2025 NETX Price Prediction: Expert Analysis and Market Forecast for the Next Generation Technology Token

Introduction: NETX's Market Position and Investment Value

NETX (NETX) is a next-generation blockchain ecosystem built on trusted computing and Layer-1 secure network infrastructure, designed to provide modular economic infrastructure. Since its inception, NETX has established itself as an innovative platform powered by AI and the MCP protocol, delivering intelligent support for dApps and financial activities.

As of December 2025, NETX has achieved a market capitalization of $40,065,000, with circulating supply of approximately 16.61 million tokens currently trading at $0.8013. This asset is distinguished by its unique integration of Real-World Assets (RWA) support, enabling seamless connections between on-chain innovation and the real economy while driving the fusion of Web3 with the global value network.

This article will comprehensively analyze NETX's price trajectory through 2030, integrating historical market patterns, supply-demand dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies grounded in market fundamentals.

NETX Market Analysis Report

I. NETX Price History Review and Market Status

NETX Historical Price Evolution

-

2024: NETX reached its all-time high of $18.816 on March 3, 2024, representing a peak valuation period for the project during its early market phase.

-

2025: The token experienced significant decline throughout the year, with a one-year price change of -79.14%, falling from its historical peak to current trading levels.

-

December 2025: NETX reached its all-time low of $0.62 on December 15, 2025, before recovering slightly to $0.8013 as of December 21, 2025.

NETX Current Market Conditions

Price and Performance Metrics:

- Current Price: $0.8013 (as of December 21, 2025)

- 24-Hour Price Change: -0.86%

- 7-Day Performance: +18.72%

- 30-Day Performance: +4.78%

- 52-Week Performance: -79.14%

Market Capitalization and Circulation:

- Market Cap: $13,311,957.64

- Fully Diluted Valuation (FDV): $40,065,000.00

- Circulating Supply: 16,612,951 NETX (33.23% of total supply)

- Total Supply: 50,000,000 NETX

- Market Dominance: 0.0012%

Trading Activity:

- 24-Hour Volume: $31,676.99

- 24-Hour High: $0.8503

- 24-Hour Low: $0.7718

- Active Holders: 3,679

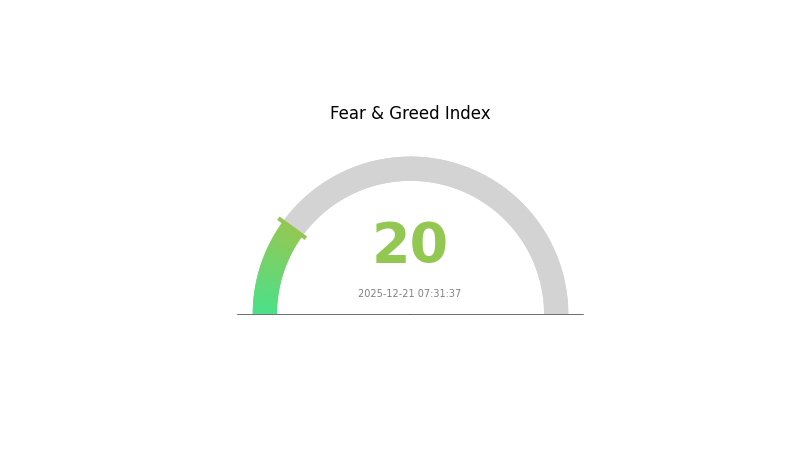

Market Sentiment: The current market environment reflects extreme fear conditions (VIX level: 20), indicating heightened market volatility and risk aversion among investors.

Click to view current NETX market price

NETX Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates heightened market anxiety and significant risk aversion among investors. During periods of extreme fear, market volatility typically increases as participants rush to liquidate positions. However, contrarian investors often view such conditions as potential buying opportunities, as assets may be undervalued. Monitor market developments closely on Gate.com to identify strategic entry points and manage risk effectively.

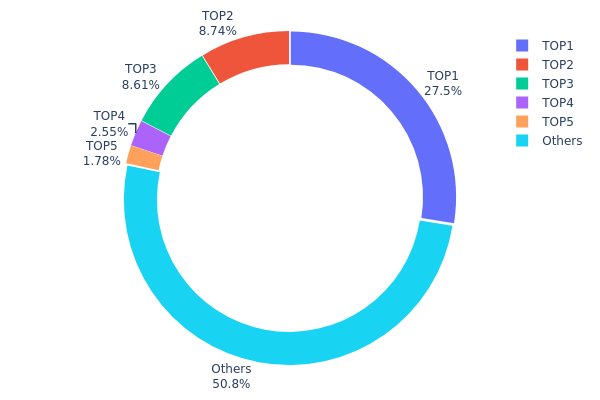

NETX Holdings Distribution

The address holdings distribution map illustrates the concentration pattern of NETX tokens across the blockchain, measuring what percentage of total supply is held by top addresses and the remaining market participants. This metric serves as a critical indicator for assessing token decentralization, market structure stability, and potential manipulation risks within the ecosystem.

