From Trustless Bitcoin to Tokenized Gold — Which Is the Real “Digital Gold”?

Have you noticed more people around you discussing “gold” recently?

That’s right—I mean gold in the physical, tangible sense. As geopolitical risks and global macroeconomic uncertainties intensify, gold’s total market capitalization has at times reached $30 trillion, firmly securing its place as the world’s leading asset.

Meanwhile, a noteworthy shift is taking place in the crypto space. Beyond Bitcoin, which is widely regarded as “digital gold,” physical gold is rapidly moving on-chain: tokenized gold, led by Tether Gold (XAUT), is gaining new capabilities through the RWA wave, including divisibility, programmability, and even yield generation.

This trend is challenging a narrative long dominated by Bitcoin: “Who is the true digital gold?”

1. BTC: A Decade of Narrative Evolution

Is BTC a currency or an asset? Is its primary function payment or value storage? Or is it a risk asset akin to technology stocks?

Since Bitcoin’s launch in 2009, this question has persisted throughout every stage of its history.

Although Satoshi Nakamoto clearly defined BTC as “Electronic Cash” in the original white paper, the narrative has shifted repeatedly over the past decade as its scale has grown—moving from an early payment method to a “store of value” and “alternative asset,” sparking ongoing debates within the community.

Notably, the approval of spot ETFs in 2024 marked a turning point in this narrative. Fewer people now expect Bitcoin to become a “global currency” for transactions and payments; instead, more view Bitcoin as a consensus-driven store of value—essentially, “digital gold”:

Like gold, Bitcoin is scarce in supply and its production is predictable and stable, but it also offers advantages that gold cannot match: superior divisibility (1 satoshi = 0.00000001 BTC), portability (instant cross-border transfers), and liquidity (24/7 markets).

As a result, Bitcoin is gradually becoming the third pillar of global store-of-value logic in the macro monetary system, following the US dollar and gold.

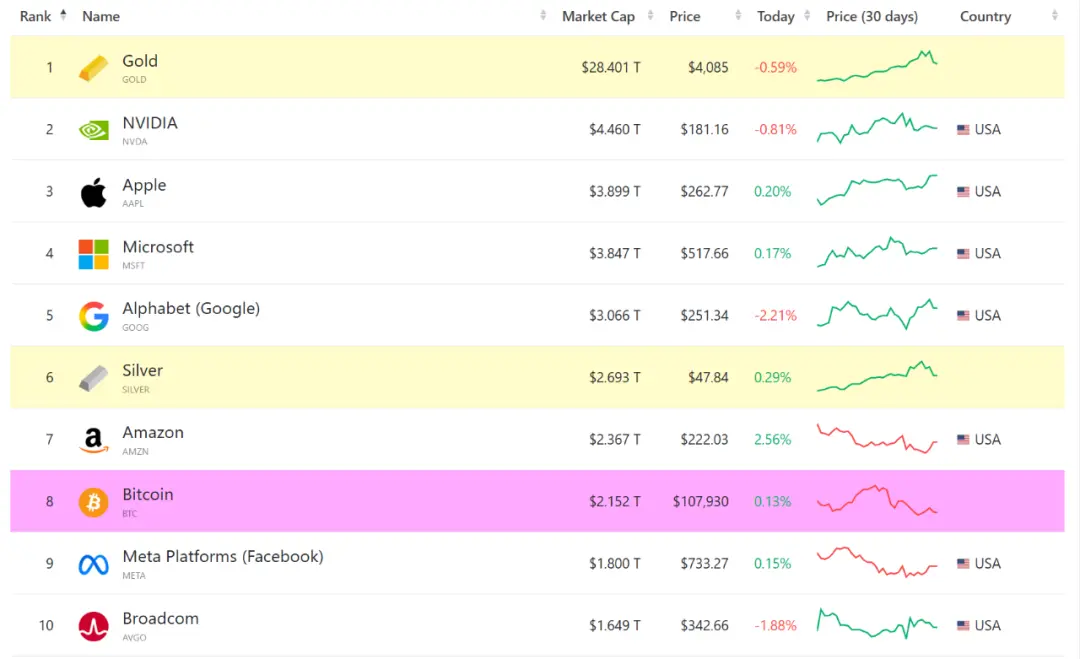

Source: companiesmarketcap.com

According to companiesmarketcap, gold currently leads all global assets by a wide margin, with a total market value of $28.4 trillion—far exceeding the combined value of the next nine assets ($26 trillion).

