2025 BABYBNB Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of BABYBNB

BABYBNB (BABYBNB), a meme coin backed by the strongest BNB community, has emerged as a notable project launched through GRA.FUN. Since its launch in September 2024, BABYBNB has captured significant attention within the BNB ecosystem. As of December 28, 2025, BABYBNB maintains a market capitalization of $880,400, with a circulating supply of 1,000,000,000 tokens and a current price hovering around $0.0008804. This community-driven asset, recognized for its role in strengthening the BNB ecosystem, represents a unique segment within the meme coin landscape.

This article will provide a comprehensive analysis of BABYBNB's price trends and market dynamics, examining historical performance patterns, market supply and demand conditions, ecosystem developments, and broader macroeconomic factors. Through this detailed examination, we aim to deliver professional price forecasting and practical investment guidance for stakeholders seeking to understand this asset's trajectory and potential opportunities in the crypto market.

BABYBNB Market Analysis Report

I. BABYBNB Price History Review and Market Status

BABYBNB Historical Price Evolution

-

September 2024: Project launch from GRA.FUN platform, achieving all-time high of $0.18032 on September 29, 2024, backed by strong BNB community support.

-

July 2025: Price reached all-time low of $0.0004909 on July 4, 2025, representing a significant decline of approximately 99.73% from the historical peak.

-

2025 Year-to-Date: Experiencing sustained downward pressure with a one-year price decline of -85.97% from the launch price of $0.11.

BABYBNB Current Market Conditions

As of December 28, 2025, BABYBNB is trading at $0.0008804, reflecting recent short-term weakness with the following performance metrics:

Price Performance Summary:

- 1-hour change: -1.014%

- 24-hour change: -0.97%

- 7-day change: -7.97%

- 30-day change: -14.41%

- 1-year change: -85.97%

Market Capitalization and Supply Metrics:

- Market capitalization: $880,400.00

- Fully diluted valuation: $880,400.00

- Circulating supply: 1,000,000,000 BABYBNB

- Total supply: 1,000,000,000 BABYBNB

- Market cap dominance: 0.000027%

- Current holders: 18,097 addresses

Trading Activity:

- 24-hour trading volume: $12,900.38

- Listed on 3 cryptocurrency exchanges

- Price range (24h): $0.0008595 - $0.0009166

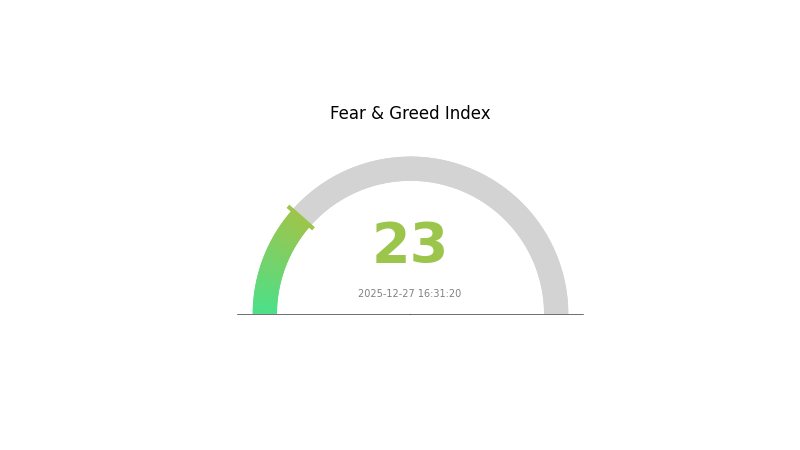

The token maintains 100% circulation ratio with market sentiment characterized by extreme fear (VIX: 23 as of December 27, 2025).

