2025 CWS Price Prediction: Analyzing Market Trends and Potential Growth Factors for Crowns

Introduction: CWS's Market Position and Investment Value

Seascape Crowns (CWS), as a game platform designed around NFT and DeFi economy, has made significant strides since its inception in 2021. As of 2025, CWS has a market capitalization of $569,386, with a circulating supply of approximately 7,645,850 tokens, and a price hovering around $0.07447. This asset, often referred to as the "crown jewel of blockchain gaming," is playing an increasingly crucial role in the fields of NFT-based gaming and DeFi.

This article will provide a comprehensive analysis of CWS's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CWS Price History Review and Current Market Status

CWS Historical Price Evolution

- 2021: CWS reached its all-time high of $61.33 on March 17, marking a significant milestone in its price history.

- 2023-2024: The cryptocurrency market experienced a prolonged bearish phase, with CWS price declining substantially.

- 2025: CWS hit its all-time low of $0.063296 on July 13, representing a dramatic drop from its peak.

CWS Current Market Situation

As of November 26, 2025, CWS is trading at $0.07447, showing a 4.65% decrease in the last 24 hours. The current price represents a significant decline of 99.88% from its all-time high. The token's market capitalization stands at $569,386, ranking it 3132nd in the overall cryptocurrency market. CWS has a circulating supply of 7,645,850.97 tokens, which is 76.46% of its maximum supply of 10,000,000 tokens. The 24-hour trading volume is $20,965.40, indicating moderate market activity. Over the past week, CWS has experienced a 10.6% price decrease, while the 30-day and 1-year price changes show more substantial declines of 50.51% and 63.1% respectively, reflecting a persistent downward trend in the medium to long term.

Click to view the current CWS market price

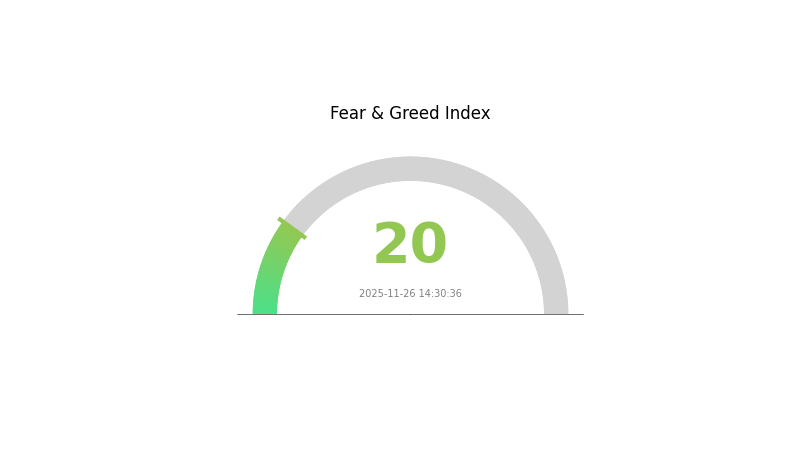

CWS Market Sentiment Indicator

2025-11-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 20. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market dynamics remain unpredictable. Traders should consider diversifying their portfolios and implementing risk management strategies. Remember, market sentiment can shift rapidly, so stay informed and make decisions based on thorough research and analysis.

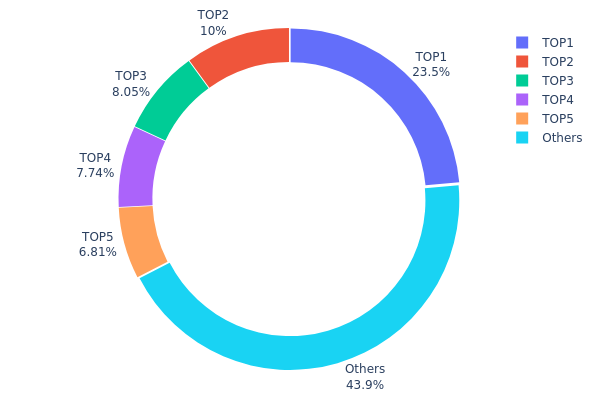

CWS Holdings Distribution

The address holdings distribution data provides insights into the concentration of CWS tokens among different addresses. Analysis of this data reveals a significant level of centralization in CWS token holdings. The top address, likely a burn address (0x0000...00dead), holds 23.54% of the total supply, while the top 5 addresses collectively control 56.12% of all tokens.

This concentration pattern raises concerns about potential market manipulation and price volatility. With a small number of addresses holding a majority of tokens, there's an increased risk of large sell-offs or coordinated actions that could significantly impact CWS's market dynamics. The high concentration also suggests a lower degree of decentralization, which may affect the token's resilience and overall market stability.

