Gate Research: Tổng vốn huy động tăng 7,3%, các vòng gọi vốn Seed giá trị lớn nổi lên thành xu hướng trọng tâm mới|Tổng quan gây quỹ Web3 tháng 9 năm 2025

Tóm tắt

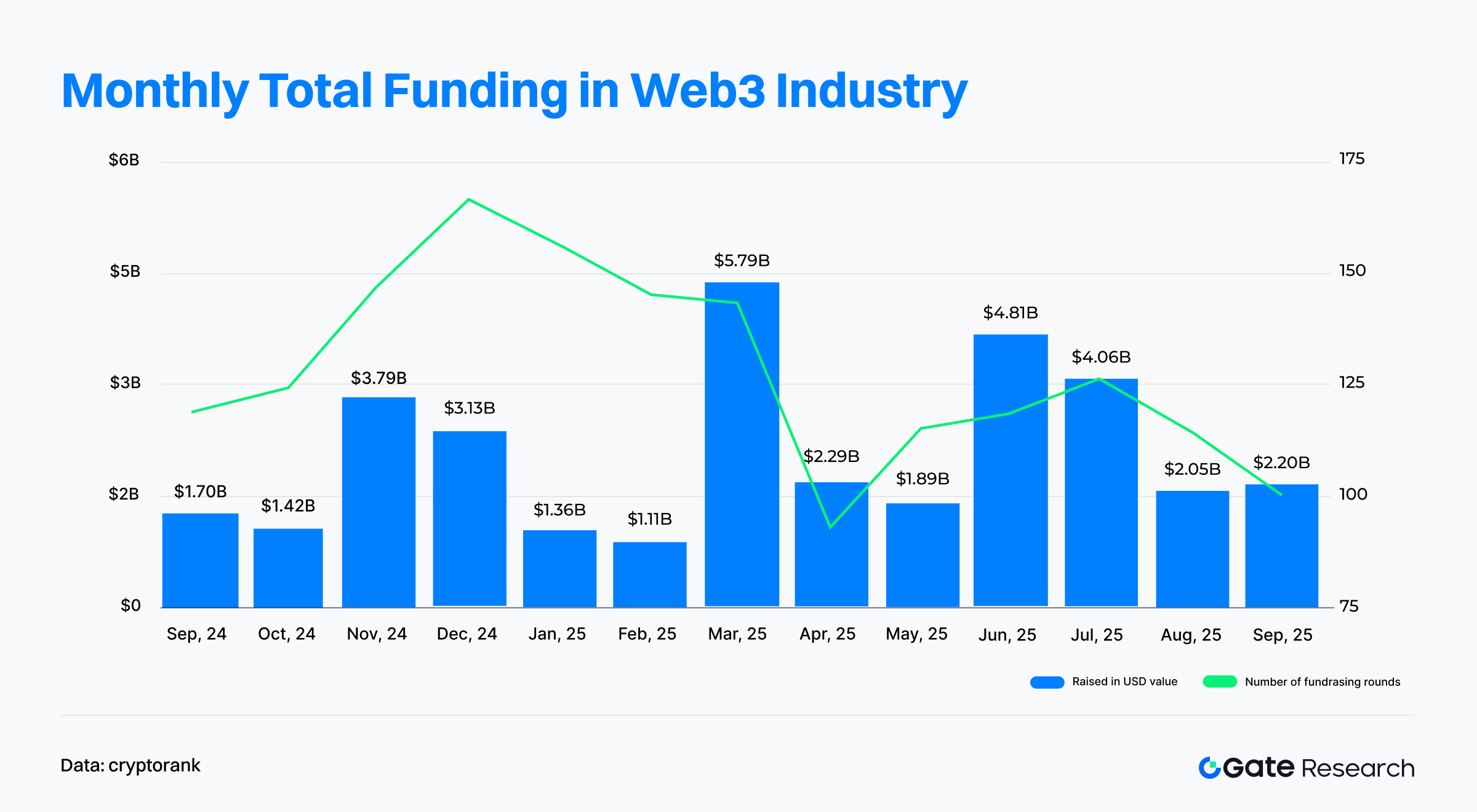

- Theo số liệu do Cryptorank công bố ngày 9 tháng 10 năm 2025, ngành Web3 đã hoàn tất 100 thương vụ gọi vốn trong tháng 9 năm 2025 với tổng vốn huy động đạt 2,2 tỷ USD. Số lượng thương vụ giảm 12,3% so với tháng trước, nhưng tổng vốn lại tăng 7,3%, phản ánh dòng tiền ngày càng hướng vào các dự án dẫn đầu và trưởng thành.