Click to view current BABYBNB market price

Market Sentiment Indicator

2025-12-27 Fear and Greed Index: 23 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 23. This historically low reading indicates heightened market anxiety and pessimism among investors. During such periods of extreme fear, risk assets typically face significant selling pressure as market participants prioritize capital preservation over growth opportunities. However, contrarian investors often view these extreme conditions as potential buying opportunities, as excessive fear can create attractive entry points for long-term investors. Monitor market developments closely on Gate.com to navigate these volatile conditions effectively.

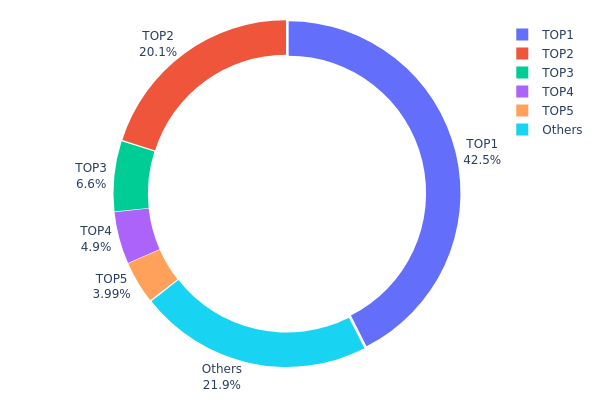

BABYBNB Address Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, providing crucial insights into the decentralization level and market structure of BABYBNB. This metric reveals how token supply is allocated among different holders, serving as a fundamental indicator for assessing potential concentration risks and market manipulation vulnerabilities.

The current distribution data demonstrates significant concentration concerns within the BABYBNB ecosystem. The top two addresses collectively control 62.59% of the total token supply, with the leading address alone holding 42.51%. This level of concentration substantially exceeds healthy decentralization thresholds, indicating that major token supply decisions and liquidity movements are heavily dependent on a limited number of stakeholders. The top five addresses command 78.06% of all holdings, while the remaining addresses collectively possess only 21.94%, further emphasizing the imbalanced distribution pattern.

This pronounced concentration creates notable implications for market dynamics and price stability. With such substantial token holdings concentrated among few addresses, the potential for coordinated selling pressure or market manipulation becomes elevated. Large holders possess the structural capacity to influence price movements through significant token transfers or liquidations. Additionally, the concentrated ownership structure may limit genuine decentralization and distributed governance principles, potentially creating liquidity challenges during volatile market conditions. Investors should monitor these top addresses' on-chain activities closely, as their trading patterns could serve as leading indicators for broader market sentiment and potential price volatility in the BABYBNB token ecosystem.

Click to view current BABYBNB address holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2c31...6462ee | 425161.29K | 42.51% |

| 2 | 0xd290...2180d1 | 200897.83K | 20.08% |

| 3 | 0xf399...2bdcc6 | 66037.62K | 6.60% |

| 4 | 0x53f7...f3fa23 | 48982.58K | 4.89% |

| 5 | 0x83c2...c40dbd | 39893.09K | 3.98% |

| - | Others | 219027.60K | 21.94% |

II. Core Factors Affecting BABYBNB's Future Price

Market Demand and Adoption

- Market Acceptance: BABYBNB's price movements are significantly influenced by market demand and acceptance levels within the crypto community.

- Social Media Impact: Major announcements and social media activity have demonstrated notable influence on price volatility, with significant price swings following key public statements.

- Trading Volume Dynamics: Recent data shows trading volume fluctuations, with 24-hour trading volumes experiencing both increases and decreases based on market sentiment.

Regulatory Environment

- Regulatory Changes: Cryptocurrency prices, including BABYBNB, remain sensitive to regulatory developments and policy changes across different jurisdictions.

- Compliance Impact: Changes in regulatory frameworks can significantly affect market adoption and price stability.

Technical Development

- Technology Evolution: Ongoing technical development within the blockchain ecosystem continues to shape market conditions and investor sentiment toward tokens like BABYBNB.

Note: The provided sources contain limited detailed information about BABYBNB's specific fundamentals, tokenomics, or ecosystem developments. Investors should conduct comprehensive research before making trading decisions. Cryptocurrency markets remain highly volatile and unpredictable.

