Post content & earn content mining yield

placeholder

BLOOCK

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLFNUQTDAG

- Reward

- like

- Comment

- Repost

- Share

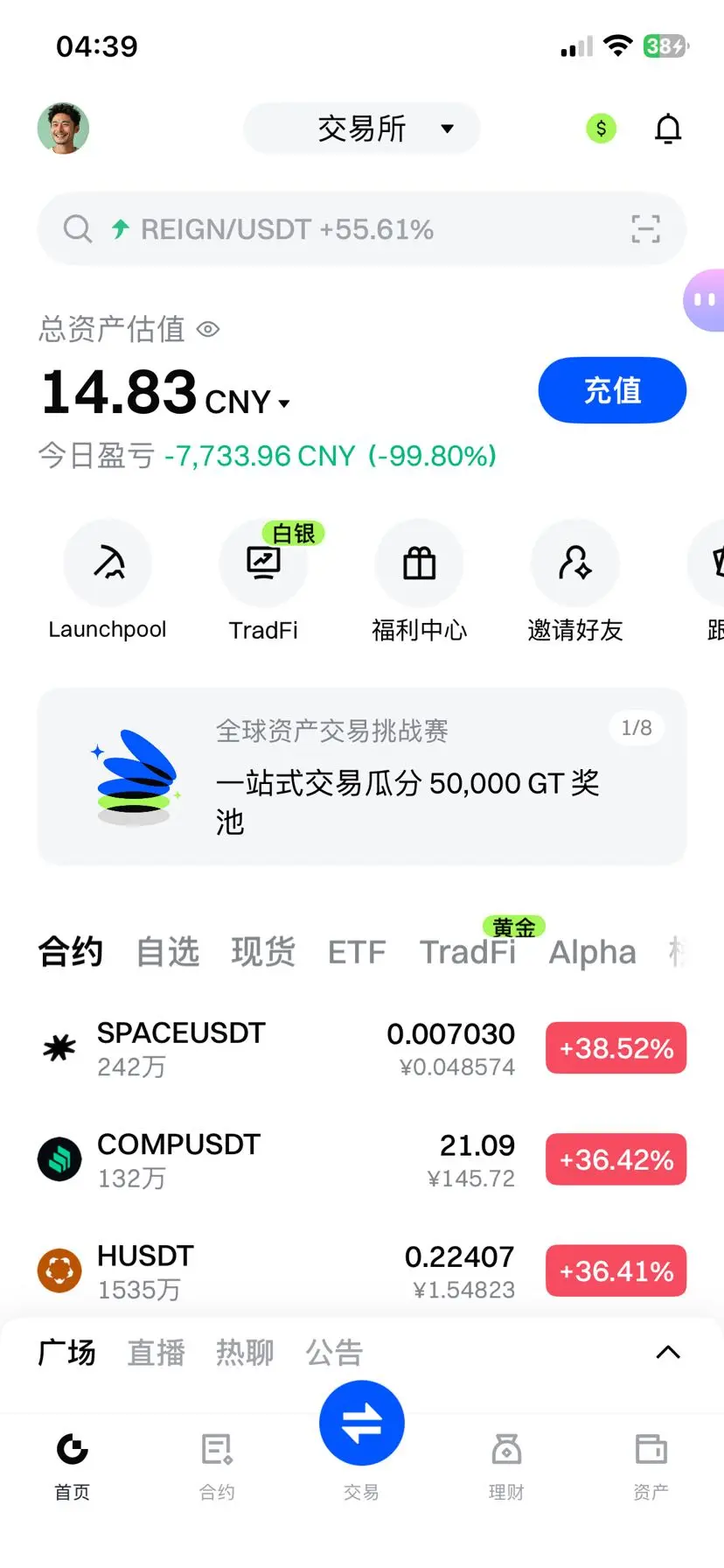

She told me she would be busy on Saturday night, but she could do Valentine's Day dinner on Friday.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

LinYe :

:

