Post content & earn content mining yield

placeholder

ox_Alan

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 4

- Comment

- Repost

- Share

#CryptoMarketWatch

The crypto market is currently in the red, with most major coins trading lower amid heavy selling pressure, macroeconomic uncertainty, and leverage unwinding. Bitcoin (BTC) is hovering in the $82,000–$83,000 range, after briefly dipping near $81,000, while Ethereum (ETH), Solana (SOL), XRP, and other top altcoins are down 5–8%+ in the last 24 hours.

BTC is down roughly 1.5%–3% in 24 hours and 8–9% over the past week, reflecting a cooldown from its recent all-time high near $126,000. The total crypto market cap has fallen to around $2.8–$2.9 trillion, signaling a broad marke

The crypto market is currently in the red, with most major coins trading lower amid heavy selling pressure, macroeconomic uncertainty, and leverage unwinding. Bitcoin (BTC) is hovering in the $82,000–$83,000 range, after briefly dipping near $81,000, while Ethereum (ETH), Solana (SOL), XRP, and other top altcoins are down 5–8%+ in the last 24 hours.

BTC is down roughly 1.5%–3% in 24 hours and 8–9% over the past week, reflecting a cooldown from its recent all-time high near $126,000. The total crypto market cap has fallen to around $2.8–$2.9 trillion, signaling a broad marke

- Reward

- 1

- Comment

- Repost

- Share

湾湾请回家

湾湾湾湾

Created By@XuanyuanSword9

Subscription Progress

0.00%

MC:

$0

Create My Token

【$BTC Signal】Empty Position + Observation of Volume-Price Divergence

$BTC Volume-price divergence appears near historical highs, with prices slightly declining but open interest remaining high. Market logic suggests caution against long liquidation or main force distribution risks.

🎯 Direction: Empty Position

The current market shows falling prices accompanied by high open interest, which is a typical "cooling period" warning signal. Price action (PA) indicates weak buying absorption, with stagnation or slight decline in prices under high open interest, often a precursor to a shift between

$BTC Volume-price divergence appears near historical highs, with prices slightly declining but open interest remaining high. Market logic suggests caution against long liquidation or main force distribution risks.

🎯 Direction: Empty Position

The current market shows falling prices accompanied by high open interest, which is a typical "cooling period" warning signal. Price action (PA) indicates weak buying absorption, with stagnation or slight decline in prices under high open interest, often a precursor to a shift between

BTC-0.55%

- Reward

- like

- Comment

- Repost

- Share

【$W Signal】Empty position + Downtrend accompanied by open interest warning

$W Price drops -1.12%, trading volume 8.68 million, but open interest reaches 180 million. Market logic suggests that the combination of open interest should be considered to determine whether it is a long squeeze or main force distribution. The current market shows a decline accompanied by high open interest, indicating a high-risk uncertain state that does not align with a high-probability trading structure.

🎯 Direction: Short position

Waiting for price action to provide clear signals of bullish support or continue

View Original$W Price drops -1.12%, trading volume 8.68 million, but open interest reaches 180 million. Market logic suggests that the combination of open interest should be considered to determine whether it is a long squeeze or main force distribution. The current market shows a decline accompanied by high open interest, indicating a high-risk uncertain state that does not align with a high-probability trading structure.

🎯 Direction: Short position

Waiting for price action to provide clear signals of bullish support or continue

- Reward

- like

- Comment

- Repost

- Share

Why is silver easier to tokenize than gold?

Many people ask: since gold can also be tokenized, why has the market recently shown more interest in silver?

The answer is quite practical: because silver's volatility naturally aligns better with the risk preferences of crypto users.

Gold tends to be more stable, mainly used for asset allocation; silver is more volatile, making it easier to generate trading opportunities, and it also better matches the "high elasticity" nature of the crypto world.

In addition, silver has a special identity in the real world: it is both a precious metal and an indus

Many people ask: since gold can also be tokenized, why has the market recently shown more interest in silver?

The answer is quite practical: because silver's volatility naturally aligns better with the risk preferences of crypto users.

Gold tends to be more stable, mainly used for asset allocation; silver is more volatile, making it easier to generate trading opportunities, and it also better matches the "high elasticity" nature of the crypto world.

