Post content & earn content mining yield

placeholder

Suysuy

Happy New Year to everyone! US-China relations will ease, and the bear will gradually walk away.

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJEAVLAUW

View Original

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4097?ref=VQAVXF9DAW&ref_type=132

- Reward

- 1

- 3

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

PS

PowerShell

Created By@GateUser-e25873e3

Listing Progress

0.00%

MC:

$0.1

More Tokens

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/id/campaigns/4044?ref=VQDGUFBABG&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

Altcoin Market Overview: Top Movers Today

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQVAUAWKVA

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQIWUATXVQ

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$Mubarak strong sustained uptrend with all MAs perfectly stacked and curling up beneath price. Volume consistently growing with each leg higher. Tapping new highs near 0.0220 and pulling back.

Entry Zone: 0.01920 – 0.02000

TP1 0.02200

TP2 0.02550

TP3 0.03000

SL 0.01720

Entry Zone: 0.01920 – 0.02000

TP1 0.02200

TP2 0.02550

TP3 0.03000

SL 0.01720

MUBARAK18.13%

- Reward

- like

- Comment

- Repost

- Share

TRON ($TRX)

Trend: Consolidation with mild bearish bias.

Current Value: ~$0.28

Entry: $0.26 – $0.30

TP 1: $0.34 | TP 2: $0.42 | TP 3: $0.50

SL: $0.24

Analysis: TRX is trading in a tight range with low volatility; a breakout above $0.34 may trigger bullish momentum from short‑term traders.

$TRX #GateSquare$50KRedPacketGiveaway

Trend: Consolidation with mild bearish bias.

Current Value: ~$0.28

Entry: $0.26 – $0.30

TP 1: $0.34 | TP 2: $0.42 | TP 3: $0.50

SL: $0.24

Analysis: TRX is trading in a tight range with low volatility; a breakout above $0.34 may trigger bullish momentum from short‑term traders.

$TRX #GateSquare$50KRedPacketGiveaway

TRX1.16%

- Reward

- like

- Comment

- Repost

- Share

$TRX remarkably tight MA compression, all three levels within a pip of each other at 0.280. Price is sitting just above the cluster after recovering from 0.265 lows. Descending trendline is still overhead capping upside.

Entry Zone: 0.2795 – 0.2825

TP1 0.2900

TP2 0.2970

TP3 0.3050

Stop Loss 0.2680

#CelebratingNewYearOnGateSquare

Entry Zone: 0.2795 – 0.2825

TP1 0.2900

TP2 0.2970

TP3 0.3050

Stop Loss 0.2680

#CelebratingNewYearOnGateSquare

TRX1.16%

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQRFAVBYVA

View Original

- Reward

- like

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$8.92K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQRGBWOLUW

View Original

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=BVVEVQ9c

- Reward

- like

- Comment

- Repost

- Share

Chainlink ($LINK)

Trend: Mild downtrend; bearish momentum.

Current Value: ~$8.7 – $8.8 (approx) �

Entry: $8.30 – $9.00

TP 1: $10.50 | TP 2: $12 | TP 3: $15

SL: $7.90

Analysis: LINK remains below major resistance with weak price action. A break above $10.50 could attract buyers, but sellers remain dominant near current levels.

$LINK #GateSquare$50KRedPacketGiveaway

Trend: Mild downtrend; bearish momentum.

Current Value: ~$8.7 – $8.8 (approx) �

Entry: $8.30 – $9.00

TP 1: $10.50 | TP 2: $12 | TP 3: $15

SL: $7.90

Analysis: LINK remains below major resistance with weak price action. A break above $10.50 could attract buyers, but sellers remain dominant near current levels.

