Gate Research: Interest Rate Cuts Trigger Sharp Market Volatility|Major Banks Accelerate Adoption of Bitcoin-Backed Lending

Summary

- Market sentiment has warmed up as BTC and ETH strengthened, with sectors such as prediction markets, GambleFi, and ZK recording weekly gains of 18%–35%.

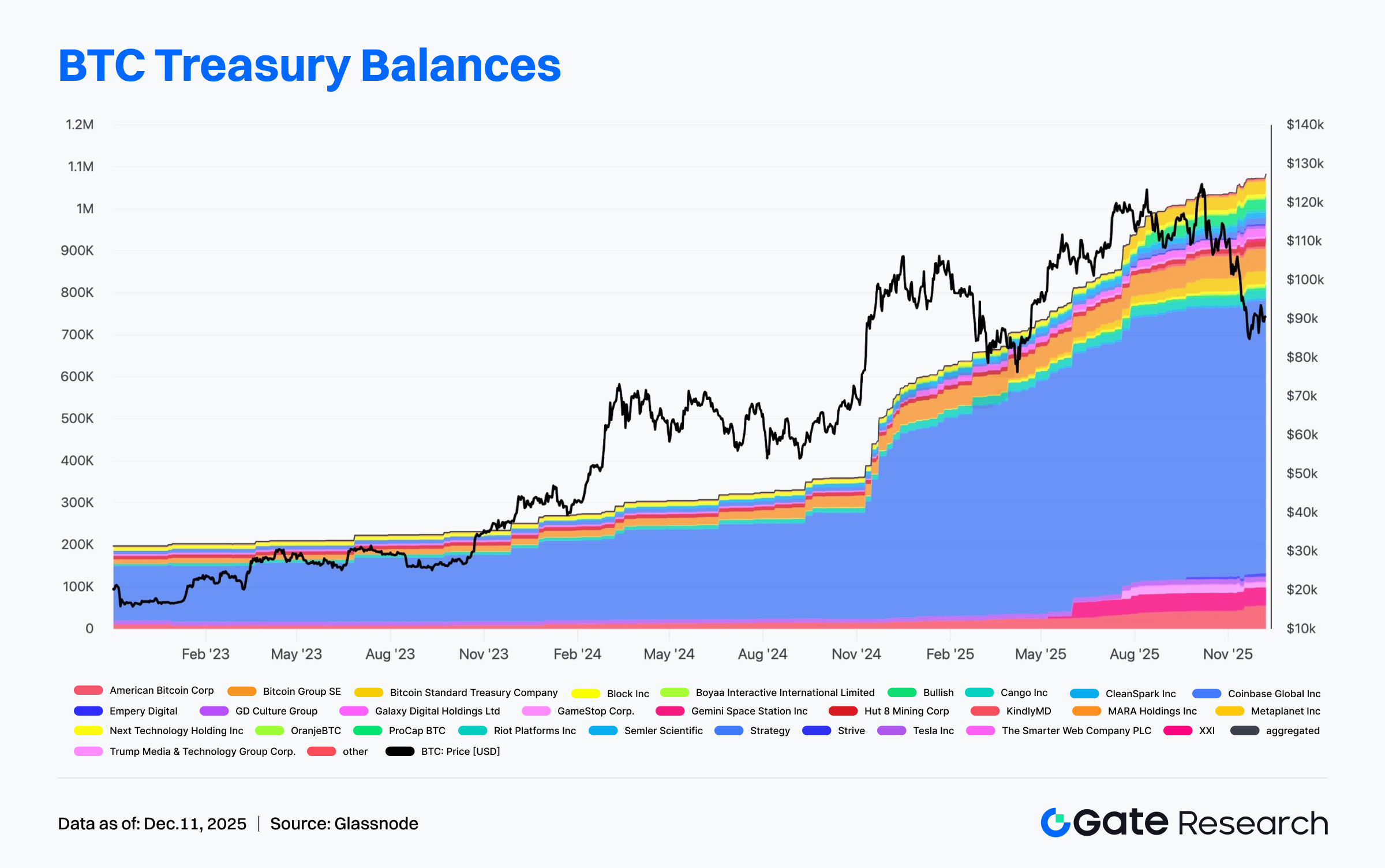

- Institutional Bitcoin holdings have risen sharply, and capital allocation structures continue to deepen.

- Major banks are accelerating the deployment of Bitcoin-collateralized lending services, with institutional-level acceptance continuing to increase.

- Interest rate cuts triggered sharp market volatility, with Ethereum and Bitcoin experiencing significant swings in response to macro signals.

- Digital Asset completed a 50-million-dollar financing round led by DRW Venture.