In addition, silver has a special identity in the real world: it is both a precious metal and an indus

View Original

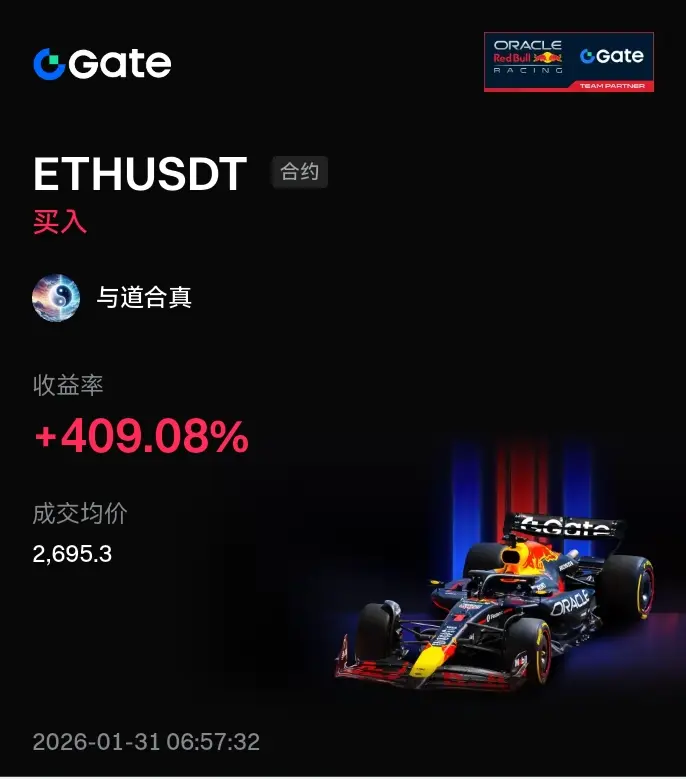

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 2

- Repost

- Share

CoinWay :

:

2026 Go Go Go 👊View More

Bitcoin is dropping after news broke that Donald Trump is likely to nominate Kevin Warsh as the next Federal Reserve chair. Warsh is known for his "hawkish" stance, which means he typically supports higher interest rates and a tighter money supply. As soon as speculation picked up around his possible nomination, Bitcoin fell to a two-month low near $81,000.

Here's why this hit the crypto market so fast:

- Investors worry that a Fed led by Warsh would be less willing to flood the market with cheap money ("liquidity"). Bitcoin and other cryptocurrencies thrived during years of low rates and ampl

Here's why this hit the crypto market so fast:

- Investors worry that a Fed led by Warsh would be less willing to flood the market with cheap money ("liquidity"). Bitcoin and other cryptocurrencies thrived during years of low rates and ampl

BTC-0.55%

- Reward

- 17

- 11

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

【$ONDO Signal】Short position + Decline accompanied by abnormal trading volume

$ONDO Price decline accompanied by high trading volume, market logic suggests caution against long liquidation or main force distribution risks. The current market lacks a clear bottom absorption structure, so it is not advisable to blindly buy the dip.

🎯 Direction: Short position

Wait for price action to give a clear bottom signal or a reversal failure pattern. In the current environment, protecting capital is more important than seeking opportunities.

Trade here 👇 $ONDO

---

Follow me: Get more real-time analysi

$ONDO Price decline accompanied by high trading volume, market logic suggests caution against long liquidation or main force distribution risks. The current market lacks a clear bottom absorption structure, so it is not advisable to blindly buy the dip.

🎯 Direction: Short position

Wait for price action to give a clear bottom signal or a reversal failure pattern. In the current environment, protecting capital is more important than seeking opportunities.

Trade here 👇 $ONDO

---

Follow me: Get more real-time analysi

ONDO-1.32%

- Reward

- like

- Comment

- Repost

- Share

Tracking real-time hot topics in the crypto world and seizing the best trading opportunities. Today is Saturday, January 31, 2026. I am Wang Yibo! Good morning, fellow crypto enthusiasts☀Iron fans check-in👍Like and make a fortune🍗🍗🌹🌹

==================================

💎

💎

==================================

The three major US stock indices closed lower, with the Dow down 0.36%, up 1.73% in January; the Nasdaq down 0.94%, up 0.95% in January; the S&P 500 down 0.43%, up 1.37% in January. On Friday, the US dollar surged significantly, marking the largest single-day gain since July, while go

View Original==================================

💎

💎

==================================

The three major US stock indices closed lower, with the Dow down 0.36%, up 1.73% in January; the Nasdaq down 0.94%, up 0.95% in January; the S&P 500 down 0.43%, up 1.37% in January. On Friday, the US dollar surged significantly, marking the largest single-day gain since July, while go

- Reward

- 1

- 2

- Repost

- Share

MakeSteadyProfits :

:

感谢老师的分享!祝愿:老师发财!朋友们都发财!💰💰💰View More

【$W Signal】Short position + decline accompanied by abnormal open interest

$W Price decline accompanied by high open interest, market logic suggests caution against main force distribution risk. The market shows persistent selling pressure, with no effective buying absorption observed.