$LINK #GateSquare$50KRedPacketGiveaway

LINK1%

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJFAATFUQ

View Original

- Reward

- like

- Comment

- Repost

- Share

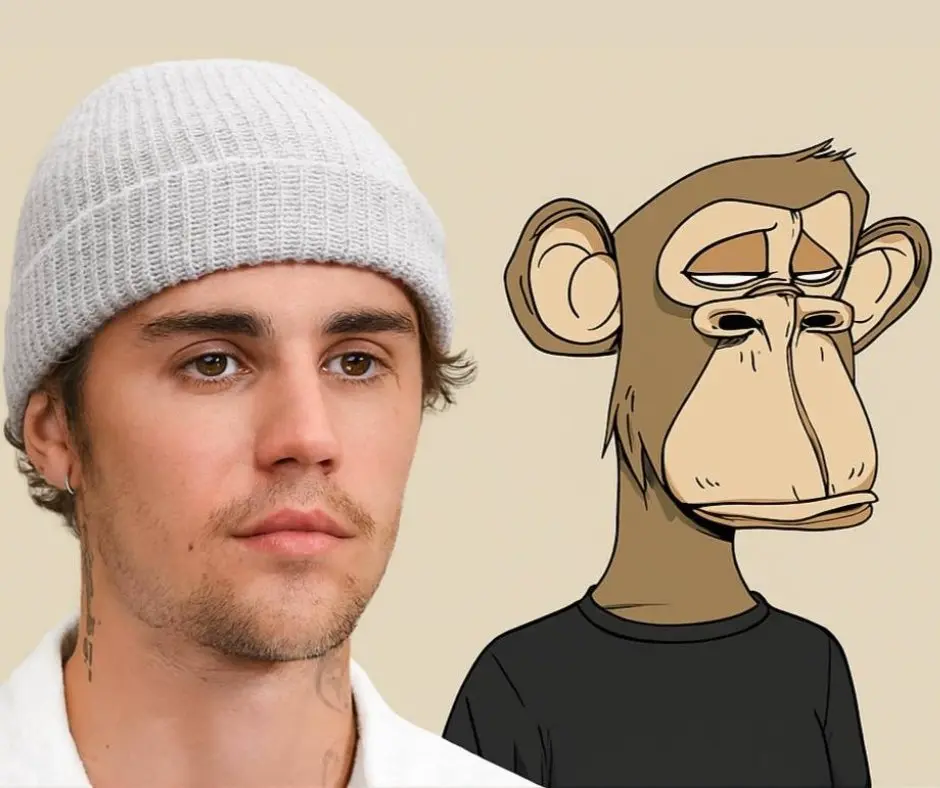

In January 2022, Justin Bieber bought an NFT from Bored Ape Yacht Club for $1.3 million.

The same NFT is now valued at approximately $12,000.

View OriginalThe same NFT is now valued at approximately $12,000.

- Reward

- like

- Comment

- Repost

- Share

#HongKongPlansNewVAGuidelines

Hong Kong is moving forward with plans to introduce updated virtual asset (VA) guidelines aimed at strengthening market integrity, enhancing investor protection, and fostering responsible innovation in the crypto space. These new guidelines are expected to provide clearer regulatory frameworks for exchanges, service providers, and digital asset projects, while aligning with global standards. Market participants anticipate that the changes will improve transparency, mitigate risks, and create a more secure environment for both retail and institutional investors.

#C

Hong Kong is moving forward with plans to introduce updated virtual asset (VA) guidelines aimed at strengthening market integrity, enhancing investor protection, and fostering responsible innovation in the crypto space. These new guidelines are expected to provide clearer regulatory frameworks for exchanges, service providers, and digital asset projects, while aligning with global standards. Market participants anticipate that the changes will improve transparency, mitigate risks, and create a more secure environment for both retail and institutional investors.

