CyberpunkDanny

Ainda sem conteúdo

CyberpunkDanny

Bom dia CT 🌅

Sentindo-me agridoce ao olhar para estas telas vermelhas e liquidações sem fim.

Se a minha carteira fosse mais profunda, eu estaria a fazer degen total: comprar o medo, aproveitar tudo enquanto o mercado sangra. Paciência compensa. HODL ou apostar tudo.

confortavelmente entorpecido

Olá

Há alguém aí?

Só acene se me consegue ouvir

Há alguém em casa?

Vamos lá agora

Ouço que estás a sentir-te para baixo

Bem, posso aliviar a tua dor

Colocar-te de pé novamente

Relaxa

Vou precisar de algumas informações primeiro

Apenas os factos básicos

Consegues mostrar-me onde dói?

Ver originalSentindo-me agridoce ao olhar para estas telas vermelhas e liquidações sem fim.

Se a minha carteira fosse mais profunda, eu estaria a fazer degen total: comprar o medo, aproveitar tudo enquanto o mercado sangra. Paciência compensa. HODL ou apostar tudo.

confortavelmente entorpecido

Olá

Há alguém aí?

Só acene se me consegue ouvir

Há alguém em casa?

Vamos lá agora

Ouço que estás a sentir-te para baixo

Bem, posso aliviar a tua dor

Colocar-te de pé novamente

Relaxa

Vou precisar de algumas informações primeiro

Apenas os factos básicos

Consegues mostrar-me onde dói?

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

GE CT 📉🩸

Ainda há alguém vivo por aí?

Este gráfico parece ter sido co-dirigido por Tarantino e Lynch: reviravoltas surreais estranhas, violência súbita, poças de vermelho, puro combustível de pesadelo… mas misturado com uma excitação elétrica.

Sobreviventes, mostrem 🫀 abaixo.

Ver originalAinda há alguém vivo por aí?

Este gráfico parece ter sido co-dirigido por Tarantino e Lynch: reviravoltas surreais estranhas, violência súbita, poças de vermelho, puro combustível de pesadelo… mas misturado com uma excitação elétrica.

Sobreviventes, mostrem 🫀 abaixo.

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Shhh… o segredo está à vista de todos:

Compre quando estiver a sangrar vermelho, venda quando estiver a brilhar verde. 🔥

Deixe o dinheiro trabalhar por si, em vez de trabalhar pelo dinheiro.

Parece sedutoramente simples e lucrativo.

…Certo? O que poderia correr mal? 😏

Ver originalCompre quando estiver a sangrar vermelho, venda quando estiver a brilhar verde. 🔥

Deixe o dinheiro trabalhar por si, em vez de trabalhar pelo dinheiro.

Parece sedutoramente simples e lucrativo.

…Certo? O que poderia correr mal? 😏

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

$BTC

Li sobre BTC e descobri que o Bitcoin tem estado preso numa tendência de baixa persistente desde meados de janeiro de 2025. Os preços têm caído dos máximos recentes, com uma pressão de venda renovada a atingir duramente o mercado. Neste momento, no final de janeiro de 2026, o BTC está a oscilar entre $88.000 e $89.000 (preços à vista recentemente perto de $89.000–$89.100, com algumas sessões a descerem para $86.000–$87.000 durante o fim de semana—o valor mais baixo que vimos este ano).

Um grande fator por trás desta fraqueza parece estar ligado a mudanças geopolíticas e macroeconómicas.

Li sobre BTC e descobri que o Bitcoin tem estado preso numa tendência de baixa persistente desde meados de janeiro de 2025. Os preços têm caído dos máximos recentes, com uma pressão de venda renovada a atingir duramente o mercado. Neste momento, no final de janeiro de 2026, o BTC está a oscilar entre $88.000 e $89.000 (preços à vista recentemente perto de $89.000–$89.100, com algumas sessões a descerem para $86.000–$87.000 durante o fim de semana—o valor mais baixo que vimos este ano).

Um grande fator por trás desta fraqueza parece estar ligado a mudanças geopolíticas e macroeconómicas.

BTC-3,21%

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

O mercado de criptomoedas sofreu uma forte queda hoje, 26 de janeiro de 2026, apelidada de "Segunda-feira Vermelha" pelos traders, à medida que o sentimento de aversão ao risco dominou.

A capitalização global do mercado de criptomoedas caiu brevemente abaixo da marca de $3 trilhão, devido a preocupações macroeconómicas e geopolíticas renovadas que assustaram os investidores. Desde então, recuperou-se ligeiramente para cerca de $3,05 trilhões.

