A disputa de US$5,6 bilhões pelo futuro da Hyperliquid

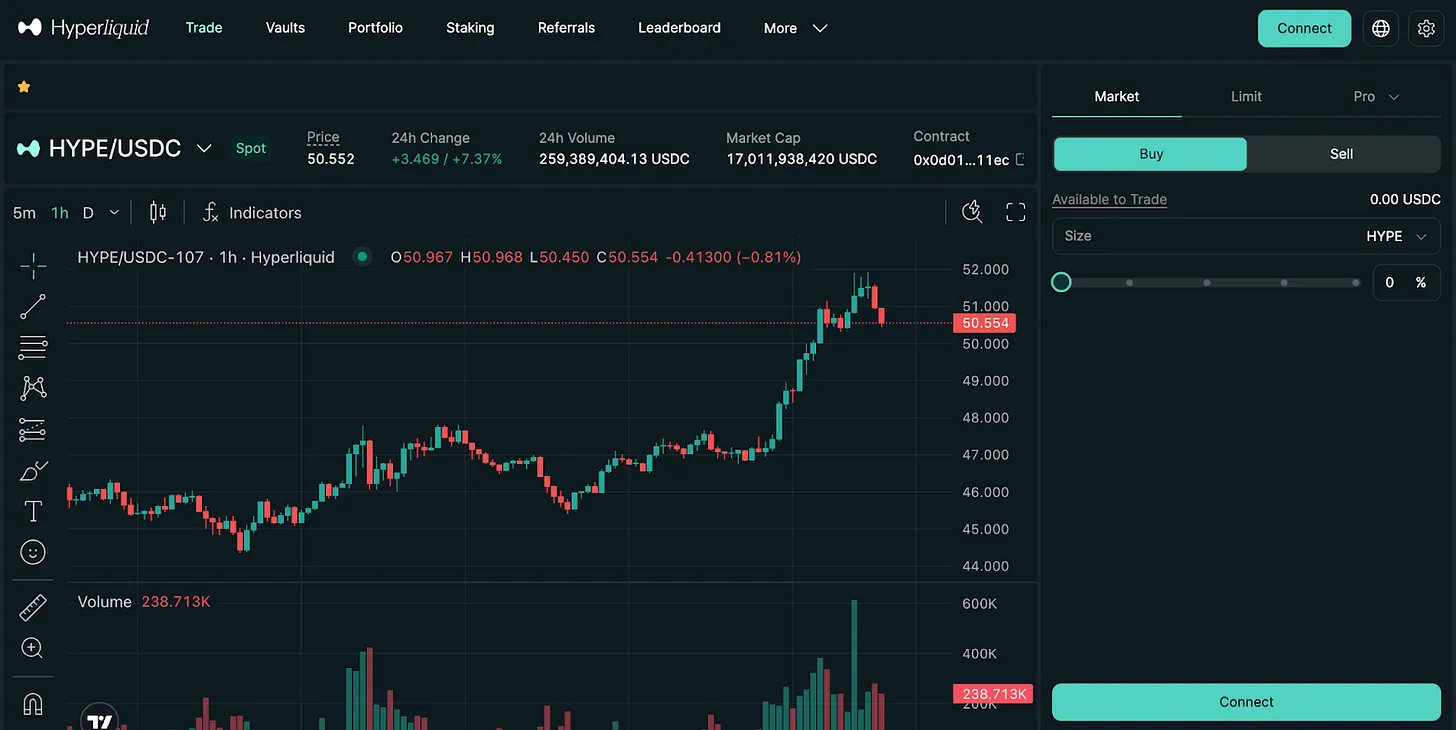

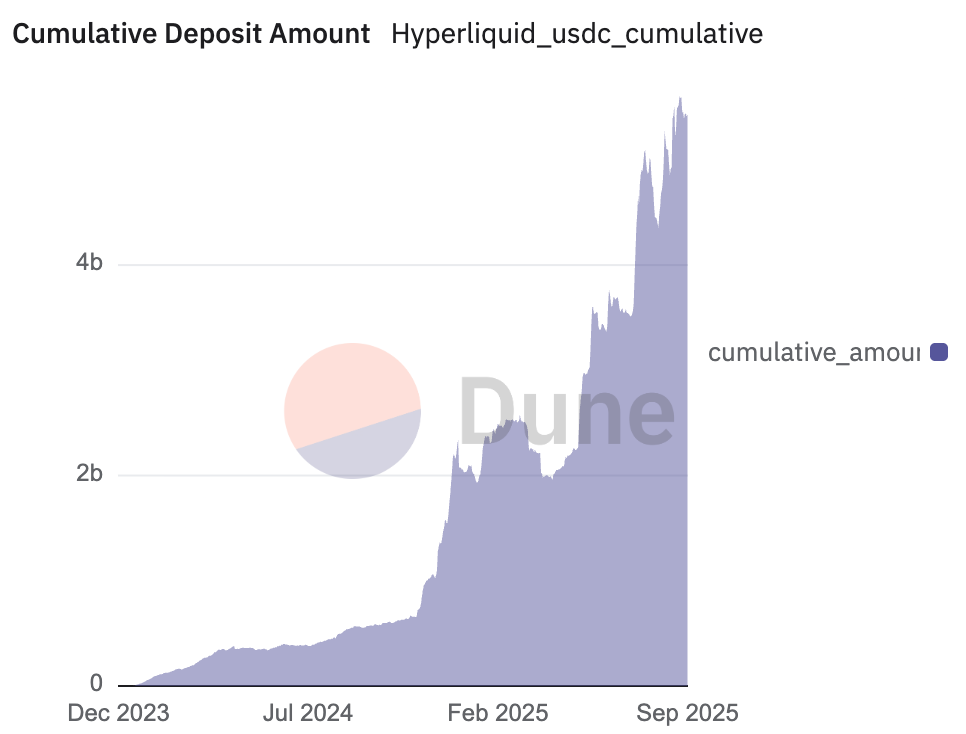

Um prêmio bilionário está bloqueado na Hyperliquid, uma das exchanges de perpétuos que mais cresce no DeFi. Alimentada por uma experiência de usuário extremamente fluida e uma base de usuários crescente, a exchange consolidou-se como líder em derivativos on-chain, com mais de 5,6 bilhões em stablecoins — quase tudo USDC da Circle — abastecendo seu motor de negociação.

Esse capital gera receitas expressivas a partir das reservas, que hoje vão para partes externas. Agora, a comunidade Hyperliquid se mobiliza para recuperar esse fluxo.