The current holdings distribution of NETX reveals a moderate concentration pattern with notable market structure considerations. The top address commands 27.53% of total supply, while the combined top five addresses hold 49.19% of circulating tokens. This concentration level falls within a range that warrants attention, though the fact that over half of all tokens (50.81%) remain distributed among other addresses suggests a reasonably fragmented market base. The second and third largest holders maintain similar positions at 8.74% and 8.61% respectively, indicating that wealth distribution beyond the top holder shows some degree of balance rather than extreme centralization in a single entity.

From a market structure perspective, this distribution pattern presents both stabilizing and destabilizing characteristics. While the moderate concentration could theoretically provide some price stability through anchored large holders, the 27.53% holding by the leading address introduces potential volatility risk should this position experience significant liquidation activity. The remaining 50.81% dispersed across numerous addresses suggests organic distribution among smaller stakeholders, which typically enhances genuine market participation and reduces single-point-of-failure risks. Overall, NETX demonstrates a decentralization level that is neither severely compromised nor exceptionally robust, reflecting a maturing token ecosystem with room for further holder diversification.

Click to view current NETX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4982...6e89cb | 5507.19K | 27.53% |

| 2 | 0x43fb...301e5d | 1748.90K | 8.74% |

| 3 | 0xc882...84f071 | 1722.82K | 8.61% |

| 4 | 0x0d07...b492fe | 509.09K | 2.54% |

| 5 | 0x4a46...052f63 | 355.09K | 1.77% |

| - | Others | 10156.91K | 50.81% |

II. Core Factors Affecting NETX's Future Price

Supply Mechanism

-

Token Economics Design: The total supply and unlocking schedule of NETX represent critical factors in the token's price dynamics. These elements directly influence short-term price movements, as the circulation of tokens into the market can create supply-demand imbalances that drive volatility.

-

Current Impact: As circulating supply increases relative to total supply, market participants must closely monitor token unlock events. The pace at which new tokens enter circulation can either suppress or accelerate price appreciation depending on market absorption capacity.

Macroeconomic Environment

-

Monetary Policy Impact: Cryptocurrency markets demonstrate high correlation with broader economic conditions. Macroeconomic data such as GDP growth rates, inflation rates, and unemployment figures directly influence investor sentiment and capital allocation toward digital assets like NETX. Central bank policy decisions regarding interest rates remain particularly influential.

-

Geopolitical Factors: Global political and economic uncertainty increases demand for alternative assets. Trade tensions, international conflicts, and policy divergence among major economies can redirect investment flows toward cryptocurrency markets as investors seek portfolio diversification and value preservation.

Market Sentiment and Correlation Dynamics

-

Correlation with Major Assets: NETX's price performance exhibits high correlation with leading cryptocurrencies such as Bitcoin and Ethereum. The directional movements of these major assets, along with shifts in overall market sentiment, significantly impact NETX's trading patterns and price trajectories.

-

Regulatory Environment: Policy developments and regulatory announcements shape market confidence in cryptocurrency assets. Positive regulatory signals and institutional adoption frameworks can catalyze upward price movements, while restrictive policies may suppress valuation multiples.

III. NETX Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.7176 - $0.7973

- Base Case Forecast: $0.7973

- Optimistic Forecast: $0.8691 (requiring sustained market recovery and positive regulatory developments)

2026-2028 Medium-term Perspective

- Market Stage Expectation: Gradual accumulation and recovery phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.7165 - $1.0498

- 2027: $0.5931 - $1.1769

- 2028: $0.8685 - $1.1863

- Key Catalysts: Institutional adoption, ecosystem expansion, technological upgrades, and improving market sentiment with anticipated 3-32% cumulative growth

2029-2030 Long-term Outlook

- Base Case Scenario: $0.8196 - $1.6055 (assuming moderate adoption and market maturation)

- Optimistic Scenario: $1.1227 - $1.8552 (assuming accelerated institutional inflow and mainstream recognition)

- Transformational Scenario: $1.3641 - $1.8552 (contingent on breakthrough regulatory clarity, major partnerships, and significant ecosystem achievements)

