2025 LON Price Prediction: Expert Analysis and Future Market Outlook for Longevity Token

Introduction: Market Position and Investment Value of LON

Tokenlon (LON) serves as a decentralized transaction payment and settlement protocol token based on blockchain networks. Since its launch in 2020, LON has established itself as a utility token within its ecosystem. As of December 2025, LON has achieved a market capitalization of approximately $57.78 million, with a circulating supply of around 123.77 million tokens trading at $0.4114 per unit. This token, designed to incentivize network participants and enable transaction fee discounts, continues to play an important role in supporting the Tokenlon ecosystem's development.

This article will provide a comprehensive analysis of LON's price trends and market dynamics, combining historical performance patterns, market supply and demand factors, and ecosystem development to deliver professional price forecasts and actionable investment strategies for investors interested in this decentralized protocol token.

Tokenlon (LON) Market Analysis Report

I. LON Price History Review and Market Current Status

LON Historical Price Evolution Trajectory

- January 2021: LON reached its all-time high (ATH) of $9.81, marking the peak of its early market performance following its launch in September 2020.

- June 2023: LON hit its all-time low (ATL) of $0.371875, representing a significant decline from its historical peak over the preceding period.

- December 2025: LON is trading at $0.4114, reflecting recovery from the 2023 lows while remaining substantially below historical highs.

LON Current Market Status

As of December 18, 2025, LON demonstrates the following market characteristics:

Price Performance:

- Current Price: $0.4114

- 24-Hour Change: -3.63%

- 7-Day Change: -11.21%

- 30-Day Change: -8.74%

- 1-Year Change: -49.8%

- 24-Hour Range: $0.3611 - $0.6000

Market Capitalization Metrics:

- Market Capitalization: $50,920,093.73

- Fully Diluted Valuation: $57,781,553.26

- Market Dominance: 0.0018%

- Market Cap to FDV Ratio: 61.89%

Supply Information:

- Circulating Supply: 123,772,712.03 LON (61.89% of total supply)

- Total Supply: 140,451,028.84 LON

- Maximum Supply: 200,000,000 LON

Trading Activity:

- 24-Hour Trading Volume: $17,553.74

- Number of Holders: 40,074

- Exchange Listings: 2 exchanges

Market Sentiment:

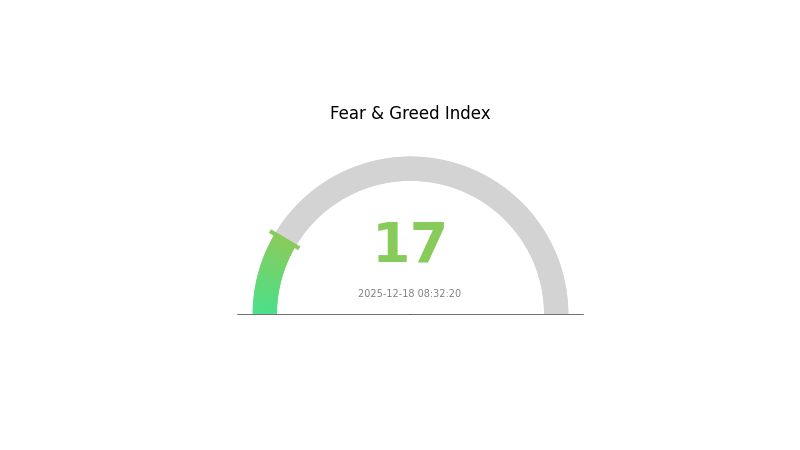

- Extreme Fear detected (VIX: 17), indicating heightened market pessimism

View current LON market price

LON Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 17. This indicates heightened market anxiety and pessimistic sentiment among investors. During periods of extreme fear, risk-averse trading dominates and asset prices typically face downward pressure. However, contrarian investors often view such extreme readings as potential buying opportunities, as markets historically tend to rebound from these oversold conditions. Monitoring this indicator on Gate.com can help traders make more informed decisions about market entry and exit points.

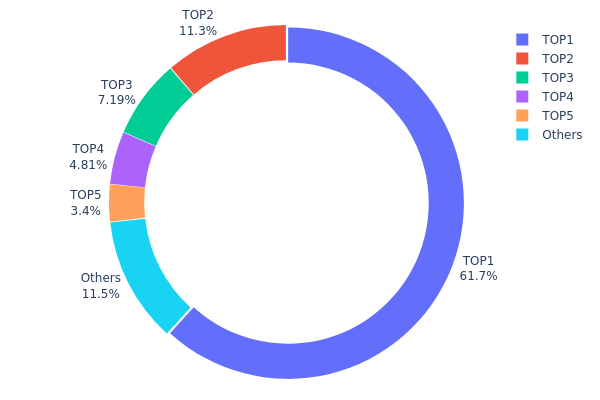

LON Address Distribution

The address distribution chart illustrates the concentration of LON token holdings across different wallet addresses on the blockchain. It provides critical insights into the token's decentralization level, ownership structure, and potential market concentration risks. By analyzing the percentage of tokens held by top addresses versus distributed holders, market participants can assess the token's vulnerability to price manipulation and evaluate its long-term sustainability as a decentralized asset.

