Bit_Bull

Percayalah pada sesuatu

Bit_Bull

Dominasi Bitcoin tampaknya sedang dalam fase distribusi.

Tanda baik untuk altcoin.

Tanda baik untuk altcoin.

BTC-1,36%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

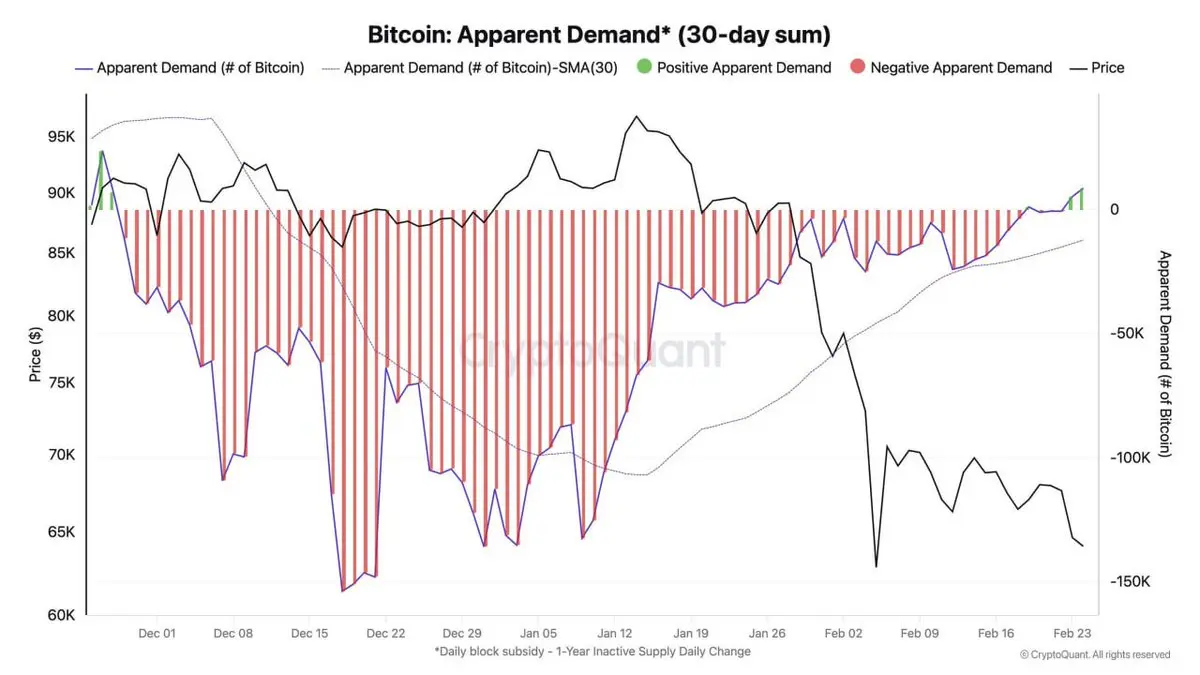

ETF Bitcoin telah mempercepat pembeliannya lagi.

Dalam waktu hanya 3 hari, ETF telah membeli lebih dari $1 miliar BTC, terutama didorong oleh ETF BlackRock.

Selama periode ini, BTC telah menguat lebih dari 10% dan sekarang bertahan dengan baik.

Dalam waktu hanya 3 hari, ETF telah membeli lebih dari $1 miliar BTC, terutama didorong oleh ETF BlackRock.

Selama periode ini, BTC telah menguat lebih dari 10% dan sekarang bertahan dengan baik.

BTC-1,36%

- Hadiah

- 3

- Komentar

- Posting ulang

- Bagikan

RSI mingguan Bitcoin kemungkinan besar telah mencapai titik terendah.

Tapi harga belum mencapai titik terendah.

Saya kira sama seperti tahun 2022, BTC akan membuat titik terendah yang lebih rendah sementara RSI akan membuat titik terendah yang lebih tinggi.

Ini akan membentuk divergensi bullish mingguan, yang telah menjadi indikator titik terendah yang sempurna.

Tapi harga belum mencapai titik terendah.

Saya kira sama seperti tahun 2022, BTC akan membuat titik terendah yang lebih rendah sementara RSI akan membuat titik terendah yang lebih tinggi.

Ini akan membentuk divergensi bullish mingguan, yang telah menjadi indikator titik terendah yang sempurna.

BTC-1,36%

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

Kult apa yang terkait dengan angka 10?

$10B pendapatan.

Kejatuhan 10 Mei.

Kehancuran 10 Oktober.

Dumps pukul 10 pagi.