🎯 Direction: Short position

The current structure is relatively weak, and price action indicates that downward momentum has not yet been fully released. Price declines under high open interest typically indicate intense battles between bulls and bears, but combined with a lack of resistance in the downward tre

View Original$W Price decline accompanied by high open interest, market logic suggests caution against main force distribution risk. The market shows persistent selling pressure, with no effective buying absorption observed.

🎯 Direction: Short position

The current structure is relatively weak, and price action indicates that downward momentum has not yet been fully released. Price declines under high open interest typically indicate intense battles between bulls and bears, but combined with a lack of resistance in the downward tre

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

㎡

扑街

Created By@ListeningToOthers'Stories

Listing Progress

0.00%

MC:

$3.23K

Create My Token

I called $molt at 100k, it just it $89MI WILL MAKE A NEW CALL TOMORROW AT 6:00PM UTC,IT WILL GO FROM 50K TO 100M,YOU STILL DONT FOLLOW ME, REMAIN POOR .

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

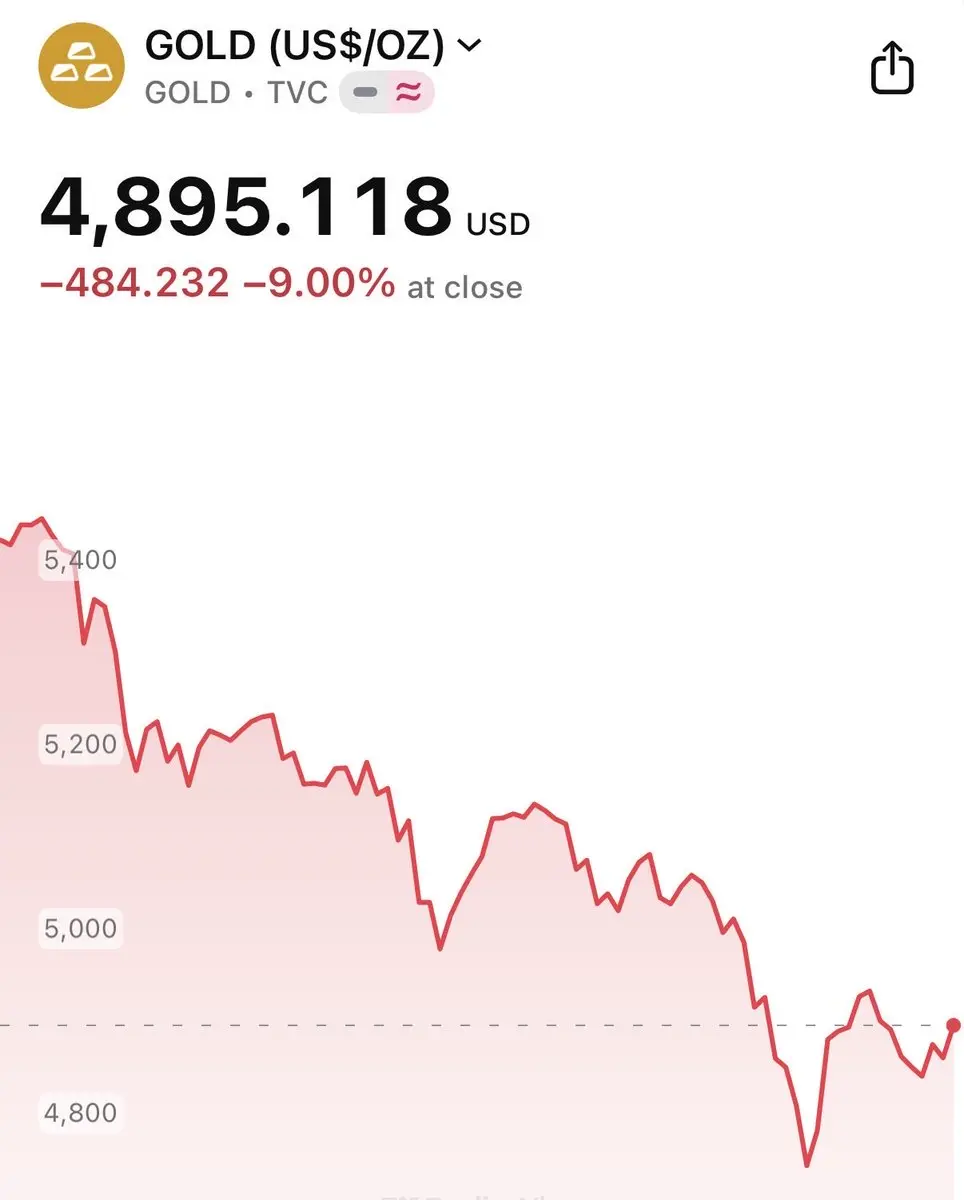

Be honest, did you listen to Peter Schiff and buy the top at $5,600 just a day ago? 🤔

- Reward

- 1

- Comment

- Repost

- Share

#TokenizedSilverTrend #TokenizedSilverTrend 🪙

The future of precious metals is no longer locked inside vaults — it’s moving on-chain. Tokenized silver is emerging as one of the most powerful bridges between traditional commodities and decentralized finance, creating a brand-new way for everyday investors to access real-world value with digital speed.

For decades, silver has been known as a safe-haven asset, a hedge against inflation, and a critical industrial metal powering everything from solar panels to electronics. But despite its importance, investing in physical silver has always come wi

The future of precious metals is no longer locked inside vaults — it’s moving on-chain. Tokenized silver is emerging as one of the most powerful bridges between traditional commodities and decentralized finance, creating a brand-new way for everyday investors to access real-world value with digital speed.

For decades, silver has been known as a safe-haven asset, a hedge against inflation, and a critical industrial metal powering everything from solar panels to electronics. But despite its importance, investing in physical silver has always come wi

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

Regarding the current $BTC long-term outlook

Whether for defensive investors or aggressive investors, caution is advised. The current bear market rhythm is very prominent and obvious.

