The Liquidity Challenge of RWAs: Why AMMs Can Only Be a “Convenience Layer” and Not the “Main Market”

Introduction: Bridging the RWA Liquidity Gap

Real-world assets (RWAs) are rapidly becoming a defining narrative for Web3’s move into the mainstream. Yet, onboarding trillions of dollars in real-world assets to the blockchain is just the beginning. The real test lies in whether we can build efficient, resilient secondary market liquidity for these assets—tokenization alone is not enough. Automated market makers (AMMs), a cornerstone of DeFi, are naturally attracting attention as a potential solution. But can we simply transplant the AMM model into the RWA landscape?

Summary (Three-Point Overview)

· Conclusion: Today’s mainstream AMMs (like concentrated liquidity pools and stablecoin curves) are ill-suited to serve as the “primary market” for RWAs. The core issue isn’t the curve model itself but the underlying economic incentives for LPs (liquidity providers). In low-turnover, compliance-heavy, slow-moving RWA environments, these models simply aren’t sustainable.

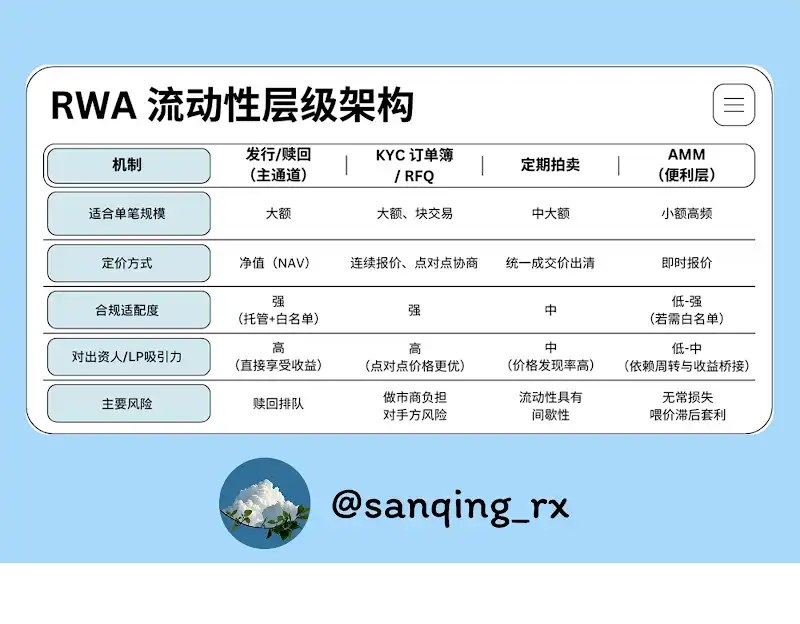

· Positioning: RWA liquidity should primarily be routed through issuance/redemption mechanisms, KYC-enabled order books or RFQs, and scheduled auctions. AMMs should stand back as a “convenience layer,” only facilitating small-scale, everyday swaps and smooth minor asset adjustments.

· Approach: To truly make RWA-native yields (interest, rent, etc.) flow to LPs, a combination of “narrow-band market making, oracle slip-band/hooks, and yield bridging” strategies should be used—underpinned by solid risk controls and robust disclosure practices.

1. AMMs Aren’t Fit to Be the “Primary Market” for RWAs

RWA trading demands predictability, auditability, and settlement certainty. Continuous-quote AMMs are an innovative DeFi construct, but they face three fundamental challenges in RWA markets: chronically low trading activity, slow information “heartbeat,” and drawn-out compliance routes. That leaves LPs with exceedingly thin fee returns—while exposing them to the risk of impermanent loss.

In short, AMMs shouldn’t bear the “primary market” burden for RWAs—they’re best-suited as the “last mile” for liquidity. The role of AMMs should be to offer users frictionless, anytime, anywhere small swaps that enhance day-to-day user experience. Large trades and real price discovery, however, must be handled with alternative, better-suited mechanisms.