Jane street pasti mengikuti suatu kultus dan saya benar-benar ingin bergabung dengan itu.

Lihat Asli$10B pendapatan.

Kejatuhan 10 Mei.

Kehancuran 10 Oktober.

Dumps pukul 10 pagi.

Jane street pasti mengikuti suatu kultus dan saya benar-benar ingin bergabung dengan itu.

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

Kult apa yang terkait dengan angka 10?

$10B pendapatan.

Kejatuhan 10 Mei.

Kehancuran 10 Oktober.

Dumps pukul 10 pagi.

Jane street pasti mengikuti suatu kultus dan saya benar-benar ingin bergabung dengan itu.

Lihat Asli$10B pendapatan.

Kejatuhan 10 Mei.

Kehancuran 10 Oktober.

Dumps pukul 10 pagi.

Jane street pasti mengikuti suatu kultus dan saya benar-benar ingin bergabung dengan itu.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

ETH di Persimpangan Jalan: Likuiditas, Leverage, dan Pertempuran Long-Short yang Sebenarnya

ETH sedang berada di salah satu zona langka di mana pasar terbagi hampir secara merata antara optimisme dan kehati-hatian. Itulah mengapa pertempuran long-short saat ini begitu menarik — ini bukan hanya tentang arah harga, tetapi tentang posisi, likuiditas, dan kelompok trader mana yang tidak sejalan dengan kenyataan.

Di satu sisi, paus tampaknya mengurangi eksposur. Di sisi lain, alamat akumulasi dilaporkan menambahkan sekitar **2,5 juta ETH selama Februari**. Sekilas, sinyal-sinyal ini tampak kontradi

ETH sedang berada di salah satu zona langka di mana pasar terbagi hampir secara merata antara optimisme dan kehati-hatian. Itulah mengapa pertempuran long-short saat ini begitu menarik — ini bukan hanya tentang arah harga, tetapi tentang posisi, likuiditas, dan kelompok trader mana yang tidak sejalan dengan kenyataan.

Di satu sisi, paus tampaknya mengurangi eksposur. Di sisi lain, alamat akumulasi dilaporkan menambahkan sekitar **2,5 juta ETH selama Februari**. Sekilas, sinyal-sinyal ini tampak kontradi

ETH-3,49%

- Hadiah

- 4

- 1

- Posting ulang

- Bagikan

SYEDA :

:

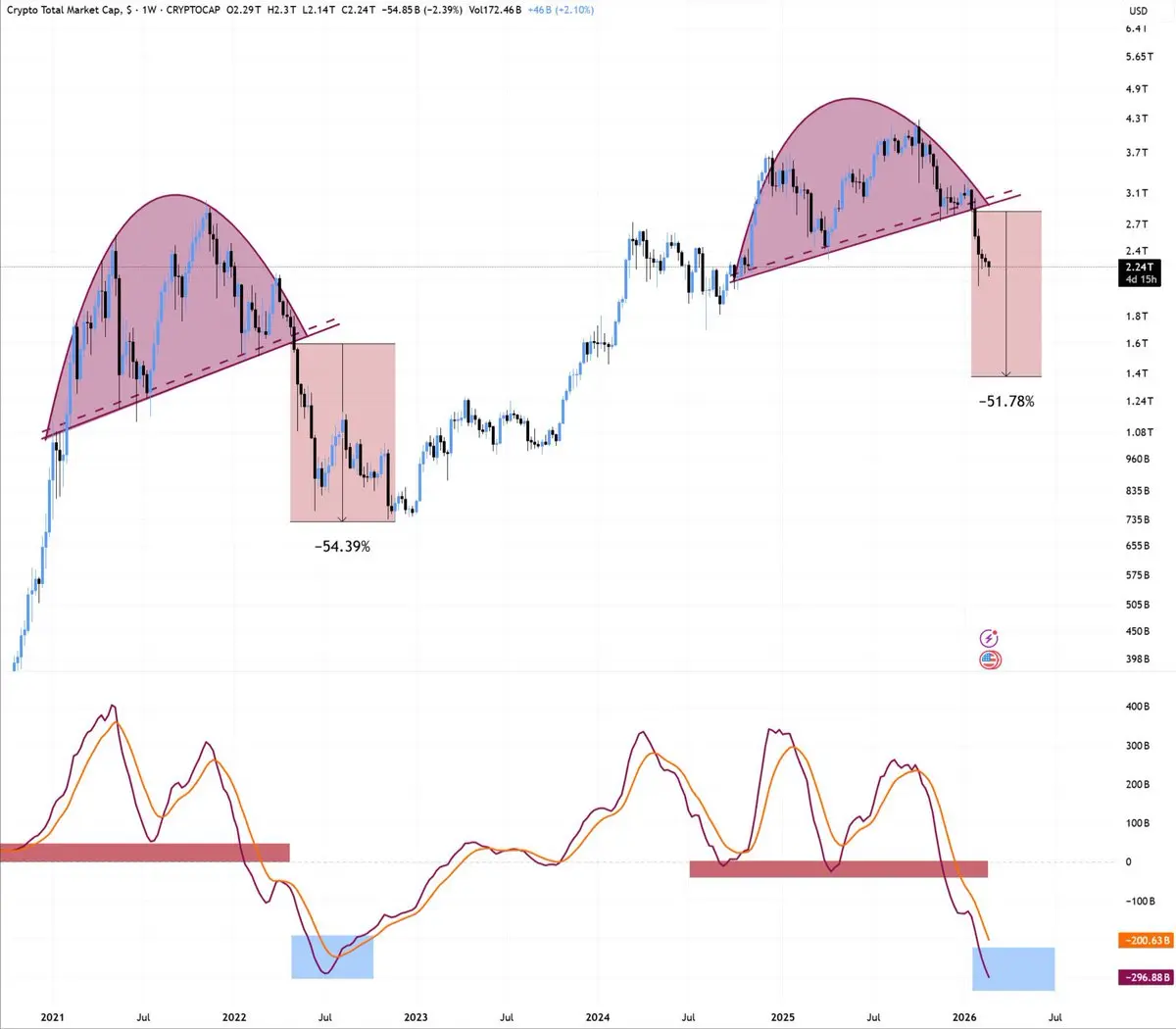

1000x VIbes 🤑Crypto MCap masih belum mencapai titik terendah.

Lihat saja fraktal dari tahun 2022, dan Anda akan menyadari kesamaannya.

Lihat AsliLihat saja fraktal dari tahun 2022, dan Anda akan menyadari kesamaannya.

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

Crypto MCap masih belum mencapai titik terendah.

Lihat saja fraktal dari tahun 2022, dan Anda akan menyadari kesamaannya.

Lihat AsliLihat saja fraktal dari tahun 2022, dan Anda akan menyadari kesamaannya.

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

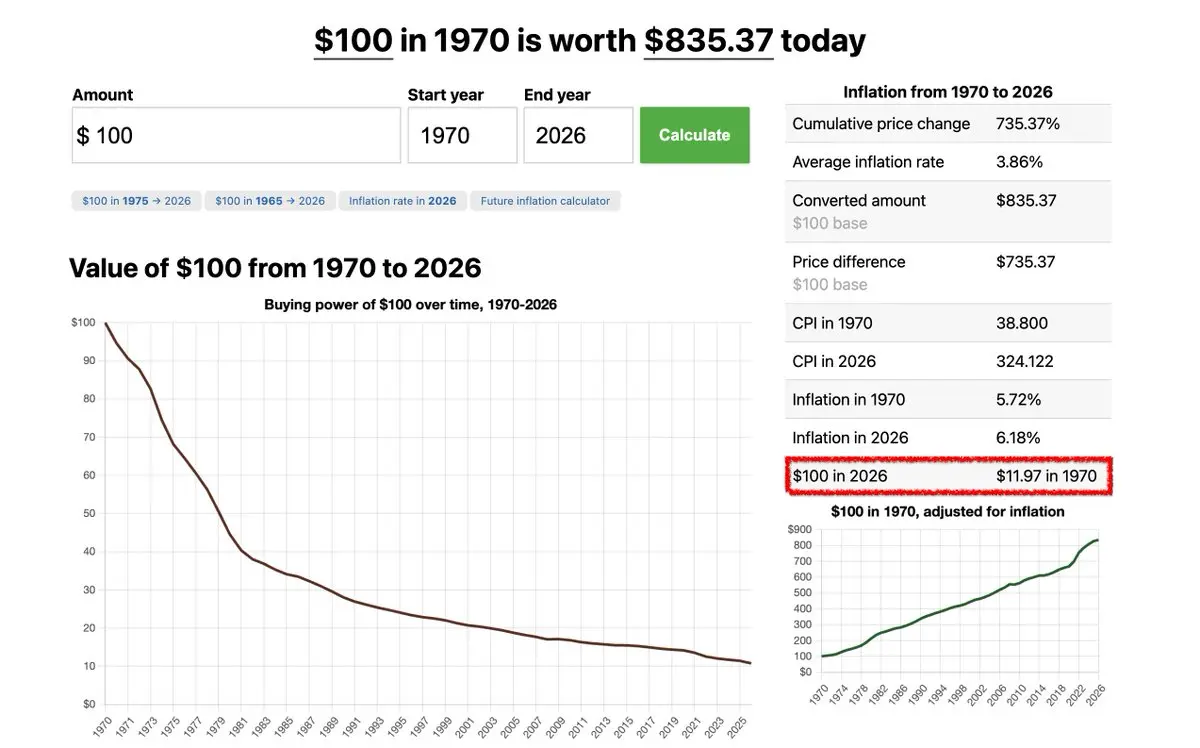

Tidak ada yang benar-benar tetap sama seiring waktu.

