Relatório do Mercado de Stablecoins não USD no Sudeste Asiático relativo ao 2.º trimestre de 2025: XSGD assume uma posição dominante, observa-se diversidade política e regulatória. O volume de transações em DEX regista uma forte queda. Porém, o número de

Antes de mais, o nosso agradecimento a Jay Jo da Tiger Research Reports, cujas recomendações, aconselhamento e contributos foram fundamentais para este artigo.

Resumo Executivo:

- Dominância dos stablecoins indexados ao SGD: A XSGD, única emissora de stablecoin com paridade ao SGD, lidera o mercado local de stablecoins no Sudeste Asiático, sustentada por colaborações com a Grab e a Alibaba.

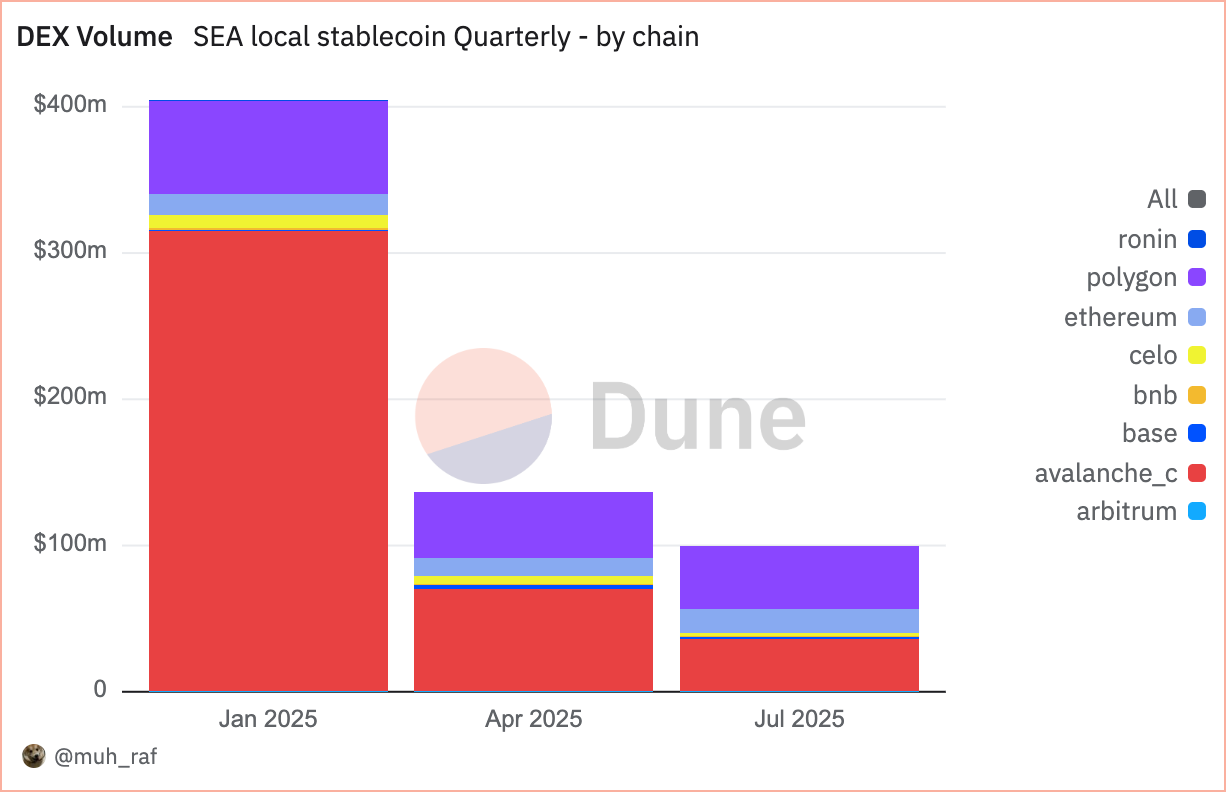

- Métricas de mercado: Presente em mais de 8 blockchains EVM com 8 emissoras e 5 moedas nativas, atingiu 136 M US$ de volume em DEX no segundo trimestre de 2025 (com destaque para Avalanche e SGD), o que representa uma queda de 66 % face aos 404 M US$ do primeiro trimestre.

