Asiftahsin

Share Crypto Related Market Analysis, Share Crypto Related knowledge for my follower(brother and Sister)

Asiftahsin

Technical Outlook For DOGE:

DOGE is trading around US$0.26–$0.28, consolidating after recent gains while struggling to clear higher resistance levels.

Key resistance: $0.29–$0.30; a clean breakout above this zone could unlock a stronger move toward $0.35+.

Immediate supports: $0.26–$0.27; deeper support sits at $0.24, with a lower cushion around $0.21–$0.22 if weakness extends.

To extend upside, DOGE must push above $0.30 with strong volume. Failure could invite a retest of $0.26 or below.

RSI is neutral to slightly bullish, showing momentum is intact but vulnerable to short-term pullbacks. So

DOGE is trading around US$0.26–$0.28, consolidating after recent gains while struggling to clear higher resistance levels.

Key resistance: $0.29–$0.30; a clean breakout above this zone could unlock a stronger move toward $0.35+.

Immediate supports: $0.26–$0.27; deeper support sits at $0.24, with a lower cushion around $0.21–$0.22 if weakness extends.

To extend upside, DOGE must push above $0.30 with strong volume. Failure could invite a retest of $0.26 or below.

RSI is neutral to slightly bullish, showing momentum is intact but vulnerable to short-term pullbacks. So

DOGE-10.69%

- Reward

- 11

- 8

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

Technical Outlook for XRP :

XRP is in a consolidation phase around $2.95-$3.00. It has reasonable upside if it can clear $3.10-$3.13 with strength. If resistance holds and support weakens, it may test $2.75-$2.80, and failing that perhaps drop toward $2.50-$2.60. But the long-term trend still has some tailwinds from institutional/whale accumulation.

The market is relatively neutral/slightly bearish in the short term, due to resistance near $3.10–$3.20 and support testing around $2.75–$2.80.

Resistance

$3.10–$3.13 and $3.20–$3.30.

Support

$2.95–$3.00, $2.75–$2.80 and $2.50–$2.60.

Indicators ar

XRP is in a consolidation phase around $2.95-$3.00. It has reasonable upside if it can clear $3.10-$3.13 with strength. If resistance holds and support weakens, it may test $2.75-$2.80, and failing that perhaps drop toward $2.50-$2.60. But the long-term trend still has some tailwinds from institutional/whale accumulation.

The market is relatively neutral/slightly bearish in the short term, due to resistance near $3.10–$3.20 and support testing around $2.75–$2.80.

Resistance

$3.10–$3.13 and $3.20–$3.30.

Support

$2.95–$3.00, $2.75–$2.80 and $2.50–$2.60.

Indicators ar

XRP-6.06%

- Reward

- 12

- 18

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

Technical Outlook for ETH:

Ethereum (ETH) is trading around US$4,450–US$4,500, consolidating after its recent highs. The push toward $5,000 has so far been capped by strong resistance.

Key Resistance: $4,900–$5,000

Immediate Supports: $4,200–$4,400

Deeper Supports: $4,000, and lower around $3,700–$3,800 if weakness extends.

ETH needs a decisive breakout above $5,000 to unlock more upside. Strong supports below may cushion pullbacks if momentum fades.

RSI is in a neutral-to-bullish zone, suggesting upside potential remains, though some indicators hint at overextension.

A breakout needs strong v

Ethereum (ETH) is trading around US$4,450–US$4,500, consolidating after its recent highs. The push toward $5,000 has so far been capped by strong resistance.

Key Resistance: $4,900–$5,000

Immediate Supports: $4,200–$4,400

Deeper Supports: $4,000, and lower around $3,700–$3,800 if weakness extends.

ETH needs a decisive breakout above $5,000 to unlock more upside. Strong supports below may cushion pullbacks if momentum fades.

RSI is in a neutral-to-bullish zone, suggesting upside potential remains, though some indicators hint at overextension.