2. Why Do AMMs Thrive in Crypto-Native Markets?

To understand why AMMs stumble with RWAs, we must first examine what enables their success in crypto-native settings:

● Continuous trading: Crypto markets run 24/7 globally, and permissionless arbitrageurs jump on any price gaps instantly—this sustains ceaseless trading volumes.

● Extreme composability: Anyone or any protocol can be an LP or arbitrageur without barriers, fueling powerful network effects and reinforcing liquidity.

● Volatility is the business: High volatility triggers constant trade and arbitrage demand, generating fees that can help LPs outpace impermanent loss.

Try replicating these features for RWAs, and the foundation crumbles: trade frequency plummets, price updates slow to a crawl, and compliance thresholds shoot up.

[In-Context Definition | Pricing Heartbeat]

“Pricing heartbeat” is how often you get a reliable price update—a core distinction between RWAs and crypto-native assets.

· Crypto-native assets: Heartbeat is often measured in seconds (exchange quotes, oracle feeds).

· Most RWAs: Heartbeat is daily or even weekly (fund NAV updates, real estate appraisals, auction results).

The slower the heartbeat, the less appropriate deep, continuous-quote AMM pools become for the asset.

3. Why LP Economics Break Down in RWA Scenarios

LPs expect a certain “annualized return”—but this hinges on three factors: trading fees, how often their capital is actually used in the right price zone, and the frequency of these trading cycles through the year.

For RWAs, the math almost never works out. Here’s why:

● Low turnover is the norm: “Dormant” capital in pools is rarely activated by high-frequency trading, so fee income is meager.

● High opportunity costs: Off-chain markets may offer attractive yields or risk-free returns. If LPs could simply own the RWA itself, that would often beat the returns from providing AMM liquidity.

● Risk/reward is unattractive: With little fee income, LPs still shoulder impermanent loss (vs. holding the RWA) and are exposed to arbitrageurs who exploit oracle lags.

Bottom line: the AMM LP model is structurally disadvantaged for RWAs.

4. Two Structural Frictions: Pricing & Compliance

There are two more structural frictions at play beyond pure economics:

· Pricing rhythm mismatch: RWA valuations and auctions update on a “slow heartbeat,” while AMMs quote in real-time. This time lag creates rich arbitrage opportunities for the informed, with LPs left holding the bag.

· Compliance fragments composability: KYC, whitelists, and transfer restrictions lengthen on/off ramps and disrupt the “anyone can participate” Lego-brick architecture of DeFi—directly causing fragmented, shallow liquidity.

· Cash flow “pipeline engineering”: Interest and rent flows from RWAs either show up as NAV increases or require direct distributions. If AMMs/LPs aren’t engineered to capture and distribute these yields, LPs may miss out or get diluted by arbitrage flows.

5. Use Cases & Applicability Boundaries

Not all RWAs are fundamentally incompatible with AMMs—classification is key.

· More suitable: Short-term, daily-NAV, high-transparency assets (e.g., money market funds, tokenized Treasuries, yield-bearing notes). Their clear, centralized pricing makes them ideal for narrow-band AMMs serving quick exchanges.

· Less suitable: Real-world assets relying on offline valuations or infrequent auctions (e.g., commercial real estate, private equity). Here, slow heartbeat and deep information asymmetry call for order book/RFQ or auction mechanisms instead.

Case Study: Arbitrage Windows on Plume Chain’s Nest

· Background: The Nest project’s nALPHA and nBASIS tokens traded on Curve and Rooster DEX AMM pools. Early on, redemption was fast (about 10 minutes), but token prices updated only daily—or slower.

· What happened: Since NAVs updated daily but AMMs quoted second-by-second, a new NAV would cause AMM prices to lag. Arbitrageurs could: buy cheap on DEX → immediately redeem with the protocol → settle at the new, higher NAV.

· Result: Arbitrageurs profited while AMM LPs took all the impermanent loss—especially those with liquidity further from the prevailing price, who suffered even heavier losses.