Even as BTC breaks the $100,000 mark, its total market capitalization is only $2 trillion, roughly 1/15th that of gold. This is the underlying driver behind the BTC community’s persistent “digital gold” narrative: aiming for the largest and oldest store of value in traditional finance.

Interestingly, as BTC seeks to embody the “digital gold” narrative, gold itself is undergoing “digitization.”

The most direct catalyst has been physical gold reaching new highs and this year’s RWA wave, fueling the rapid rise of tokenized gold represented by Tether Gold (XAUT) and PAX Gold (PAXG).

Because these tokens are backed by physical gold—each token issued is supported by an equivalent amount of gold reserves—these “digital gold” products represent a new financial species for both crypto and traditional finance.

2. The “Emergence” of Gold RWA Wave

Describing tokenized gold as “emergent” may not be entirely precise.

Strictly speaking, neither XAUT—the largest by volume—nor PAXG, which closely follows, are newly launched trending products. Rather, the current RWA wave and macro market conditions have elevated their strategic significance and market attention.

For example, XAUT traces its early development back to late 2019, when Bitfinex and Tether CTO Paolo Ardoino revealed plans for a gold-backed stablecoin, Tether Gold. The XAUT white paper was published on January 28, 2022.

The white paper explicitly states that each XAUT token represents ownership of one ounce of physical gold. Tether guarantees a corresponding amount of physical gold reserves for every token issued, with all gold stored in Swiss vaults with top-tier security.

