#WhenisBestTimetoEntertheMarket

Pertanyaan lama dalam dunia crypto: Kapan waktu terbaik untuk masuk ke pasar?

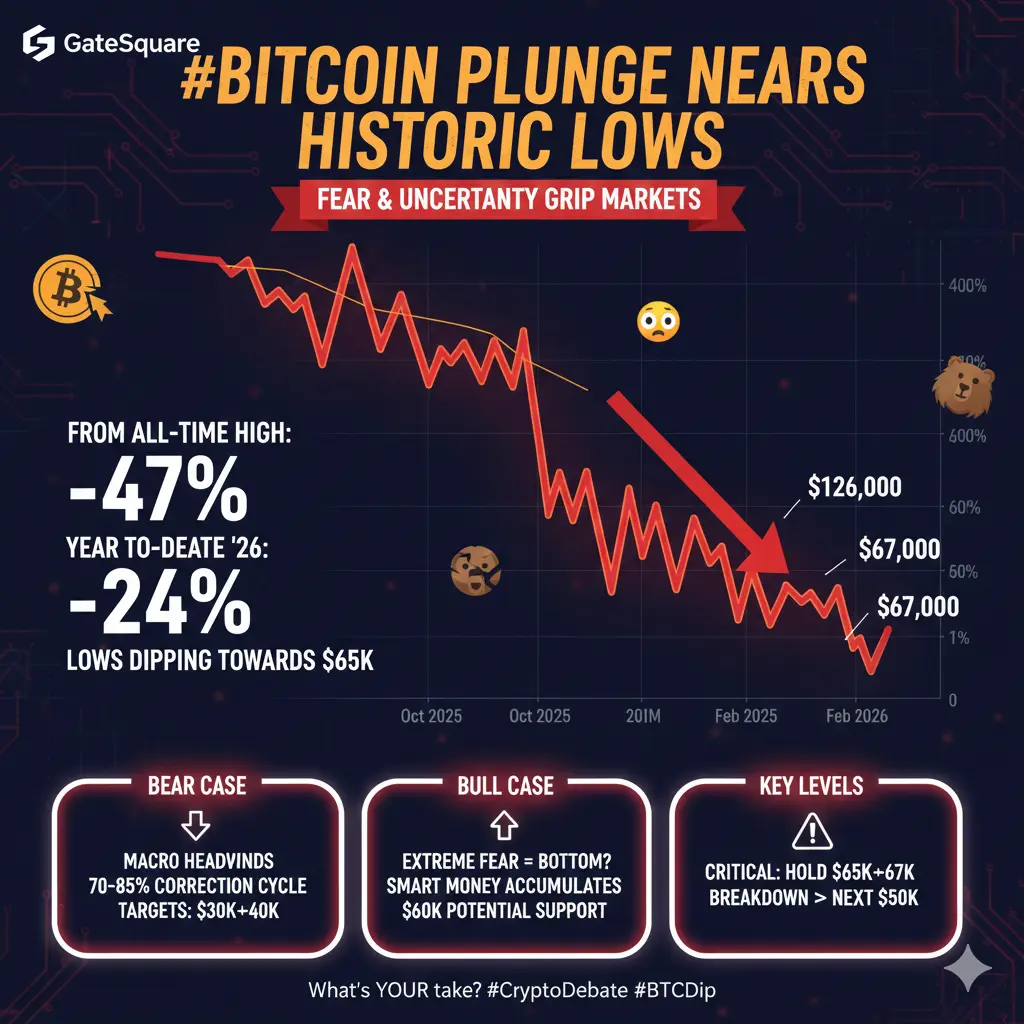

Menentukan waktu pasar adalah salah satu topik yang paling diperdebatkan di antara para investor. Ada yang bersumpah menunggu penurunan yang sempurna, ada juga yang bilang itu tidak mungkin dan sebaiknya langsung masuk saja. Dalam crypto yang sangat volatil, terutama Bitcoin saat ini (sedang berada di sekitar $67K–$70K setelah penurunan tajam dari $126K puncak), jawaban tidaklah satu ukuran cocok untuk semua—tetapi ada strategi terbukti, pola historis, dan pendekatan cerdas yang dapat meningkatkan peluang keberhasilan Anda.