#C

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

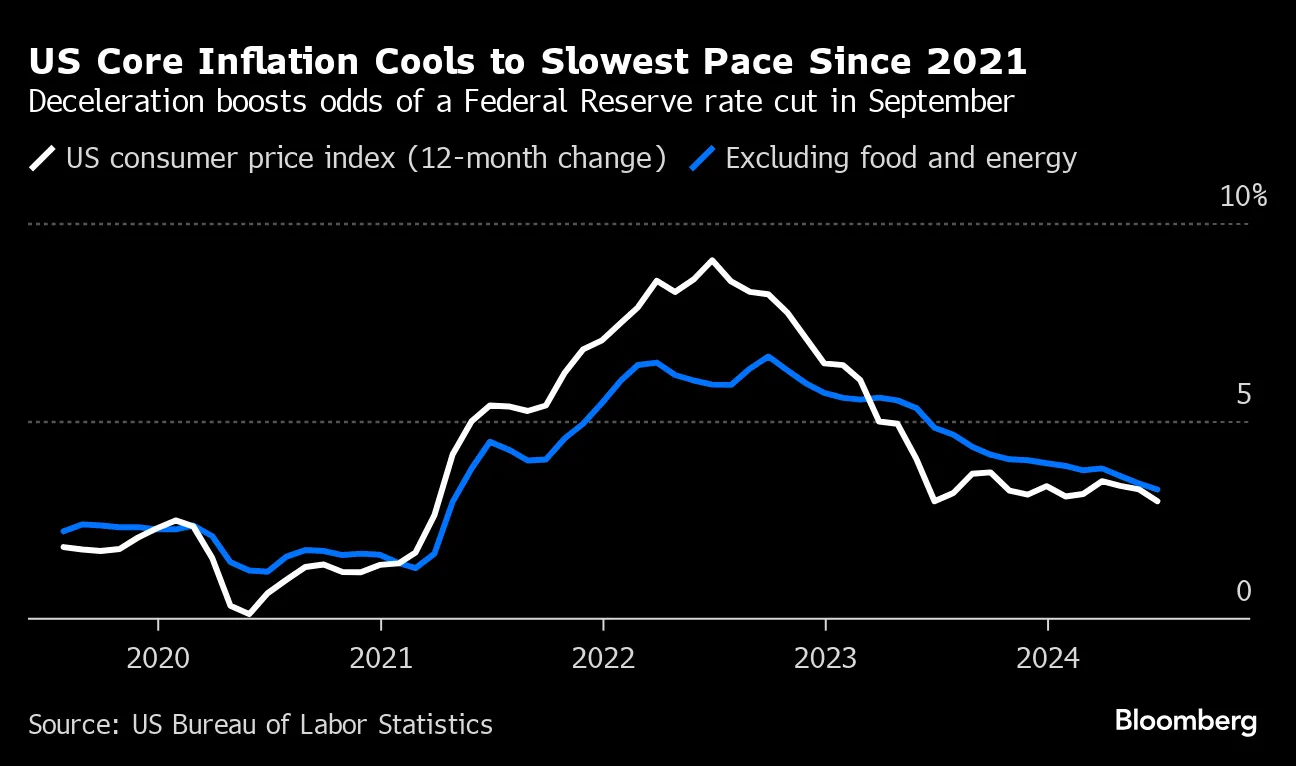

2026 GOGOGO 👊📉 US Core CPI Hits Four-Year Low!

Economists and investors are buzzing as the US Core Consumer Price Index (CPI) shows its lowest reading in four years! This key indicator, which excludes volatile food and energy prices, is signaling a cooling in inflation, giving markets and consumers a sigh of relief.

🔹 Why it matters:

A lower core CPI can influence the Federal Reserve’s interest rate decisions, potentially easing pressure on borrowing costs and stimulating economic growth. For investors, this could mean more stability in markets and renewed confidence in long-term strategies.

🔹 What it t

Economists and investors are buzzing as the US Core Consumer Price Index (CPI) shows its lowest reading in four years! This key indicator, which excludes volatile food and energy prices, is signaling a cooling in inflation, giving markets and consumers a sigh of relief.

🔹 Why it matters:

A lower core CPI can influence the Federal Reserve’s interest rate decisions, potentially easing pressure on borrowing costs and stimulating economic growth. For investors, this could mean more stability in markets and renewed confidence in long-term strategies.

🔹 What it t

- Reward

- 2

- 4

- Repost

- Share

Lock_433 :

:

2026 GOGOGO 👊View More

Crypto Market Direction Today – Technical Overview

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More153.99K Popularity

29.5K Popularity

26.31K Popularity

71.82K Popularity

12.46K Popularity

News

View MoreEuropean Central Bank's Nagel: Euro stablecoins facilitate low-cost cross-border payments

7 m

Fed Governor Notes Fading Crypto Euphoria; Chinese Exchanges Tighten Rules; Senators Query UAE Stake in WLFI

13 m

Data: Over the past 24 hours, the entire network has been liquidated for $296 million, mainly long positions.

2 h

BTC short-term decline of -1.17%: Panic spreading and long-term holders selling dominate downward pressure

2 h

In the past 4 hours, the entire network has been liquidated for $123 million, mainly long positions.

2 h

Pin