A breakout needs strong v

ETH-6.37%

- Reward

- 9

- 6

- Repost

- Share

Sakura_3434 :

:

Just go for it💪View More

Technical Outlook For PI:

PI is trading around US$0.355–US$0.36.

The market is showing signs of consolidation / attempting to stabilise after a longer downtrend. Resistance remains in place, while support zones are being tested.

Resistance:

$0.37–$0.38 — near-term resistance; breaking above this could open the door toward $0.40.

Above that, stronger resistance may lie around $0.40+ if momentum strengthens.

Support:

Immediate support is around $0.34–$0.35.

If those give way, a lower cushion may be in the $0.30–$0.32100 range.

The RSI is in a neutral-to-mildly positive zone, but not strong; som

PI is trading around US$0.355–US$0.36.

The market is showing signs of consolidation / attempting to stabilise after a longer downtrend. Resistance remains in place, while support zones are being tested.

Resistance:

$0.37–$0.38 — near-term resistance; breaking above this could open the door toward $0.40.

Above that, stronger resistance may lie around $0.40+ if momentum strengthens.

Support:

Immediate support is around $0.34–$0.35.

If those give way, a lower cushion may be in the $0.30–$0.32100 range.

The RSI is in a neutral-to-mildly positive zone, but not strong; som

PI-16.98%

- Reward

- 15

- 15

- Repost

- Share

GateUser-3bd39532 :

:

Just go for it💪View More

Technical Outlook For XRP :

XRP is trading around US$2.96–US$3.00.

The market is consolidating after a recent push higher, struggling to clear key resistance levels.

Key resistance: $3.18–$3.25; a breakout above this zone could unlock a stronger move toward $3.50+.

Immediate supports: $3.00–$3.02; deeper support levels sit around $2.80–$2.85, with a lower cushion at $2.50–$2.60 if weakness extends.

To extend upside, XRP needs a clean break above $3.25 on strong buying volume. Failure to do so may trigger a pullback toward $3.00 and below.

Indicators:

RSI sits in neutral to slightly bullish ter

XRP is trading around US$2.96–US$3.00.

The market is consolidating after a recent push higher, struggling to clear key resistance levels.

Key resistance: $3.18–$3.25; a breakout above this zone could unlock a stronger move toward $3.50+.

Immediate supports: $3.00–$3.02; deeper support levels sit around $2.80–$2.85, with a lower cushion at $2.50–$2.60 if weakness extends.

To extend upside, XRP needs a clean break above $3.25 on strong buying volume. Failure to do so may trigger a pullback toward $3.00 and below.

Indicators:

RSI sits in neutral to slightly bullish ter

XRP-6.06%

- Reward

- 11

- 4

- Repost

- Share

Cryptogether :

:

Ape In 🚀View More

Technical Outlook For ETH:

ETH is trading around US$4,450–US$4,500.

Market is in a period of consolidation after recent highs. The stretch toward $5,000 has been met with resistance.

Key resistance $4,900-$5,000; supports in $4,200-$4,400, and further down around $4,000; and a lower band near $3,700-$3,800 if weaker support fails.

ETH needs to break past resistance cleanly to unlock more upside. Strong support zones may cushion downside in worse scenarios.

Mixed signals: RSI in neutral to slightly bullish zones; some momentum remains, but some indicators are showing signs of weakening or ove

ETH is trading around US$4,450–US$4,500.

Market is in a period of consolidation after recent highs. The stretch toward $5,000 has been met with resistance.

Key resistance $4,900-$5,000; supports in $4,200-$4,400, and further down around $4,000; and a lower band near $3,700-$3,800 if weaker support fails.

ETH needs to break past resistance cleanly to unlock more upside. Strong support zones may cushion downside in worse scenarios.

