Resultados de la búsqueda para "TYPE"

El creador de Thodex fue encontrado muerto en su celda tras una sentencia de 11,000 años.

Faruk Fatih Özer, el fundador de la plataforma Thodex, fue encontrado muerto en su celda en la prisión de máxima seguridad Tekirdağ F-Type, según GDH Digital. Las sospechas iniciales sugirieron que se suicidó, pero la causa oficial aún está bajo investigación.

Thodex, fundado en 2017, fue una de las principales plataformas de intercambio en Turquía.

TapChiBitcoin·2025-11-01 11:40

Línea TGE cuenta regresiva: análisis completo de tecnología, ecosistema y tokenómica

Linea, como una red de segunda capa de Ethereum, fue creada por ConsenSys y utiliza la tecnología Type 2 zkEVM. Este artículo analiza en profundidad su tecnología, el desarrollo del ecosistema, su tokenómica única y la hoja de ruta futura. Este artículo se basa en un escrito de Jinse Finance, organizado, traducido y redactado por PANews. (Resumen: Cuenta regresiva para el Airdrop de Linea: ¿Cuándo comenzará L2 a beneficiar a Ethereum?) (Información adicional: ¿Podrá Etherex dar el primer golpe antes del TGE de Linea?) Linea se posiciona a sí misma como "una red de segunda capa de Ethereum nacida para potenciar a Ethereum (L2)". La misión parece simple, pero está llena de poder. Con el precio de Ethereum recuperándose drásticamente en los últimos dos meses y acercándose a nuevos máximos, Linea se ha convertido rápidamente en uno de los proyectos más esperados en el ámbito de la encriptación.

ETH0,62%

動區BlockTempo·2025-08-23 02:33

HashKey Exchange ha pasado la verificación doble de SOC 1 Tipo 2 y SOC 2 Tipo 2

El mayor intercambio de activo digital con licencia en Hong Kong, HashKey Exchange, anunció hoy que HashKey Custody Services Limited (en adelante, "HashKey Exchange") ha obtenido con éxito la verificación SOC 1 Tipo 2 y SOC 2 Tipo 2, convirtiéndose en una de las pocas empresas en la industria que ha obtenido ambas certificaciones internacionales de prestigio. Esto marca un progreso continuo para HashKey Exchange en términos de Cumplimiento y seguridad, proporcionando servicios de activo digital de nivel empresarial más confiables para inversores individuales e institucionales.

HashKey Exchange ha obtenido simultáneamente dos certificaciones, lo que destaca su fortaleza profesional y ventaja de cumplimiento en el campo de los activos digitales. Entre ellas, la certificación SOC 1 Type 2 verifica principalmente HashKey Ex

DeepFlowTech·2025-05-09 09:31

De la toma de decisiones humanas al dominio del código: ¿cómo permiten los terceros tipos de moneda estable que los ingresos se "autogeneren"?

Título original: "Type III Stablecoins"

Autor original: STANFORD BLOCKCHAIN CLUB

Compilado por|Odaily Planet Daily Ethan(@ethanzhang\_web3)

Las stablecoins, como componente clave del ámbito de las criptomonedas, han visto su capitalización de mercado total de activos líquidos superar los 200 mil millones de dólares, consolidándose en una posición central en el mercado cripto actual. Algunos creen que la escala de las stablecoins se ha desacoplado de un mercado cripto extremadamente volátil, a pesar de que en 2025 se prevé una corrección en el mercado cripto.

星球日报·2025-04-03 10:56

Análisis simple del mercado de comercio de agentes de IA del Protocolo de Historias.

Story exists for IP, and IP is a type of asset that includes brands, creative works, technological achievements, etc. Story combined with AI agents can form an on-chain market that combines IP and AI agents, where training data, creative works, etc., can be traded. Story's framework can help facilitate interaction and transactions of IP between AI agents, thereby creating a new type of on-chain economy. Its success depends on the total volume of IP transactions between AI agents.

金色财经_·2025-01-15 14:32

¿El DAO también necesita registrarse para su revisión? Wu Chi-chuang, miembro del Consejo Legislativo de Hong Kong, sugiere que el gobierno imite la emisión de licencias de la industria de valores.