- CONX, APT, and ARB will unlock approximately 21.83 million, 19.68 million, and 19.58 million USD worth of tokens respectively over the next 7 days.

Market Overview

Market Commentary

- BTC Market Update — Over the past day, BTC has shown a pattern of “minor weak consolidation following a choppy pullback.” The price repeatedly faced resistance above 92,000 USD and retreated continuously around 91,000 USD, with short-term momentum clearly weakening. On the technical side, the MA5 and MA10 have turned downward and fallen below the MA30, with the three lines converging, indicating that the short-term trend has shifted from strong to neutral-weak. If BTC cannot quickly reclaim the MA10, the strength of any rebound will be limited. In the MACD, the fast and slow lines continued to decline after forming a bearish crossover at high levels, with the red bars shortening and turning into green bars, signaling weakening bullish momentum. In the short term, attention should be paid to the 90,500–90,800 USD support zone. If this area holds, BTC may still attempt a recovery near the moving averages; otherwise, a drop toward the 89,000–88,500 USD region may occur, entering a deeper corrective phase.

- ETH Market Update — After touching a high near 3,440 USD, ETH quickly pulled back, forming a structure of “technical correction after a failed breakout.” In the short term, the price fell below the MA5 and hovered near the MA10, slowing the previously strong short-term structure. Although the MA5, MA10, and MA30 remain in a bullish alignment, their convergence shows that bullish advantage is weakening. The MACD simultaneously formed a bearish crossover at high levels, with red bars shrinking and momentum divergence intensifying, indicating insufficient short-term buying power. If ETH can stabilize above the MA10, the overall structure remains healthy, and it may still challenge the 3,420–3,450 USD zone. But if it falls below the 3,260–3,280 USD support, it may extend down to the MA30 and previous lows for a more complete corrective wave.

- Altcoins — Market sentiment improved as BTC consolidated and ETH strengthened, with capital beginning to flow into the Ethereum ecosystem. Prediction markets, GambleFi, ZK, and LRT sectors recorded weekly gains of 18%–35%, reflecting a re-pricing of ETH-related high-beta sectors.

- Stablecoins — The total stablecoin market cap is currently 311.7 billion USD, having grown by 4.125 billion USD over the past week, an increase of 1.34%.

- Gas Fees — Ethereum network gas fees generally remained below 1 Gwei during the past week, with the highest hourly peak at 2.62 Gwei. As of December 11, the daily average gas fee was 0.167 Gwei.

Trending Tokens

Over the past 24 hours, the market has shown an overall downward trend, with sentiment still leaning cautious. The Fear Index remains at 29, indicating persistently low risk appetite. On the charts, BTC and ETH declined by roughly 1.3%, becoming the primary drag on the broader market. XRP, SOL, and other major assets fell within the 1%–3% range, with most sectors showing uniform weakness, illustrating capital contraction and a wait-and-see attitude.

NIGHT Midnight(+61.18%,Market Cap: $1.077b)

According to Gate data, the NIGHT token is trading at 0.06512 USD, up over 61.18% in 24 hours. Midnight (NIGHT) is a newly launched privacy-focused Layer-1 network led by Cardano founder Charles Hoskinson, aiming to provide efficient privacy-preserving computation without sacrificing regulatory compliance.

NIGHT’s price surge has been driven by multiple catalysts. The NIGHT/USDT pair was listed on exchanges such as Gate, bringing exposure and liquidity. Meanwhile, the Midnight Foundation opened redemption portals for GlacierDrop and Scavenger Mine, allowing early participants to claim allocations and boosting community activity. Additionally, Blockchain.com publicly expressed support for Midnight and released in-depth interview content, strengthening the project narrative and market recognition.

BEAT Audiera(+40.63%,Market Cap: $237m)

According to Gate data, BEAT is priced at 1.67870 USD, up over 40.63% in 24 hours. Audiera (BEAT) is an AI-driven music platform enabling creators, musicians, and dancers to earn through on-chain interactions and content production. Its core mechanisms integrate AI content generation, on-chain creator incentives, and community engagement to make content creation and distribution more participatory.

BEAT’s recent surge is supported by several positive developments. The project announced its fully diluted market cap surpassed 1.5 billion USD, reinforcing market confidence. The team also launched small-scale airdrop events to boost community engagement. Furthermore, Audiera partnered with Greedy World, combining GameFi and musical interaction to broaden user reach and enhance its narrative potential.

