2025 CC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: CC's Market Position and Investment Value

Canton Network (CC), as the only public, permissionless blockchain purpose-built for institutional finance, has uniquely combined privacy, compliance, and scalability since its inception. As of 2025, Canton Network's market capitalization has reached $2.57 billion, with a circulating supply of approximately 36.16 billion CC, and a price hovering around $0.07119. This asset, hailed as the "bridge between blockchain vision and global finance," is playing an increasingly crucial role in enabling real-time, secure synchronization and settlement across multiple asset classes in institutional finance.

This article will comprehensively analyze Canton Network's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. CC Price History Review and Current Market Status

CC Historical Price Evolution

- 2025: Canton Network launched, price reached all-time high of $0.175 on November 10

- 2025: Market downturn, price dropped to all-time low of $0.05867 on December 6

- 2025: Volatile period, price fluctuated between $0.05867 and $0.175

CC Current Market Situation

The current price of CC is $0.07119, showing a slight decrease of 0.18% in the past 24 hours. The trading volume over the last 24 hours stands at $1,714,476.03. CC has experienced significant declines across various timeframes, with a 7-day drop of 7.47%, a 30-day decrease of 37.01%, and a substantial 53.095% decline over the past year. The market capitalization is currently at $2,573,917,962.13, with a circulating supply of 36,155,611,211.20 CC tokens. The coin's all-time high of $0.175 was recorded on November 10, 2025, while its all-time low of $0.05867 occurred on December 6, 2025. The current price represents a 59.31% decrease from its all-time high and a 21.34% increase from its all-time low.

Click to view the current CC market price

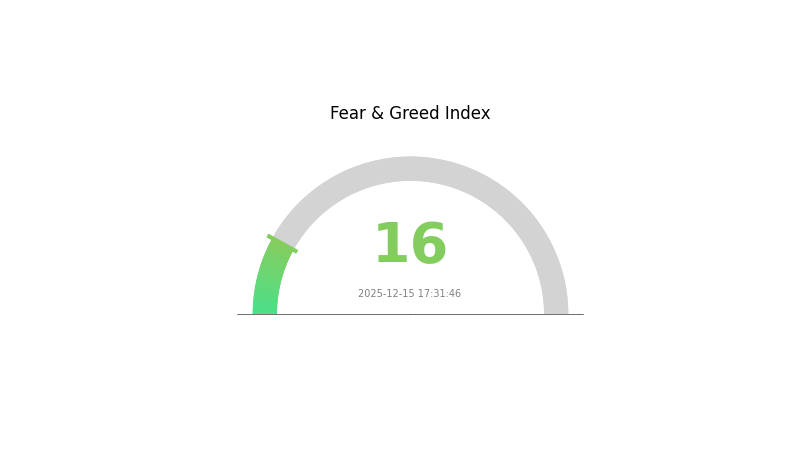

CC Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to 16. This stark indicator suggests investors are highly pessimistic, potentially creating oversold conditions. Historically, such extreme fear has often preceded market bottoms, presenting potential buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should consider risk management strategies while watching for signs of sentiment reversal.

CC Holdings Distribution

The address holdings distribution data for CC reveals a relatively decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation by large individual holders appears to be minimal. This distribution pattern suggests a healthy level of decentralization, which is generally considered positive for the overall stability and resilience of the CC ecosystem.

The absence of highly concentrated holdings indicates that the CC market may be less susceptible to sudden price swings caused by the actions of a few large holders. This distribution pattern could contribute to more organic price discovery and potentially reduce volatility. However, it's important to note that while the current distribution appears balanced, market dynamics can change over time as new participants enter or exit the market.

Overall, the current address distribution reflects a mature and well-distributed network for CC, which may inspire confidence among investors and users. This structure supports the principles of decentralization and could be seen as a positive indicator for the long-term sustainability of the CC ecosystem.

Click to view the current CC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing CC's Future Price

Supply Mechanism

- Gradual Minting: The gradual minting of new CC tokens may create inflationary pressure on the price.

- Current Impact: As a newly listed token, CC may face limited liquidity, leading to higher price volatility risks.

Institutional and Whale Dynamics

- Institutional Holdings: The Coinbase Bitcoin Premium Index has been positive for six consecutive days, indicating strong buying from institutional or compliant funds in the US market.

Macroeconomic Environment

- Monetary Policy Impact: Market expectations for interest rate cuts are strengthening, which could potentially benefit crypto assets.