Mixed signals: RSI in neutral to slightly bullish zones; some momentum remains, but some indicators are showing signs of weakening or ove

ETH-6.37%

- Reward

- 15

- 6

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

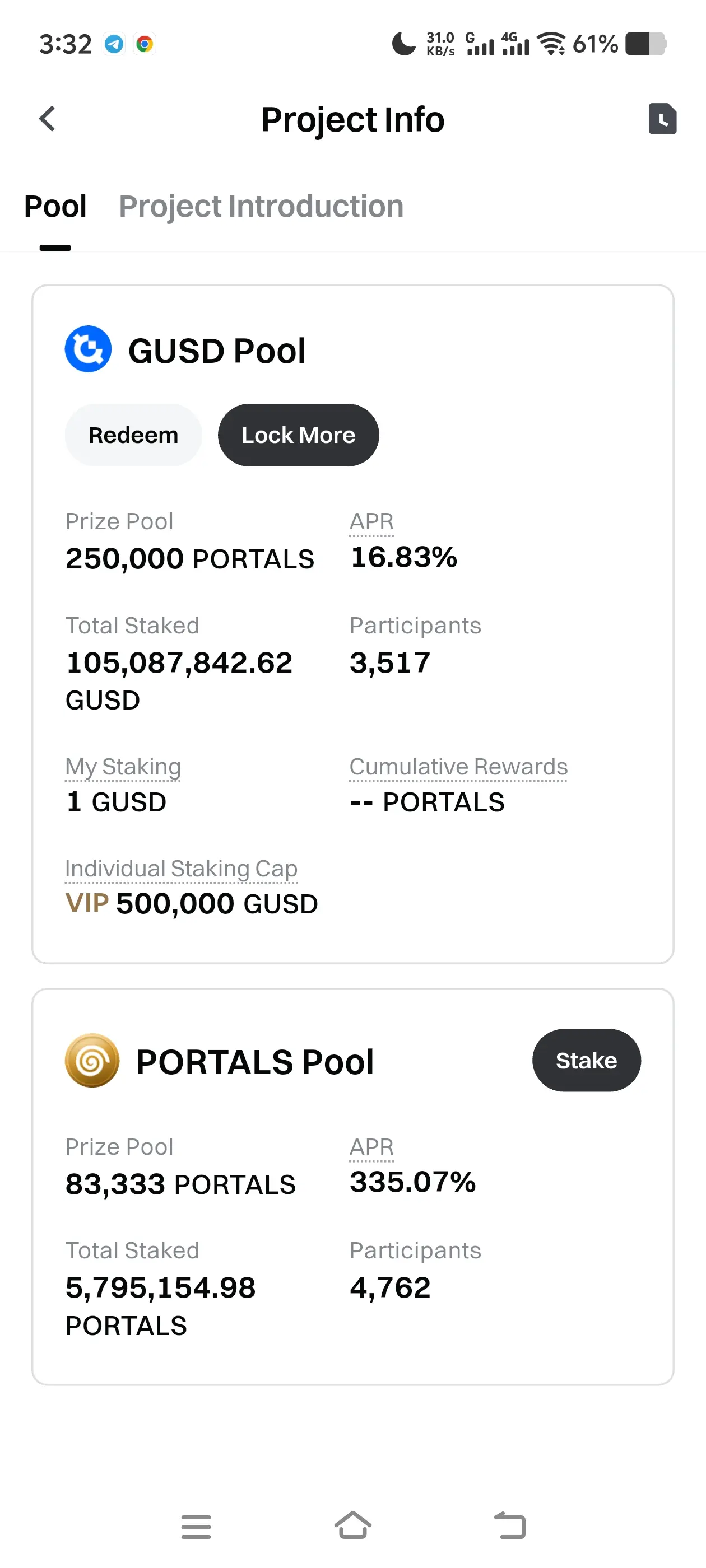

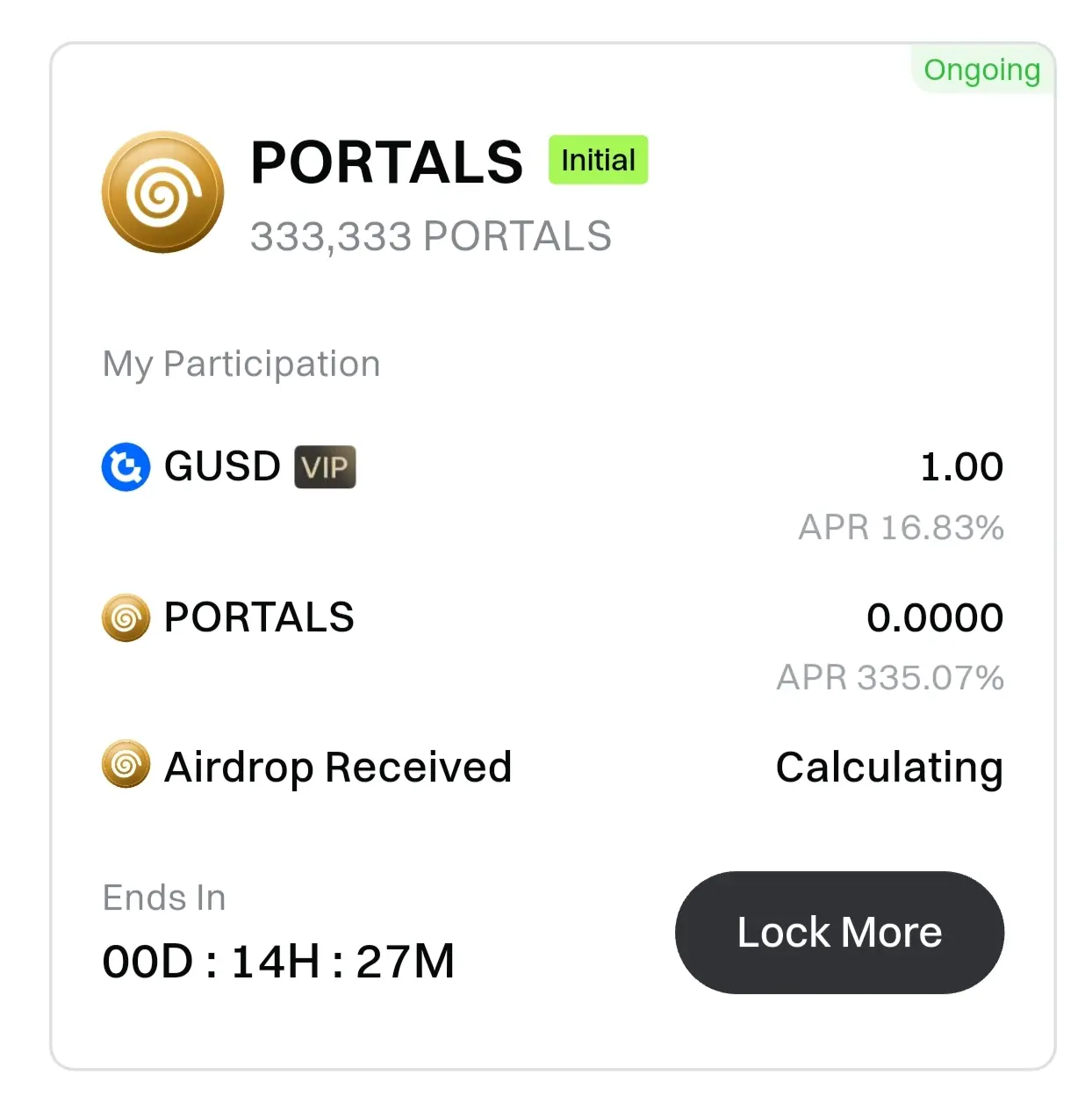

#PostToWinPORTALS#

Hi everyone hope everyone is well today i will talk about Gate Launchpool (PORTALS) hope you will be by my side.

🎉 What is Gate Launchpool?

Gate Launchpool is an innovative staking and airdrop platform where users can stake GT, BTC, ETH, USDT, GUSD or other tokens to earn hourly airdrops of hot and new coins. With low entry barriers and high APR, it’s the ultimate platform for effortlessly capturing market opportunities.