Os principais fatores incluíram o medo de uma potencial escalada da guerra comercial entre os EUA e o Canadá—provocada por ameaças tarifárias recentes do

Ver originalA capitalização global do mercado de criptomoedas caiu brevemente abaixo da marca de $3 trilhão, devido a preocupações macroeconómicas e geopolíticas renovadas que assustaram os investidores. Desde então, recuperou-se ligeiramente para cerca de $3,05 trilhões.

Os principais fatores incluíram o medo de uma potencial escalada da guerra comercial entre os EUA e o Canadá—provocada por ameaças tarifárias recentes do

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

$BTC

O Bitcoin quebrou decisivamente abaixo do nível de suporte crítico de $90k , sinalizando uma renovada fraqueza no mercado de criptomoedas à medida que o interesse institucional esfria e os ventos macroeconômicos se intensificam.

Após um período de consolidação em torno do marco psicologicamente importante de $32 , o BTC não conseguiu manter a linha diante de uma pressão de venda crescente. A queda ocorre enquanto os investidores digerem saídas persistentes de ETFs de Bitcoin à vista e se preparam para decisões importantes do banco central que podem pressionar ainda mais os ativos de risc

O Bitcoin quebrou decisivamente abaixo do nível de suporte crítico de $90k , sinalizando uma renovada fraqueza no mercado de criptomoedas à medida que o interesse institucional esfria e os ventos macroeconômicos se intensificam.

Após um período de consolidação em torno do marco psicologicamente importante de $32 , o BTC não conseguiu manter a linha diante de uma pressão de venda crescente. A queda ocorre enquanto os investidores digerem saídas persistentes de ETFs de Bitcoin à vista e se preparam para decisões importantes do banco central que podem pressionar ainda mais os ativos de risc

BTC-3,21%

- Recompensa

- 2

- 1

- Republicar

- Partilhar

Após investigar os últimos anúncios e atualizações sobre esta iniciativa, aqui está o que me destaca a partir de meados de janeiro de 2026:

Os principais bancos europeus estão claramente fartos do domínio quase total das stablecoins lastreadas em dólar no setor de cripto e pagamentos digitais. Reuniram-se para formar algo chamado Qivalis, uma empresa sediada em Amsterdã especificamente criada para emitir uma stablecoin regulamentada e adequada, lastreada no euro.

Os bancos por trás desta iniciativa atualmente são ING, BNP Paribas, UniCredit, CaixaBank, Danske Bank, SEB, KBC, DekaBank, Banca Se

Os principais bancos europeus estão claramente fartos do domínio quase total das stablecoins lastreadas em dólar no setor de cripto e pagamentos digitais. Reuniram-se para formar algo chamado Qivalis, uma empresa sediada em Amsterdã especificamente criada para emitir uma stablecoin regulamentada e adequada, lastreada no euro.

Os bancos por trás desta iniciativa atualmente são ING, BNP Paribas, UniCredit, CaixaBank, Danske Bank, SEB, KBC, DekaBank, Banca Se

Ver original

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

CZ Lança Bombas: 'A Temporada de Altcoins é Inevitalável' 🔥 – Estamos Prontos para o Boom das Altcoins?

No mundo sempre volátil das criptomoedas, poucas vozes têm tanto peso quanto a de Changpeng Zhao, mais conhecido como CZ, fundador e ex-CEO da Binance. Recentemente, durante uma animada sessão de perguntas e respostas no Binance Square em chinês, CZ lançou uma bomba otimista que está a fazer a comunidade cripto vibrar: "A temporada de altcoins é inevitável." Esta afirmação não é apenas hype—é um reconhecimento da natureza cíclica dos mercados que traders experientes vivem por. Mas, com o Bi

Ver originalNo mundo sempre volátil das criptomoedas, poucas vozes têm tanto peso quanto a de Changpeng Zhao, mais conhecido como CZ, fundador e ex-CEO da Binance. Recentemente, durante uma animada sessão de perguntas e respostas no Binance Square em chinês, CZ lançou uma bomba otimista que está a fazer a comunidade cripto vibrar: "A temporada de altcoins é inevitável." Esta afirmação não é apenas hype—é um reconhecimento da natureza cíclica dos mercados que traders experientes vivem por. Mas, com o Bi

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

CZ Lança Bombas: 'A Temporada de Altcoins é Inevitalável' 🔥 – Estamos Prontos para o Boom das Altcoins?