Hong Kong has heard the world's first lawsuit involving a Decentralized Autonomous Organization (DAO) this year, highlighting the legal and governance challenges of such new organizations. Hong Kong Legislative Council member Wu Jiezhuang suggested that the Hong Kong government should promptly establish a regulatory framework for DAO to help the development of the Web3 ecosystem and attract global resources. (Background: a tweet raised 35,000 SOL, what is the AI-Pool presale by ai16zdao?) (Background: DeSci's new chapter! Quantum Biology DAO launches $QBIO tokens, BIO Protocol's first emisión) The High Court of Hong Kong ruled in August this year on the world's first case involving a Decentralized Autonomous Organization (DAO), marking the substantive stage of the legal and compliance challenges faced by this new type of organization. As the Web3 ecosystem continues to grow, Hong Kong Legislative Council member Wu Jiezhuang believes that Hong Kong should formulate targeted regulations for

動區BlockTempo·2024-12-31 07:47

Un juez federal acaba de darle un golpe en la barbilla a la SEC. Esto es lo que significa. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

El camino avanzado de OP Stack: OP Succinct desbloquea el potencial de ZK Rollup

TL;DR

●OP Succinct es un módulo principal ofrecido para integrar ZKP en la arquitectura modular de OP Stack para convertir OP Stack Rollup en ZK Rollup completamente verificado;

●Si el destino final de la expansión futura de Ethereum es convertir cada Rollup en ZK Rollup, el objetivo de OP Succinct es implementar despliegues de Type-1 zkEVM (completamente equivalente a Ethereum) combinando Rust y SP1 para OP Stack.

● OP Succinct Proposer se encarga principalmente de la generación paralela de pruebas y la agregación y verificación de pruebas;

El sistema actual de OP Stack depende de la "ventana antifraude de 7 días". En caso de disputa, la verificación de la transacción se pospondrá por una semana.

金色财经_·2024-09-26 08:23

El camino hacia la evolución de OP Stack: OP Succinct desbloquea el potencial de ZK Rollup

TL;DR

La función principal proporcionada por OP Succinct es integrar ZKP en la arquitectura modular de OP Stack para convertir OP Stack Rollup en un ZK Rollup totalmente verificado;

● Si el final de la expansión de ETH es convertir cada Rollup en ZK Rollup, el objetivo de OP Succinct es implementar la implementación de OP Stack Type-1 zkEVM (totalmente equivalente a ETH) combinando Rust y SP1.

● OP Succinct Proposer 主要完成了并行生成证明和证明聚合与验证;

● El sistema actual de OP Stack depende de "7

律动·2024-09-26 01:05

La evolución de OP Stack: OP Succinct libera el potencial de ZK Rollup

Autor: YBB Capital Investigador Ac-Core

TLDR

La función principal de OP Succinct es integrar ZKP en la arquitectura modular de OP Stack, convirtiendo OP Stack Rollups en ZK Rollups completamente verificados.

Si la solución de escalado futura de Ethereum es convertir todos los Rollups en ZK Rollups, entonces OP Succinct tiene como objetivo desplegar Type-1 zkEVM en la pila OP utilizando Rust y SP1 (totalmente equivalente a Ethereum y otros).

OP Succinct Proposer implementa la generación de pruebas en paralelo, así como la agregación y verificación de pruebas.

El sistema actual de OP Stack depende de "7

金色财经_·2024-09-25 10:48

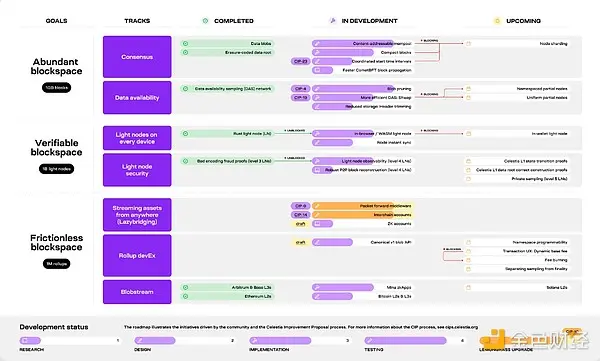

Una visión completa del futuro de Celestia: expansión a 1 GB Bloquear

Celestia Mainnet Beta recently released a technical roadmap, with the core goal of expanding to 1GB of Bloquear to improve data throughput. The roadmap is divided into three main workflows: Sufficient Bloquear space, Verifiable Bloquear space, and Barrier-free Bloquear space. To ensure that anyone can verify Bloquear space on any device, the Celestia community is working hard to enable lightweight nodes to run in web browsers. Developers can build any type of application to meet the throughput requirements of different use cases while achieving high throughput and unstoppable effects.

