2025 A2Z Price Prediction: Expert Forecast and Market Analysis for the Upcoming Year

Introduction: Market Position and Investment Value of A2Z

Arena-Z (A2Z) is a Web3 gaming hub designed to unite players, creators, and communities through a shared, interoperable reward system. As of December 2025, A2Z has achieved a market capitalization of $13.34 million with a circulating supply of approximately 6.54 billion tokens, maintaining a price around $0.001334. This innovative gaming platform is playing an increasingly crucial role in the Web3 gaming ecosystem.

This article will provide a comprehensive analysis of A2Z's price trends through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Arena-Z (A2Z) Market Analysis Report

I. A2Z Price History Review and Current Market Status

A2Z Historical Price Movement Trajectory

- August 8, 2025: A2Z reached its all-time high of $0.01132395, marking the peak of its price performance since launch.

- December 19, 2025: A2Z touched its all-time low of $0.00127528, representing a significant decline from historical highs.

- December 22, 2025: Current period shows price consolidation at $0.001334, reflecting market stabilization after extended downward pressure.

A2Z Current Market Performance

As of December 22, 2025, Arena-Z (A2Z) is trading at $0.001334, with a 24-hour trading volume of $71,156.26. The token has experienced a 24-hour price decline of -2.19%, while showing a modest 1-hour gain of 0.3%. Over the medium to long-term horizons, the token exhibits significant downward pressure: a 7-day loss of -6.16%, a 30-day decline of -58.25%, and a substantial 1-year loss of -99.37%.

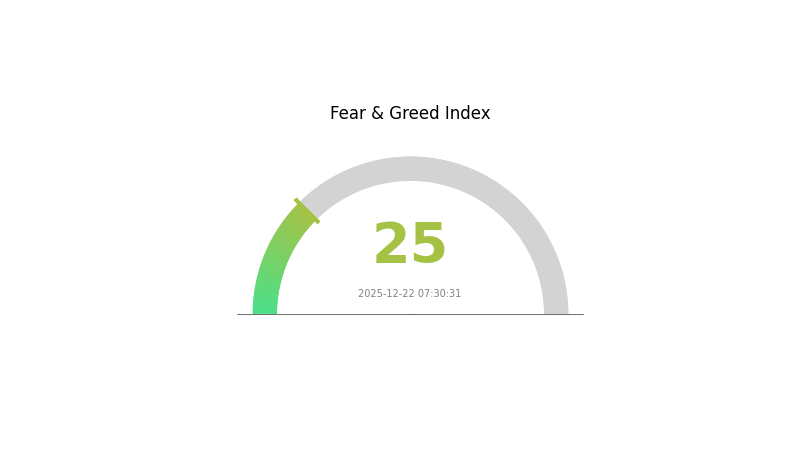

The total market capitalization stands at $13.34 million with a fully diluted valuation (FDV) of $13.34 million. The circulating supply is 6.54 billion A2Z tokens out of a maximum supply of 10 billion, representing 65.37% circulation. The token maintains a market share of 0.0041% in the overall cryptocurrency market. With 4,523 token holders and listings across 21 exchanges, A2Z maintains modest market presence. Current market sentiment indicates "Extreme Fear" with a VIX reading of 25, reflecting broader market conditions on December 22, 2025.

Click to view current A2Z market price

A2Z Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 25. This indicates significant market pessimism and heightened anxiety among investors. During such periods, market volatility tends to increase, and asset prices may face downward pressure. However, extreme fear often presents contrarian opportunities for long-term investors seeking value entry points. Traders should exercise caution and implement proper risk management strategies while monitoring market developments closely on Gate.com's market data tools.

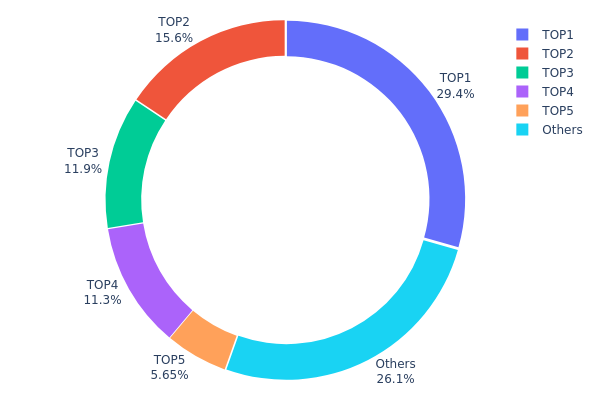

A2Z Holdings Distribution

The address holdings distribution chart illustrates the concentration of A2Z tokens across different wallet addresses on the blockchain. This metric provides crucial insights into token ownership structure, liquidity distribution, and potential market manipulation risks. By analyzing the top holders and their respective percentages of total supply, investors can assess the decentralization level and market stability of the asset.