No mundo sempre volátil das criptomoedas, poucas vozes têm tanto peso quanto a de Changpeng Zhao, mais conhecido como CZ, fundador e ex-CEO da Binance. Recentemente, durante uma animada sessão de perguntas e respostas no Binance Square em chinês, CZ lançou uma bomba otimista que está a fazer a comunidade cripto vibrar: "A temporada de altcoins é inevitável." Esta afirmação não é apenas hype—é um reconhecimento da natureza cíclica dos mercados que traders experientes vivem por. Mas, com o Bi

Ver originalNo mundo sempre volátil das criptomoedas, poucas vozes têm tanto peso quanto a de Changpeng Zhao, mais conhecido como CZ, fundador e ex-CEO da Binance. Recentemente, durante uma animada sessão de perguntas e respostas no Binance Square em chinês, CZ lançou uma bomba otimista que está a fazer a comunidade cripto vibrar: "A temporada de altcoins é inevitável." Esta afirmação não é apenas hype—é um reconhecimento da natureza cíclica dos mercados que traders experientes vivem por. Mas, com o Bi

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

Ripple Cria um “Kit de Wall Street” para Adoção Institucional de XRP: Hype ou Realidade?

Em 14 de janeiro de 2026, o engenheiro de software Vincent Van Code afirmou que a Ripple montou silenciosamente um “kit de Wall Street” completo para atrair grandes instituições para o XRP. A pilha inclui Ripple Payments, GTreasury, Ripple Prime e custódia de XRP de grau institucional.

Destinado a pensões, bancos, fundos de hedge e empresas, oferece custódia regulada, gestão de tesouraria, serviços de corretagem prime, liquidação rápida na (XRPL), e apoio do stablecoin RLUSD da Ripple — com reservas mantid

Em 14 de janeiro de 2026, o engenheiro de software Vincent Van Code afirmou que a Ripple montou silenciosamente um “kit de Wall Street” completo para atrair grandes instituições para o XRP. A pilha inclui Ripple Payments, GTreasury, Ripple Prime e custódia de XRP de grau institucional.

Destinado a pensões, bancos, fundos de hedge e empresas, oferece custódia regulada, gestão de tesouraria, serviços de corretagem prime, liquidação rápida na (XRPL), e apoio do stablecoin RLUSD da Ripple — com reservas mantid

XRP-5,01%

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

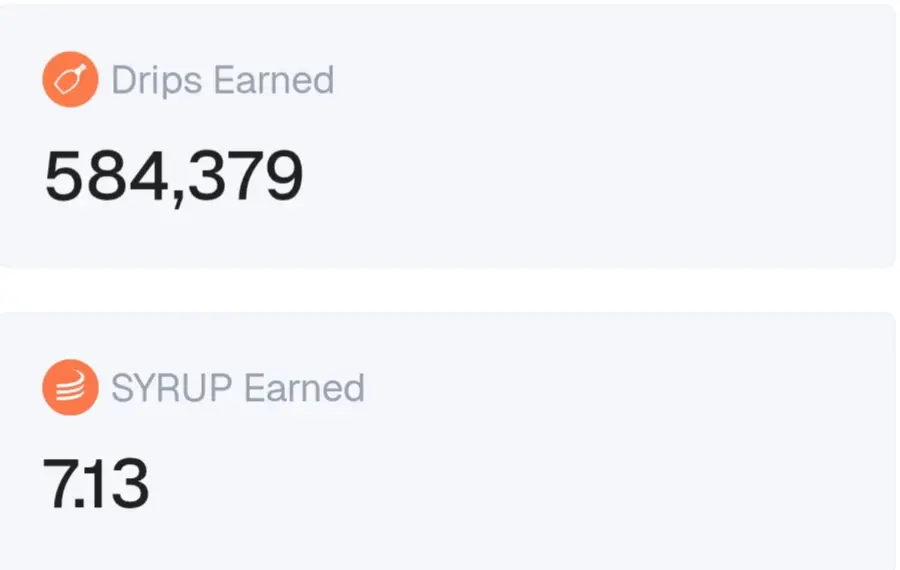

Conquistas fantásticas. Os números estão a disparar parabólica.

Maple = equivalente a notícias otimistas. 🥞 📈

Domínio silencioso no crédito onchain.

Outro bilhão em empréstimos: o valor total das originações da Maple ultrapassou $17 bilhões.