Case Review & Solutions:

● Root cause: Out-of-sync pricing heartbeats, with no protocol-level risk barriers or trade-routing mechanisms.

● Fixes:

-Segregate order flows: AMMs should handle only small swaps (see below); large trades must be routed to RFQ or issuance/redemption channels.

-Active price following: Use “oracle slip-band + hooks” to keep liquidity tightly concentrated near the latest NAV. When NAV updates, automatically move the price corridor or temporarily hike fees.

-Risk boundaries: Set minimum oracle freshness, premium/discount circuit breakers, and switch to auction/redemption-only mode on major revaluation days.

-Transparency: Launch a public dashboard showing premium/discount range, oracle feed status, redemption queues, and so on, so LPs can make informed decisions.

6. A Four-Tiered “Liquidity Skeleton”

A robust RWA market requires multi-layered liquidity infrastructure.

[In-Context Definition | “AMMs Only Handle Small Trades”]

· Positioning: AMMs should serve as the “last mile” convenience layer—handling small orders and minor portfolio adjustments.

· Implementation: On the routing layer, force all trades above a set threshold (e.g., single trades > 0.5%–1% of pool TVL) to RFQ, order book, or issuance/redemption channels. AMMs should ensure users can “swap a little, anytime”—not absorb large trade shocks.

7. Running RWA AMMs Well: Three Key Levers

To make the most of AMMs in a “convenience layer” role, focus on three things:

1. Concentrated Liquidity

Only provide liquidity in a tight range around the asset’s NAV. This greatly improves capital efficiency and slashes the time window during which liquidity can be arbitraged at stale prices.

2. Price Adaptation & Self-Protection (Oracle Slip-Band / Hooks)

This is the dynamic upgrade to concentrated liquidity. Oracles and smart contracts enable automatic, up-to-date price following and can trigger protection mechanisms during volatility.

[In-Context Definition | Oracle Slip-Band & Hook]

· Slip-Band: A narrow corridor for pricing, closely tracking the oracle-provided reference price (e.g., NAV), where liquidity is concentrated.

· Hook: Programmable action in the AMM contract that, when the oracle updates, automatically shifts the “slip-band” to the new price, or temporarily increases fees to manage risk.

The core objective: avoid leaving liquidity “stranded” at stale prices, while retaining the convenience of small swaps.

3. Yield Bridging

There must be clear, code-level mechanisms for RWA yield—interest, rent, etc.—to be correctly credited and distributed to AMM pool LPs. That means explicitly defining “yield enters pool → how claims are calculated → when LPs can withdraw” so LP returns are expanded to include both trading fees and native asset yield.

8. Conclusion: Moving from “Continuous Quotes” to “Predictable Liquidity”

RWAs don’t need round-the-clock pricing noise—they need reliable, measurable, and settlable liquidity rails.

The right approach: let every mechanism do its proper job.

· Build the main “highways” with issuance/redemption, KYC order books/RFQ, and scheduled auctions—for true price discovery and major trades.

· Relegate AMMs to the “last mile,” focusing on smooth, transparent, small-size swap experiences.

When we align capital efficiency with compliance realities—and stop forcing AMMs into an ill-fitting “primary market” role—the on-chain secondary liquidity ecosystem for RWAs will be healthier and more sustainable.

Disclaimer:

- This article is republished from [BlockBeats] and the copyright belongs to the original author [ @sanqing_rx, core member of the RealtyX DAO community]. For any questions about this republication, please contact the Gate Learn team for prompt resolution per our procedures.

- Disclaimer: The opinions and views expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is specifically mentioned, translation of this article may not be copied, distributed, or plagiarized.

Related Articles

Reshaping Web3 Community Reward Models with RWA Yields

ONDO, a Project Favored by BlackRock

What is Plume Network

What Are Crypto Narratives? Top Narratives for 2025 (UPDATED)

Real World Assets - All assets will move on-chain