- 2030-12-21: NETX trading near $1.3641 (reflecting consolidated growth with 70% appreciation potential from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.86906 | 0.7973 | 0.71757 | 0 |

| 2026 | 1.0498 | 0.83318 | 0.71653 | 3 |

| 2027 | 1.17686 | 0.94149 | 0.59314 | 17 |

| 2028 | 1.18628 | 1.05918 | 0.86853 | 32 |

| 2029 | 1.6055 | 1.12273 | 0.81959 | 40 |

| 2030 | 1.8552 | 1.36412 | 0.80483 | 70 |

NETX Professional Investment Strategy and Risk Management Report

I. Executive Summary

NetX is a next-generation blockchain ecosystem built on trusted computing and Layer-1 secure network infrastructure, designed to provide modular economic infrastructure. Powered by AI and the MCP protocol, it delivers intelligent support for dApps and financial activities. As of December 21, 2025, NETX is trading at $0.8013 with a market capitalization of approximately $13.31 million.

II. NETX Market Overview

Current Market Position

| Metric | Value |

|---|---|

| Current Price | $0.8013 |

| Market Capitalization | $13,311,957.64 |

| Fully Diluted Valuation | $40,065,000.00 |

| Circulating Supply | 16,612,951 NETX |

| Total Supply | 50,000,000 NETX |

| Market Dominance | 0.0012% |

| 24H Trading Volume | $31,676.99 |

| Active Holders | 3,679 |

Price Performance Analysis

| Time Period | Change |

|---|---|

| 1 Hour | -0.53% |

| 24 Hours | -0.86% |

| 7 Days | +18.72% |

| 30 Days | +4.78% |

| 1 Year | -79.14% |

| All-Time High | $18.816 (March 3, 2024) |

| All-Time Low | $0.62 (December 15, 2025) |

III. NETX Technology and Ecosystem

Core Architecture

NetX operates as a blockchain ecosystem founded on:

- Trusted Computing Framework: Ensures secure transaction verification and data integrity

- Layer-1 Security Network: Provides base-layer security infrastructure for all ecosystem participants

- Modular Economic Infrastructure: Enables flexible deployment of financial services and applications

- AI + MCP Protocol Integration: Powers intelligent automation for decentralized applications

Real-World Asset (RWA) Integration

The NetX ecosystem enables all projects to utilize tokens backed by Real-World Assets for payments and settlements, including:

- Regulated stablecoins

- Tokenized financial instruments

- Physical asset representations

- Cross-border settlement mechanisms

Blockchain Implementation

- Network: Binance Smart Chain (BSC)

- Token Standard: BEP20

- Contract Address: 0x4c32964715e9a42f8d119bfa8917d57822d3adf1

IV. NETX Professional Investment Strategy and Risk Management

NETX Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Risk-averse institutional investors, cryptocurrency believers in Web3 infrastructure, long-term value investors

- Operational Recommendations:

- Dollar-cost averaging (DCA) to reduce entry price volatility, with periodic purchases over 6-12 months

- Establish a core position during market downturns when valuations are attractive, particularly following significant correction periods

- Monitor ecosystem development milestones and RWA integration progress as portfolio rebalancing signals

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Support and Resistance Levels: Track historical price action around $0.62 (ATL) and $0.8013 (current price) for entry points

- Volatility Metrics: Monitor 7-day price movements (currently +18.72%) to identify trading opportunity windows

-

Trading Operation Highlights:

- Execute trades during high-volume periods to ensure optimal liquidity conditions

- Establish clear profit-taking targets at resistance levels and loss-limiting stops at support levels

NETX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% portfolio allocation maximum, focusing on exposure to Web3 infrastructure innovation

- Active Investors: 5-15% portfolio allocation, with tactical rebalancing based on market conditions

- Professional Investors: Up to 20% allocation, with sophisticated hedging strategies and derivatives positioning

(2) Risk Hedging Approaches

- Stablecoin Reserve Strategy: Maintain 30-40% of allocated capital in USDT or USDC to execute opportunistic purchases during corrections

- Position Sizing Protocol: Limit individual trade positions to 2-3% of total portfolio to contain downside exposure

(3) Secure Storage Solutions

- Web3 Self-Custody: Gate Web3 wallet provides non-custodial storage with hardware wallet integration capabilities

- Exchange Custody: Gate.com offers secure institutional-grade storage for active traders requiring frequent trading access

- Security Considerations:

- Enable two-factor authentication on all exchange accounts

- Never disclose private keys or seed phrases

- Verify all wallet addresses before transferring tokens

- Use hardware wallet backup solutions for holdings exceeding $50,000

V. NETX Potential Risks and Challenges

NETX Market Risks

- Liquidity Risk: With 24-hour trading volume of only $31,676.99, significant market slippage may occur during large transactions, limiting institutional participation

- Price Volatility: Year-to-date decline of -79.14% demonstrates extreme price instability; investors may face substantial drawdowns during unfavorable market conditions