LUNA Terra(+41.87%,Market Cap: $135m)

According to Gate data, LUNA is trading at 0.20018 USD, up over 41.87% in 24 hours. LUNA is the native asset of the Terra blockchain ecosystem, used for governance, validator staking, and maintaining application-layer operations. Despite the ecosystem shrinking significantly after its stablecoin mechanism collapse, on-chain applications remain functional, and the community continues efforts in governance improvements and protocol maintenance to preserve baseline network activity.

The current price jump appears to represent a typical “bottom rebound.” After prolonged decline, LUNA found support at previous lows and saw a volume-supported breakout following a period of contraction, triggering a short-term technical bounce. The moving-average system shows the price re-crossing short-term averages, with momentum indicators rising concurrently, forming a short-term reversal pattern. Overall, the increase reflects technical recovery more than fundamental change.

Key Market Data Highlights

Major banks accelerate Bitcoin-collateralized lending; institutional acceptance continues rising

MicroStrategy founder and executive chairman Michael Saylor stated that multiple major banks have begun offering credit services backed by Bitcoin collateral. These include BNY Mellon, Wells Fargo, Charles Schwab, JPMorgan, and Citigroup. As key players in traditional finance, their participation signals that digital assets are transitioning from fringe assets into mainstream financial infrastructure. Bitcoin’s high-liquidity collateral properties are gaining formal recognition in institutional contexts.

The rollout of such credit products represents maturity in risk assessment and compliance frameworks, and it indicates that banks are beginning to incorporate digital assets into broader balance-sheet management. Saylor emphasized that Bitcoin is increasingly viewed as an institutional-grade collateral asset with strong anti-inflation characteristics and high liquidity. As more institutions adopt Bitcoin custody, clearing, and credit services, the integration of traditional finance and crypto markets will accelerate, potentially driving new structured products, financing solutions, and capital-efficiency strategies.

Institutional Bitcoin holdings surge; allocation structures deepen

According to Glassnode, institutional Bitcoin holdings have risen from approximately 197,000 BTC in January 2023 to 1.08 million BTC, an increase of about 448%. This rapid expansion shows Bitcoin’s evolution from an alternative asset to a core allocation in institutional portfolios, reflecting increased confidence in its long-term value and inflation-resistant characteristics.

The shift in holding structure also suggests a strategic change: more capital is using Bitcoin as a hedge against macro uncertainty and viewing it as a long-term investment with potentially superior growth compared to traditional assets. As custody, trading, and risk-management systems improve, institutional participation is expected to continue rising, making Bitcoin’s market structure more mature and stable.

Tempo testnet officially launched; payment-oriented blockchain targets instant-settlement scenarios

Tempo, backed by Stripe and Paradigm, announced the launch of its testnet, positioning itself as a payment-optimized blockchain architecture designed for instant settlement and predictable fees. The project aims to improve on-chain payment efficiency, maintaining stable and transparent costs even during high throughput, thereby meeting daily payment requirements for speed and reliability.

With the testnet open, Tempo plans to validate performance in settlement speed, network stability, and fee consistency, while expanding its ecosystem. If successful, Tempo may become foundational infrastructure for large-scale payment use cases, offering a competitive environment for on-chain transactions, merchant payments, and next-generation applications.

Focus of the Week

SpaceX plans historic IPO in 2026; nearly 300 million USD in Bitcoin holdings may become a focal point

SpaceX is accelerating preparations for its initial public offering, targeting a 2026 listing with a valuation potentially reaching 1.5 trillion USD—poised to become the largest IPO in history. Bloomberg reports that the company plans to raise well over 30 billion USD. At such scale, even small allocations attract market attention. Blockchain analysis indicates a wallet cluster linked to SpaceX holds approximately 3,991 BTC—worth nearly 300 million USD—custodied via Coinbase Prime. These holdings have fluctuated multiple times over the years, with recent large internal transfers detected on-chain. If the IPO proceeds, investors will gain exposure not only to aerospace and satellite operations but also to crypto assets including Bitcoin and Dogecoin.

Elon Musk’s long-standing ties to crypto consistently amplify market reactions. From influencing Dogecoin’s price to funding a lunar mission with DOGE and Tesla holding over 11,000 BTC, his impact is well established. A potential SpaceX IPO would support Starlink expansion and space-based data centers while reinforcing his position at the intersection of AI and crypto infrastructure. Prediction markets show rising confidence that SpaceX’s post-IPO valuation may exceed 1 trillion USD, with trader-assigned probability reaching 67%.

Stripe acquires crypto payment app Valora, strengthening stablecoin and on-chain payment strategy

Stripe announced the acquisition of Valora, a Celo-based crypto payment application. The Valora team will join Stripe to deepen integration of blockchain and stablecoins into Stripe’s payment ecosystem. Valora’s founder noted that stablecoins’ potential to enhance economic opportunity is becoming increasingly evident, and joining Stripe will accelerate their mission. Spun out from cLabs in 2021 and having raised 20 million USD, Valora brings expertise in wallet infrastructure and on-chain tooling that will directly support Stripe’s crypto strategy.