However, it's worth noting that 43.88% of tokens are distributed among "Others," indicating some level of wider distribution. This fragmentation could provide a counterbalance to the top holders' influence, potentially mitigating some risks associated with high concentration. Overall, the current holdings distribution reflects a market structure that is centralized but with a notable portion of tokens spread among smaller holders.

Click to view the current CWS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 2354.15K | 23.54% |

| 2 | 0xe0e5...f14c46 | 1000.00K | 10.00% |

| 3 | 0x0d07...b492fe | 804.50K | 8.04% |

| 4 | 0x53f7...f3fa23 | 773.63K | 7.73% |

| 5 | 0xd621...d19a2c | 681.12K | 6.81% |

| - | Others | 4386.61K | 43.88% |

II. Core Factors Affecting CWS Future Price

Supply Mechanism

- Maximum Supply: CWS has a fixed maximum supply of 100,000,000 tokens.

- Current Impact: The limited supply may create scarcity, potentially supporting price stability or growth as demand increases.

Technological Development and Ecosystem Building

- Seascape Network: CWS is the native token of the Seascape Network, a gaming platform built on blockchain technology.

- Ecosystem Applications: Seascape Network hosts various blockchain games and NFT-based projects, which could drive demand for CWS tokens.

III. CWS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.06961 - $0.07405

- Neutral prediction: $0.07405 - $0.07627

- Optimistic prediction: $0.07627 - $0.07849 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.04424 - $0.09915

- 2027: $0.07982 - $0.09297

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.09034 - $0.11423 (assuming steady market growth)

- Optimistic scenario: $0.11423 - $0.14736 (assuming strong market performance)

- Transformative scenario: $0.14736+ (extreme favorable conditions in crypto market)

- 2030-12-31: CWS $0.14736 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07849 | 0.07405 | 0.06961 | 0 |

| 2026 | 0.09915 | 0.07627 | 0.04424 | 2 |

| 2027 | 0.09297 | 0.08771 | 0.07982 | 17 |

| 2028 | 0.10661 | 0.09034 | 0.06505 | 21 |

| 2029 | 0.12999 | 0.09847 | 0.05515 | 32 |

| 2030 | 0.14736 | 0.11423 | 0.07768 | 53 |

IV. Professional Investment Strategies and Risk Management for CWS

CWS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operation suggestions:

- Accumulate CWS during market dips

- Set price targets for partial profit-taking

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Use stop-loss orders to manage risk

CWS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CWS

CWS Market Risks

- High volatility: CWS price can fluctuate dramatically

- Limited liquidity: May face challenges in large-volume trades

- Market sentiment: Susceptible to broader crypto market trends

CWS Regulatory Risks

- Uncertain regulations: Potential for stricter cryptocurrency regulations

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws for cryptocurrency transactions

CWS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Transaction delays during high network activity

- Scalability challenges: Potential limitations in processing capacity

VI. Conclusion and Action Recommendations

CWS Investment Value Assessment

CWS offers potential in the gaming and NFT sectors but faces significant volatility and regulatory uncertainties. Long-term value depends on Seascape's ecosystem growth, while short-term risks include market fluctuations and technical challenges.

CWS Investment Recommendations

✅ Beginners: Start with small, affordable investments; focus on learning ✅ Experienced investors: Consider a balanced approach with regular profit-taking ✅ Institutional investors: Conduct thorough due diligence; consider as part of a diversified crypto portfolio

CWS Trading Participation Methods

- Spot trading: Buy and sell CWS on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore DeFi opportunities within the Seascape ecosystem

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Which coin will reach $1 in 2030?

While it's difficult to predict with certainty, CWS (Crowns) has potential to reach $1 by 2030, given its innovative blockchain gaming ecosystem and growing adoption in the Web3 space.

Does compound have a future?

Yes, Compound has a promising future. As DeFi grows, Compound's lending protocol is likely to remain a key player, innovating and expanding its services in the evolving crypto ecosystem.

Can Coti reach $10?

While ambitious, reaching $10 is possible for Coti in the long term with significant adoption and market growth. However, it would require substantial increases in market cap and demand.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or more by 2030.

2025 ENJ Price Prediction: Analyzing Market Trends and Potential Growth Factors for Enjin Coin

2025 GCOIN Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Asset

KARRAT vs ENJ: A Comprehensive Comparison of Two Leading Gaming Token Projects

2025 AGLD Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Is Vulcan Forged (PYR) a good investment?: A Comprehensive Analysis of Gaming Token Prospects and Market Potential

2025 CTA Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Understanding UMA: A Beginner's Guide to the Protocol

How to Use MACD, RSI, and Bollinger Bands for Crypto Price Prediction?

What is Vision (VSN) token? A complete fundamentals analysis of whitepaper logic, use cases, and team background

Pyramid Schemes vs. Ponzi Schemes: A Complete Guide to Types of Financial Fraud

How Volatile Is GIGGLE's Price? A Look at 475% Swings and Support Levels