2025 JELLYJELLY Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: JELLYJELLY's Market Position and Investment Value

JELLYJELLY (JELLYJELLY) has emerged as a notable player in the video chat sharing space since its inception. As of 2025, JELLYJELLY's market capitalization has reached $77,939,929, with a circulating supply of approximately 999,999,099 tokens, and a price hovering around $0.07794. This asset, known for its innovative approach to social media content sharing, is playing an increasingly crucial role in the realm of digital communication and social networking.

This article will provide a comprehensive analysis of JELLYJELLY's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. JELLYJELLY Price History Review and Current Market Status

JELLYJELLY Historical Price Evolution

- 2025: Project launch, price reached ATH of $0.2451 on January 30

- 2025: Market correction, price dropped to ATL of $0.003674 on March 10

- 2025: Recovery phase, price climbed to $0.07794 as of October 21

JELLYJELLY Current Market Situation

JELLYJELLY is currently trading at $0.07794, with a 24-hour trading volume of $953,454.51. The token has experienced a 3.96% increase in the last 24 hours. Its market capitalization stands at $77,939,929.80, ranking it 474th in the cryptocurrency market. The circulating supply is 999,999,099.34 JELLYJELLY, which is also the total and maximum supply. The token has shown significant growth over the past year, with a 322.73% increase. However, it's still trading 68.20% below its all-time high of $0.2451.

Click to view the current JELLYJELLY market price

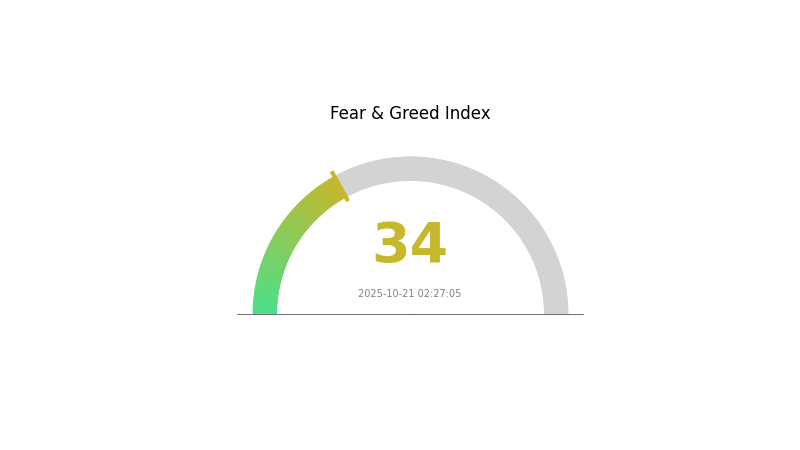

JELLYJELLY Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index standing at 34. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Traders should remain vigilant, conduct thorough research, and consider diversifying their portfolios to mitigate risks in this uncertain environment. As always, it's wise to only invest what you can afford to lose.

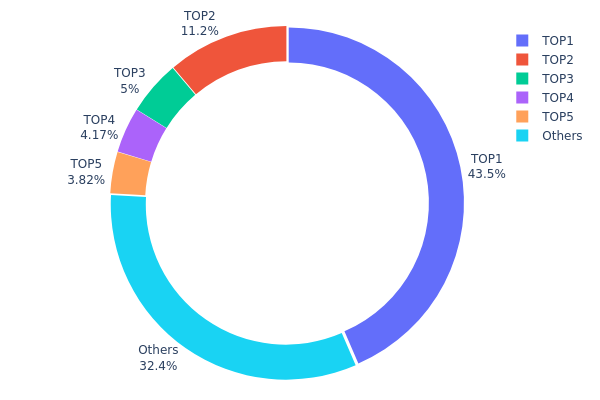

JELLYJELLY Holdings Distribution

The address holdings distribution data for JELLYJELLY reveals a highly concentrated ownership structure. The top address holds a substantial 43.49% of the total supply, followed by the second-largest holder with 11.15%. Together, the top five addresses control 67.61% of JELLYJELLY tokens, while the remaining 32.39% is distributed among other addresses.

This concentration of holdings raises concerns about the token's decentralization and market stability. With nearly half of the supply controlled by a single address, there is a significant risk of market manipulation and price volatility. The dominance of a few large holders could potentially impact liquidity and create barriers for new investors entering the market.

The current distribution pattern suggests a relatively low level of decentralization for JELLYJELLY. This concentration may lead to increased market volatility and susceptibility to large-scale sell-offs or accumulation events. Investors should be aware of these ownership dynamics when considering JELLYJELLY's on-chain structural stability and potential market movements.

Click to view the current JELLYJELLY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 434917.51K | 43.49% |

| 2 | 7TWnq4...ueuVuh | 111546.81K | 11.15% |

| 3 | FseyqZ...AsEbdj | 50000.00K | 5.00% |

| 4 | 4zqWVr...1RnTqk | 41687.27K | 4.16% |

| 5 | 9KY9Tu...iKr4T2 | 38176.85K | 3.81% |

| - | Others | 323640.26K | 32.39% |

II. Key Factors Influencing JELLYJELLY's Future Price

Supply Mechanism

- Current Impact: The price of JELLYJELLY has experienced roller-coaster-like fluctuations since its launch, which has contributed to its rapid popularity.