O modelo de empréstimo com colateralização excessiva continua a impulsionar rendimentos sustentáveis de syrupUSDC e syrupUSDT.

Ver originalMaple = equivalente a notícias otimistas. 🥞 📈

Domínio silencioso no crédito onchain.

Outro bilhão em empréstimos: o valor total das originações da Maple ultrapassou $17 bilhões.

O modelo de empréstimo com colateralização excessiva continua a impulsionar rendimentos sustentáveis de syrupUSDC e syrupUSDT.

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

Ethereum's Recent Breakout

Em meados de janeiro de 2026, o Ethereum (ETH) apresenta sinais promissores após um período difícil. O preço saiu de um canal de tendência descendente que o mantinha preso há semanas. Importante, o antigo nível de resistência em torno de $3.000 agora virou suporte – o que significa que o preço tende a rebotar para cima em vez de cair ao tocar essa área.

Neste momento, o ETH está a negociar entre $3.100 e $3.115 e a consolidar-se pouco abaixo da próxima zona de resistência difícil de $3.300–$3.500.

O Quadro Técnico

Durante meses, o Ethereum esteve preso num padrão de

Em meados de janeiro de 2026, o Ethereum (ETH) apresenta sinais promissores após um período difícil. O preço saiu de um canal de tendência descendente que o mantinha preso há semanas. Importante, o antigo nível de resistência em torno de $3.000 agora virou suporte – o que significa que o preço tende a rebotar para cima em vez de cair ao tocar essa área.

Neste momento, o ETH está a negociar entre $3.100 e $3.115 e a consolidar-se pouco abaixo da próxima zona de resistência difícil de $3.300–$3.500.

O Quadro Técnico

Durante meses, o Ethereum esteve preso num padrão de

ETH-4,59%

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

CZ Está certo? O Fim do Ciclo de 4 Anos do Bitcoin e o Amanhecer de um Superciclo?

O famoso ciclo de 4 anos do Bitcoin tem sido um dos padrões mais confiáveis na história das criptomoedas. A cada quatro anos, aproximadamente coincidente com o evento de halving que reduz pela metade as recompensas de mineração, o Bitcoin experimentou enormes altas seguidas de correções acentuadas. Vimos picos explosivos em 2013, 2017 e 2021, cada um seguido de quedas de 70–85%. O mecanismo era simples: oferta nova reduzida encontrava demanda crescente, criando rallies impulsionados pela escassez.

Mas muitos ago

Ver originalO famoso ciclo de 4 anos do Bitcoin tem sido um dos padrões mais confiáveis na história das criptomoedas. A cada quatro anos, aproximadamente coincidente com o evento de halving que reduz pela metade as recompensas de mineração, o Bitcoin experimentou enormes altas seguidas de correções acentuadas. Vimos picos explosivos em 2013, 2017 e 2021, cada um seguido de quedas de 70–85%. O mecanismo era simples: oferta nova reduzida encontrava demanda crescente, criando rallies impulsionados pela escassez.

Mas muitos ago

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

A Impulso do ETF de Bitcoin da Morgan Stanley Sinaliza "Ainda Estamos No Começo" em Meio a Fluxos Diários Mistas

Numa semana marcada pelo pedido da Morgan Stanley para o seu próprio ETF de Bitcoin à vista com marca própria, o conselheiro da Bitwise Jeff Park destacou a movimentação como um dos desenvolvimentos mais otimistas para o Bitcoin até agora. Falando na quarta-feira, Park delineou três razões principais pelas quais a decisão do gigante de Wall Street reforça a sua perspetiva otimista.

Primeiro, isso significa que o mercado é muito maior do que o esperado — mesmo duas anos após a onda i

Ver originalNuma semana marcada pelo pedido da Morgan Stanley para o seu próprio ETF de Bitcoin à vista com marca própria, o conselheiro da Bitwise Jeff Park destacou a movimentação como um dos desenvolvimentos mais otimistas para o Bitcoin até agora. Falando na quarta-feira, Park delineou três razões principais pelas quais a decisão do gigante de Wall Street reforça a sua perspetiva otimista.

Primeiro, isso significa que o mercado é muito maior do que o esperado — mesmo duas anos após a onda i

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

A partir de 7 de janeiro de 2026, o Ethereum (ETH) negocia-se a aproximadamente $3.250–$3.270 USD.

Alcançar os $4.000 este mês exigiria um aumento de cerca de 22–23% em relação aos níveis atuais nas restantes ~3 semanas de janeiro.