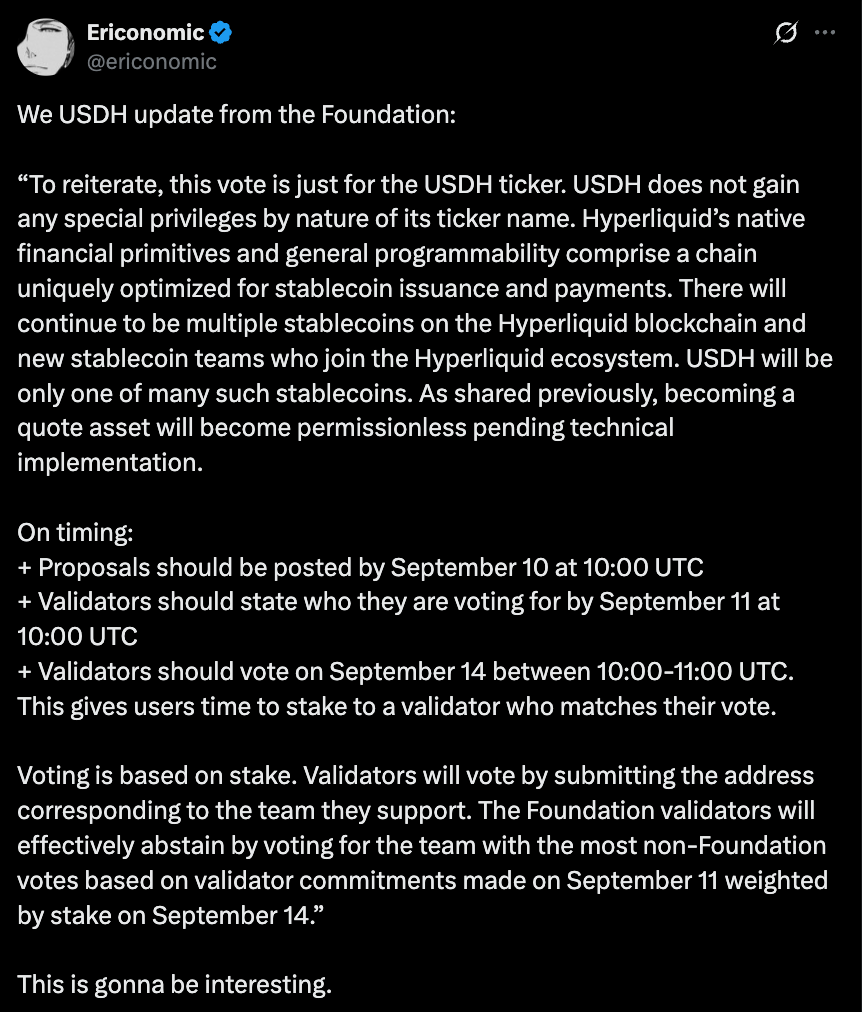

No dia 14 de setembro, Hyperliquid viverá seu momento decisivo: validadores realizarão uma votação única e definitiva para escolher quem receberá as chaves do USDH, o primeiro stablecoin nativo da plataforma. O que está em jogo vai além de um token; está em disputa o controle de uma engrenagem capaz de redirecionar centenas de milhões para dentro do ecossistema. O processo lembra um leilão bilionário, semelhante aos leilões de títulos públicos, mas ocorre de forma transparente on-chain. Os validadores, que fazem staking de HYPE para proteger a rede, atuam como comitê de seleção — decidindo quem emitirá USDH e como bilhões em rendimentos serão redistribuídos.

Os concorrentes são opostos: um grupo de construtores nativos do universo cripto, que defende alinhamento total, enfrenta grandes fortunas e operações sofisticadas das finanças institucionais.

O Modelo Comprovado: Uma Oportunidade Anual de 220 Milhões

Para entender o que está em jogo, acompanhe o movimento do dinheiro. Hoje, o USDC está no centro. A Circle, emissora do USDC, lucra ao depositar reservas em Títulos do Tesouro dos EUA e capturar o rendimento — 658 milhões em um único trimestre. Esse é exatamente o modelo de negócio que a Hyperliquid busca adotar.

Ao substituir stablecoins de terceiros por USDH, seu próprio token nativo, a plataforma deixa de perder valor para fora e passa a capturar esses fluxos internamente. Considerando apenas os saldos atuais, as reservas do USDH poderiam gerar 220 milhões por ano. É a transição de inquilino para proprietária: deixa de ser cliente de stablecoins externas para ser proprietária de sua própria base financeira. Para a Circle, o impacto seria enorme: perder os saldos da Hyperliquid pode custar até 10% de sua receita, evidenciando a dependência do rendimento de juros.

A grande questão para a comunidade não é se deve buscar esse prêmio, mas sim a quem confiar sua execução.

Mas a Circle não pretende ceder espaço. Antes mesmo do plano do USDH, a Circle já trabalhava para se consolidar na Hyperliquid, anunciando USDC nativo e CCTP V2 no final de julho. A atualização promete transferências perfeitas de USDC entre blockchains compatíveis, com maior eficiência de capital — sem wrapped tokens ou pontes antigas. A Circle também integrou seus canais institucionais de entrada e saída via Circle Mint. O recado é claro: o emissor público do USDC não vai abrir mão da liquidez da Hyperliquid sem luta.

Os Concorrentes: Um Confronto de Filosofias

Várias propostas distintas para o USDH surgiram, cada qual representando um caminho estratégico para a Hyperliquid.

A Native Markets, equipe nativa da Hyperliquid, entrou rápido após o anúncio do USDH e propôs um stablecoin compatível com a GENIUS Act e feito especialmente para a plataforma. O plano inclui gateways fiat integrados para entrada e saída facilitada, além de compartilhamento de receita com o Hyperliquid Assistance Fund. O time traz nomes experientes como MC Lader, ex-presidente da Uniswap Labs, mas parte da comunidade questiona o momento e os recursos da proposta. A equipe se posiciona como a opção mais alinhada localmente — combinando conformidade, expertise on-chain e compromisso de reinvestir no ecossistema. O diferencial: uma solução caseira, regulada e em sintonia direta com o HYPE. A dúvida, para alguns membros, é se o time tem estrutura para entregar em larga escala na hora certa.

