2025 WOO Price Prediction: Analyzing Market Trends and Expert Forecasts for WOO Network's Future Value

Introduction: WOO's Market Position and Investment Value

WOO (WOO), as a next-generation trading platform connecting CeFi and DeFi markets, has achieved significant milestones since its inception. As of 2025, WOO's market capitalization has reached $81,861,002, with a circulating supply of approximately 1,905,073,374 tokens, and a price hovering around $0.04297. This asset, often referred to as the "liquidity bridge," is playing an increasingly crucial role in providing deep liquidity across centralized and decentralized markets.

This article will comprehensively analyze WOO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. WOO Price History Review and Current Market Status

WOO Historical Price Evolution

- 2021: WOO reached its all-time high of $1.78 on November 15

- 2022: Market downturn affected WOO, price declined significantly

- 2023-2024: Gradual recovery and ecosystem expansion, price fluctuated

WOO Current Market Situation

As of October 21, 2025, WOO is trading at $0.04297. The token has experienced a 1.6% increase in the last 24 hours, but shows a significant decline of 39.86% over the past 30 days and 79.75% over the year. The current market capitalization stands at $81,861,002, ranking WOO at 466th in the crypto market. With a circulating supply of 1,905,073,374 WOO tokens, representing 63.5% of the total supply, the project maintains a relatively high circulation ratio. The 24-hour trading volume is $133,213, indicating moderate market activity. The token's all-time high remains at $1.78, while its all-time low is $0.02211546, showcasing the considerable price range WOO has experienced since its inception.

Click to view the current WOO market price

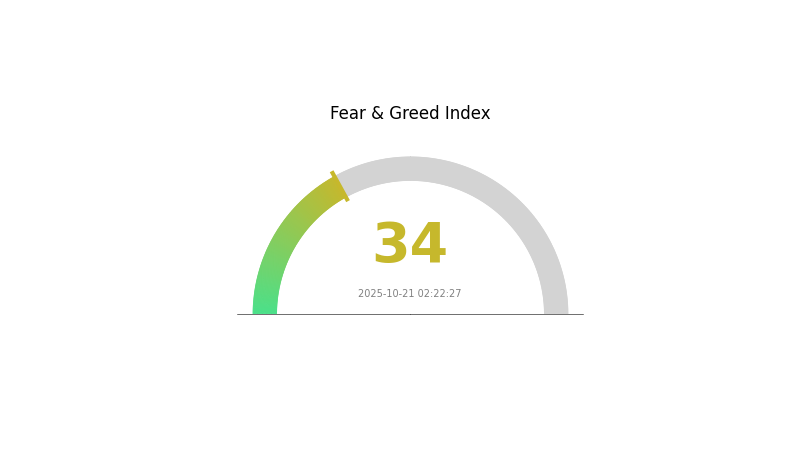

WOO Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 34. This suggests that investors are cautious and uncertain about market conditions. During such times, it's crucial to remain vigilant and conduct thorough research before making investment decisions. Remember, market sentiment can shift rapidly, and periods of fear may present potential opportunities for long-term investors. Stay informed and consider diversifying your portfolio to manage risk effectively.

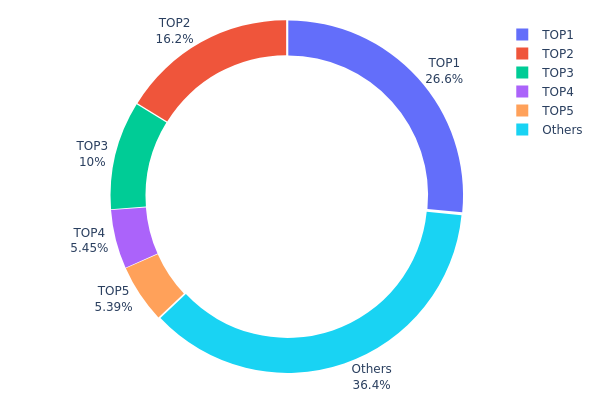

WOO Holdings Distribution

The address holdings distribution data for WOO reveals a notable concentration of tokens among a few top addresses. The largest holder, with an address starting with 0x0000, controls 26.55% of the total supply, while the top five addresses collectively account for 63.58% of all WOO tokens.

This level of concentration suggests a relatively centralized token distribution, which could have significant implications for market dynamics. The presence of large holders, particularly the top address controlling over a quarter of the supply, may introduce volatility risks and potential for market manipulation. Such concentration could lead to sudden price movements if these major holders decide to liquidate their positions.

However, it's worth noting that 36.42% of tokens are distributed among other addresses, indicating some level of broader market participation. This distribution pattern reflects a balance between major stakeholders and smaller holders, which is crucial for the token's long-term stability and decentralization efforts. Monitoring changes in this distribution over time will be essential for assessing the evolving market structure and potential risks associated with WOO token.

Click to view the current WOO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000000 | 796550.75K | 26.55% |

| 2 | 0xa3a7...d60eec | 485786.72K | 16.19% |

| 3 | 0x3592...1bd60a | 300000.00K | 10.00% |

| 4 | 0xdcf0...711071 | 163588.40K | 5.45% |

| 5 | 0xba91...a89b13 | 161702.44K | 5.39% |

| - | Others | 1092371.69K | 36.42% |

II. Key Factors Influencing WOO's Future Price

Supply Mechanism

- Market Dynamics: The supply and demand relationship in the market significantly affects WOO's price.