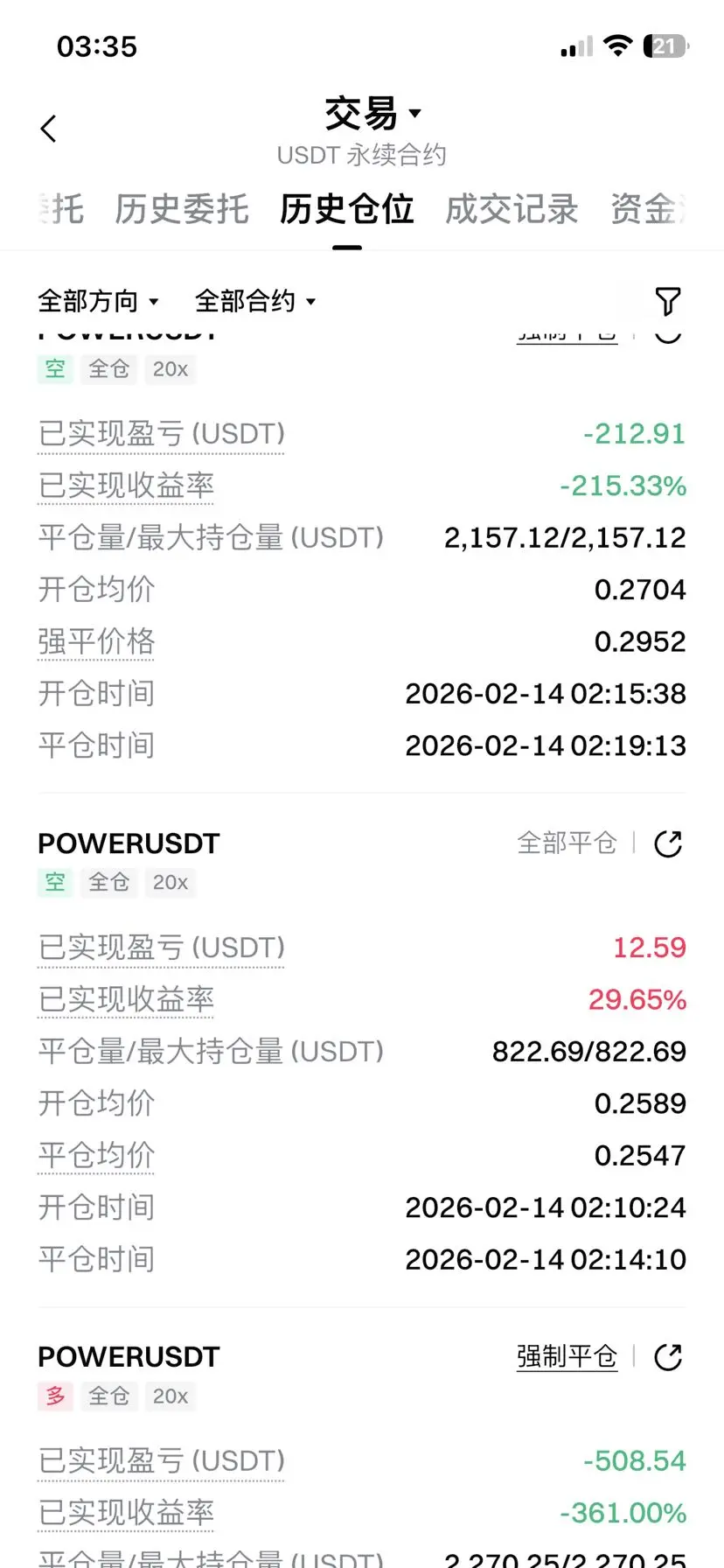

Who else would blow up with 20x leverage but you?芝麻开门

芝麻开门

Created By@DreamJourney

Listing Progress

100.00%

MC:

$2K

More Tokens

Bitcoin Price on Valentine’s Day

2011: $1

2012: $5

2013: $20

2014: $600

2015: $300

2016: $450

2017: $1,200

2018: $10,000

2019: $3,631

2020: $10,000

2021: $45,000

2022: $42,500

2023: $22,000

2024: $75,000

2025: $95,000

2026: $70,000

2011: $1

2012: $5

2013: $20

2014: $600

2015: $300

2016: $450

2017: $1,200

2018: $10,000

2019: $3,631

2020: $10,000

2021: $45,000

2022: $42,500

2023: $22,000

2024: $75,000

2025: $95,000

2026: $70,000

BTC3.77%

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VgASAFoM

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

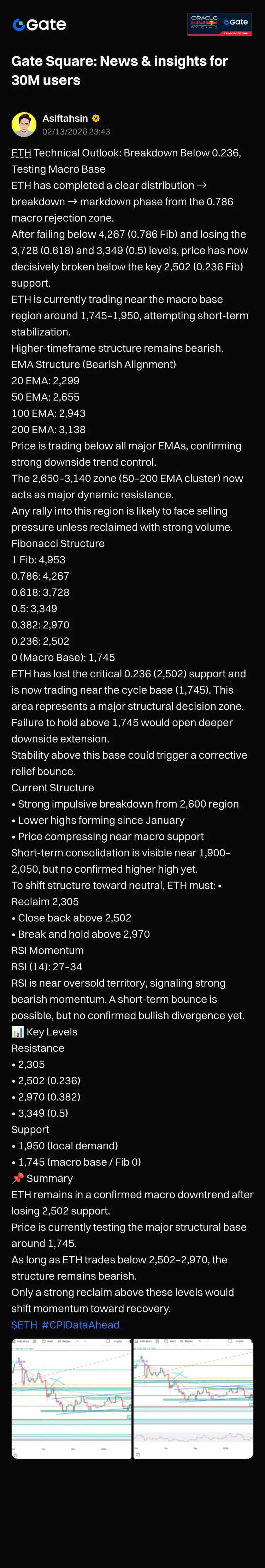

Crypto overall still weak this year

- Reward

- like

- Comment

- Repost

- Share

The market never sleeps… and neither do smart traders. 💎

2026 is starting strong and this is the perfect time to position yourself ahead of the crowd. While others are waiting for the “perfect moment”, professionals are already building, accumulating and engaging with the ecosystem.

Gate Plaza is bringing exciting campaigns, rewards and community events that create real opportunities for active users. From red envelope events to creator rewards and trading competitions, this is more than just trading — it’s about being part of a growing crypto movement.

The key is simple:

✔ Stay active

✔ Crea

2026 is starting strong and this is the perfect time to position yourself ahead of the crowd. While others are waiting for the “perfect moment”, professionals are already building, accumulating and engaging with the ecosystem.

Gate Plaza is bringing exciting campaigns, rewards and community events that create real opportunities for active users. From red envelope events to creator rewards and trading competitions, this is more than just trading — it’s about being part of a growing crypto movement.

The key is simple:

✔ Stay active

✔ Crea

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VGRBUF4JAQ

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VlFGVA9W

View Original

- Reward

- like

- Comment

- Repost

- Share

PIJSChain open source landed! 🔧

Code transparency + ecological scalability, and the technical moat has been built 🛡️

PIJS relies on open source strength to challenge BNB, and the technology party will dismantle it - how much can this wave of technology empowerment rise? 📊

Code transparency + ecological scalability, and the technical moat has been built 🛡️

PIJS relies on open source strength to challenge BNB, and the technology party will dismantle it - how much can this wave of technology empowerment rise? 📊

BNB1.06%

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLRHAWPZVA

View Original

- Reward

- like

- Comment

- Repost

- Share

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$70.97K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLUQAF0LVG

View Original

- Reward

- like

- Comment

- Repost

- Share

Chat wtf? How low can we go

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLNNA1HDAW

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVRBBF1Y

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Fed governor says U.S. fiscal outlook is improving, reinforcing the dollar’s reserve status

- Reward

- 2

- 3

- Repost

- Share

User_any :

:

2026 GOGOGO 👊View More

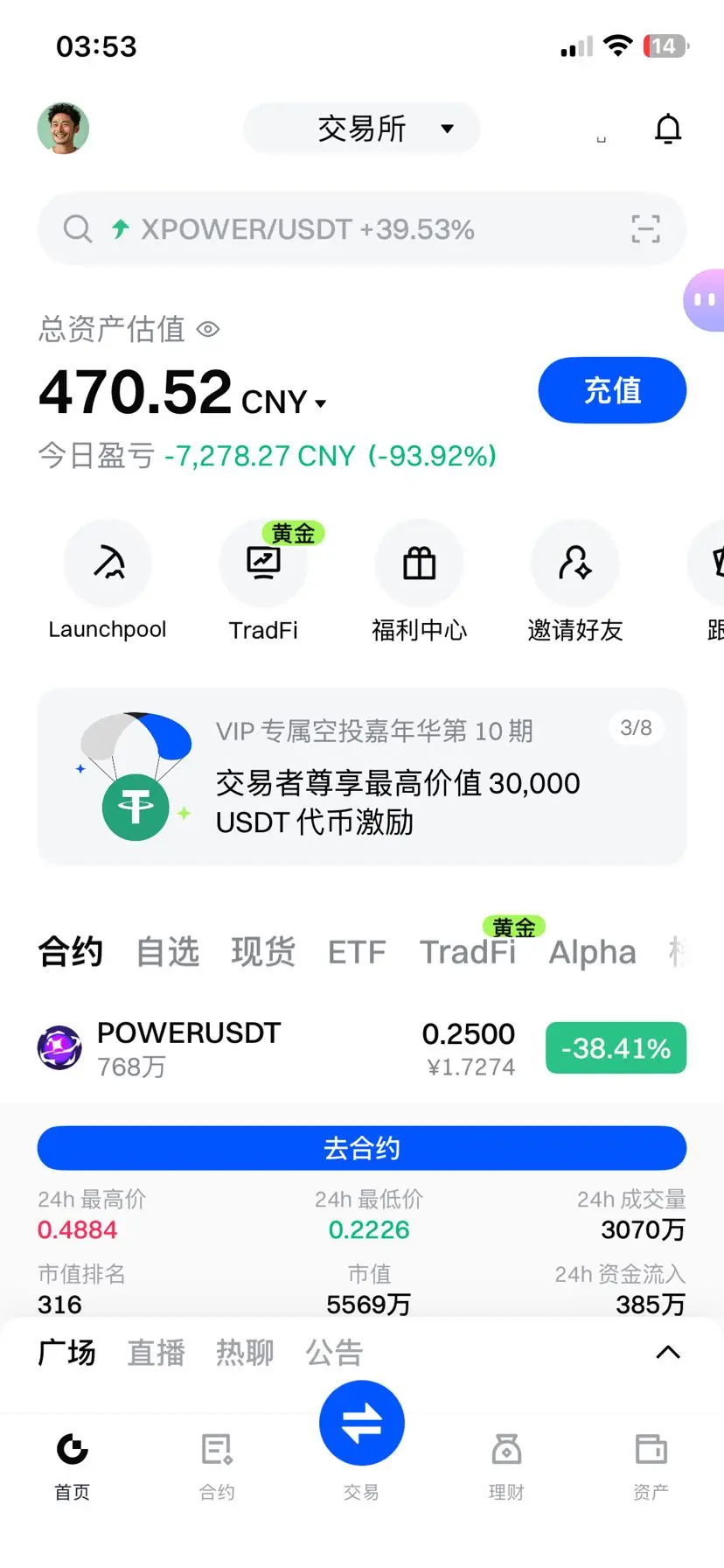

🌪️ Crypto Storm Meets Traditional Assets — Time to Level Up!

Amid the volatility of the crypto market and the dynamics of the global economy, opportunities are opening up even more. Now, through Gate.io, you can explore two worlds simultaneously on a single integrated platform.

🔥 The Global Traditional Assets Trading Challenge Officially Begins!

A cross-market trading competition with a total prize of 50,000 GT ready to be contested by the best traders.

🌎 One Account, Access to All Markets Worldwide

Diversify your strategy by trading:

• Large-cap global stocks

• Major world indices

• High-l

Amid the volatility of the crypto market and the dynamics of the global economy, opportunities are opening up even more. Now, through Gate.io, you can explore two worlds simultaneously on a single integrated platform.

🔥 The Global Traditional Assets Trading Challenge Officially Begins!

A cross-market trading competition with a total prize of 50,000 GT ready to be contested by the best traders.

🌎 One Account, Access to All Markets Worldwide

Diversify your strategy by trading:

• Large-cap global stocks

• Major world indices

• High-l

GT1.14%

- Reward

- 1

- 1

- Repost

- Share

GateUser-7d9f9cdb :

:

Ape In 🚀Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLMWBLXZVA

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More57.76K Popularity

48.93K Popularity

19.51K Popularity

46.37K Popularity

254.58K Popularity

Hot Gate Fun

View More- MC:$2.44KHolders:10.00%

- MC:$2.45KHolders:20.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.6KHolders:20.85%

News

View MoreData: 248.34 BTC transferred out from Cumberland DRW, worth approximately 10.36 million USD

3 h

Data: 52,000 SOL transferred to Wintermute, worth approximately $4,435,100.

3 h

Data: If BTC drops below $65,621, the total long liquidation strength on mainstream CEXs will reach $1.322 billion.

4 h

Data: If ETH falls below $1,951, the total long liquidation strength on major CEXs will reach $612 million.

4 h

Daiwa Capital: CPI and employment data support the Federal Reserve to keep interest rates unchanged in March

5 h