Institutional and Whale Dynamics

- Institutional Holdings: Institutional fund inflows are strengthening JELLYJELLY's price trend, with attention focused on whether it can break through resistance levels to open up upward potential.

Macroeconomic Environment

- Monetary Policy Impact: In the short term, disagreements among Federal Reserve officials and progress on applications for more cryptocurrency ETFs will be key factors influencing market direction.

Technological Development and Ecosystem Building

-

Ecosystem Applications: JELLYJELLY is deeply integrated with the Jelly application, which is a video call recording platform incorporating advanced AI technology.

-

Market Sentiment: JELLYJELLY's price is significantly influenced by market sentiment, news announcements, and community mood. These factors can be important price action drivers for JELLYJELLY. Long-term holders tend to focus on fundamental analysis, while short-term traders may be more influenced by these sentiment factors.

III. JELLYJELLY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05219 - $0.0779

- Neutral prediction: $0.0779 - $0.09

- Optimistic prediction: $0.09 - $0.10906 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth and stabilization

- Price range forecast:

- 2026: $0.05515 - $0.09816

- 2027: $0.05749 - $0.10923

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.10253 - $0.13142 (assuming steady market growth)

- Optimistic scenario: $0.13142 - $0.18004 (assuming strong market performance)

- Transformative scenario: $0.18004+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: JELLYJELLY $0.18004 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10906 | 0.0779 | 0.05219 | 0 |

| 2026 | 0.09816 | 0.09348 | 0.05515 | 19 |

| 2027 | 0.10923 | 0.09582 | 0.05749 | 22 |

| 2028 | 0.12406 | 0.10253 | 0.06459 | 31 |

| 2029 | 0.14954 | 0.11329 | 0.06458 | 45 |

| 2030 | 0.18004 | 0.13142 | 0.10908 | 68 |

IV. Professional Investment Strategies and Risk Management for JELLYJELLY

JELLYJELLY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in video sharing technology

- Operational suggestions:

- Accumulate JELLYJELLY tokens during market dips

- Set up automated recurring purchases

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor social media sentiment and adoption metrics

- Set strict stop-loss and take-profit levels

JELLYJELLY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto sectors

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for JELLYJELLY

JELLYJELLY Market Risks

- High volatility: Cryptocurrency market fluctuations can lead to significant price swings

- Competition: Other video sharing platforms may emerge and capture market share

- User adoption: Slow user growth could impact token value

JELLYJELLY Regulatory Risks

- Uncertain regulations: Changing crypto regulations may affect JELLYJELLY's operations

- Data privacy concerns: Potential scrutiny over user data handling practices

- Content moderation: Challenges in moderating user-generated content

JELLYJELLY Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token contract

- Scalability issues: Challenges in handling increased user load

- Network congestion: Solana network congestion could affect transaction speeds

VI. Conclusion and Action Recommendations

JELLYJELLY Investment Value Assessment

JELLYJELLY presents an innovative solution in the video sharing space, with potential for long-term growth. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

JELLYJELLY Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics

✅ Experienced investors: Consider a balanced approach, allocating a portion to JELLYJELLY within a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence and consider JELLYJELLY as part of a broader blockchain technology investment strategy

JELLYJELLY Trading Participation Methods

- Spot trading: Buy and sell JELLYJELLY tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance opportunities involving JELLYJELLY tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Jasmy hit $10?

While possible, reaching $10 would require significant growth of about 33,000% from current prices. It depends on market conditions and widespread adoption of Jasmy's IoT and AI solutions.

Which memecoin will reach $1 in 2025?

DOGE has the highest potential to reach $1 in 2025, followed by SHIB and PEPE. However, meme coin prices are highly volatile and unpredictable.

Is Jelly Jelly coin legit?

Jelly Jelly coin operates in the Solana and Pump.fun ecosystems. While not widely recognized, it's a legitimate token with potential. Always research before investing.

Will fun tokens reach $1 cent?

Based on current predictions, FUN tokens are not expected to reach $1 cent. The highest projected price is around $0.03 by 2050, according to existing analysis.

2025 FWOG Price Prediction: Analyzing Market Trends and Growth Potential for the Next Bull Run

2025 BOOP Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is GameStop (GME) a good investment?: Analyzing the risks and potential rewards of the controversial meme stock

Is DADDY TATE (DADDY) a good investment?: Analyzing The Potential And Risks Of This Controversial Meme Coin In Today's Crypto Market

How Does On-Chain Data Analysis Reveal WIF's Market Dynamics in 2025?

How Does On-Chain Data Reveal USELESS Coin's Whale Activity in 2025?

Understanding Private Keys: Tips for Safeguarding Your Cryptocurrency

Exploring Layer 2 Solutions for Enhanced Ethereum Scalability

Understanding Blockchain Node Functionality: A Beginner's Guide

Top Secure Bitcoin Wallets Supporting Taproot Technology

Understanding Ethereum Transaction Costs and How to Minimize Them