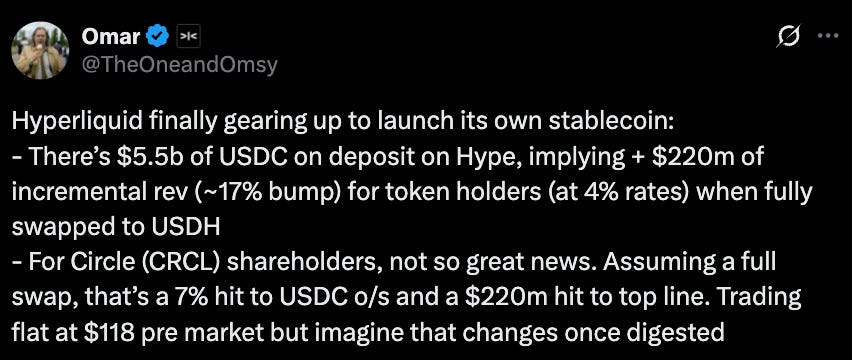

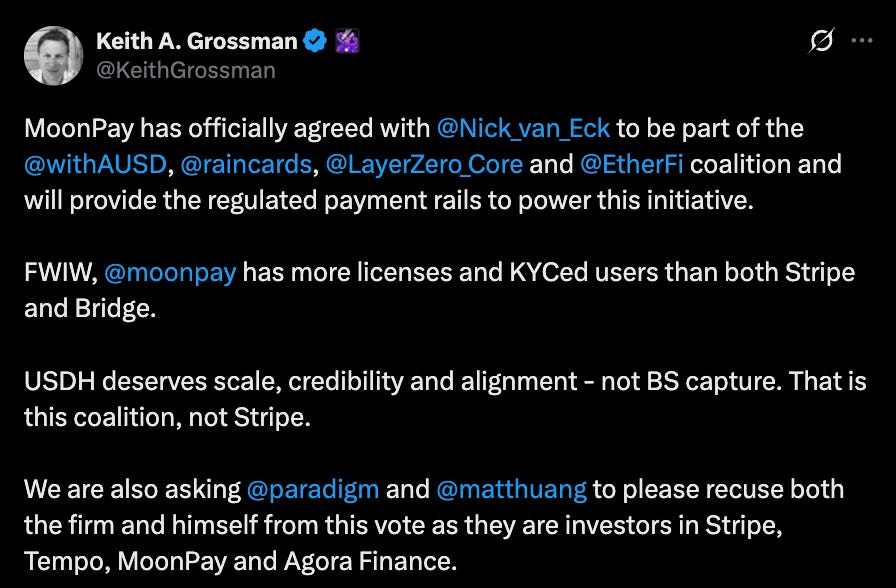

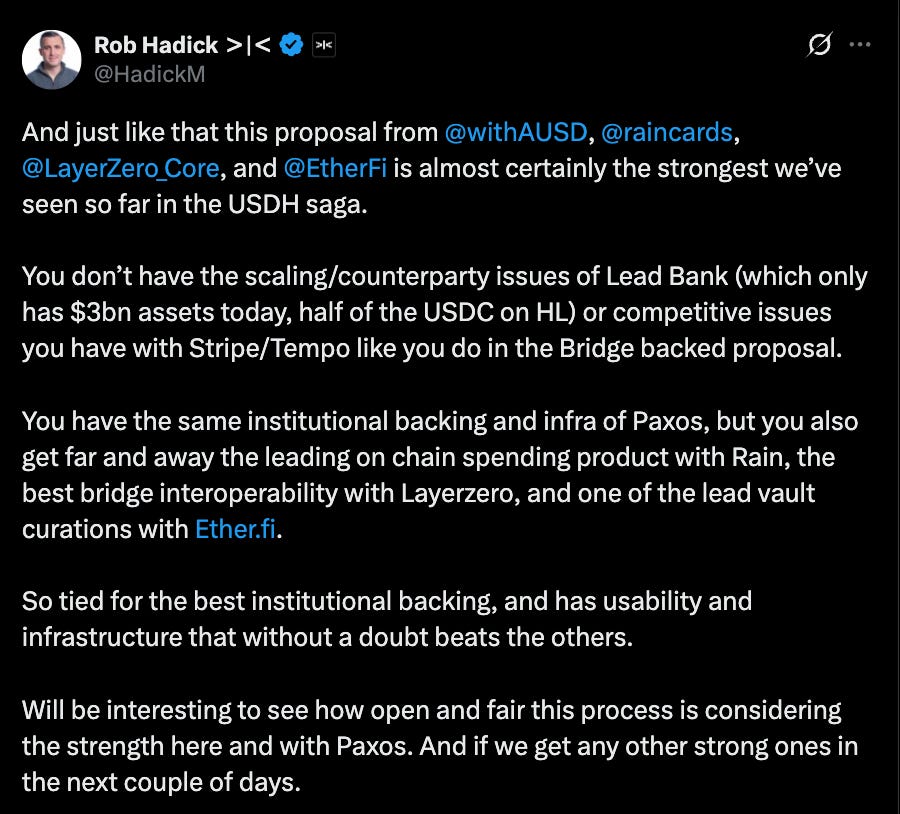

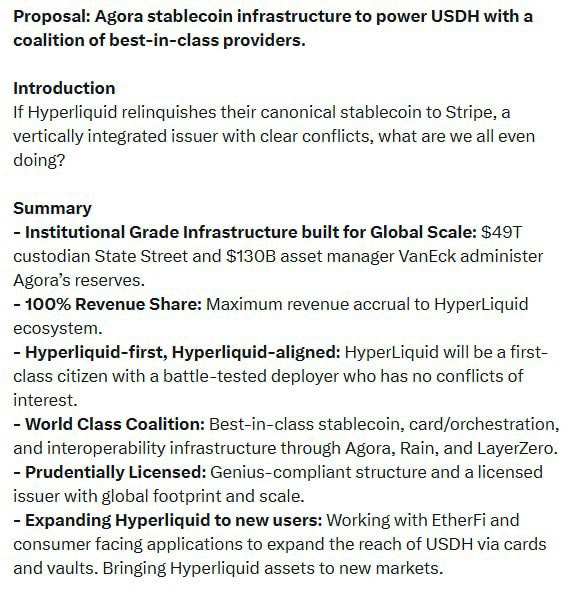

Quem mais ganha força é a proposta da Agora, provedora de infraestrutura de stablecoins, que formou uma coalizão com parceiros consolidados. A Agora tem apoio da MoonPay, serviço de entrada de fiat com mais jurisdições licenciadas e usuários com identificação de usuário (KYC) que a Stripe;

Rain, para pagamentos on-chain e serviços de cartão ágeis; e LayerZero, referência em interoperabilidade entre blockchains.

Apoiados por uma captação de 50 milhões liderada pela Paradigm e com foco total na conformidade via prova de reservas, a Agora posiciona-se como representante dos interesses da Hyperliquid. As reservas seriam custodiadas pela State Street, administradas pela VanEck e auditadas pela Chaos Labs. O grupo ainda promete pelo menos 10 milhões em liquidez inicial por meio de parceiros como Cross River e Customers Bank. A proposta é institucional, testada e tem uma promessa central: todo o lucro líquido das reservas do USDH retorna integralmente para o ecossistema Hyperliquid. Na prática, o crescimento do stablecoin gera retorno direto para detentores de HYPE. As vantagens são credibilidade institucional, acesso a capital e ampla distribuição. O risco está na dependência de bancos e custodians, que pode criar novamente gargalos fora da blockchain — justamente o que USDH tenta evitar.