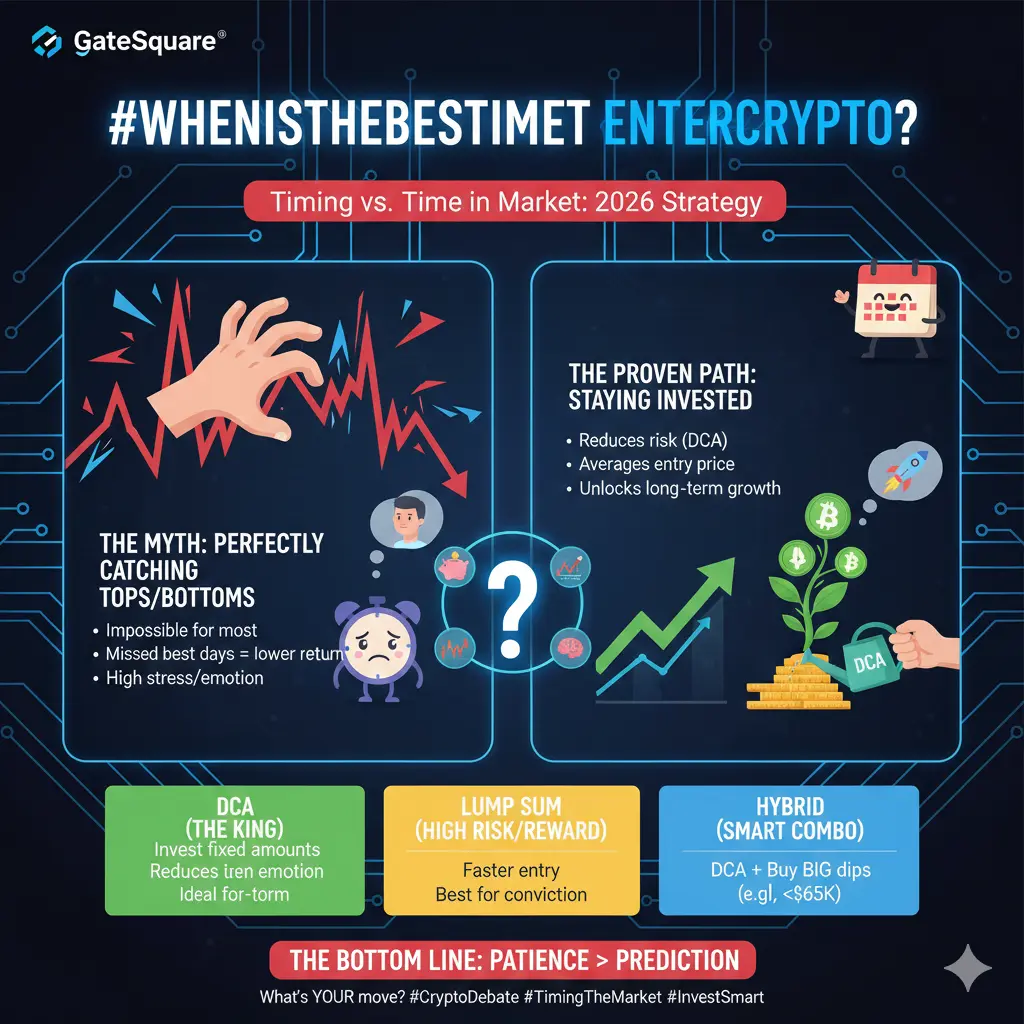

1. Kebenaran Pahit: Tidak Ada yang Bisa Menentukan Waktu Pasar Secara Sempurna (Konsisten)

Mencoba menangkap titik terendah atau tertinggi secara mutlak seperti berjudi. Bahkan profesional pun bisa salah. Studi dan backtest menunjukkan bahwa timing pasar (menunggu entri "sempurna") tidak seefisien hanya dengan tetap berada di pasar dalam jangka panjang. Mengapa? Pasar menghabiskan lebih banyak waktu naik daripada turun, dan melewatkan hari-hari terbaik menghancurkan hasil. Dalam crypto, ini diperkuat—lonjakan bullish besar Bitcoin memberi penghargaan kepada mereka yang tetap berinvestasi melalui keributan.