The current holdings data reveals a notably concentrated distribution pattern. The top four addresses collectively control approximately 68.25% of the circulating supply, with the largest holder alone commanding 29.37%. This elevated concentration level indicates substantial market power concentrated in relatively few entities. The second and third largest holders maintain significant positions at 15.63% and 11.91% respectively, further reinforcing the centralized nature of current ownership. While the "Others" category accounts for 26.11% of holdings, the top five addresses still retain nearly 74% of total supply, suggesting limited decentralization at present.

Such pronounced concentration presents both structural implications and market considerations. High holder concentration typically increases price volatility potential, as large token movements from major addresses can significantly impact market dynamics. The presence of such substantial single positions raises questions regarding market participants' exposure to potential large-scale liquidations or strategic token releases. Additionally, the concentrated distribution may indicate limited retail participation relative to institutional or early-stage holders, potentially affecting market depth and liquidity resilience. The current structure suggests that price discovery mechanisms may be influenced by the actions of a small number of dominant holders, warranting continuous monitoring of major address activities for market participants seeking to understand A2Z's on-chain dynamics.

Click to view current A2Z Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 2810302.82K | 29.37% |

| 2 | 0x0c7c...2503e2 | 1495598.36K | 15.63% |

| 3 | 0x9018...600915 | 1140000.00K | 11.91% |

| 4 | 0x9e64...051d71 | 1085714.28K | 11.34% |

| 5 | 0x90d6...328d03 | 540132.15K | 5.64% |

| - | Others | 2495988.38K | 26.11% |

II. Core Factors Influencing A2Z's Future Price

Technology Development and Ecosystem Building

-

Autonomous Driving Collaboration: A2Z is partnering with Grab, a leading Southeast Asian super-app platform, to advance autonomous vehicle shuttle services and robotics solutions. This collaboration positions A2Z at the forefront of mobility innovation in the region and enhances its market competitiveness through integration with Grab's extensive user base and logistics network.

-

Market Demand and Competition: A2Z's future price trajectory is influenced by overall market demand for autonomous mobility solutions, competitive dynamics within the autonomous vehicle sector, and the company's ability to execute on technological innovations effectively. Investors should monitor the pace of technology adoption and competitive pressure from other players in the autonomous vehicle market.

Three、2025-2030 A2Z Price Forecast

2025 Outlook

- Conservative Forecast: $0.00089 - $0.00133

- Neutral Forecast: $0.00133

- Optimistic Forecast: $0.00188 (requires sustained market demand and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and gradual accumulation phase with emerging bullish momentum

- Price Range Forecast:

- 2026: $0.00112 - $0.00217 (20% upside potential)

- 2027: $0.00183 - $0.00232 (41% upside potential)

- 2028: $0.00149 - $0.00305 (57% upside potential)

- Key Catalysts: Increased adoption metrics, platform utility expansion, and favorable regulatory environment

2029-2030 Long-term Outlook

- Base Case: $0.00219 - $0.00288 (93% upside potential by 2029, assuming steady ecosystem development)

- Optimistic Case: $0.00224 - $0.00349 (104% upside potential by 2030, assuming accelerated mainstream adoption)

- Transformative Case: $0.00349+ (assuming breakthrough technological innovations and institutional participation surge)

- 2030-12-22: A2Z trading at elevated levels (reflecting multi-year accumulation and ecosystem maturation)

Analysis Note: The forecast trajectory demonstrates consistent upward momentum across the six-year period, with cumulative gains potentially reaching 104% by 2030. Price volatility is expected to moderate as the asset matures within its ecosystem.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00188 | 0.00133 | 0.00089 | 0 |

| 2026 | 0.00217 | 0.0016 | 0.00112 | 20 |

| 2027 | 0.00232 | 0.00188 | 0.00183 | 41 |

| 2028 | 0.00305 | 0.0021 | 0.00149 | 57 |

| 2029 | 0.00288 | 0.00257 | 0.00219 | 93 |

| 2030 | 0.00349 | 0.00273 | 0.00224 | 104 |

Arena-Z (A2Z) Investment Strategy and Risk Management Report

IV. A2Z Professional Investment Strategy and Risk Management

A2Z Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Web3 gaming enthusiasts and community-focused investors with medium to long-term investment horizons

- Operational recommendations:

- Accumulate during market downturns to build positions at lower valuations

- Participate actively in Arena-Z ecosystem rewards and community initiatives to maximize token utility

- Hold through market cycles to benefit from potential ecosystem growth and adoption

(2) Active Trading Strategy

- Technical analysis tools:

- Price action analysis: Monitor support and resistance levels across 1-hour, 4-hour, and daily timeframes to identify entry and exit points

- Volume analysis: Track 24-hour trading volume trends to confirm price movements and identify potential reversals

- Wave trading key points:

- Current price volatility (24H: -2.19%, 7D: -6.16%) suggests multiple trading opportunities within established support/resistance bands

- Monitor the resistance level at $0.001373 (24H high) and support at $0.001295 (24H low) for tactical entries

A2Z Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Active investors: 3-7% of crypto portfolio