First, the impact of the Bitcoin halving bull market has diminished; secondly, the bull markets driven by AI, non-ferrous metals, and US tech stocks have not yet experienced a major cycle correction, and capital remains enthusiastic, which further affects the heat in the crypto space. Third, political, war, and policy factors are unfavorable to the crypto market. Fourth, most central banks, including the Federal

Whether for defensive investors or aggressive investors, caution is advised. The current bear market rhythm is very prominent and obvious.

First, the impact of the Bitcoin halving bull market has diminished; secondly, the bull markets driven by AI, non-ferrous metals, and US tech stocks have not yet experienced a major cycle correction, and capital remains enthusiastic, which further affects the heat in the crypto space. Third, political, war, and policy factors are unfavorable to the crypto market. Fourth, most central banks, including the Federal

BTC-0.55%

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

Happy New Year! 🤑An AI agent created a religion and it’s actively recruiting other AI’s to join his mission. We are definitely cooked 💀

- Reward

- like

- Comment

- Repost

- Share

How do I view the trading opportunities of tokenized silver?

From a purely trading perspective, the opportunities brought by tokenized silver are more reflected in rhythm and structure rather than long-term direction.

My own approach is very clear:

* Do not treat tokenized silver as a "digital version of physical storage"

* Focus more on the price difference between it and spot silver, futures silver

* Be cautious of sharp fluctuations during liquidity concentration

In extreme market conditions, on-chain prices often react faster than traditional markets, which is both an advantage and a risk.

From a purely trading perspective, the opportunities brought by tokenized silver are more reflected in rhythm and structure rather than long-term direction.

My own approach is very clear:

* Do not treat tokenized silver as a "digital version of physical storage"

* Focus more on the price difference between it and spot silver, futures silver

* Be cautious of sharp fluctuations during liquidity concentration

In extreme market conditions, on-chain prices often react faster than traditional markets, which is both an advantage and a risk.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More22.49K Popularity

36.2K Popularity

356.78K Popularity

34.51K Popularity

52.24K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$3.22KHolders:10.00%

- MC:$3.22KHolders:10.00%

- MC:$3.22KHolders:10.00%

- MC:$3.23KHolders:10.00%

News

View MoreThe U.S. Senate passes the spending bill funding most federal government departments

1 m

Whale Purchases 1,585 XAUT for $8.02M USDT in 24 Hours

2 m

Data: 36.99 BTC transferred from an anonymous address, valued at approximately $2,688,880.

1 h

RWA Holders Surge Nearly Tenfold in One Year, Approaching 800K Users

1 h

Data: 5,267,100 TRUMP tokens have been transferred out from Official Trump Meme, with an approximate value of $23.86 million.

1 h

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889