- Historical Pattern: Increased platform user growth and liquidity enhancement have typically driven WOO's price upward.

- Current Impact: High liquidity and trading volume generally lead to more stable prices, while low liquidity may result in greater price volatility.

Institutional and Whale Dynamics

- Corporate Adoption: WOO Network attracts numerous traders through high liquidity, deep markets, and low-cost services, potentially increasing market demand and value for WOO tokens.

Macroeconomic Environment

- Monetary Policy Impact: U.S. economic data and monetary policy are significant factors influencing the broader cryptocurrency market, including WOO.

- Inflation Hedging Properties: The deterioration of the macroeconomic environment has been cited as a major reason for market declines, suggesting WOO's price may be sensitive to inflationary pressures.

- Geopolitical Factors: Global economic conditions and market sentiment play a role in WOO's price movements.

Technical Development and Ecosystem Building

- Synthetic Proactive Market Making (sPMM): WOO's core technology is its innovative sPMM system, which forms the foundation of its trading platform.

- Ecosystem Applications: WOO X Global has launched pre-issuance perpetual futures markets, allowing users to speculate on tokens before their official launch, potentially impacting WOO's ecosystem and price.

III. WOO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.03605 - $0.04

- Neutral forecast: $0.04 - $0.0429

- Optimistic forecast: $0.0429 - $0.0455 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.02999 - $0.05155

- 2028: $0.03149 - $0.06249

- Key catalysts: Increasing adoption of WOO Network, overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.05585 - $0.06646 (assuming steady market growth)

- Optimistic scenario: $0.06646 - $0.07244 (assuming strong bull market)

- Transformative scenario: $0.07244 - $0.07707 (assuming widespread adoption and integration)

- 2030-12-31: WOO $0.07244 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0455 | 0.04292 | 0.03605 | 0 |

| 2026 | 0.04951 | 0.04421 | 0.02873 | 2 |

| 2027 | 0.05155 | 0.04686 | 0.02999 | 9 |

| 2028 | 0.06249 | 0.0492 | 0.03149 | 14 |

| 2029 | 0.07707 | 0.05585 | 0.03407 | 29 |

| 2030 | 0.07244 | 0.06646 | 0.05383 | 54 |

IV. Professional Investment Strategies and Risk Management for WOO

WOO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate WOO tokens during market dips

- Stake tokens to earn rewards and participate in network governance

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor WOO ecosystem developments and partnerships

- Track trading volume and liquidity metrics on WOO platforms

WOO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance WOO holdings with other crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for WOO

WOO Market Risks

- Volatility: Cryptocurrency market fluctuations can impact WOO's price

- Competition: Emerging DeFi and CeFi platforms may challenge WOO's market share

- Liquidity: Changes in trading volume could affect WOO's utility and value

WOO Regulatory Risks

- Global regulatory uncertainty: Changing crypto regulations may impact WOO's operations

- Compliance costs: Adapting to new regulations could increase operational expenses

- Geographic restrictions: Regulatory actions may limit WOO's availability in certain regions

WOO Technical Risks

- Smart contract vulnerabilities: Potential exploits in WOO's underlying code

- Network congestion: High traffic on supported blockchains may affect transaction speed

- Integration challenges: Issues with new blockchain or protocol integrations

VI. Conclusion and Action Recommendations

WOO Investment Value Assessment

WOO presents a unique value proposition in connecting CeFi and DeFi liquidity, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

WOO Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about WOO's ecosystem ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance ✅ Institutional investors: Evaluate WOO's potential for liquidity provision and market making

WOO Trading Participation Methods

- Spot trading: Buy and sell WOO tokens on Gate.com

- Staking: Participate in WOO Network's staking programs for passive income

- Liquidity provision: Contribute to liquidity pools on WOOFi for potential rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of the woo coin?

WOO coin's future looks promising with AI integration, multichain expansion, and potential revenue growth. It aims to attract traders and institutions through innovative features.

What will Wink be worth in 2030?

Based on market predictions, WINkLink is expected to trade between $0.000448 and $0.000491 in 2030.

Which coin will hit $1 in 2025?

MoonBull ($MOBU) is expected to hit $1 in 2025. Its innovative presale, deflationary model, and strong community support make it a top contender.

Does Wink have a future?

Yes, Wink has a promising future. Analysts predict it could reach $0.00189981 by 2030, indicating potential for significant growth in the coming years.

2025 JOEPrice Prediction: Analyzing Market Trends and Growth Potential for Trader Joe's Native Token

Is Aark (AARK) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

BLZ vs GMX: A Comprehensive Analysis of Two Leading Cloud Service Providers

DIAM vs GMX: Comparing Two Leading Decentralized Exchange Protocols for Enhanced Liquidity and Trading Efficiency

ASK vs GMX: Comparing Two Leading Email Providers for Business Communication

How Does ASTER's Capital Flow Indicate Its Market Trend in 2025?

Understanding DeFi Liquidity Pools: How They Function and Impact Crypto Markets

Discover Top NFT Rarity Scoring Tools for Collectors

Introduction to the CQT Token: Features and Functions in the Web3 Ecosystem

Understanding Blockchain Nodes: A Comprehensive Guide

Understanding Blockchain Nodes: How They Work and Operate