III. BABYBNB Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00074 - $0.00088

- Neutral Forecast: $0.00088

- Optimistic Forecast: $0.00101 (requiring sustained market confidence and increased institutional adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Consolidation phase with gradual recovery, transitioning into early growth cycle as market sentiment stabilizes

- Price Range Predictions:

- 2026: $0.00057 - $0.00132 (7% upside potential)

- 2027: $0.00069 - $0.00143 (28% cumulative growth)

- 2028: $0.00124 - $0.00164 (45% cumulative growth)

- Key Catalysts: Ecosystem expansion, strategic partnerships, improved tokenomics implementation, and overall cryptocurrency market recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00120 - $0.00197 (65% growth by 2029, reflecting moderate market expansion)

- Optimistic Scenario: $0.00129 - $0.00249 (94% growth by 2030, assuming strong adoption and favorable market conditions)

- Transformative Scenario: $0.00249+ (extreme bullish case requiring breakthrough developments, major exchange listings on platforms like Gate.com, and significant community expansion)

Note: Price forecasts are based on historical data analysis and market trend projections. Actual prices may vary significantly based on regulatory changes, market dynamics, and technological developments in the cryptocurrency sector.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00101 | 0.00088 | 0.00074 | 0 |

| 2026 | 0.00132 | 0.00094 | 0.00057 | 7 |

| 2027 | 0.00143 | 0.00113 | 0.00069 | 28 |

| 2028 | 0.00164 | 0.00128 | 0.00124 | 45 |

| 2029 | 0.00197 | 0.00146 | 0.0012 | 65 |

| 2030 | 0.00249 | 0.00171 | 0.00129 | 94 |

BABYBNB Professional Investment Strategy and Risk Management Report

IV. BABYBNB Professional Investment Strategy and Risk Management

BABYBNB Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Community-driven investors and BNB ecosystem enthusiasts

- Operation Recommendations:

- Accumulate during market downturns when price volatility is high, particularly during bearish sentiment periods

- Set clear entry and exit targets based on support and resistance levels identified from historical price data

- Maintain secure holdings through proper asset management practices

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($12,900.38) to identify liquidity levels and confirm price movements

- Price Action Pattern Recognition: Track the recent downtrend indicators (1H: -1.014%, 24H: -0.97%, 7D: -7.97%) to identify potential reversal points

- Wave Trading Key Points:

- Identify support at the historical low price of $0.0004909 (ATL) as a potential buying opportunity

- Utilize resistance at the all-time high of $0.18032 (ATH) as a reference for profit-taking strategies

BABYBNB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total portfolio allocation

- Active Investors: 5-8% of total portfolio allocation

- Professional Investors: Up to 10% with sophisticated hedging strategies

(2) Risk Hedging Solutions

- Position Sizing Strategy: Limit individual trade size to protect against extreme volatility experienced in meme tokens

- Diversification Approach: Balance BABYBNB holdings with more established cryptocurrencies to reduce concentration risk

(3) Secure Storage Solution

- Custody Management: Utilize Gate.com's secure platform for active trading and transaction execution

- Private Key Management: For long-term holdings, implement secure offline storage practices with redundant backup systems

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all trading accounts; regularly audit wallet access logs

V. BABYBNB Potential Risks and Challenges

BABYBNB Market Risk

- Extreme Volatility: The token has experienced an 85.97% decline over the past year, demonstrating significant price fluctuations that can result in substantial losses

- Liquidity Risk: With a 24-hour trading volume of only $12,900.38 relative to a market cap of $880,400, the token faces liquidity constraints that may hinder rapid position exit

- Meme Token Sentiment Dependency: BABYBNB's value is primarily driven by community sentiment and social media trends, making it susceptible to rapid sentiment shifts

