2025 RSR Price Prediction: Navigating the Future of Reserve Rights Token in a Volatile Crypto Market

Introduction: RSR's Market Position and Investment Value

ReserveRights (RSR), as a token designed to maintain the stability of the Reserve stablecoin system, has made significant strides since its inception in 2019. As of 2025, ReserveRights has a market capitalization of $377,100,005, with a circulating supply of approximately 60,607,522,512 tokens, and a price hovering around $0.006222. This asset, often referred to as the "stability guardian" of the Reserve ecosystem, is playing an increasingly crucial role in the field of decentralized finance and stable digital payment systems.

This article will provide a comprehensive analysis of ReserveRights' price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. RSR Price History Review and Current Market Status

RSR Historical Price Evolution

- 2020: Project launch, price fluctuated around $0.001

- 2021: Bull market peak, price reached all-time high of $0.117424 on April 17

- 2022-2023: Crypto winter, price declined to lows around $0.003-$0.004

RSR Current Market Situation

As of October 17, 2025, RSR is trading at $0.006222. The token has experienced a 10.11% decrease in the last 24 hours, with a trading volume of $2,901,754. RSR's market capitalization stands at $377,100,005, ranking it 184th in the crypto market. The circulating supply is 60,607,522,512 RSR, which represents 60.61% of the total supply of 100 billion tokens. Despite recent short-term losses, RSR has shown a 4.87% increase over the past week, indicating some positive momentum. However, longer-term performance remains negative, with a 16.91% decrease over the last 30 days and an 8.87% decline over the past year.

Click to view the current RSR market price

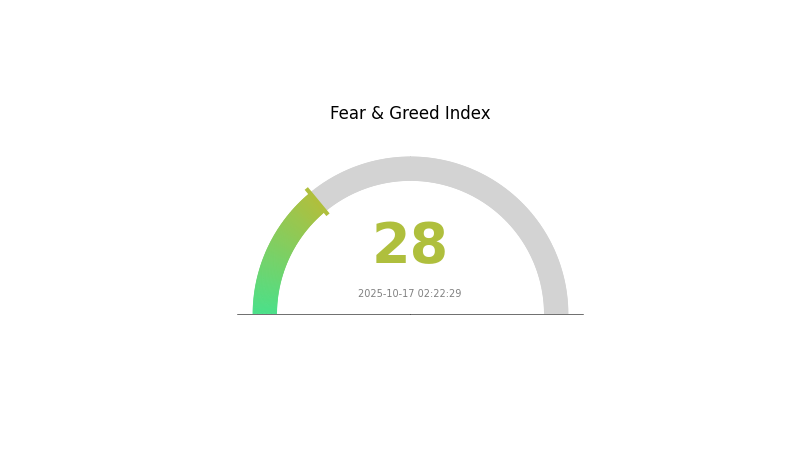

RSR Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for RSR is currently in a state of fear, with the Fear and Greed Index standing at 28. This indicates a cautious approach among investors, potentially presenting buying opportunities for those looking to accumulate RSR tokens. However, it's crucial to conduct thorough research and consider various factors before making any investment decisions. Keep an eye on market trends and stay informed about RSR's latest developments to make well-informed choices in this volatile market environment.

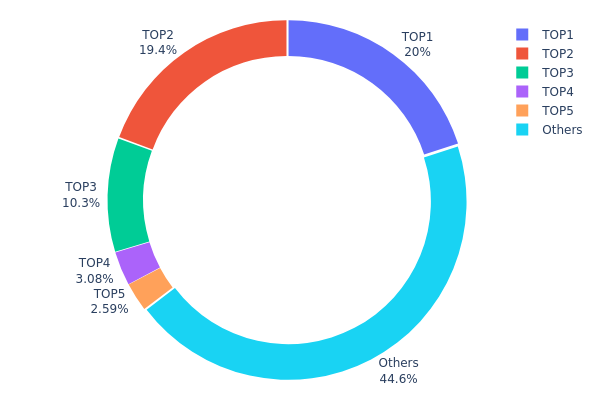

RSR Holdings Distribution

The address holdings distribution data for RSR reveals a significant concentration of tokens among a few top addresses. The top address holds 20% of the total supply, while the top five addresses collectively control 55.35% of RSR tokens. This high concentration suggests a potential centralization issue within the RSR ecosystem.

Such a concentrated distribution pattern could have substantial implications for market dynamics. The large holdings by a few addresses may lead to increased volatility and susceptibility to price manipulation. If any of these major holders decide to sell a significant portion of their holdings, it could trigger substantial price fluctuations in the RSR market.

This concentration also raises concerns about the overall decentralization and on-chain stability of RSR. While 44.65% of tokens are distributed among other addresses, the dominance of top holders indicates a need for improved token distribution to enhance network resilience and reduce potential centralization risks.