- Progresso regulatório: A MAS de Singapura avançou o enquadramento dos stablecoins para SGD e moedas do G10; Indonésia e Malásia lançaram sandboxes regulatórios.

- Comércio transfronteiriço: Apenas 22 % das trocas comerciais do Sudeste Asiático em 2023 foram intra-regionais, sendo a dependência do USD fonte de atrasos e custos significativos. Os stablecoins locais podem transformar a liquidação, permitindo transferências imediatas e de baixo custo, e as iniciativas regionais de pagamentos QR da ASEAN BAC aceleram este processo.

- Inclusão financeira: Mais de 260 milhões de habitantes no Sudeste Asiático permanecem fora do sistema bancário. Stablecoins não USD, integrados em super-apps como GoPay ou MoMo, podem ampliar o acesso financeiro acessível, impulsionando remessas, microtransações e pagamentos digitais do dia-a-dia.

O Sudeste Asiático (SEA), agregando um PIB de 3,8 biliões US$ e uma população de 671 milhões [1] [2], constitui o quinto maior bloco económico a nível mundial. Com 440 milhões de utilizadores de internet, a região lidera a transformação digital [3]

Neste ambiente dinâmico, os stablecoins não USD e moedas digitais vinculadas a moedas regionais ou cestos cambiais tornam-se instrumentos decisivos para o ecossistema financeiro local. Ao diminuírem a dependência do dólar norte-americano, estes stablecoins potenciam a eficiência do comércio transfronteiriço, estabilizam as transações internas e promovem a inclusão financeira em economias diversificadas.

O presente artigo aborda as razões pelas quais os stablecoins não USD são estratégicos para instituições financeiras e decisores do SEA visarem um futuro económico resiliente e integrado.