2. Siklus Historis: Di Mana Kita di 2026?

Bitcoin mengikuti siklus sekitar 4 tahun yang terkait dengan halving (yang terakhir adalah April 2024). Setelah halving, biasanya kita melihat:

Akumulasi → Puncak bull run sekitar 12–18 bulan kemudian.

Kemudian koreksi tajam / fase bear.

Di tahun 2026, kita kira-kira sudah 20+ bulan pasca halving. Banyak analis melihat ini sebagai akhir siklus: potensi konsolidasi yang berombak, koreksi lebih dalam (beberapa memprediksi $50K–$65K pengujian), atau dorongan terakhir ke atas jika permintaan institusional tetap ada. Prediksi sangat bervariasi—$75K–$150K+ menjelang akhir tahun—tetapi volatilitas diperkirakan akan tetap tinggi dengan faktor makro (suku bunga, geopolitik, regulasi).

Intisari utama: Jika Anda bullish jangka panjang terhadap Bitcoin/crypto, sekarang (selama koreksi) sering terlihat seperti entri "terbaik" jika dilihat dari belakang—tapi hanya jika Anda bertahan melalui badai.

3. Timing Jangka Pendek: Kapan Waktu Terbaik dalam Hari/Minggu untuk Masuk

Crypto tidak pernah tidur, tetapi pola ada karena tumpang tindih global:

Waktu terbaik dalam hari — Pagi hari (sebelum pasar NYSE buka) atau larut malam Minggu/awal Senin UTC—harga sering turun lebih rendah dengan likuiditas yang lebih tipis, lalu naik saat volume meningkat.

Hari terbaik — Senin (setelah akhir pekan yang lambat) atau pertengahan minggu (Sel–Kam) saat likuiditas memuncak selama tumpang tindih Eropa/AS (sekitar pukul 1–9 malam UTC / malam hari di banyak zona waktu).

Hindari akhir pekan jika Anda aktif trading—volume yang lebih rendah berarti fluktuasi yang lebih liar dan slippage.

Ini adalah keunggulan untuk trader harian atau entri cepat—bukan sihir untuk investor jangka panjang.

4. Strategi Inti: Bagaimana Cara Masuk dengan Cerdas

Dollar-Cost Averaging (DCA) — Raja untuk kebanyakan orang. Investasikan jumlah tetap secara rutin (mingguan/bulanan) tanpa memandang harga.

Keuntungan: Mengurangi risiko timing, merata-rata entri Anda, menghilangkan emosi.

Dalam volatilitas 2026, DCA bersinar saat penurunan—beli lebih banyak saat murah, lebih sedikit saat tinggi. Backtest menunjukkan ini mengalahkan mencoba timing saat penurunan sebagian besar waktu.

Ideal jika: Anda membangun selama berbulan-bulan/tahun dan membenci FOMO/penyesalan.

Lump Sum — Investasikan seluruh jumlah sekaligus saat Anda memutuskan untuk masuk.

Keuntungan: Mempercepat masuk ke pasar—secara historis mengalahkan DCA sekitar 70–80% karena waktu di pasar > timing.

Kerugian: Kejam jika Anda membeli tepat sebelum crash besar.

Terbaik untuk: Keyakinan kuat + horizon panjang (3–5+ tahun).

Hybrid/Tiered — DCA paling banyak, tetapi tambahkan pembelian lebih besar saat penurunan 10–20% (misalnya, level saat ini atau di bawah $65K support). Ini menggabungkan disiplin dengan peluang.