LON exhibits significant concentration characteristics, with the top address commanding 61.72% of total supply—a substantial majority that warrants careful consideration. The top five addresses collectively control 88.44% of all LON tokens, while the remaining 11.56% is dispersed across other holders. This distribution pattern reveals a highly concentrated token structure, where a single entity or a small group of stakeholders possesses disproportionate control over supply dynamics. Such concentration creates notable risks, including the potential for coordinated selling pressure, sudden price volatility, or perceived centralization concerns that may undermine investor confidence in the project's decentralization narrative.

The extreme concentration observed in LON's address distribution raises meaningful questions about market maturity and governance resilience. With nearly two-thirds of the token supply concentrated in a single address, the market structure remains vulnerable to sudden liquidity events and concentrated decision-making. However, the presence of diversified secondary holders suggests ongoing distribution efforts. For market participants monitoring LON's fundamentals, this concentration metric underscores the importance of tracking distribution announcements and large holder movements through blockchain explorers. The current distribution pattern indicates that LON's price trajectory and market stability remain partially dependent on the strategic decisions of principal token holders, a characteristic typical of earlier-stage projects undergoing decentralization phases.

Click to view current LON address distribution data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf885...d30f23 | 86690.95K | 61.72% |

| 2 | 0x0000...9023db | 15926.87K | 11.33% |

| 3 | 0x3557...c20a46 | 10103.50K | 7.19% |

| 4 | 0x4014...3ae51d | 6750.00K | 4.80% |

| 5 | 0xa3a7...d60eec | 4779.13K | 3.40% |

| - | Others | 16200.58K | 11.56% |

II. Core Factors Influencing LON's Future Price

Macroeconomic Environment

-

Global Economic Conditions Impact: LON's future price trends are primarily influenced by global economic conditions and macroeconomic factors. Supply and demand dynamics in the broader market play a crucial role in determining price movements and market sentiment.

-

Geopolitical Factors: International geopolitical events can significantly impact LON's price trajectory. Historical commodity market analysis demonstrates that geopolitical tensions in key regions can drive price volatility and create trading opportunities in futures markets.

-

Market Speculation and Regulatory Changes: Price fluctuations are further impacted by market speculation activities and evolving regulatory frameworks. Changes in regulatory policies can substantially affect investor sentiment and trading volumes.

Technology Development

- Technological Advancements: Continuous technological progress influences LON's market positioning and adoption. Technological improvements can affect supply efficiency, accessibility, and overall market dynamics, contributing to long-term price trends.

Three、2025-2030 LON Price Forecast

2025 Outlook

- Conservative Forecast: $0.37849 - $0.41140

- Neutral Forecast: $0.41140 - $0.45000

- Optimistic Forecast: $0.49779 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory, characterized by increasing institutional interest and ecosystem expansion.

- Price Range Forecast:

- 2026: $0.40005 - $0.54552

- 2027: $0.47505 - $0.70508

- Key Catalysts: Protocol upgrades, increased adoption metrics, expansion of use cases, positive regulatory environment, and growing market confidence in the asset's fundamentals.

2028-2030 Long-term Outlook

- Base Case: $0.38564 - $0.8918 (assumes steady ecosystem growth, moderate market adoption, and stable macroeconomic conditions)

- Optimistic Case: $0.58605 - $1.35816 (assumes accelerated mainstream adoption, successful protocol implementations, and favorable market cycles)

- Transformation Case: Above $1.35816 (assumes revolutionary developments in technology, significant institutional backing, breakthrough in market penetration, and favorable macroeconomic tailwinds)

Note: These forecasts are based on historical trend analysis and market conditions as of December 18, 2025. Investors are advised to conduct their own due diligence and consider trading on reputable platforms such as Gate.com for price discovery and portfolio management.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.49779 | 0.4114 | 0.37849 | 0 |

| 2026 | 0.54552 | 0.4546 | 0.40005 | 10 |

| 2027 | 0.70508 | 0.50006 | 0.47505 | 21 |

| 2028 | 0.8918 | 0.60257 | 0.38564 | 46 |

| 2029 | 1.11331 | 0.74718 | 0.43337 | 81 |

| 2030 | 1.35816 | 0.93024 | 0.58605 | 126 |

Tokenlon (LON) Professional Investment Strategy and Risk Management Report

IV. LON Professional Investment Strategy and Risk Management

LON Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors with long-term perspective focused on ecosystem development and governance participation

- Operational Recommendations:

- Accumulate LON during market downturns to benefit from utility features including trading fee discounts

- Hold positions through market cycles to participate in future governance opportunities once the governance module is activated

- Maintain a diversified crypto portfolio with LON representing a calculated allocation based on risk tolerance

(2) Active Trading Strategy

-

Technical Analysis Approach:

- Price action analysis: Monitor support and resistance levels, with current price at $0.4114 and 24-hour range between $0.3611-$0.60

