What is Meteora (MET)?

What Is Meteora?

(Source: MeteoraAG)

Meteora is a next-generation DeFi protocol, backed by YZi Labs and IDG Capital, designed to deliver the most efficient, composable, and sustainable liquidity infrastructure on Solana. After rebranding from Mercurial Finance to Meteora in 2023, the project quickly became the primary liquidity source for major Solana aggregators such as Jupiter Swap. This powered dynamic capital flows across the ecosystem.

To date, Meteora has secured over $55 million in multiple funding rounds. The protocol has established itself as one of the flagship foundational projects within Solana DeFi.

Meteora’s Core Mission

Meteora aims to build a dynamic, composable, and perpetual capital layer connecting liquidity providers with new projects, and to elevate overall capital efficiency through an innovative market-making framework. This mission is embodied in Meteora’s three core components:

- DLMM (Dynamic Liquidity Market Maker)

- DAMM (Dynamic Automated Market Maker)

- Dynamic Vault

Together, these modules form Solana’s most adaptable liquidity engine, reducing trade slippage and enabling liquidity providers to adjust strategies and enhance returns in real time.

DLMM Technology

DLMM is Meteora’s flagship innovation, fundamentally transforming the typical AMM model. Rather than passively dispersing liquidity across the entire price spectrum, DLMM uses a price bin structure to concentrate liquidity in targeted price bands. This approach dramatically increases capital efficiency and empowers liquidity providers to actively manage funds in volatile markets.

For instance, if you expect SOL’s price to range between $100 and $110, you can allocate liquidity exclusively within that range, maximizing trading fee income instead of leaving capital idle outside relevant price levels.

Dynamic Vaults: Automated Yield and Risk Management

Dynamic Vaults are another key innovation from Meteora. The system automatically moves idle assets among multiple DeFi lending protocols (including Kamino, MarginFi, Solend) to optimize yields. These vaults automate both fund allocation and income generation, providing users with two sources of compounding income:

- Trading fees (from DLMM pools)

- Lending interest (from integrated protocols)

Users do not need to manually intervene, as Meteora’s system continuously monitors market conditions and automatically refines strategies, providing two compounding income streams.

Alpha Vault & Fair Launch Mechanism

Meteora introduced Alpha Vaults during its token launch to address the persistent issue of sniper bots. In conventional launches, bots often buy large amounts of tokens instantly, causing extreme price swings. Meteora’s Alpha Vaults utilize liquidity locks and phased release structures to ensure an equitable launch. This system enables genuine community participants to buy in at fair prices, prevents liquidity drainage and short-term dumping, and safeguards ecosystem stability.

M3M3: Hold-to-Earn Liquidity Incentives

Meteora’s M3M3 module implements a hold-to-earn system, allowing token holders to earn continuous returns from locked liquidity. By staking tokens in liquidity pools, holders receive a share of trading revenue generated within those pools. This mechanism incentivizes long-term participation and reduces short-term selloffs. M3M3 rewards are automatically compounded, creating a sustainable yield cycle that enhances token stability and appeal.