Contexto Atual do Mercado

O ETH mostrou ganhos modestos no início de 2026, recuperando de uma consolidação no final de 2025.

Os ETFs de Ethereum à vista tiveram entradas significativas nos primeiros dias de negociação de janeiro (, por exemplo, ~$174 milhões apenas em 2 de janeiro, parte de fluxos mais amplos de ETFs de criptomoedas que excederam $600–670 milhões c

Ver originalAlcançar os $4.000 este mês exigiria um aumento de cerca de 22–23% em relação aos níveis atuais nas restantes ~3 semanas de janeiro.

Contexto Atual do Mercado

O ETH mostrou ganhos modestos no início de 2026, recuperando de uma consolidação no final de 2025.

Os ETFs de Ethereum à vista tiveram entradas significativas nos primeiros dias de negociação de janeiro (, por exemplo, ~$174 milhões apenas em 2 de janeiro, parte de fluxos mais amplos de ETFs de criptomoedas que excederam $600–670 milhões c

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

Surto Bullish do BNB: Ganhos de Preço e a Impending Fermi Hard Fork Impulsionam Interesse dos Investidores

Binance Coin (BNB), a criptomoeda nativa do ecossistema BNB Chain, continua a consolidar a sua posição como um ator-chave no espaço de finanças descentralizadas (DeFi) e blockchain. Originalmente lançada pela exchange Binance em 2017, a BNB evoluiu de um token utilitário para descontos em taxas de negociação para um pilar de uma das blockchains mais ativas do mundo. Com foco em alta capacidade de processamento, taxas baixas e interoperabilidade, a BNB Chain suporta uma vasta gama de aplic

Ver originalBinance Coin (BNB), a criptomoeda nativa do ecossistema BNB Chain, continua a consolidar a sua posição como um ator-chave no espaço de finanças descentralizadas (DeFi) e blockchain. Originalmente lançada pela exchange Binance em 2017, a BNB evoluiu de um token utilitário para descontos em taxas de negociação para um pilar de uma das blockchains mais ativas do mundo. Com foco em alta capacidade de processamento, taxas baixas e interoperabilidade, a BNB Chain suporta uma vasta gama de aplic