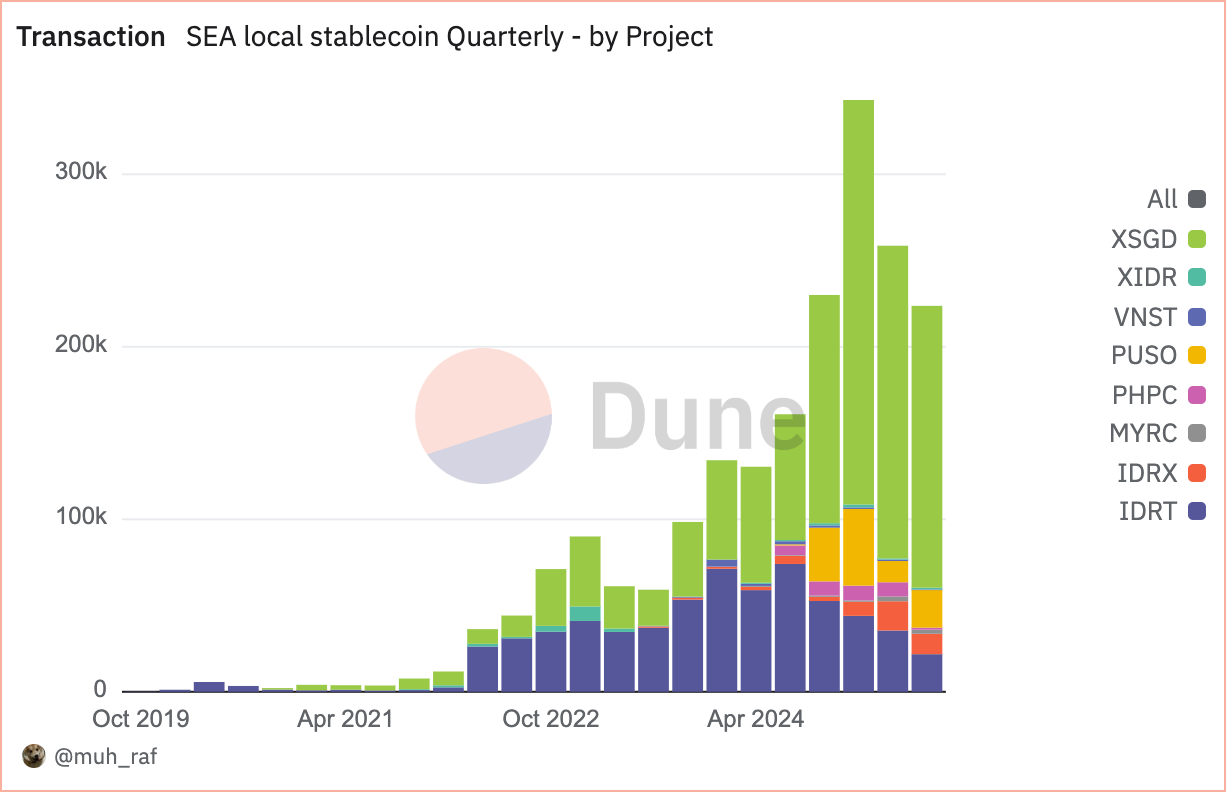

Transações

Fonte: https://dune.com/queries/5728202/9297229

Desde janeiro de 2020, o uso de stablecoins não USD no Sudeste Asiático cresceu rapidamente, com o número de projetos a passar de dois para oito até 2025. Este desenvolvimento resulta do aumento do volume de transações e da diversificação de blockchains.

No segundo trimestre de 2025, os stablecoins não USD registaram no SEA 258 000 transações, com os stablecoins indexados ao Dólar de Singapura (SGD), sobretudo XSGD, a deterem 70,1 % da quota, seguidos por stablecoins indexados à Rupia indonésia (IDRT e IDRX) com 20,3 %. Isto revela intensa atividade regional e suporte regulatório [4], afirmando o papel dos stablecoins na economia digital do SEA.

