2025 FRED Price Prediction: Analyzing Economic Indicators and Market Trends for Accurate Forecasts

Introduction: FRED's Market Position and Investment Value

First Convicted Raccon (FRED), as a token dedicated to "Justice for Fred", has been making waves since its inception. As of 2025, FRED's market capitalization has reached $906,857.87, with a circulating supply of approximately 999,843,302 tokens, and a price hovering around $0.000907. This asset, dubbed the "raccoon justice token", is playing an increasingly crucial role in the realm of meme coins and social justice-themed cryptocurrencies.

This article will provide a comprehensive analysis of FRED's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer investors professional price predictions and practical investment strategies.

I. FRED Price History Review and Current Market Status

FRED Historical Price Evolution Trajectory

- 2024: FRED launched, price reached all-time high of $0.2388 on November 15

- 2025: Market downturn, price dropped significantly to all-time low of $0.0006767 on November 21

FRED Current Market Situation

As of November 26, 2025, FRED is trading at $0.000907, showing a 4.01% increase in the last 24 hours. The token has experienced significant volatility, with a 24-hour trading volume of $3,288.08. FRED's market capitalization stands at $906,857.87, ranking it at 2732 in the crypto market. The current price represents a substantial decline of 99.21% from its all-time high, indicating a prolonged bear market for the token. Short-term trends show a positive 2.51% gain in the past hour, but a 45.56% drop over the last 30 days, suggesting ongoing price instability.

Click to view the current FRED market price

FRED Market Sentiment Indicator

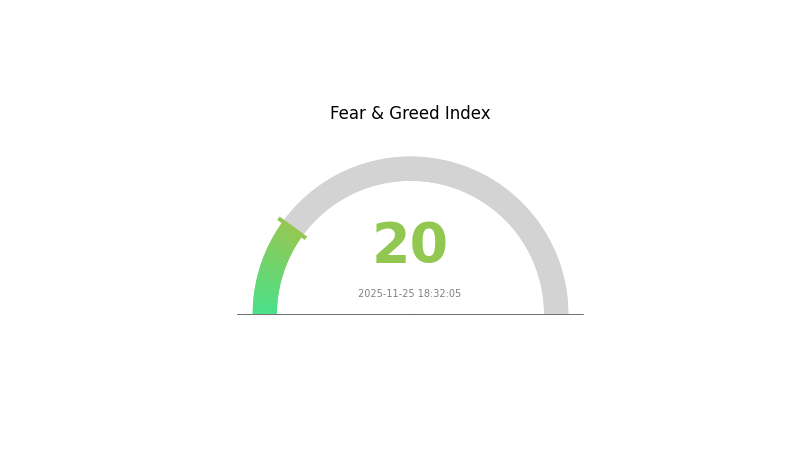

2025-11-25 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment has plunged into extreme fear territory, with the Fear and Greed Index registering a mere 20 points. This significant drop signals intense pessimism among investors, potentially creating oversold conditions. Historically, such extreme fear levels have often preceded market rebounds. However, traders should remain cautious and conduct thorough research before making any investment decisions. Gate.com offers various tools and resources to help navigate these volatile market conditions.

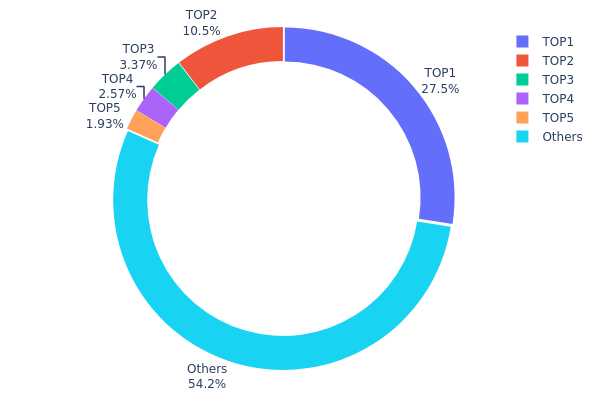

FRED Holdings Distribution

The address holdings distribution chart for FRED reveals a significant concentration of tokens among a few top addresses. The largest holder possesses 27.50% of the total supply, while the top five addresses collectively control 45.81% of FRED tokens. This concentration level indicates a relatively centralized ownership structure, which could potentially impact market dynamics.

Such a distribution pattern may lead to increased volatility in FRED's price movements. Large holders have the capacity to influence market sentiment and liquidity through substantial buy or sell orders. Moreover, this concentration raises concerns about potential market manipulation risks, as coordinated actions by major holders could significantly sway token valuations.

Despite these concerns, it's noteworthy that over half (54.19%) of FRED tokens are distributed among smaller holders. This broader distribution base provides some level of decentralization and may help mitigate the influence of top holders to an extent. However, the overall token distribution suggests that FRED's on-chain structure stability and decentralization level have room for improvement to enhance market resilience and reduce concentration risks.