Click to view the current RSR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6bab...ad81c1 | 20000000.00K | 20.00% |

| 2 | 0x0774...7f7ef8 | 19398992.45K | 19.39% |

| 3 | 0xf977...41acec | 10300000.00K | 10.30% |

| 4 | 0x3154...0f2c35 | 3077723.34K | 3.07% |

| 5 | 0x18ba...1ae7b8 | 2592401.58K | 2.59% |

| - | Others | 44630882.63K | 44.65% |

II. Key Factors Affecting RSR's Future Price

Supply Mechanism

- Market Supply and Demand: The long-term price trend is often determined by market supply and demand fundamentals. When market supply is tight or demand is strong, prices typically show an upward trend.

Institutional and Whale Dynamics

- Market Sentiment: Investor sentiment and confidence have a direct impact on RSR price movements.

Macroeconomic Environment

- Policy Influence: Regulatory policies and government decisions can significantly affect the cryptocurrency market, including RSR.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development and adoption of DApps and ecosystem projects within the Reserve Rights network could impact RSR's value.

Note: Investors should closely monitor Reserve Rights price trends and adjust their investment strategies according to market changes, considering these influencing factors.

III. RSR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00466 - $0.00621

- Neutral prediction: $0.00621 - $0.00683

- Optimistic prediction: $0.00683 - $0.00745 (requires positive market sentiment and project developments)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2026: $0.00587 - $0.00854

- 2027: $0.00684 - $0.00868

- Key catalysts: Ecosystem expansion, technological advancements, and increased utility of RSR token

2030 Long-term Outlook

- Base scenario: $0.00675 - $0.00964 (assuming steady market growth and project development)

- Optimistic scenario: $0.00964 - $0.0106 (assuming strong market performance and widespread adoption)

- Transformative scenario: Above $0.0106 (under extremely favorable market conditions and revolutionary use cases)

- 2030-12-31: RSR $0.0106 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00745 | 0.00621 | 0.00466 | 0 |

| 2026 | 0.00854 | 0.00683 | 0.00587 | 9 |

| 2027 | 0.00868 | 0.00768 | 0.00684 | 23 |

| 2028 | 0.01072 | 0.00818 | 0.00532 | 31 |

| 2029 | 0.00983 | 0.00945 | 0.00728 | 51 |

| 2030 | 0.0106 | 0.00964 | 0.00675 | 54 |

IV. RSR Professional Investment Strategies and Risk Management

RSR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate RSR during market dips

- Set price targets for partial profit-taking

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor for trend reversals

- RSI: Identify overbought/oversold conditions

- Key points for swing trading:

- Use stop-loss orders to limit downside risk

- Take profits at resistance levels

RSR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for RSR

RSR Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Competition: Other stablecoin projects may impact RSR's market share

- Liquidity risk: Potential difficulties in large-scale buying or selling

RSR Regulatory Risks

- Stablecoin regulations: Potential new laws affecting RSR's operations

- Cross-border restrictions: Varying regulatory stances in different jurisdictions

- Compliance challenges: Adapting to evolving global financial regulations

RSR Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Challenges in handling increased transaction volume

- Interoperability concerns: Integration difficulties with other blockchain networks

VI. Conclusion and Action Recommendations

RSR Investment Value Assessment

RSR presents a unique value proposition in the stablecoin ecosystem but faces significant short-term volatility and regulatory uncertainties. Long-term potential exists if Reserve can successfully implement its vision.

RSR Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with defined entry and exit points ✅ Institutional investors: Evaluate RSR as part of a diversified crypto portfolio

RSR Trading Participation Methods

- Spot trading: Buy and sell RSR on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities involving RSR

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will RSR go?

RSR could potentially reach a maximum of $0.08614 by 2025, based on current market analysis and projections.

Is RSR a stable coin?

No, RSR is not a stablecoin. It's a governance token used to maintain the stability of the Reserve stablecoin system.

What is the price prediction for RSR in 2026?

Based on current market sentiment, the price prediction for RSR in 2026 is $0.006639. This forecast is as of 2025-10-17.

Why is RSR pumping?

RSR's price surge is driven by speculation from prominent crypto voices. Their tweets highlighting Reserve's potential have sparked significant market interest and excitement.

2025 RESOLV Price Prediction: Analyzing Market Trends and Future Valuation Potential

ENA vs CRO: A Comparative Analysis of Two Leading Genomic Data Repositories

What Is the Current Market Overview for ENA in 2025?

Is FeiUSD (FEI) a good investment?: Analyzing the potential and risks of this stablecoin in the volatile crypto market

Is GHO (GHO) a good investment?: Analyzing the potential and risks of Aave's new stablecoin

JST vs SNX: A Comparative Analysis of Two Synthetic Asset Protocols in DeFi

Xenea Daily Quiz Answer December 12, 2025

Dropee Daily Combo December 11, 2025

Tomarket Daily Combo December 11, 2025

Understanding Impermanent Loss in Decentralized Finance

Understanding Double Spending in Cryptocurrency: Strategies for Prevention