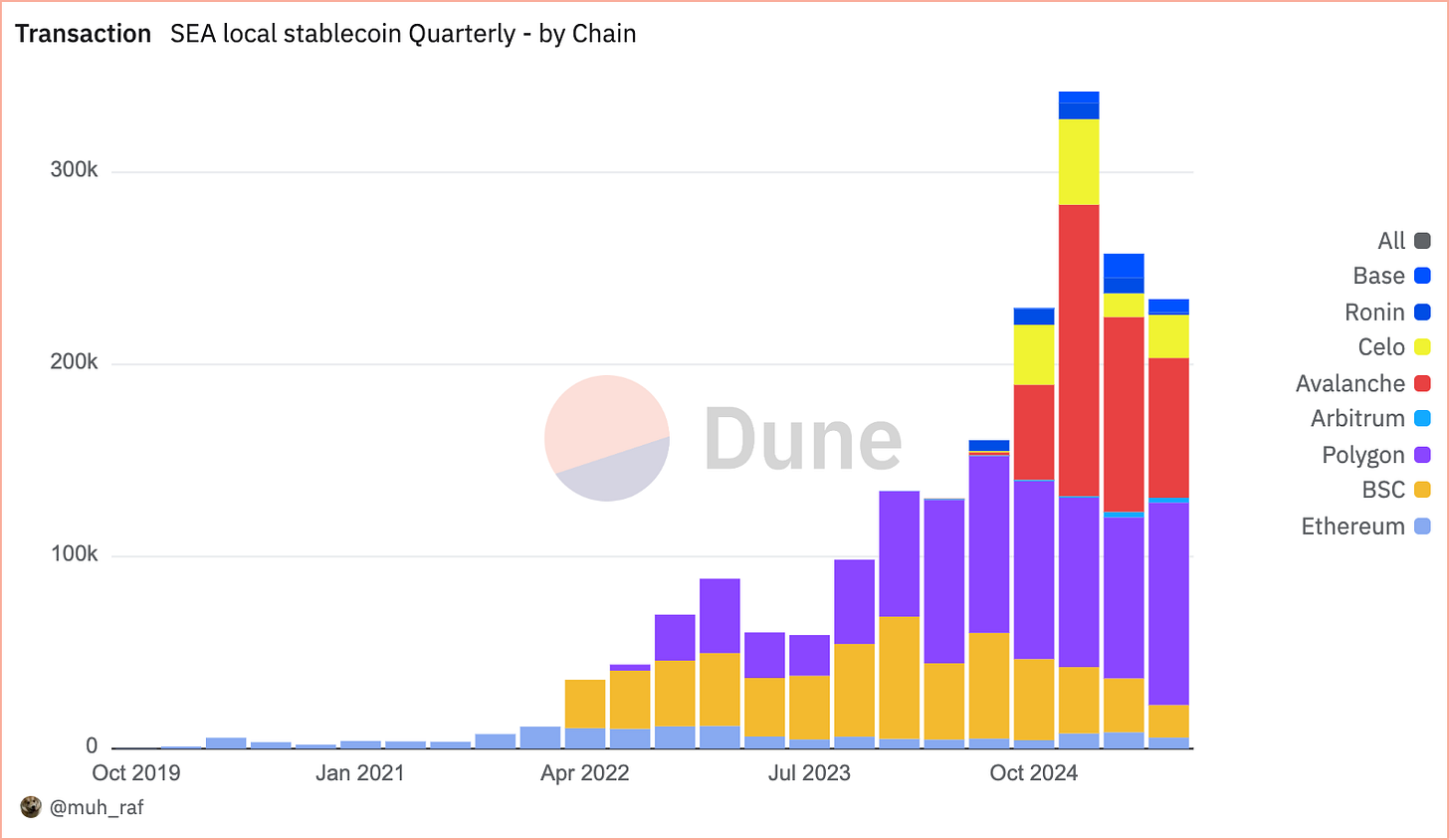

Fonte : https://dune.com/embeds/5728202/9297229

Em quatro anos, desde 2020, as transações com stablecoins não USD ultrapassaram 1 milhão, impulsionadas pela elevada adoção e exposição às blockchains EVM, que lideram o crescimento trimestre após trimestre. No segundo trimestre de 2025, a Avalanche é líder com (101 K) 39,4 %, seguida pela Polygon com (83 K) 32,5 % e Binance Smart Chain com (28 K) 10,9 %.

A ascensão rápida da Avalanche está diretamente ligada ao projeto XSGD, atualmente o único stablecoin disponível nesta blockchain, que tem ganho forte tração desde o seu lançamento. A XSGD é um stablecoin com paridade 1:1 ao Dólar de Singapura, emitido pela StraitsX. A StraitsX é uma Instituição Principal de Pagamento licenciada pela Autoridade Monetária de Singapura (MAS).