- Inflation Hedging Properties: The correlation between CC price trends and inflation indicators may influence its perception as an inflation hedge.

Technical Development and Ecosystem Building

- Market Sentiment Analysis: The long/short ratio is a core indicator for measuring CC market sentiment, showing a significant positive correlation with price trends.

- Derivatives Market Indicators: Futures open interest and funding rates are important leading indicators for CC price movements. The total open interest reflects market activity and helps reveal signals of market strength and trend reversals.

III. CC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05196 - $0.07118

- Neutral prediction: $0.07118 - $0.07545

- Optimistic prediction: $0.07545 - $0.08000 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.05362 - $0.08937

- 2028: $0.05681 - $0.10526

- Key catalysts: Technological advancements, wider market acceptance, and potential regulatory clarity

2030 Long-term Outlook

- Base scenario: $0.08908 - $0.10998 (assuming steady market growth)

- Optimistic scenario: $0.10998 - $0.12758 (assuming strong market performance and increased utility)

- Transformative scenario: $0.12758 - $0.15000 (assuming breakthrough applications and mainstream adoption)

- 2030-12-31: CC $0.12758 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07545 | 0.07118 | 0.05196 | 0 |

| 2026 | 0.08211 | 0.07332 | 0.06892 | 2 |

| 2027 | 0.08937 | 0.07771 | 0.05362 | 9 |

| 2028 | 0.10526 | 0.08354 | 0.05681 | 17 |

| 2029 | 0.12556 | 0.0944 | 0.05853 | 32 |

| 2030 | 0.12758 | 0.10998 | 0.08908 | 54 |

IV. Professional Investment Strategies and Risk Management for CC

CC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Institutional investors and risk-tolerant individual investors

- Operational suggestions:

- Accumulate CC tokens during market dips

- Set periodic review points to reassess investment thesis

- Store tokens in secure cold storage solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Track institutional adoption and partnership announcements

- Monitor overall market sentiment towards institutional blockchain solutions

CC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple institutional blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Air-gapped computer for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for CC

CC Market Risks

- Volatility: Price fluctuations due to market sentiment and adoption rate

- Competition: Emergence of rival institutional blockchain solutions

- Liquidity: Potential challenges in large-volume trading

CC Regulatory Risks

- Compliance changes: Evolving regulations in different jurisdictions

- Institutional adoption barriers: Regulatory hurdles for financial institutions

- Cross-border transactions: Varying legal frameworks across countries

CC Technical Risks

- Scalability issues: Potential limitations in handling high transaction volumes

- Security vulnerabilities: Unforeseen weaknesses in the blockchain protocol

- Interoperability challenges: Integration difficulties with existing financial systems

VI. Conclusion and Action Recommendations

CC Investment Value Assessment

Canton Network (CC) presents a unique value proposition as a blockchain solution tailored for institutional finance. While it offers long-term potential in revolutionizing financial infrastructure, short-term risks include market volatility and regulatory uncertainties.

CC Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging strategy with regular portfolio rebalancing

✅ Institutional investors: Explore strategic partnerships and pilot programs with Canton Network

CC Trading Participation Methods

- Spot trading: Purchase CC tokens on Gate.com

- OTC trading: For large volume transactions, contact Gate.com's OTC desk

- Staking: Participate in network validation when available to earn additional rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is CC stock a good buy?

Yes, CC stock appears to be a good buy. Analysts are generally positive, with 40% recommending it as a Strong Buy and overall consensus leaning towards Buy.

Will Costco stock reach $1000?

Yes, Costco stock is likely to reach $1000 in 2026. Analysts are optimistic, with 60% bullish on the stock.

What will Coca-Cola stock be worth in 5 years?

Based on current trends, Coca-Cola stock could reach around $90 per share in 5 years, assuming a 5% annual growth rate from its current price of $71.

What is the projection for Caterpillar 2025?

Caterpillar stock is projected to trade between $598.70 and $630.29 in 2025, based on current market analysis and trends.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How to Analyze Onchain Data: Active Addresses, Transaction Volume, and Whale Movements Explained

What is M Pattern Trading in Crypto

What is ULTIMA tokenomics: distribution, deflation mechanism, and governance utility explained?

How to Make $10 Now with Cryptocurrency Trading

What are the key crypto derivatives market signals in 2025: futures open interest, funding rates, and liquidation data