- Market Cap Risk: Total market capitalization of $13.31 million represents a micro-cap asset with limited institutional investor participation and potential for significant price manipulation

NETX Regulatory Risks

- RWA Regulatory Uncertainty: As Real-World Asset integration remains nascent globally, changes in securities regulations could impact the viability of tokenized financial instruments

- Stablecoin Compliance: Future regulatory frameworks governing stablecoins and fiat-backed digital assets may impose operational constraints on ecosystem projects

- Jurisdictional Challenges: Different regulatory approaches across jurisdictions could limit cross-border functionality and ecosystem adoption

NETX Technology Risks

- Trusted Computing Implementation: The security assumptions underlying the trusted computing framework may face unforeseen vulnerabilities requiring substantial protocol adjustments

- MCP Protocol Maturity: As an emerging protocol standard, the MCP protocol may encounter technical limitations or performance bottlenecks as ecosystem scale increases

- Smart Contract Vulnerabilities: Bugs or exploits in the ecosystem's underlying smart contracts could result in catastrophic capital loss for participants

VI. Conclusion and Action Recommendations

NETX Investment Value Assessment

NetX presents a speculative opportunity positioned at the intersection of blockchain infrastructure, AI integration, and real-world asset tokenization. The project's focus on bridging on-chain innovation with traditional economic systems aligns with long-term industry trends. However, the current market valuation reflects significant pessimism, with the token trading 96% below its all-time high. Success depends critically on ecosystem adoption of RWA-backed settlement mechanisms and regulatory clarity around tokenized financial instruments.

NETX Investment Recommendations

✅ Beginners: Start with minimal positions (1-2% portfolio allocation) using Gate.com's trading interface. Employ dollar-cost averaging over 12 months to reduce timing risk. Prioritize understanding the RWA tokenization mechanism before increasing exposure.

✅ Experienced Investors: Consider tactical accumulation during sentiment extremes, utilizing technical support levels around $0.62. Monitor ecosystem milestones as rebalancing signals. Maintain hedged positions using stablecoin reserves for volatility management.

✅ Institutional Investors: Evaluate NETX through the lens of blockchain infrastructure thesis with emphasis on RWA integration potential. Structure positions with transparent exit criteria tied to regulatory developments and adoption metrics. Utilize Gate.com's institutional services for secure custody and settlement.

NETX Trading Participation Methods

- Spot Trading: Purchase NETX directly on Gate.com using USDT or USDC pairs; suitable for long-term holders

- Technical Trading: Utilize Gate.com's advanced charting tools to execute swing trades based on identified support and resistance levels

- Portfolio Integration: Combine NETX holdings with complementary Web3 infrastructure assets to construct diversified technology exposure

Cryptocurrency Investment Risk Disclaimer: Digital asset investment carries extreme risk. This report does not constitute financial advice. Investors must conduct independent research and consult qualified financial professionals before deploying capital. Only invest funds you can afford to lose completely. Past performance does not guarantee future results. Regulatory changes, technological failures, or market manipulation could result in total capital loss.

FAQ

How much is the NetX token?

The NetX token is currently priced at $0.690 USD with a market cap of $10.11 million. The token has experienced a 1.08% decrease over the last 24 hours, with a trading volume of $40.56K.

What is the NETX token and what does it do?

NETX is a blockchain platform that leverages AI to manage and integrate real-world assets, bridging traditional finance with digital ecosystems. It enables seamless interaction between physical and blockchain-based assets.

What are the price predictions for NETX in 2025?

NETX is predicted to trade between $5.46 and $6.37 in 2025, with an average price of $6.04. This forecast reflects current market trends and technical analysis projections for the year.

What are the risks of investing in NETX?

NETX uses 2X leverage, which amplifies both gains and losses. Key risks include potential total loss of investment, increased volatility, and swap agreement exposure. Active monitoring and management are essential for investors.

How does NETX compare to other similar blockchain tokens?

NETX stands out as an AI-powered utility and GAS token directly tied to network economics. Unlike traditional blockchain tokens, NETX bridges Web3 with real-world applications, offering unique value proposition and practical utility.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Janitor Coin Deep Dive: Innovative Whitepaper Logic Reshaping Cryptocurrency Utility

Janitor Crypto Unveiled: How This Token Could Be The Next Blockchain Revolution

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

What is POLS: Understanding the Fundamentals of Political Science and Its Real-World Applications

What is POLIS: A Comprehensive Guide to Decentralized Governance and Community-Driven Decision Making

What is GHST: A Complete Guide to the Aavegotchi Governance Token

Understanding Web 3.0: The Future of Online Interaction

What is A2Z: A Comprehensive Guide to Understanding the Complete Alphabet System