金色财经_·2024-09-06 02:34

¿Por qué Ethervista está provocando el seguimiento de la comunidad de DeFi de la red ETH? ¿Cómo participar?

Ethervista is a new type of DEX that aims to solve the problem of lack of innovation in Mainnet for ETH blockchain DeFi users by leveraging market gaps. The VISTA token has raised over $15 million within just 2 days of the release of the White Paper. Its key advantages include a fair launch mechanism, a deflationary economic model, upcoming features, and market penetration. Users can connect their ETH wallet to the official website, exchange ETH for VISTA, and lock it in LP for 5 days. However, early investors should be cautious as the price may experience a sharp decline.

金色财经_·2024-09-03 10:37

Hashed: ¿Por qué invertimos en Taiko?

原文作者:Ryan Kim, Edward Tan, Dan Park

原文编译:深潮 TechFlow

想象一下,在这个世界里,以太坊的可扩展性是无止境的,交易速度快如闪电,用户隐私是神圣不可侵犯的。这不是一个遥远的梦想,而是一个迅速接近的现实,这一切都归功于 Taiko。

作为主要投资者,我们很高兴支持 Taiko 在Ethereum生态系统中进行革命性创新的旅程,他们的Type-1

星球日报·2024-05-28 06:02

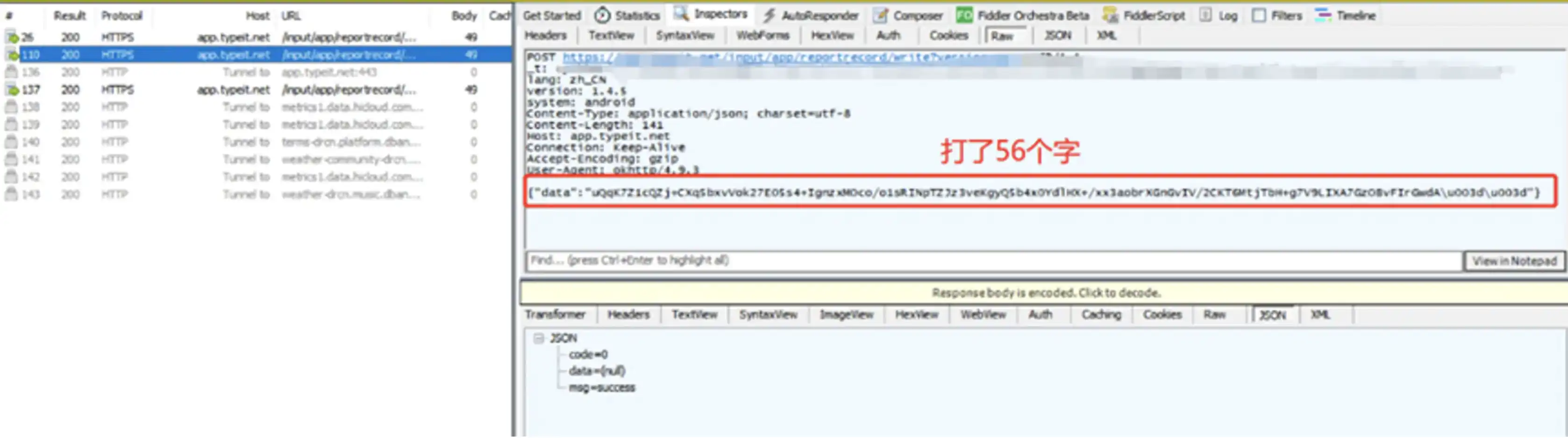

TypeIt!: método de entrada Web3 protegido por privacidad, lanzamiento innovador de Type to Earn

Type!t es el primer método de entrada Web3 del mundo, basado en tecnología de encriptación y almacenamiento descentralizado para proteger los datos de uso de los usuarios y otra información privada, y también tiene funciones Web3 como Type To Earn, Gamefi, chat encriptado y tesauro AI.

律动·2023-05-31 14:25

Cargar más