Dip Buying — Tunggu ekstrem ketakutan/kelaparan (cek indeks). Beli saat panik menjual—tapi hanya apa yang mampu Anda pegang selamanya.

5. Indikator Utama yang Perlu Dipantau Sebelum Masuk

Sentimen pasar: Ketakutan ekstrem (seperti sekarang?) sering menandakan dasar.

Level support: $65K tahan adalah penting—jika hilang, $50K berikutnya; tahan → potensi pemulihan ke $100K+.

Data on-chain: Akumulasi whale, inflow ETF.

Makro: Suku bunga lebih rendah, adopsi institusional mendukung bullish.

Situasi Anda: Investasikan hanya apa yang bisa Anda kehilangan. Miliki dana darurat, portofolio yang terdiversifikasi terlebih dahulu.

6. Jawaban Utama: Waktu Terbaik Adalah Saat Anda Siap

Persiapkan secara finansial (tanpa tekanan utang).

Siap secara mental (terima volatilitas, pandangan jangka panjang).

Tetapkan secara strategis (rencana DCA, manajemen risiko).

Dalam perjalanan liar crypto, waktu di pasar mengalahkan timing pasar untuk 90% orang. Menunggu momen "sempurna" sering berarti melewatkan seluruh peluang. 2026 bisa membawa upside besar jika siklus tetap—atau lebih banyak rasa sakit jika makro memburuk. Tapi sejarah mendukung mereka yang masuk saat ketakutan dan bertahan melalui keserakahan.

Pertanyaan lama dalam dunia crypto: Kapan waktu terbaik untuk masuk ke pasar?

Menentukan waktu pasar adalah salah satu topik yang paling diperdebatkan di antara para investor. Ada yang bersumpah menunggu penurunan yang sempurna, ada juga yang bilang itu tidak mungkin dan sebaiknya langsung masuk saja. Dalam crypto yang sangat volatil, terutama Bitcoin saat ini (sedang berada di sekitar $67K–$70K setelah penurunan tajam dari $126K puncak), jawaban tidaklah satu ukuran cocok untuk semua—tetapi ada strategi terbukti, pola historis, dan pendekatan cerdas yang dapat meningkatkan peluang keberhasilan Anda.

1. Kebenaran Pahit: Tidak Ada yang Bisa Menentukan Waktu Pasar Secara Sempurna (Konsisten)

Mencoba menangkap titik terendah atau tertinggi secara mutlak seperti berjudi. Bahkan profesional pun bisa salah. Studi dan backtest menunjukkan bahwa timing pasar (menunggu entri "sempurna") tidak seefisien hanya dengan tetap berada di pasar dalam jangka panjang. Mengapa? Pasar menghabiskan lebih banyak waktu naik daripada turun, dan melewatkan hari-hari terbaik menghancurkan hasil. Dalam crypto, ini diperkuat—lonjakan bullish besar Bitcoin memberi penghargaan kepada mereka yang tetap berinvestasi melalui keributan.

2. Siklus Historis: Di Mana Kita di 2026?

Bitcoin mengikuti siklus sekitar 4 tahun yang terkait dengan halving (yang terakhir adalah April 2024). Setelah halving, biasanya kita melihat:

Akumulasi → Puncak bull run sekitar 12–18 bulan kemudian.

Kemudian koreksi tajam / fase bear.

Di tahun 2026, kita kira-kira sudah 20+ bulan pasca halving. Banyak analis melihat ini sebagai akhir siklus: potensi konsolidasi yang berombak, koreksi lebih dalam (beberapa memprediksi $50K–$65K pengujian), atau dorongan terakhir ke atas jika permintaan institusional tetap ada. Prediksi sangat bervariasi—$75K–$150K+ menjelang akhir tahun—tetapi volatilitas diperkirakan akan tetap tinggi dengan faktor makro (suku bunga, geopolitik, regulasi).