A Stripe, ao adquirir Bridge por 1,1 bilhão, lançou proposta para tornar o USDH base de uma rede global de pagamentos em stablecoins. A infraestrutura do Bridge permite pagamentos e liquidações com USDC em mais de 100 países, com taxas baixas e liquidação quase instantânea. A integração à Stripe traz credibilidade regulatória, API para desenvolvedores e conectividade total em cartões e pagamentos. A empresa está lançando seu próprio stablecoin lastreado em moeda fiduciária, USDB, dentro do Bridge — uma forma de evitar custos externos com blockchains e criar barreiras estratégicas. O potencial é evidente: a escala e a marca da Stripe podem levar o USDH ao mainstream. O risco é o domínio estratégico: uma fintech verticalizada, com blockchain (Tempo) e carteira próprios, pode controlar uma parte fundamental da camada monetária da Hyperliquid.

Outros concorrentes preferem rotas alternativas. Paxos, fiduciária regulada de Nova York, oferece a opção mais conservadora — priorizando conformidade. Paxos promete destinar 95% do rendimento das reservas do USDH para recompras de HYPE e listá-lo em redes como PayPal, Venmo e MercadoLivre — um canal institucional sem igual. Apesar do ambiente regulatório americano estar mais amigável sob Trump, Paxos segue como a opção mais tradicional para quem valoriza durabilidade e aprovação regulatória. O ponto fraco? Dependência total de custódia fiat, exposta ao risco bancário e regulatório — mesma fragilidade que levou ao encerramento do BUSD.