📢 Launchpool project #319: Launchpool x PORTALS Users can stake GUSD or PORTALS to share 333,333 PORTALS tokens for free. Airdrop rewards are distribute

Hi everyone hope everyone is well today i will talk about Gate Launchpool (PORTALS) hope you will be by my side.

🎉 What is Gate Launchpool?

Gate Launchpool is an innovative staking and airdrop platform where users can stake GT, BTC, ETH, USDT, GUSD or other tokens to earn hourly airdrops of hot and new coins. With low entry barriers and high APR, it’s the ultimate platform for effortlessly capturing market opportunities.

📢 Launchpool project #319: Launchpool x PORTALS Users can stake GUSD or PORTALS to share 333,333 PORTALS tokens for free. Airdrop rewards are distribute

- Reward

- 23

- 17

- Repost

- Share

Surrealist5N1K :

:

thank you dear 💜View More

Technical Outlook: ENA Tests Key Support as Downside Pressure Mounts:

Ethena (ENA) is clinging to the 50-day EMA at $0.6664 heading into Friday, with momentum indicators pointing to a fragile setup. The broader bias appears tilted downward, as multiple signals align against the bulls.

The MACD has held a sell signal since Monday, reinforcing bearish sentiment and encouraging traders to scale back exposure. At the same time, the RSI has slid to 44 from overbought territory at 74 earlier in August, confirming waning momentum and strengthening the downside case.

If ENA loses its grip on the 50-da

Ethena (ENA) is clinging to the 50-day EMA at $0.6664 heading into Friday, with momentum indicators pointing to a fragile setup. The broader bias appears tilted downward, as multiple signals align against the bulls.

The MACD has held a sell signal since Monday, reinforcing bearish sentiment and encouraging traders to scale back exposure. At the same time, the RSI has slid to 44 from overbought territory at 74 earlier in August, confirming waning momentum and strengthening the downside case.

If ENA loses its grip on the 50-da

ENA-9.3%

- Reward

- 11

- 9

- Repost

- Share

GateUser-51649f0c :

:

I have been in the trap for a few days, adding more at a high position.View More

Technical Outlook: XRP Faces Crucial $3.00 Test Amid Bearish Pressure:

XRP is sliding toward the key short-term support at $3.00 as of Friday, weighed down by fresh risk-off sentiment across the broader crypto market. The Relative Strength Index (RSI) has corrected to 50 after peaking at 57 midweek, signaling waning bullish momentum. A move below the midline into bearish territory would confirm the growing downside bias and increase the likelihood of a decisive break under the $3.00 level.

The SuperTrend indicator, currently positioned above price, continues to flash a sell signal, reinforcing

XRP is sliding toward the key short-term support at $3.00 as of Friday, weighed down by fresh risk-off sentiment across the broader crypto market. The Relative Strength Index (RSI) has corrected to 50 after peaking at 57 midweek, signaling waning bullish momentum. A move below the midline into bearish territory would confirm the growing downside bias and increase the likelihood of a decisive break under the $3.00 level.

The SuperTrend indicator, currently positioned above price, continues to flash a sell signal, reinforcing

XRP-6.06%

- Reward

- 13

- 3

- Repost

- Share

Ryakpanda :

:

Steadfast HODL💎View More

Near Protocol Price Forecast: Near Protocol extends bullish momentum :

Near Protocol bulls remain largely in control at the time of writing on Friday, although the price has pulled back from its intraday high of $3.34. The breakout was built on strong macro signals following the United States (US) Federal Reserve's (Fed) 25-basis-point interest rate cut to a range of 4.00% to 4.25%. Additionally, buzz around the AI economy in the cryptocurrency sector has helped.

The Moving Average Convergence Divergence (MACD) indicator's buy signal, which has been sustained since September 8, underpins the b

Near Protocol bulls remain largely in control at the time of writing on Friday, although the price has pulled back from its intraday high of $3.34. The breakout was built on strong macro signals following the United States (US) Federal Reserve's (Fed) 25-basis-point interest rate cut to a range of 4.00% to 4.25%. Additionally, buzz around the AI economy in the cryptocurrency sector has helped.