This acquisition follows Stripe’s recent push into crypto. The company previously acquired stablecoin infrastructure firm Bridge and wallet application Privy, and collaborated with Paradigm to develop Tempo, a blockchain designed specifically for stablecoin payments and now in testnet. As stablecoins rapidly grow in importance for cross-border payments, Stripe is accelerating the construction of a comprehensive on-chain payment stack to reinforce its position as a leading global financial infrastructure platform.

Interest rate cut triggers sharp volatility; ETH and BTC fluctuate significantly with macro signals

A financial decision-making body announced a 0.25-percentage-point cut to the benchmark interest rate on Wednesday, while signaling stricter thresholds for further easing. This triggered sharp short-term volatility in ETH and BTC. The benchmark rate was adjusted to the 3.5%–3.75% range, with notable internal disagreement over the scale of cuts. After an initial brief rally, the market quickly retraced. Despite cautious sentiment, derivatives markets are still pricing roughly a 40% probability of another rate cut in March. BTC fluctuated between 93,200 and 91,700 USD, ETH moved between 3,340 and 3,440 USD, and assets such as Solana, XRP, and BNB experienced synchronized pullbacks. Meanwhile, the institution announced the restart of treasury purchases—buying 40 billion USD of treasuries starting December 12—which observers consider a “light-version quantitative easing.”

From the current structure, future crypto trends will depend largely on the pace of rate cuts and inflation expectations. If rates continue to decline in the coming months under a supportive macro environment, the likelihood of BTC breaking the key resistance zones at 99,000 and 102,000 USD increases significantly, potentially opening a path toward 112,000 USD. Conversely, if easing slows or policy divisions intensify, the market may remain in high-level consolidation, with risk appetite struggling to recover before year-end. Overall, this rate cut provides a directional framework: lower capital costs may improve liquidity conditions, but sustained asset appreciation will depend on whether policy trajectories and market sentiment improve together.

Funding Weekly Recap

According to RootData, from December 5 to December 11, 2025, a total of 21 crypto and related projects announced financing or acquisitions across sectors including RWA, staking services, CeFi, infrastructure, and others. Below are brief introductions to the larger funding rounds:

Real Finance

Announced a 29-million-dollar funding round on December 10, led by Nimbus Capital.

REAL is a Layer-1 blockchain infrastructure enabling institutions to tokenize, insure, and trade real-world financial assets in a secure, transparent, and regulatory-compliant manner. The funds will accelerate the development of its institutional RWA tokenization infrastructure, including compliance systems, custody and settlement capabilities, and institutional-level asset tokenization channels. Real Finance plans to bring roughly 500 million USD worth of real assets on-chain within the next year, enabling safer, more transparent, and regulation-aligned tokenization—advancing integration between traditional and blockchain-based finance.

TenX

Announced a 22-million-dollar funding round on December 10, led by Borderless Capital.

TenX is building secure and reliable staking infrastructure tailored for high-throughput blockchain protocols, helping them scale confidently and rapidly. The funds will be used to purchase tokens from high-throughput networks and participate in staking/validator operations to support network security and earn staking rewards.

MetaComp

Announced a 22-million-dollar round on December 10, led by Sky9 Capital.

MetaComp is a licensed digital-asset financial services platform providing trading and custody for institutional investors. The funds will support expansion of its hybrid payment network StableX Network, upgrades to technology and risk-control systems, and global market and compliance expansion.

Next Week to Watch

Token Unlocks

According to data from Tokenomist, the market is set to see large unlocks of several important tokens over the next 7 days (December 12 - December 18, 2025). The top 3 unlocks are as follows:

- CONX will unlock tokens valued at approximately $21.83 million over the next 7 days, representing 71.3% of the circulating supply.

- APT will unlock tokens valued at approximately $19.68 million over the next 7 days, representing 1.5% of the circulating supply.

- ARB will unlock tokens valued at approximately $19.58 million over the next 7 days, representing 1.6% of the circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Coindesk, https://www.coindesk.com/markets/2025/12/10/dnp-spacex-s-usd300m-bitcoin-stack-puts-crypto-inside-the-world-s-biggest-planned-ipo

- Coindesk, https://www.coindesk.com/business/2025/12/10/stripe-acqui-hires-crypto-payments-startup-valora-venturing-further-into-stablecoins

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

- X, https://x.com/Cointelegraph/status/1998618750170394933?s=20

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025