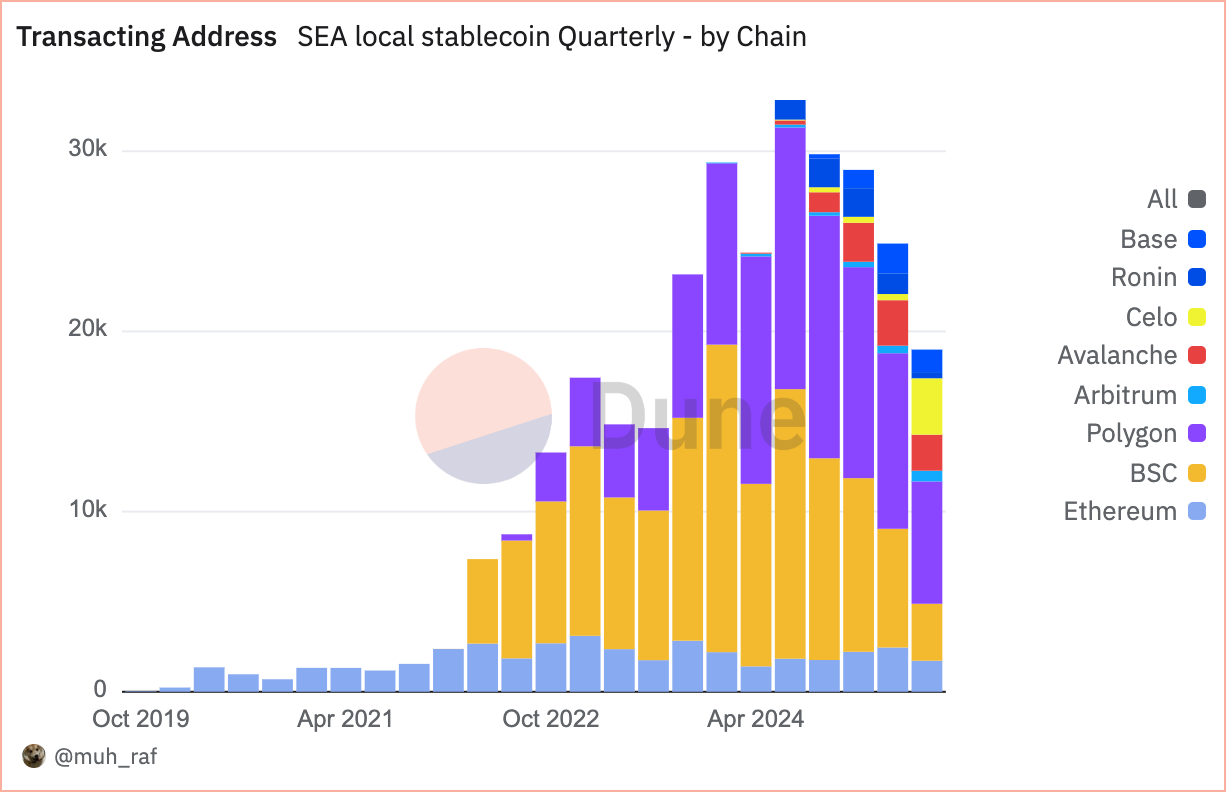

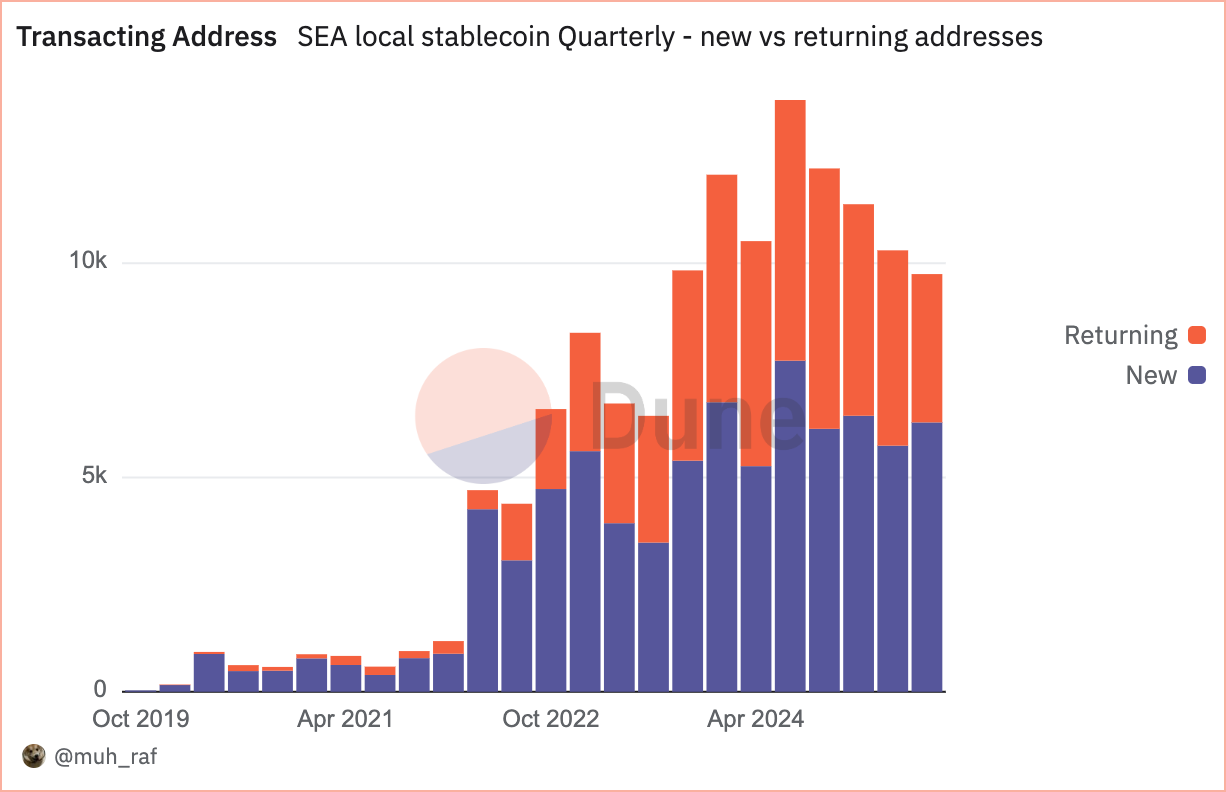

Endereços ativos

Fonte : https://dune.com/queries/5728541/9297706

Desde o segundo trimestre de 2025, a adoção dos stablecoins não USD no SEA é notória, refletindo um salto superior a 10 000 endereços ativos (em transação), dos quais 4 558 são recorrentes e 5 743 são novos.