Orang berubah, rencana berubah… dan uang kehilangan nilai tanpa Anda sadari.

Apa yang dulu terasa seperti $100 sekarang hampir tidak memiliki kekuatan yang sama seperti sebelumnya.

Mata uang terus menjadi lebih lemah.

Tapi 1 Bitcoin tetaplah 1 Bitcoin.

Orang berubah, rencana berubah… dan uang kehilangan nilai tanpa Anda sadari.

Apa yang dulu terasa seperti $100 sekarang hampir tidak memiliki kekuatan yang sama seperti sebelumnya.

Mata uang terus menjadi lebih lemah.

Tapi 1 Bitcoin tetaplah 1 Bitcoin.

BTC-1,36%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Pertanyaan terbesar saat ini adalah di mana posisi kita dalam siklus BTC ini dibandingkan dengan tahun 2022?

Beberapa orang mengatakan Februari 2022.

Beberapa orang mengatakan Mei 2022.

Beberapa orang mengatakan Juni 2022.

Beberapa orang mengatakan November 2022.

Saya pikir kita saat ini berada pada level yang sama dengan Mei 2022.

Ini berarti, ada satu penurunan brutal yang belum terjadi, yang akan menjadi peluang pembelian generasi Anda.

Beberapa orang mengatakan Februari 2022.

Beberapa orang mengatakan Mei 2022.

Beberapa orang mengatakan Juni 2022.

Beberapa orang mengatakan November 2022.

Saya pikir kita saat ini berada pada level yang sama dengan Mei 2022.

Ini berarti, ada satu penurunan brutal yang belum terjadi, yang akan menjadi peluang pembelian generasi Anda.

BTC-1,36%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Ini adalah pertama kalinya seluruh kepemimpinan AS secara terbuka mendukung Bitcoin.

Presiden mendukungnya.

Wakil Presiden mendukungnya.

Kepala Federal Reserve berikutnya diharapkan akan bersikap positif terhadapnya.

Kepemimpinan SEC dan CFTC tidak lagi bersikap antagonis.

Keselarasan semacam itu belum pernah terjadi sebelumnya.

Empat tahun ke depan bisa mengubah segalanya untuk Bitcoin.

Presiden mendukungnya.

Wakil Presiden mendukungnya.

Kepala Federal Reserve berikutnya diharapkan akan bersikap positif terhadapnya.

Kepemimpinan SEC dan CFTC tidak lagi bersikap antagonis.

Keselarasan semacam itu belum pernah terjadi sebelumnya.

Empat tahun ke depan bisa mengubah segalanya untuk Bitcoin.

BTC-1,36%

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

🚨 Trump baru saja menaikkan ambang tarif global menjadi 15% setelah Mahkamah Agung memblokir kekuasaan tarif daruratnya.

Dia mengatakan bahwa tarif baru yang diuji secara hukum akan datang berikutnya.

Jadi tarif tidak akan berakhir, mereka sedang dibangun kembali di bawah undang-undang perdagangan lain seperti Bagian 232 dan 301.

Biaya impor yang lebih tinggi = tekanan lebih besar pada harga dan margin perusahaan.

Ketegangan perdagangan tidak akan hilang, melainkan memasuki fase hukum yang baru.

Lihat AsliDia mengatakan bahwa tarif baru yang diuji secara hukum akan datang berikutnya.

Jadi tarif tidak akan berakhir, mereka sedang dibangun kembali di bawah undang-undang perdagangan lain seperti Bagian 232 dan 301.

Biaya impor yang lebih tinggi = tekanan lebih besar pada harga dan margin perusahaan.

Ketegangan perdagangan tidak akan hilang, melainkan memasuki fase hukum yang baru.

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

Topik Trending

Lihat Lebih Banyak356.15K Popularitas

18.89K Popularitas

58.57K Popularitas

12.84K Popularitas

466.66K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$2.44KHolder:20.07%

- MC:$2.46KHolder:20.28%

- MC:$2.45KHolder:20.07%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:10.00%

Sematkan