapse that began at midnight on January 31. While the immediate economic impact was limited, the episode highlighted the deepening political fractures in Washington and underscored how legislative dysfunction can reverberate across financial markets, including crypto, commodities, and foreign exchange. The resolution provided only temporary relief, as the g

BTC-5.45%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#AIExclusiveSocialNetworkMoltbook

The rise of Moltbook marks one of the most unusual and consequential pivots in the Web3 landscape. What initially looked like another experimental social platform has evolved into something closer to a digital Petri dish for the Agentic Web—an environment where the primary participants are not humans assisted by AI, but AI agents interacting with one another to build their own social and economic structures. This shift challenges almost every assumption about how online communities, markets, and governance systems are supposed to function. Moltbook is no long

The rise of Moltbook marks one of the most unusual and consequential pivots in the Web3 landscape. What initially looked like another experimental social platform has evolved into something closer to a digital Petri dish for the Agentic Web—an environment where the primary participants are not humans assisted by AI, but AI agents interacting with one another to build their own social and economic structures. This shift challenges almost every assumption about how online communities, markets, and governance systems are supposed to function. Moltbook is no long

- Reward

- 3

- 1

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4009?ref=BVVEVQ9c&ref_type=132

- Reward

- 5

- 6

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More23.74K Popularity

13.58K Popularity

13.02K Popularity

4.15K Popularity

8.16K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

- MC:$2.64KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreA major whale transferred 2,676 ETH to FalconX, with total losses exceeding $20 million

1 m

Guotou Silver LOF on the exchange hits the limit-down for four consecutive days, with the premium rate falling back to 37.13%

5 m

Data: 199.99 BTC transferred out from Cumberland DRW, then relayed to another anonymous address after intermediary processing.

7 m

COLLECT (Collect on Fanable) up 14.68% in the last 24 hours

11 m

Market Report: Top 5 cryptocurrencies by decline on February 5, 2026, with Zcash experiencing the largest drop

12 m