Fonte: https://dune.com/queries/5728383/9297467

Ao contrário da métrica de número de transações, que revela o nível geral de atividade, os endereços ativos (transacionantes) refletem a efetiva participação dos utilizadores. Para os stablecoins não USD, no segundo trimestre de 2025 o Polygon liderou com (9,7 K) 39,2 %, seguido pelo Binance Smart Chain (BSC) com (6,5 K) 23,1 % e Avalanche com (2,5 K) 10,1 %.

Notas: Na análise ‘agrupada por blockchain’, endereços que utilizam stablecoins em várias blockchains (exemplo: Polygon e Base) são contabilizados como únicos por blockchain, originando um total superior à análise ‘não agrupada’, que elimina duplicados multichain.

Volume DEX

Fonte: https://dune.com/queries/5748360/9327460

O volume negociado em DEX no segundo trimestre de 2025 caiu 66 % para 136 M US$, face aos 404 M US$ do trimestre anterior. A Avalanche liderou com 51 % (69 M US$), seguida pela Polygon com 33 % (45 M US$) e Ethereum com 9 % (12 M US$). A descida demonstra uma transição para blockchains mais escaláveis, com Avalanche e Polygon a destacarem-se.

Fonte: https://dune.com/queries/5748398/9327527

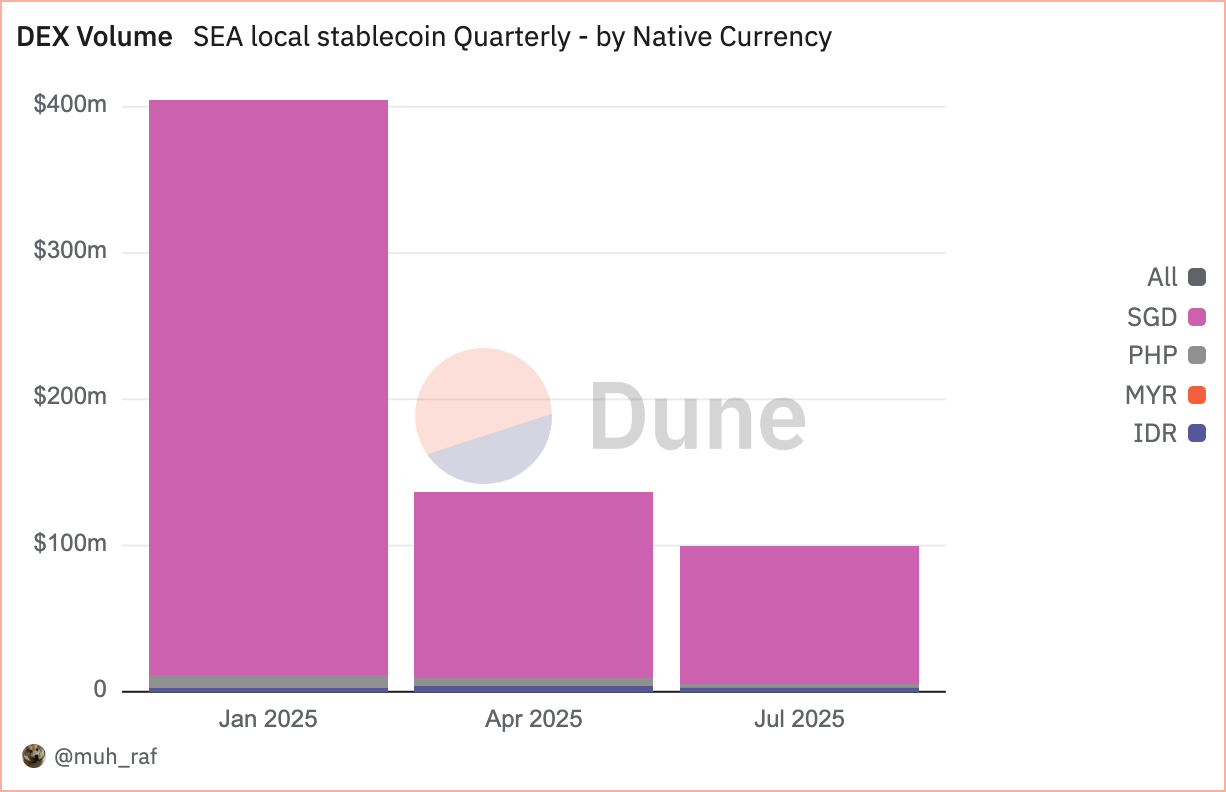

Conforme já mencionado, o volume DEX por moeda nativa no segundo trimestre de 2025 foi de 132 M US$, com os stablecoins indexados ao SGD a liderarem o mercado não USD do Sudeste Asiático. Os ativos em SGD corresponderam a 93,1 % (127 M US$), PHP a 3,9 % (5 M US$) e IDR a 2,7 % (3,6 M US$), evidenciando a supremacia do SGD na atividade DEX regional.