The Moving Average Convergence Divergence (MACD) indicator's buy signal, which has been sustained since September 8, underpins the b

- Reward

- 15

- 12

- Repost

- Share

Flowergirl34 :

:

1000x Vibes 🤑View More

PI Price Forecast :Selling pressure declines as PI extends consolidation :

Pi Network above $0.3500 in a larger consolidation range between the $0.32100 support floor and the $0.4000 ceiling. A potential close above the $0.4000 could extend the rally to the $0.50196 level, marked by the June 22 close.

The momentum indicators on the daily chart remain unchanged as the Keltner channels sustain a sideways move, indicating lowered volatility. At the same time, the Relative Strength Index (RSI) remains flat at 49-50, suggesting that trend momentum is dampened.

Still, the Accumulation/Distribution

Pi Network above $0.3500 in a larger consolidation range between the $0.32100 support floor and the $0.4000 ceiling. A potential close above the $0.4000 could extend the rally to the $0.50196 level, marked by the June 22 close.

The momentum indicators on the daily chart remain unchanged as the Keltner channels sustain a sideways move, indicating lowered volatility. At the same time, the Relative Strength Index (RSI) remains flat at 49-50, suggesting that trend momentum is dampened.

Still, the Accumulation/Distribution

PI-16.98%

- Reward

- 21

- 9

- Repost

- Share

GateUser-decfcdb1 :

:

good evening everyone in the house View More

Bitcoin Cash Price Forecast: Bulls aiming for levels above $700 :

Bitcoin Cash price declined slightly at the start of the week on Monday, but recovered the next day and closed above $616.13 on Wednesday. At the time of writing on Thursday, it continues its upward momentum, reaching a new yearly high of $650.46.

If BCH continues its upward trend, it could extend the rally to retest its April 5, 2024, high of $719.14.

The Relative Strength Index (RSI) on the daily chart reads 65, above its neutral level of 50, and points upward, indicating that bullish momentum is gaining traction. The Moving A

Bitcoin Cash price declined slightly at the start of the week on Monday, but recovered the next day and closed above $616.13 on Wednesday. At the time of writing on Thursday, it continues its upward momentum, reaching a new yearly high of $650.46.

If BCH continues its upward trend, it could extend the rally to retest its April 5, 2024, high of $719.14.

The Relative Strength Index (RSI) on the daily chart reads 65, above its neutral level of 50, and points upward, indicating that bullish momentum is gaining traction. The Moving A

BCH-3.95%

- Reward

- 15

- 6

- Repost

- Share

MominurRahman990 :

:

thank you for sharing news vaiView More

XRP Price Forecast: XRP gains bullish momentum :

XRP remains above $3.10-$3.12 at the time of writing on Thursday, supported by a strong technical structure. The dovish macro outlook presented by the Fed on Wednesday has led to an improvement in risk-on sentiment, resulting in steady demand for XRP.

Bulls have the upper hand based on the position of the Relative Strength Index (RSI) at 58 and rising. Higher RSI readings approaching overbought territory would indicate growth in bullish momentum, as bulls look toward the record high of $3.66.

Key areas of interest for traders are the short-term

XRP remains above $3.10-$3.12 at the time of writing on Thursday, supported by a strong technical structure. The dovish macro outlook presented by the Fed on Wednesday has led to an improvement in risk-on sentiment, resulting in steady demand for XRP.

Bulls have the upper hand based on the position of the Relative Strength Index (RSI) at 58 and rising. Higher RSI readings approaching overbought territory would indicate growth in bullish momentum, as bulls look toward the record high of $3.66.

Key areas of interest for traders are the short-term

XRP-6.06%

- Reward

- 9

- 8

- Repost

- Share

Sakura_3434 :

:

HODL Tight 💪View More

Crypto Today: Bitcoin, Ethereum, XRP eye next leg up on growing risk-on sentiment :

Bitcoin rises above $117,000 after the Federal Reserve interest rate decision and the dot plot's dovish outlook.