Click to view the current FRED Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 275004.34K | 27.50% |

| 2 | u6PJ8D...ynXq2w | 104634.38K | 10.46% |

| 3 | 5PAhQi...cnPRj5 | 33717.22K | 3.37% |

| 4 | ASTyfS...g7iaJZ | 25647.21K | 2.56% |

| 5 | G4jXDi...z5RVXH | 19260.38K | 1.92% |

| - | Others | 541515.00K | 54.19% |

II. Key Factors Influencing FRED's Future Price

Macroeconomic Environment

-

Impact of Monetary Policy: The Federal Reserve's cautious approach to interest rate adjustments in the latter half of 2025 aims to balance inflation control and economic growth. The Fed closely monitors Personal Consumption Expenditures (PCE) and core PCE indicators, considering further rate cuts only when these metrics consistently approach the 2% target.

-

Inflation Hedging Properties: As of April 2025, the PCE inflation rate has decreased to 2.7%, reflecting reduced consumer demand and the Fed's tightening monetary policy. However, housing prices and mortgage rates remain significantly affected, with the median 30-year fixed mortgage rate at 6.94% as of May 30, 2025.

-

Geopolitical Factors: Global economic challenges, such as China's dual pressures of weak domestic demand and strong exports, influence the Fed's decision-making process. The global manufacturing Purchasing Managers' Index (PMI) indicates a slow but steady recovery, with variations across different countries impacting the overall economic outlook.

Institutional and Whale Dynamics

-

Institutional Holdings: Investment patterns show a shift towards more cautious AI-related investments, with funds concentrating on companies with clear profit prospects and stable revenue models.

-

Corporate Adoption: Major cloud computing companies are adjusting their capital expenditure strategies, shifting focus from data center and chip infrastructure to practical AI model implementation and applications.

-

National Policies: The potential implementation of "reciprocal tariffs" and other policies by the U.S. administration in 2025 could impact global economic dynamics, influencing Fed decisions and market trends.

Technological Development and Ecosystem Building

-

AI Integration: The commercialization of AI computing models is gradually driving investment opportunities in application sectors. Software companies are increasingly becoming the focus of investment, with notable stock performance in areas such as data analytics, industrial 4.0, cybersecurity, and customer relationship management.

-

Ecosystem Applications: There's a growing emphasis on AI applications in practical business scenarios, moving from training-focused investments to inference and real-world implementations. This shift represents a consensus in the AI industry towards prioritizing operational efficiency and commercial value.

III. FRED Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00066 - $0.00091

- Neutral forecast: $0.00091 - $0.00110

- Optimistic forecast: $0.00110 - $0.00129 (requires positive market sentiment)

2026-2028 Outlook

- Market phase expectation: Gradual growth and consolidation

- Price range forecast:

- 2026: $0.00100 - $0.00135

- 2027: $0.00119 - $0.00134

- Key catalysts: Increased adoption and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.00158 - $0.00169 (assuming steady market growth)

- Optimistic scenario: $0.00169 - $0.00179 (assuming strong market performance)

- Transformative scenario: $0.00179 - $0.00189 (assuming breakthrough innovations)

- 2030-12-31: FRED $0.00175 (potential peak within long-term uptrend)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00129 | 0.00091 | 0.00066 | 0 |

| 2026 | 0.00135 | 0.0011 | 0.001 | 21 |

| 2027 | 0.00134 | 0.00123 | 0.00119 | 35 |

| 2028 | 0.00189 | 0.00128 | 0.0008 | 41 |

| 2029 | 0.00179 | 0.00158 | 0.00086 | 74 |

| 2030 | 0.00175 | 0.00169 | 0.00133 | 86 |

IV. FRED Professional Investment Strategies and Risk Management

FRED Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate FRED tokens during market dips

- Set price targets for partial profit-taking

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

FRED Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for FRED

FRED Market Risks

- High volatility: FRED's price may experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

FRED Regulatory Risks

- Regulatory uncertainty: Potential for new regulations affecting meme coins

- Exchange delistings: Risk of being removed from trading platforms

- Legal challenges: Possibility of legal issues related to the project's theme

FRED Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Network congestion: Solana network issues could affect FRED transactions

- Wallet compatibility: Limited support from some wallet providers

VI. Conclusion and Action Recommendations

FRED Investment Value Assessment

FRED presents a high-risk, speculative investment opportunity with potential for significant volatility. While it may offer short-term trading opportunities, its long-term value proposition remains uncertain due to its meme coin nature and limited utility.

FRED Investment Recommendations

✅ Beginners: Avoid or limit exposure to a very small portion of portfolio ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Approach with caution, only suitable for high-risk allocations

FRED Trading Participation Methods

- Spot trading: Buy and sell FRED tokens on Gate.com

- Limit orders: Set specific entry and exit points to manage risk

- Dollar-cost averaging: Gradually accumulate tokens over time to reduce impact of volatility

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While no specific crypto is guaranteed to 1000x, emerging projects in AI, DeFi, and Web3 show high potential for significant growth in the coming years.

Which crypto will reach $1000 in 2030?

Bitcoin is the most likely candidate to reach $1000 by 2030, given its market dominance and adoption rate. Ethereum also has potential to hit this milestone.

What crypto is predicted to skyrocket in 2025?

XRP is predicted to skyrocket in 2025 due to its institutional traction. Other potential gainers include Solana and Ethereum.

Will Fred be listed on Binance?

As of 2025-11-25, Fred is not listed on any major exchanges. Its future listing plans are not publicly known.

Share

Content