- Volume analysis: Evaluate trading activity relative to 24-hour volume of 17,553.74 LON to confirm trend validity

-

Swing Trading Key Points:

- Identify entry points during downtrend phases (currently down 3.63% in 24 hours, -11.21% in 7 days)

- Set stop-loss orders at technical support levels to manage downside risk

- Take profits at resistance levels while maintaining core positions for long-term gains

LON Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Active Investors: 2-5% of crypto portfolio allocation

- Professional Investors: 5-10% of crypto portfolio allocation based on protocol adoption metrics

(2) Risk Hedging Solutions

- Portfolio diversification: Balance LON holdings with other established digital assets to reduce concentration risk

- Position sizing: Use predetermined allocation limits and rebalance quarterly to maintain target exposure levels

(3) Secure Storage Solutions

- Custody options: Utilize Gate.com's secure platform for active trading positions requiring liquidity

- Security best practices: Enable two-factor authentication, use strong passwords, and regularly verify contract addresses before transactions

- Safety considerations: Never share private keys, be cautious of phishing attempts, and verify the official contract address (0x0000000000095413afc295d19edeb1ad7b71c952 on Ethereum) before transferring assets

V. LON Potential Risks and Challenges

LON Market Risk

- Price volatility: LON has experienced significant historical fluctuations, trading from an all-time high of $9.81 (January 31, 2021) to a low of $0.3718 (June 12, 2023), representing a 96.2% decline from peak

- Liquidity constraints: 24-hour trading volume of $17,553.74 indicates limited market depth, potentially resulting in slippage during large transactions

- Market sentiment dependency: With only 40,074 token holders, the token's price is susceptible to sentiment shifts and concentrated holder actions

LON Regulatory Risk

- Governance framework uncertainty: The activation timeline and execution rules for the governance module remain unspecified, creating uncertainty for governance participation expectations

- Regulatory evolution: Changing cryptocurrency regulations across jurisdictions may impact the protocol's operational capabilities and token utility

- Decentralized protocol compliance: As governance transitions to community control, regulatory requirements may become more complex

LON Technology Risk

- Protocol adoption: Success depends on increasing adoption of Tokenlon's decentralized payment and settlement protocol

- Smart contract vulnerabilities: Any undiscovered security flaws in the protocol could impact token value and ecosystem functionality

- Network competition: Competition from other decentralized trading protocols may limit Tokenlon's market share and utility expansion

VI. Conclusion and Action Recommendations

LON Investment Value Assessment

Tokenlon (LON) represents a utility token within a decentralized trading protocol ecosystem with defined use cases including trading fee discounts and future governance rights. The token's current market position (ranked 497, market cap $57.78M, trading at $0.4114) reflects significant depreciation from historical peaks, offering potential opportunities for investors aligned with protocol development. However, the limited trading volume, uncertain governance timeline, and protocol adoption challenges present material risks requiring careful evaluation.

LON Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto allocation) after understanding the protocol's mechanics and governance roadmap. Use Gate.com's trading interface to execute small purchases and learn market dynamics before expanding exposure.

✅ Experienced Investors: Consider accumulating during market downturns while establishing clear entry and exit parameters. Participate in protocol governance once the module activates to maximize utility realization and potential value appreciation.

✅ Institutional Investors: Conduct thorough due diligence on protocol adoption metrics and development progress. Consider LON as part of a diversified digital asset strategy with allocation sizes reflecting protocol maturation and ecosystem growth trajectories.

LON Trading Participation Methods

- Spot Trading: Execute buy and sell orders on Gate.com to establish or liquidate positions based on technical analysis and market conditions

- Price Monitoring: Track LON's performance relative to the 24-hour decline of 3.63% and 7-day decline of 11.21% using Gate.com's analytics tools

- Fee Optimization: Maximize LON holdings to benefit from trading fee discounts on Gate.com, improving overall trading economics

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Longeveron go up?

Yes, Longeveron shows strong upside potential. Analysts predict approximately 990.60% upside over the next 12 months, indicating significant growth opportunity for LON price appreciation in the medium term.

Does Luna Coin have a future?

Luna Coin shows promising potential for future growth. Analysts remain positive about its prospects, with predictions suggesting significant upside potential as the ecosystem develops and adoption increases.

What is the Luna prediction for 2025?

Terra (LUNA) is predicted to reach approximately $0.1644 by mid-December 2025. Technical analysis shows neutral sentiment with mixed bullish and bearish signals. Long-term outlook remains uncertain due to market volatility.

Can holo reach $1 dollar?

Holo would need a 220,000% increase to reach $1. Based on current market dynamics and growth projections, reaching $1 appears highly unlikely in the foreseeable future.

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

2025 UNCX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHESSPrice Prediction: Market Analysis and Future Trends for the CHESS Token Ecosystem

2025 EDGE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Top Exciting NFT Projects to Watch in the Coming Months

Guide to Integrating Polygon Network with Your Crypto Wallet

Mastering the Art of NFTs: A Beginner's Guide

Unveiling the Next Phase of Decentralized Finance Evolution

Top Emerging NFT Ventures in 2024