BABYBNB Regulatory Risk

- Regulatory Uncertainty: Meme tokens and community-driven projects may face increased regulatory scrutiny from global financial authorities

- Compliance Changes: Future regulations targeting BNB ecosystem projects or meme token classifications could impact market access and trading availability

- Jurisdictional Restrictions: Certain regions may restrict or prohibit trading of speculative tokens like BABYBNB

BABYBNB Technical Risk

- Smart Contract Risk: As a BEP20 token on the Binance Smart Chain, any vulnerabilities in the contract code at address 0x2d5f3b0722acd35fbb749cb936dfdd93247bbc95 could result in loss of funds

- Blockchain Dependency: Technical issues or network congestion on BSC could impact transaction execution and asset accessibility

- Contract Upgrade Risk: Future contract migrations or updates may introduce unexpected behaviors or security vulnerabilities

VI. Conclusion and Action Recommendations

BABYBNB Investment Value Assessment

BABYBNB is a community-driven meme token that represents a speculative investment opportunity rather than a fundamental value proposition. Its positioning within the BNB ecosystem provides niche appeal, but the 85.97% year-over-year decline and extreme volatility indicate significant downside risk. The token's value is entirely contingent on sustained community engagement and social momentum. Investors should view BABYBNB as a high-risk, speculative asset suitable only for those with high risk tolerance and disposable capital.

BABYBNB Investment Recommendations

✅ Beginners: Conduct thorough community research and start with minimal allocation (under 1% of portfolio) only after understanding meme token dynamics and accepting potential total loss scenarios

✅ Experienced Investors: Employ disciplined position sizing (2-3% maximum), utilize technical analysis on shorter timeframes, and maintain strict stop-loss orders to manage downside exposure

✅ Institutional Investors: Exercise extreme caution; if considering exposure, limit to research positions with formal risk documentation and diversification requirements

BABYBNB Trading Participation Methods

- Direct Purchase on Gate.com: Access BABYBNB trading pairs directly through Gate.com's trading interface for immediate market participation

- Limit Order Placement: Utilize Gate.com's advanced order types to establish entry points at predetermined price levels aligned with technical analysis

- Real-Time Market Monitoring: Track price movements, volume changes, and community sentiment through Gate.com's market data tools to time entry and exit positions effectively

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors. Never invest funds you cannot afford to lose completely. Meme tokens are particularly speculative and carry heightened risk of total capital loss.

FAQ

What is BABYBNB and how does it differ from BNB?

BABYBNB is a token within the BNB Chain ecosystem, distinct from BNB. While BNB serves as the native token for gas fees, staking, and governance, BABYBNB has carved out its own niche with different utility and purpose within the blockchain.

What are the factors that could influence BABYBNB price in 2025?

BABYBNB price in 2025 will be influenced by supply and demand dynamics, blockchain protocol updates, market sentiment, regulatory changes, and real-world adoption trends. Trading volume and investor interest also play significant roles.

Is BABYBNB a good investment for long-term holders?

BABYBNB shows strong potential for long-term investors. With growing community support and increasing adoption in the DeFi ecosystem, it offers promising returns. Early holders are well-positioned for significant gains as the project expands its market presence and utility.

What is the current market cap and total supply of BABYBNB?

The current market cap of BABYBNB is £44,955.90, with a total supply of 1,000,000,000 BABYBNB tokens in circulation.

What are the main risks and security considerations for BABYBNB?

Main risks include market volatility, regulatory scrutiny, and potential policy changes. Smart contract vulnerabilities and liquidity risks are also considerations. Investors should conduct thorough due diligence before participating.

2025 BABYBNB Price Prediction: Will This Meme Coin Reach New Heights or Face a Crypto Winter?

2025 BABYBNB Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

Is BABYBNB (BABYBNB) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is BABYBNB (BABYBNB) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability in 2024

2025 BABYBNB Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Latest Shiba Inu Price Analysis for 2025: Insights into SHIB Token Market Trends

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?