Em contraponto, Frax Finance oferece uma abordagem DeFi nativa. Emergente do próprio ecossistema cripto, Frax prioriza mecanismos on-chain, governança comunitária e estratégias de rendimento compartilhado, atraentes para os mais puristas. A proposta aposta numa visão descentralizada e voltada à comunidade para o USDH. O desenho: USDH lastreado 1:1 com frxUSD e Títulos do Tesouro dos EUA sob gestão de gigantes como BlackRock, e resgate automático em USDC, USDT, frxUSD e moeda fiduciária. Frax garante distribuir 100% do rendimento para usuários Hyperliquid, deixando toda a governança nas mãos dos validadores. Entre os pontos fortes está ser um modelo comunitário, testado, de alto rendimento e alinhado aos ideais cripto; entre os riscos está a dependência tanto de frxUSD quanto de Títulos do Tesouro dos EUA externas, o que pode limitar adoção e trazer riscos externos.

Konelia é uma participante menor, pouco divulgada, que entrou na disputa pelo USDH via leilão on-chain igual aos grandes players. O plano foca emissão regulada, gestão de reservas e alinhamento ao ecossistema, voltados para o L1 de alta performance da Hyperliquid. O diferencial: proposta reconhecida oficialmente e ajustada ao L1, mas com poucos detalhes, pouco reconhecimento de marca e baixo suporte comunitário, tornando-a uma opção remota frente aos rivais capitalizados.

Por fim, xDFi, equipe formada por veteranos da DeFi advindos de SushiSwap e LayerZero, propõe emitir o USDH como stablecoin totalmente colateralizada em cripto, multichain e integrada a 23 redes EVM desde o início. Lastreado por ativos como ETH, BTC, USDC e AVAX, os saldos seriam sincronizados nativamente via xD, sem necessidade de pontes e sem fragmentação. O desenho direciona 69% do rendimento à governança HYPE, 30% aos validadores e 1% à manutenção do protocolo, tornando o USDH do coletivo, sem bancos ou custodians. Entre os pontos fortes está ser resistente à censura e puramente cripto, consolidando a Hyperliquid como centro de liquidez; entre os riscos está a instabilidade por ser dependente de garantias voláteis, sem respaldo regulatório para adoção ampla.

A Curve propõe outro caminho, sugerindo parceria em vez de competição. Usando o mecanismo crvUSD LLAMMA, Curve propõe sistema com dois stablecoins: um USDH regulado (Paxos ou Agora) e um dUSDH descentralizado, lastreado em HYPE e HLPs, operando na estrutura CDP da própria Curve e governado pela Hyperliquid. Esse modelo pode permitir operações em ciclo, alavancagem e estratégias de rendimento, criando um ciclo virtuoso para HYPE e HLP. Curve destaca a robustez e manutenção do peg estável do crvUSD em mercados voláteis, oferece termos flexíveis de licenciamento e aponta que seu modelo CDP já gerou de 2,5 a 10 milhões anuais para cada 100 milhões em volume. Entre os pontos fortes está a combinação — segurança regulatória aliada à opção DeFi nativa. Entre os riscos está a possível fragmentação de liquidez e marca entre dois símbolos, além do fato de usar ativos Hyperliquid como colateral ser potencialmente circular.

Mandato Descentralizado

O veredito ficará nas mãos dos validadores da Hyperliquid, via votação on-chain. Em movimento para garantir um resultado justo e comunitário, a Hyperliquid Foundation anunciou que vai se abster do voto.

Ao prometer seguir a maioria, a fundação renuncia ao comando — dissipando temores de centralização e deixando claro que a decisão cabe unicamente aos participantes.

O dia 14 de setembro será mais que uma votação: será um teste de até onde evoluiu a governança DeFi, superando debates simbólicos sobre taxas para contratos bilionários decididos pelo voto coletivo.

Aviso legal:

- Este artigo é uma republicação de [Tristero Research]. Todos os direitos autorais pertencem ao autor original [@tristero">Tristero Research]. Caso existam objeções à republicação, entre em contato com a equipe do Gate Learn, que tomará as providências necessárias.

- Aviso de responsabilidade: As opiniões apresentadas neste artigo são exclusivamente do autor e não constituem recomendação de investimento.

- Traduções para outros idiomas realizadas pela equipe Gate Learn. Salvo menção em contrário, é proibido copiar, distribuir ou plagiar os artigos traduzidos.

Artigos Relacionados

O que é o PolygonScan e como você pode usá-lo? (Atualização 2025)

O que é Bitcoin?

O que é Tronscan e como você pode usá-lo em 2025?

O que é EtherVista, o autoproclamado "Novo Padrão para DEX"?

O que é a Carteira HOT no Telegram?