Intisari utama: Jika Anda bullish jangka panjang terhadap Bitcoin/crypto, sekarang (selama koreksi) sering terlihat seperti entri "terbaik" jika dilihat dari belakang—tapi hanya jika Anda bertahan melalui badai.

3. Timing Jangka Pendek: Kapan Waktu Terbaik dalam Hari/Minggu untuk Masuk

Crypto tidak pernah tidur, tetapi pola ada karena tumpang tindih global:

Waktu terbaik dalam hari — Pagi hari (sebelum pasar NYSE buka) atau larut malam Minggu/awal Senin UTC—harga sering turun lebih rendah dengan likuiditas yang lebih tipis, lalu naik saat volume meningkat.

Hari terbaik — Senin (setelah akhir pekan yang lambat) atau pertengahan minggu (Sel–Kam) saat likuiditas memuncak selama tumpang tindih Eropa/AS (sekitar pukul 1–9 malam UTC / malam hari di banyak zona waktu).

Hindari akhir pekan jika Anda aktif trading—volume yang lebih rendah berarti fluktuasi yang lebih liar dan slippage.

Ini adalah keunggulan untuk trader harian atau entri cepat—bukan sihir untuk investor jangka panjang.

4. Strategi Inti: Bagaimana Cara Masuk dengan Cerdas

Dollar-Cost Averaging (DCA) — Raja untuk kebanyakan orang. Investasikan jumlah tetap secara rutin (mingguan/bulanan) tanpa memandang harga.

Keuntungan: Mengurangi risiko timing, merata-rata entri Anda, menghilangkan emosi.

Dalam volatilitas 2026, DCA bersinar saat penurunan—beli lebih banyak saat murah, lebih sedikit saat tinggi. Backtest menunjukkan ini mengalahkan mencoba timing saat penurunan sebagian besar waktu.

Ideal jika: Anda membangun selama berbulan-bulan/tahun dan membenci FOMO/penyesalan.

Lump Sum — Investasikan seluruh jumlah sekaligus saat Anda memutuskan untuk masuk.

Keuntungan: Mempercepat masuk ke pasar—secara historis mengalahkan DCA sekitar 70–80% karena waktu di pasar > timing.

Kerugian: Kejam jika Anda membeli tepat sebelum crash besar.

Terbaik untuk: Keyakinan kuat + horizon panjang (3–5+ tahun).

Hybrid/Tiered — DCA paling banyak, tetapi tambahkan pembelian lebih besar saat penurunan 10–20% (misalnya, level saat ini atau di bawah $65K support). Ini menggabungkan disiplin dengan peluang.

Dip Buying — Tunggu ekstrem ketakutan/kelaparan (cek indeks). Beli saat panik menjual—tapi hanya apa yang mampu Anda pegang selamanya.

5. Indikator Utama yang Perlu Dipantau Sebelum Masuk

Sentimen pasar: Ketakutan ekstrem (seperti sekarang?) sering menandakan dasar.

Level support: $65K tahan adalah penting—jika hilang, $50K berikutnya; tahan → potensi pemulihan ke $100K+.

Data on-chain: Akumulasi whale, inflow ETF.

Makro: Suku bunga lebih rendah, adopsi institusional mendukung bullish.

Situasi Anda: Investasikan hanya apa yang bisa Anda kehilangan. Miliki dana darurat, portofolio yang terdiversifikasi terlebih dahulu.

6. Jawaban Utama: Waktu Terbaik Adalah Saat Anda Siap

Persiapkan secara finansial (tanpa tekanan utang).

Siap secara mental (terima volatilitas, pandangan jangka panjang).

Tetapkan secara strategis (rencana DCA, manajemen risiko).

Dalam perjalanan liar crypto, waktu di pasar mengalahkan timing pasar untuk 90% orang. Menunggu momen "sempurna" sering berarti melewatkan seluruh peluang. 2026 bisa membawa upside besar jika siklus tetap—atau lebih banyak rasa sakit jika makro memburuk. Tapi sejarah mendukung mereka yang masuk saat ketakutan dan bertahan melalui keserakahan.