- Trending TopicsView More

53.8K Popularity

54.8K Popularity

53.4K Popularity

37.9K Popularity

7.7K Popularity

- Pin

- 🎯 To further enhance the user experience on Gate Square, we sincerely invite you to take part in our first User Experience Survey 👉 https://www.gate.com/questionnaire/7086

✅ Reward: Complete the survey for a chance to win—10 lucky participants will receive a Gate X Red Bull Bottle

🙏 Thank You: Every piece of feedback helps us improve Gate Square. Your support and participation mean a lot!

📅 Survey Period: Sep 19 – Oct 9 - 💥 Gate Square Event: #PostToWinPORTALS# 💥

Post original content on Gate Square related to PORTALS, the Alpha Trading Competition, the Airdrop Campaign, or Launchpool, and get a chance to share 1,300 PORTALS rewards!

📅 Event Period: Sept 18, 2025, 18:00 – Sept 25, 2025, 24:00 (UTC+8)

📌 Related Campaigns:

Alpha Trading Competition: Join for a chance to win rewards

👉 https://www.gate.com/announcements/article/47181

Airdrop Campaign: Claim your PORTALS airdrop

👉 https://www.gate.com/announcements/article/47168

Launchpool: Stake GT to earn PORTALS

👉 https://www.gate.com/announcements/articl - 🌕 Gate Square · Creator Incentive Program Day 10 Topic– #Fed Cuts Rates By 25 Bps# !

Share trending topic posts, and split $5,000 in prizes! 🎁

👉 Check details & join: https://www.gate.com/campaigns/1953

💝 New users: Post for the first time and complete the interaction tasks to share $600 newcomer pool!

🔥 Day 10 Hot Topic: Fed Cuts Rates By 25 Bps

The Fed lowered its benchmark rate by 25 basis points to 4.00%–4.25%, in line with market expectations. This marks the restart of the rate-cut cycle since the pause last December. Lower rates often boost liquidity and risk appetite, which could be - 🚀 Gate Square Newbie Village · Episode 1 ✖️ @Ryakpanda Community

Let’s cheer on crypto beginners together!

📚 Learn trading tips | 🎯 Unlock newbie perks | 🤝 Grow with the community

⏰ Event Date: Sept 17 – Sept 24

How to Join:

1️⃣ Follow Gate_Square + Ryakpanda

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillage#

3️⃣ Share your trading insights or newbie experiences

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures Voucher

✨ You’re not alone—join #GateNewbieVillage# today!

What is the Lindy effect and its impact on blockchain technology?

The Lindy Effect and its Application in Blockchain Technology

The Lindy effect, also known as the Lindy Law, is a theory that suggests that the life expectancy of a non-perishable item, such as a technology or a cultural phenomenon, is directly related to its current age. This concept was first introduced by the author Nassim Nicholas Taleb in the context of Broadway shows.

Characteristics and Applications of the Lindy Effect

A key feature of the Lindy effect is the nonlinear relationship between age and remaining life expectancy. In general, the longer something has existed, the stronger it becomes, as it has withstood multiple selection pressures over time.

The Lindy effect applies in various domains: in technology, older solutions tend to have a higher probability of enduring; in finance, investors tend to focus on proven methods rather than fleeting trends; while in culture, timeless works of art continue to impact society across generations.

The Lindy effect in the blockchain ecosystem

In the field of blockchain technology, the Lindy effect provides valuable insights into the resilience and longevity of various projects and cryptocurrencies. Blockchain projects that have proven their viability and longevity have a greater chance of remaining relevant and profitable in the long term.

Established cryptocurrencies that have existed for over a decade exemplify this principle. Developers and investors can use the Lindy effect to evaluate cryptocurrency and blockchain projects, considering that those with a longer history of security, decentralization, and community support are generally more reliable and resilient.

Application of the Lindy effect to the first cryptocurrency

The first cryptocurrency, which has existed since 2009, is an excellent example of the Lindy effect. Its survival and recovery over more than a decade are proof of its continued relevance and potential for future growth.

As the first decentralized digital currency, it has overcome numerous obstacles, including market volatility, technological challenges, and regulatory scrutiny. Despite the variations in cryptocurrency regulations worldwide, it has consistently maintained the number one position among cryptocurrencies in terms of market capitalization and user base.

Recent milestones and achievements

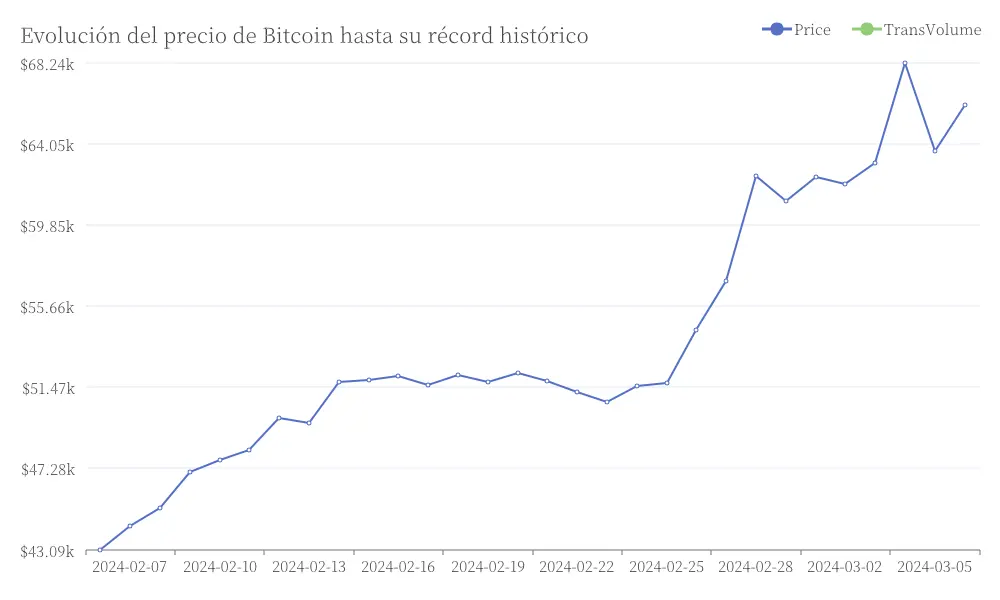

On March 6, 2024, this pioneering cryptocurrency set a new record, reaching 69,210 dollars, marking a historic day for the cryptocurrency community. Additionally, its value proposition and scarcity are reinforced by its fixed supply limit of 21 million units established by the protocol. Evolution of Bitcoin price to its historical record

Evolution of Bitcoin price to its historical record

Metcalfe's Law and the Lindy Effect

The Lindy effect focuses on the age and resilience of systems, where the probability of continuity increases with duration, thereby assessing potential resilience. On the other hand, Metcalfe's Law focuses on growth and network effects, stating that the value of a network is proportional to the square of its users, highlighting the dynamics of growth and connectivity. Both concepts complement each other in the analysis of blockchain ecosystems.

Implications for investors and traders

The Lindy effect has important implications for investors and traders of criptomonedas. In terms of history and longevity, older projects are more likely to be resilient. Regarding security and community support, there is a greater likelihood of surviving regulatory obstacles and volatility. Finally, from a long-term perspective, focusing on projects with a prolonged vision can be more advantageous. Understanding these ramifications allows investors to make informed decisions based on concepts of resilience and durability over time.