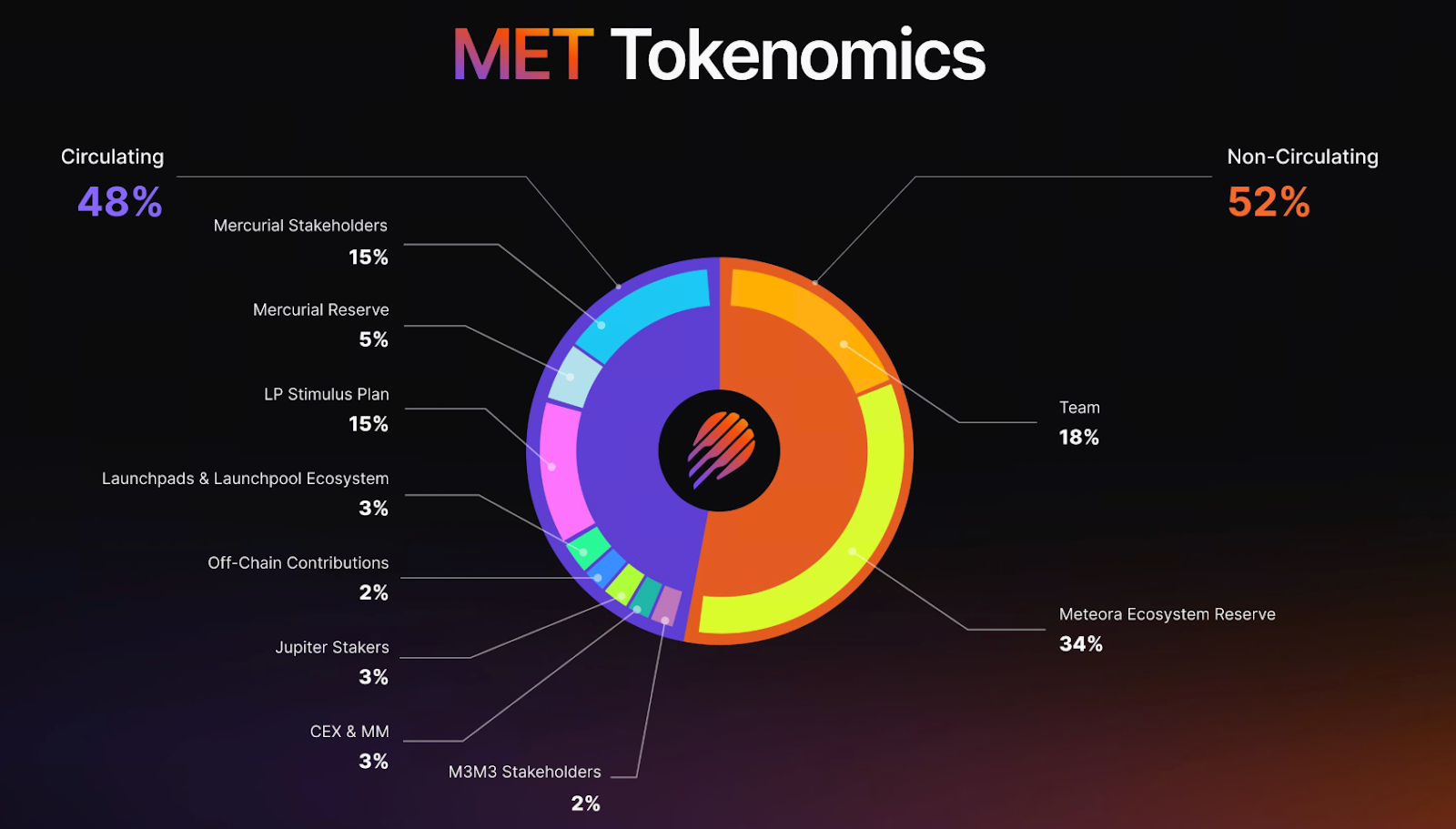

Tokenomics

Meteora adopts a distinct liquidity allocator mechanism instead of standard airdrops. Recipients are allocated liquidity positions in the MET/SOL pool rather than direct tokens, allowing them to earn trading fees and reducing sell pressure. The total supply is 1,000,000,000 MET. The initial circulating supply is 48% (480,000,000 MET). Allocation breakdown:

Immediate Circulation (48%)

- Legacy Stakeholders: 20%

- User & Liquidity Provider Rewards: 15%

- Jupiter Ecosystem Stakers: 3%

- Launchpad & Launchpool: 3%

- Advisors & Off-chain Contributors: 2%

- M3M3 Participants: 2%

- CEX Liquidity & Market Making Support: 3%

Long-Term Vesting (52%, 6-Year Linear Release)

- Core Team: 18%

- Treasury & Reserve: 34%

(Source: MeteoraAG)

This structure reflects a long-term, community-driven philosophy. The team and investor tokens undergo extended lockups, ensuring sustainable project growth and alignment with community interests.

Token Utility

$MET is the primary engine of the Meteora ecosystem, with use cases including:

- Governance: Token holders participate in protocol governance, fee settings, and product proposals;

- Liquidity Incentives: Earn MET rewards by providing liquidity or joining Vaults;

- Fee Rebates: Part of protocol revenue is used to buy back MET and distribute to stakers;

- Ecosystem Advancement: Support new project launches and partner incentive programs.

To learn more about Web3, click to register: https://www.gate.com/

Summary

Meteora is more than a DEX; it is evolving into the core liquidity engine of Solana. With DLMM’s high-efficiency market-making, Dynamic Vault’s automated yield generation, and the innovative liquidity allocator tokenomics, Meteora provides a self-sustaining, community-driven decentralized liquidity layer. As Solana DeFi matures, Meteora (MET) is not only a technical breakthrough but also a new standard for capital efficiency and fairness.

Related Articles

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About

What Are Crypto Options?