#Gate重磅上线GUSD#

#ETH走势分析#

#Solana财库公司崛起#

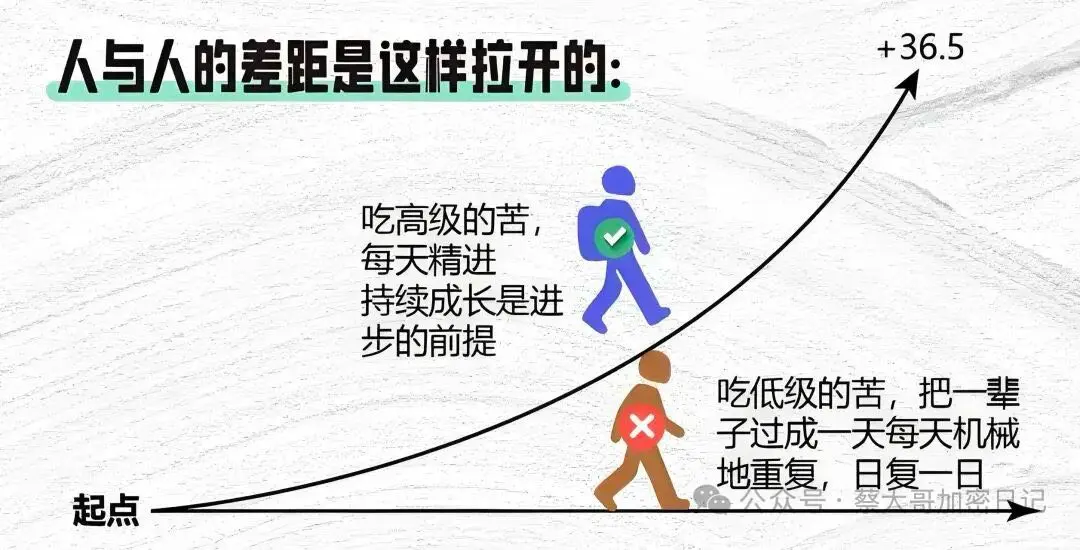

Life is meant to be experienced, not to enact perfection. Gradually accept your own dullness and mediocrity, allow yourself to make mistakes, allow yourself to occasionally lose power, and strive to bloom despite imperfections. This is the only way to reach reconciliation with yourself, let go of anxiety, and accept every stage of yourself.

#PI# #GT#

View Original#ETH走势分析#

#Solana财库公司崛起#

Life is meant to be experienced, not to enact perfection. Gradually accept your own dullness and mediocrity, allow yourself to make mistakes, allow yourself to occasionally lose power, and strive to bloom despite imperfections. This is the only way to reach reconciliation with yourself, let go of anxiety, and accept every stage of yourself.

#PI# #GT#