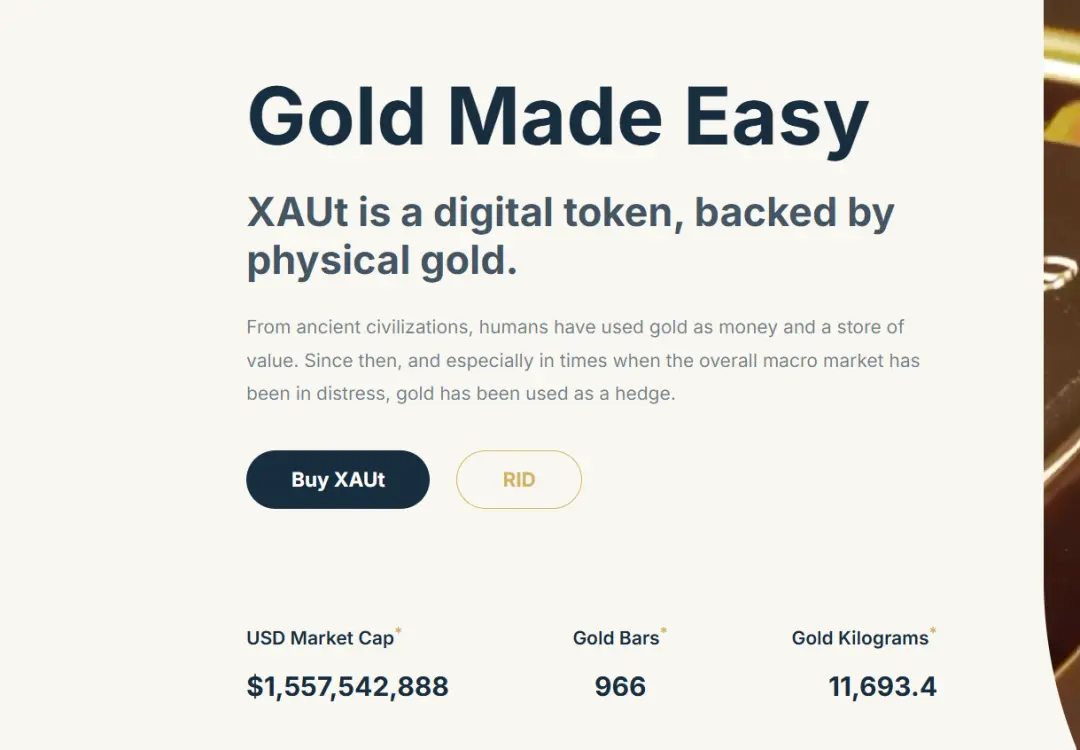

As of this writing, XAUT’s total issuance exceeds $1.55 billion, representing approximately 966 gold bars in reserve (totaling 11,693.4 kg).

Source: Tether

The Tether Gold white paper clearly defines its advantages:

- Compared to physical gold, “gold stablecoins” can divide precious metals into smaller denominations, making them easier to carry and transport, while significantly lowering the barrier to entry for individual investors;

- Compared to gold ETFs, they enable 24/7 trading with no custody fees, greatly increasing asset transfer speed and efficiency;

- Tether Gold claims it allows users to access high liquidity and divisibility while being backed by physical gold reserves.

In other words, tokenization gives real gold the digital attributes unique to BTC, allowing it to be fully integrated into the digital world as a freely transferable, composable, and computable asset unit. This step transforms XAUT and similar tokenized gold products from mere “on-chain gold certificates” to assets with vast on-chain potential.

This trend also prompts the market to reconsider: As both gold and BTC become on-chain assets, is their relationship competitive or symbiotic?

3. Reflections on Tokenized Gold vs. Digital Gold

In summary, if BTC’s core narrative is “digital scarcity consensus,” then tokenized gold (XAUT/PAXG) stands out by “bringing scarcity consensus into the digital world.”

This is a subtle but fundamental distinction: BTC creates trust from zero, while tokenized gold digitizes traditional trust structures. As CZ recently tweeted:

“Tokenized gold is not truly on-chain gold, but relies on trust in the issuer’s ability to honor commitments. Even in extreme scenarios such as management changes or war, users must depend on the continuity of this trust system.”

This statement highlights the fundamental difference between tokenized gold and Bitcoin: Bitcoin’s trust is built on algorithmic consensus, with no issuer or custodian, while tokenized gold’s trust is institutional—users must trust that Tether or Paxos will strictly honor their reserve commitments.

In other words, Bitcoin is a product of “trustlessness,” while tokenized gold is an extension of “re-trust.”

From an asset value perspective, gold’s core value in traditional finance lies in hedging and preservation, but in the blockchain context, tokenized gold gains programmability for the first time:

- It can serve as collateral in DeFi protocols, allowing users to borrow stablecoins on platforms like Aave and Compound for leverage or yield management;

- It can be integrated into smart contract logic to become yield-bearing gold;

- It can move freely across different networks via cross-chain bridges, becoming a stable, liquid asset in multi-chain ecosystems;

Essentially, gold is evolving from a static store of value to a dynamic financial unit. Tokenization endows gold with Bitcoin-like digital attributes—verifiable, liquid, composable, and computable—so gold is no longer just a symbol of value locked in vaults, but an “active asset” in the on-chain world that can generate yield and credit.

As liquidity tightens and alternative assets weaken, the rise of the RWA wave is bringing traditional assets like gold, bonds, and stocks back into the crypto spotlight. The popularity of tokenized gold signals that the market is seeking a more robust and reliable on-chain value anchor.

From this perspective, the accelerated development of tokenized gold under the RWA wave is not intended to (nor can it) replace BTC, but rather serves as the perfect complement to the BTC “digital gold” narrative—becoming a new financial species that combines the efficient liquidity of digital assets with the safe-haven certainty of traditional gold.

Statement:

- This article is reprinted from [TechFlow]. Copyright belongs to the original author [TechFlow]. If you have any objections to the reprint, please contact the Gate Learn team, and the team will handle your request promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, it is prohibited to copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?