Ethereum steadies around $4,600 despite minor ETF outflows.

XRP bulls regain control of the trend, targeting a breakout toward the $3.66 record high.

Bitcoin (BTC) edges higher above the $117,000 level on Thursday, buoyed by growing bullish sentiment in the broader cryptocurrency market. The uptick in the BTC price is accompanied by steady increases in altcoin prices, with Ethereum (ETH) and Ripple (

Bitcoin rises above $117,000 after the Federal Reserve interest rate decision and the dot plot's dovish outlook.

Ethereum steadies around $4,600 despite minor ETF outflows.

XRP bulls regain control of the trend, targeting a breakout toward the $3.66 record high.

Bitcoin (BTC) edges higher above the $117,000 level on Thursday, buoyed by growing bullish sentiment in the broader cryptocurrency market. The uptick in the BTC price is accompanied by steady increases in altcoin prices, with Ethereum (ETH) and Ripple (

- Reward

- 10

- 11

- Repost

- Share

Sakura_3434 :

:

Buy To Earn 💎View More

PI Token Price Forecast : Pi Network’s channel breakout remains trapped in a range :

PI trades above $0.3500 at press time on Thursday, following three consecutive indecisive daily candles, which highlight the low volatility movement. The price action displays a range formed between the $0.4000 ceiling and the $0.321 support floor.

Validating the consolidation, the converging Keltner channels shift from a downward trend, indicating lowered volatility. Furthermore, the Relative Strength Index (RSI) moves flat in the neutral zone at 49, which suggests a lack of momentum and indecisiveness among

PI trades above $0.3500 at press time on Thursday, following three consecutive indecisive daily candles, which highlight the low volatility movement. The price action displays a range formed between the $0.4000 ceiling and the $0.321 support floor.

Validating the consolidation, the converging Keltner channels shift from a downward trend, indicating lowered volatility. Furthermore, the Relative Strength Index (RSI) moves flat in the neutral zone at 49, which suggests a lack of momentum and indecisiveness among

PI-16.98%

- Reward

- 12

- 10

- Repost

- Share

Sakura_3434 :

:

HODL Tight 💪View More

DOGE Token Price Forecast: Can Dogecoin hold 50-period EMA support?

Dogecoin experiences a spike in short-term volatility, with the price holding slightly above the 50-period Exponential Moving Average (EMA) at $0.26298 on the 4-hour chart. The Relative Strength Index (RSI), currently at 54-55, is in the bearish region, supporting the bearish outlook.

Lower RSI readings approaching oversold territory will indicate fading bullish momentum, increasing the chances of Dogecoin extending the pullback below the 50-period EMA.

The SuperTrend indicator reinforces the bearish outlook with a sell signa

Dogecoin experiences a spike in short-term volatility, with the price holding slightly above the 50-period Exponential Moving Average (EMA) at $0.26298 on the 4-hour chart. The Relative Strength Index (RSI), currently at 54-55, is in the bearish region, supporting the bearish outlook.

Lower RSI readings approaching oversold territory will indicate fading bullish momentum, increasing the chances of Dogecoin extending the pullback below the 50-period EMA.

The SuperTrend indicator reinforces the bearish outlook with a sell signa

DOGE-10.69%

- Reward

- 14

- 11

- Repost

- Share

Sakura_3434 :

:

HODL Tight 💪View More

Technical outlook: XRP holds a bullish structure, but downside risks persist :

XRP remains above the $3.00 level, with the 50-period Exponential Moving Average (EMA) at $3.014, providing additional support. A minor reversal of the Relative Strength Index (RSI) to 51.5+ on the 4-hour chart supports XRP’s short-term bullish potential.

A bullish reversal above the next key hurdle at $3.186, which was last tested on Saturday, would boost the chances of a bullish outcome toward the round-number supply area of $3.50 and the record high of $3.66.

Conversely, XRP is not out of the woods yet, and decli

XRP remains above the $3.00 level, with the 50-period Exponential Moving Average (EMA) at $3.014, providing additional support. A minor reversal of the Relative Strength Index (RSI) to 51.5+ on the 4-hour chart supports XRP’s short-term bullish potential.