Stablecoins SEA: oportunidades e desafios

Oportunidades

1. Otimização do comércio transfronteiriço

Em 2023, o comércio intra-regional do SEA representou 22 % do total [5]. Contudo, as transações têm geralmente de passar pela banca correspondente em USD, gerando comissões e atrasos de até 2 dias [6]. Stablecoins ancorados em moedas SEA oferecem eficiência com liquidação quase instantânea e custos baixos. Acresce a adoção de pagamentos QR cross-border com liquidação em moeda local pelo Conselho Consultivo Empresarial da ASEAN (BAC). A cooperação entre BAC e um emissor SEA poderá reduzir taxas de remessa e melhorar taxas de câmbio [7]

2. Expansão da inclusão financeira

Há 260 milhões de habitantes no SEA sem acesso bancário [8]. Stablecoins não USD podem preencher esta lacuna. Carteiras móveis de stablecoin, integradas em soluções como GoPay (Indonésia) ou MoMo (Vietname), habilitam remessas e microtransações acessíveis.

Desafios

1. Incógnitas regulatórias e dispersão

Os modelos regulatórios divergentes no SEA geram incerteza para emissores e utilizadores de stablecoins. O contraste entre o modelo vanguardista de Singapura e restrições noutras jurisdições cria assimetria e complexidade na adesão.[4]

Recomendação: Os decisores políticos do SEA devem consensualizar um enquadramento regulatório, definindo regras de licenciamento, proteção do consumidor e conformidade AML, promovendo confiança e uniformização.

2. Volatilidade cambial e riscos de indexação

Stablecoins indexados a moedas regionais estão expostos à volatilidade local, o que pode afetar a estabilidade e confiança dos utilizadores. Reservas frágeis ou gestão deficiente acarretam riscos acrescidos.

Recomendação: Os emissores de stablecoins devem garantir reservas transparentes e totalmente colateralizadas, auditadas por terceiros independentes. A diversificação dos indexantes para cestos monetários é recomendada para mitigar riscos.

Conclusão

No segundo trimestre de 2025, o mercado de stablecoins não USD do Sudeste Asiático, impulsionado pela XSGD (única emissora indexada ao SGD), ganhou expressividade graças a parcerias com Grab e Alibaba. Presente em mais de 8 blockchains EVM, com 8 emissoras e 5 moedas nativas, registou 136 M US$ em volume DEX, especialmente em Avalanche e SGD, ainda que abaixo dos 404 M US$ do trimestre anterior (-66 %). A MAS de Singapura reforçou o quadro regulatório para stablecoins SGD e G10, enquanto Indonésia e Malásia testam sandboxes.

Esta evolução ilustra o potencial dos stablecoins não USD para impulsionar o comércio internacional e a inclusão financeira no SEA, mas desafios como dispersão regulatória, volatilidade cambial, riscos cibernéticos e infraestruturas desiguais exigem uma gestão rigorosa para garantir sustentabilidade e progresso.

Aviso Legal:

- Artigo republicado de [rafi’s Substack]. Todos os direitos de autor são do autor original [RAFI]. Caso haja qualquer objeção à republicação, contacte a equipa Gate Learn, que dará seguimento ao caso com prontidão.

- Isenção de responsabilidade: As opiniões veiculadas neste artigo pertencem exclusivamente ao autor e não constituem aconselhamento de investimento.

- As traduções do artigo para outros idiomas são realizadas pela equipa Gate Learn. Salvo indicação prévia, é proibido copiar, distribuir ou plagiar os artigos traduzidos.

Artigos relacionados

Utilização de Bitcoin (BTC) em El Salvador - Análise do Estado Atual

O que é o Gate Pay?

O que é o BNB?

O que é o USDC?

O que é Coti? Tudo o que precisa saber sobre a COTI