- Professional investors: Up to 10% with strict stop-loss protocols

(2) Risk Hedging Solutions

- Dollar-cost averaging (DCA): Invest fixed amounts at regular intervals to reduce timing risk and smooth entry prices across different market conditions

- Position sizing discipline: Never allocate more than your predefined risk tolerance per position to maintain portfolio stability

(3) Secure Storage Solutions

- Non-custodial wallet recommended: Gate Web3 Wallet for secure self-custody with easy access to trading and reward mechanisms

- Smart contract interaction: Ensure all wallet interactions with Arena-Z smart contracts on Ethereum are verified before executing transactions

- Security best practices: Keep private keys offline, enable multi-signature verification where possible, and regularly audit wallet permissions

V. A2Z Potential Risks and Challenges

A2Z Market Risk

- Extreme volatility exposure: A2Z has experienced a -99.37% decline over 1 year, indicating severe price instability and potential liquidity challenges during downturns

- Low trading volume: Daily volume of $71,156 USD suggests limited liquidity, which may result in slippage on larger orders and price manipulation risks

- Market concentration: With only 4,523 holders and 65.37% of max supply in circulation, token distribution remains highly concentrated, creating pump-and-dump vulnerability

A2Z Regulatory Risk

- Evolving gaming regulation: Web3 gaming platforms face increasing scrutiny from regulators regarding gambling mechanics, user protection, and compliance with regional laws

- Reward system compliance: The interoperable reward mechanism may face legal challenges regarding securities classification in certain jurisdictions

- Cross-border restrictions: Arena-Z may encounter operational restrictions or account limitations for users in regulated markets

A2Z Technology Risk

- Smart contract vulnerabilities: As an Ethereum-based token, security audits and contract upgrade mechanisms are critical; undisclosed vulnerabilities could result in significant losses

- Scalability concerns: Ethereum network congestion may impact transaction speeds and increase gas fees, affecting reward distribution and user experience

- Ecosystem dependency: Platform success relies on sustained developer activity, game integration partnerships, and community participation maintenance

VI. Conclusion and Action Recommendations

A2Z Investment Value Assessment

Arena-Z presents a specialized investment opportunity within the Web3 gaming sector, positioning itself as an interoperable reward platform connecting players, creators, and communities. However, the extreme price decline (-99.37% YoY), minimal trading liquidity ($71k daily volume), and concentrated token distribution present significant concerns. The project's value proposition depends critically on successful ecosystem expansion, sustained community engagement, and regulatory navigation. Current market conditions reflect substantial uncertainty about the platform's ability to achieve mainstream adoption.

A2Z Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto holdings) as a speculative position; focus on understanding Arena-Z's ecosystem and community participation before increasing exposure ✅ Experienced investors: Implement systematic DCA strategies during high volatility periods; actively monitor ecosystem developments, partnership announcements, and technical fundamentals ✅ Institutional investors: Conduct comprehensive due diligence on smart contract security, token economics, and regulatory compliance; consider allocation only after establishing clear risk parameters and exit strategies

A2Z Trading Participation Methods

- Spot trading on Gate.com: Access A2Z trading pairs directly on Gate.com's platform with competitive spreads and liquidity

- Ecosystem participation: Engage with Arena-Z games and reward systems to accumulate tokens through platform activities rather than pure trading

- Strategic accumulation: Use market weakness during downturns to build positions at reduced valuations while maintaining strict portfolio allocation limits

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and personal financial situation before making investment decisions. It is strongly recommended to consult with professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is A2Z crypto coin?

A2Z, or Arena-Z, is a cryptocurrency launched in 2025 operating on the Ethereum platform. It features a current supply of 9,327,712,374.15976688 tokens designed for decentralized applications and blockchain transactions.

What is the historical price performance of A2Z coin?

A2Z coin reached an all-time high of $0.01132395 on August 7, 2025. Currently, the price fluctuates between $0.00135317 and $0.00137889 in 24-hour trading range.

What are the key factors that could influence A2Z price in the future?

A2Z price will be influenced by adoption rates, market demand, cryptocurrency market trends, regulatory changes, and technological advancements. Trading volume and user base growth are also critical factors.

What are the risks associated with A2Z price prediction and investment?

A2Z price prediction involves market volatility, regulatory changes, and investor sentiment shifts. Post-rebrand liquidity remains thin, increasing price instability. Bitcoin dominance fluctuations and regulatory developments further impact investment outcomes.

2025 MAVIA Price Prediction: Expert Analysis and Future Market Outlook for the Decentralized Gaming Token

NXPC Price Trends and Web3 Application Analysis in 2025

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

Is Gomble (GM) a good investment?: Analyzing the automaker's financial performance and future prospects

How to Start Micro Trading with Just $1: A Guide for Beginners

Exploring the Features and Advantages of BNB Smart Chain

What is ADP: A Comprehensive Guide to Automated Data Processing Systems

What is READY: A Comprehensive Guide to Understanding the Framework for Excellence and Development

Understanding Replay Attacks in the Cryptocurrency World