A bullish reversal above the next key hurdle at $3.186, which was last tested on Saturday, would boost the chances of a bullish outcome toward the round-number supply area of $3.50 and the record high of $3.66.

Conversely, XRP is not out of the woods yet, and decli

XRP-6.06%

- Reward

- 8

- 10

- Repost

- Share

Ybaser :

:

HODL Tight 💪View More

Technical outlook: Solana bulls eye 27% breakout :

Solana remains above the support level provided at $230 as bulls look forward to a swift recovery above the $250 near-term target. The token also sits significantly above key moving averages, including the 50-day Exponential Moving Average (EMA) at $203, the 100-day EMA at $188 and the 200-day EMA at $177, supporting the bullish outlook.

The same moving averages would serve as tentative support levels if the macro environment fails to support a bullish outcome and holders sell, realizing profits, following the surge to $248-250 resistance in

Solana remains above the support level provided at $230 as bulls look forward to a swift recovery above the $250 near-term target. The token also sits significantly above key moving averages, including the 50-day Exponential Moving Average (EMA) at $203, the 100-day EMA at $188 and the 200-day EMA at $177, supporting the bullish outlook.

The same moving averages would serve as tentative support levels if the macro environment fails to support a bullish outcome and holders sell, realizing profits, following the surge to $248-250 resistance in

SOL-6.53%

- Reward

- 9

- 7

- Repost

- Share

Ybaser :

:

Ape In 🚀View More

Crypto Today: BTC, ETH steady and XRP slides as Fed interest-rate cut looms :

Bitcoin uptrend retests $117,000, underpinned by steady ETF inflows and optimism ahead of a widely expected Federal Reserve interest-rate cut.

Ethereum lags recovery despite holding support at $4,500, reflecting downturn in ETF inflows.

XRP falls toward the $3.00 support level, but a relatively high Open Interest suggests the short-term bullish potential remains intact.

Bitcoin (BTC) exhibits subtle bullish potential, trading marginally below $117,000 at the time of writing after pulling back from an intraday high of

Bitcoin uptrend retests $117,000, underpinned by steady ETF inflows and optimism ahead of a widely expected Federal Reserve interest-rate cut.

Ethereum lags recovery despite holding support at $4,500, reflecting downturn in ETF inflows.

XRP falls toward the $3.00 support level, but a relatively high Open Interest suggests the short-term bullish potential remains intact.

Bitcoin (BTC) exhibits subtle bullish potential, trading marginally below $117,000 at the time of writing after pulling back from an intraday high of

- Reward

- 9

- 7

- Repost

- Share

Ybaser :

:

Ape In 🚀View More

XRP rally seems imminent as REX-Osprey ETF debuts this week :

XRP holds $3.00, reflecting the calm in the crypto market ahead of Wednesday's Federal Reserve interest rate decision.

Bloomberg's James Seyffart hints at REX-Osprey XRP ETF launch this week.

XRP is still at risk of extending declines below the $3.00 level if macro factors fail to support a bullish outcome.

Ripple (XRP) upholds a bullish picture trading at around $3.045 on Tuesday, as market participants await the United States (US) Federal Reserve (Fed) interest rate decision this Wednesday.

The consensus is that the Federal Open

XRP holds $3.00, reflecting the calm in the crypto market ahead of Wednesday's Federal Reserve interest rate decision.

Bloomberg's James Seyffart hints at REX-Osprey XRP ETF launch this week.

XRP is still at risk of extending declines below the $3.00 level if macro factors fail to support a bullish outcome.

Ripple (XRP) upholds a bullish picture trading at around $3.045 on Tuesday, as market participants await the United States (US) Federal Reserve (Fed) interest rate decision this Wednesday.

The consensus is that the Federal Open

- Reward

- 16

- 11

- Repost

- Share

Rrr27377 :

:

hey buddy have a great day and stream cheerrrup 💪💪💪View More