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

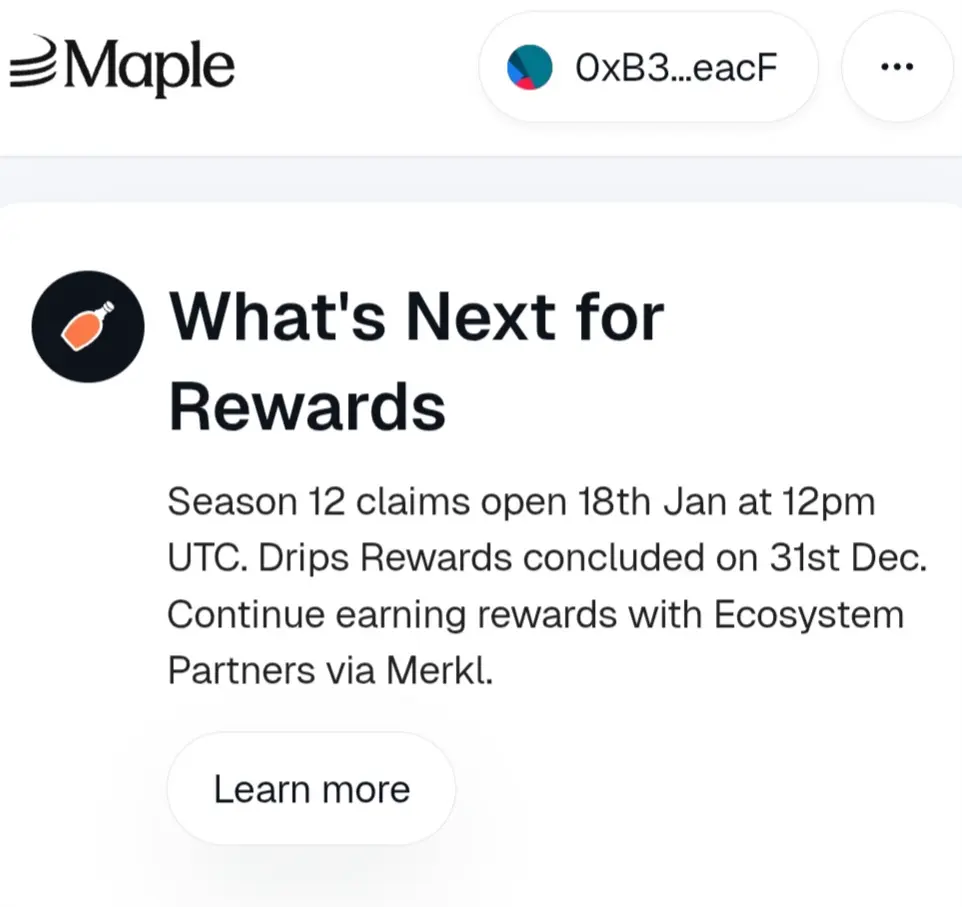

Maple Finance Elimina Recompensas Drips

Transição para Incentivos de Parceiros via Merkl

A Maple Finance, a plataforma on-chain que conecta os mercados de crédito institucional com DeFi através de produtos como syrupUSDC e syrupUSDT, encerrou oficialmente o seu popular programa de recompensas Drips. Isto marca uma mudança na forma como os utilizadores ganham incentivos dentro do ecossistema.

Introduzido juntamente com o token SYRUP, o Drips era um sistema inovador de recompensas baseado em pontos, desenhado para impulsionar a adoção inicial. Os utilizadores ganhavam Drips ao depositar em pools

Ver originalTransição para Incentivos de Parceiros via Merkl

A Maple Finance, a plataforma on-chain que conecta os mercados de crédito institucional com DeFi através de produtos como syrupUSDC e syrupUSDT, encerrou oficialmente o seu popular programa de recompensas Drips. Isto marca uma mudança na forma como os utilizadores ganham incentivos dentro do ecossistema.

Introduzido juntamente com o token SYRUP, o Drips era um sistema inovador de recompensas baseado em pontos, desenhado para impulsionar a adoção inicial. Os utilizadores ganhavam Drips ao depositar em pools

- Recompensa

- 2

- 3

- Republicar

- Partilhar

Doraemon15 :

:

Rush de 2026 👊Ver mais

A Minha Jornada com Crypto Warehouse: De Espectador a Embaixador, e as Minhas Resoluções para 2026

Como entusiasta de criptomoedas com o handle @RadovanTheIII, tenho estado sempre à procura de vozes autênticas no mundo frequentemente avassalador de blockchain e ativos digitais. Há alguns anos, descobri @GibCryptoNews e as suas transmissões ao vivo envolventes no YouTube (@cryptowarehouse), GateIO, Binance. O que começou como uma visualização casual rapidamente se transformou numa participação profunda, levando-me a tornar-me embaixador desta comunidade incrível. À medida que encerramos 2025, q

Ver originalComo entusiasta de criptomoedas com o handle @RadovanTheIII, tenho estado sempre à procura de vozes autênticas no mundo frequentemente avassalador de blockchain e ativos digitais. Há alguns anos, descobri @GibCryptoNews e as suas transmissões ao vivo envolventes no YouTube (@cryptowarehouse), GateIO, Binance. O que começou como uma visualização casual rapidamente se transformou numa participação profunda, levando-me a tornar-me embaixador desta comunidade incrível. À medida que encerramos 2025, q

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

Regras de Criptomoedas na Rússia: Um Pequeno Passo para a Pessoa Comum

O Banco Central da Rússia acaba de propor uma mudança importante na política de criptomoedas, abrindo—ligeiramente—a porta para que cidadãos comuns invistam em ativos digitais como o Bitcoin. Este quadro, submetido ao governo em 23 de dezembro de 2025, visa regular o comércio de criptomoedas começando potencialmente até julho de 2026.

O que Isto Significa para o Cidadão Russo Comum (Investidores Não Qualificados)

Se você é uma pessoa comum sem riqueza significativa ou credenciais financeiras—classificada como um "investidor

Ver originalO Banco Central da Rússia acaba de propor uma mudança importante na política de criptomoedas, abrindo—ligeiramente—a porta para que cidadãos comuns invistam em ativos digitais como o Bitcoin. Este quadro, submetido ao governo em 23 de dezembro de 2025, visa regular o comércio de criptomoedas começando potencialmente até julho de 2026.

O que Isto Significa para o Cidadão Russo Comum (Investidores Não Qualificados)

Se você é uma pessoa comum sem riqueza significativa ou credenciais financeiras—classificada como um "investidor

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

Tópicos em destaque

Ver mais222.32K Popularidade

30.87K Popularidade

16.7K Popularidade

14.37K Popularidade

7.22K Popularidade

Fixar