- 10 thương vụ gọi vốn lớn nhất chủ yếu thực hiện qua PIPE, IPO và nợ sau IPO — các công cụ thị trường vốn truyền thống. Động thái này cho thấy các dự án Web3 đang hội nhập nhanh với hệ thống tài chính truyền thống, tận dụng các kênh tuân thủ pháp lý để thu hút vốn tổ chức. CeFi dẫn đầu tháng vừa qua, chiếm 7/10 thương vụ lớn nhất và phần lớn tổng vốn, cho thấy dòng vốn mạnh mẽ quay lại các tổ chức tập trung với lợi suất thực và tiềm năng tuân thủ. Đồng thời, một số doanh nghiệp niêm yết đã bắt đầu chuyển vốn mới sang xây dựng ngân quỹ on-chain, kết nối sâu giữa tài chính truyền thống và blockchain.

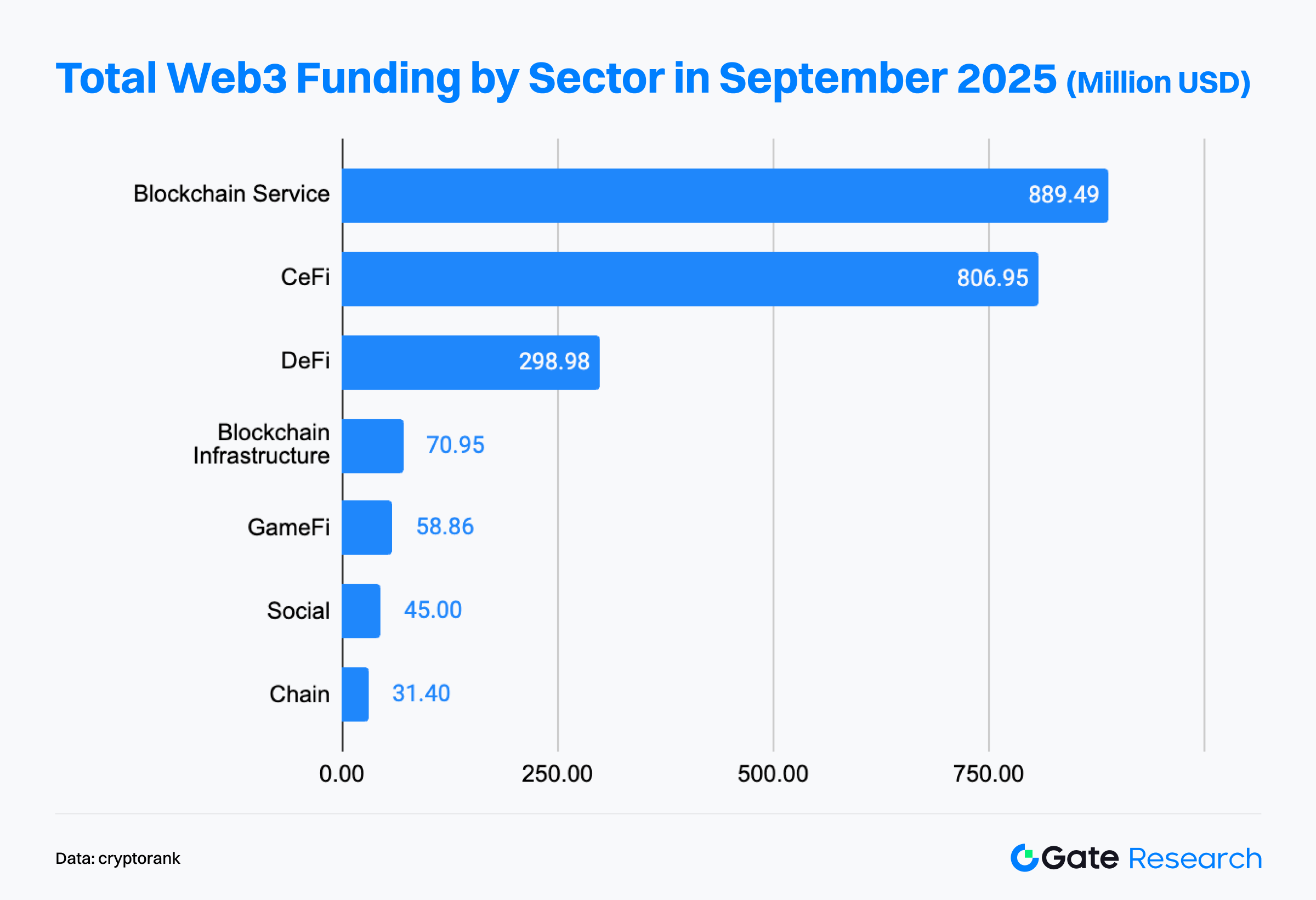

- Xét theo lĩnh vực, Blockchain Services và CeFi tạo động lực tăng trưởng kép. Blockchain Services dẫn đầu với 889 triệu USD tổng vốn huy động, vượt CeFi (806 triệu USD), thể hiện sức hấp thụ vốn bền bỉ.

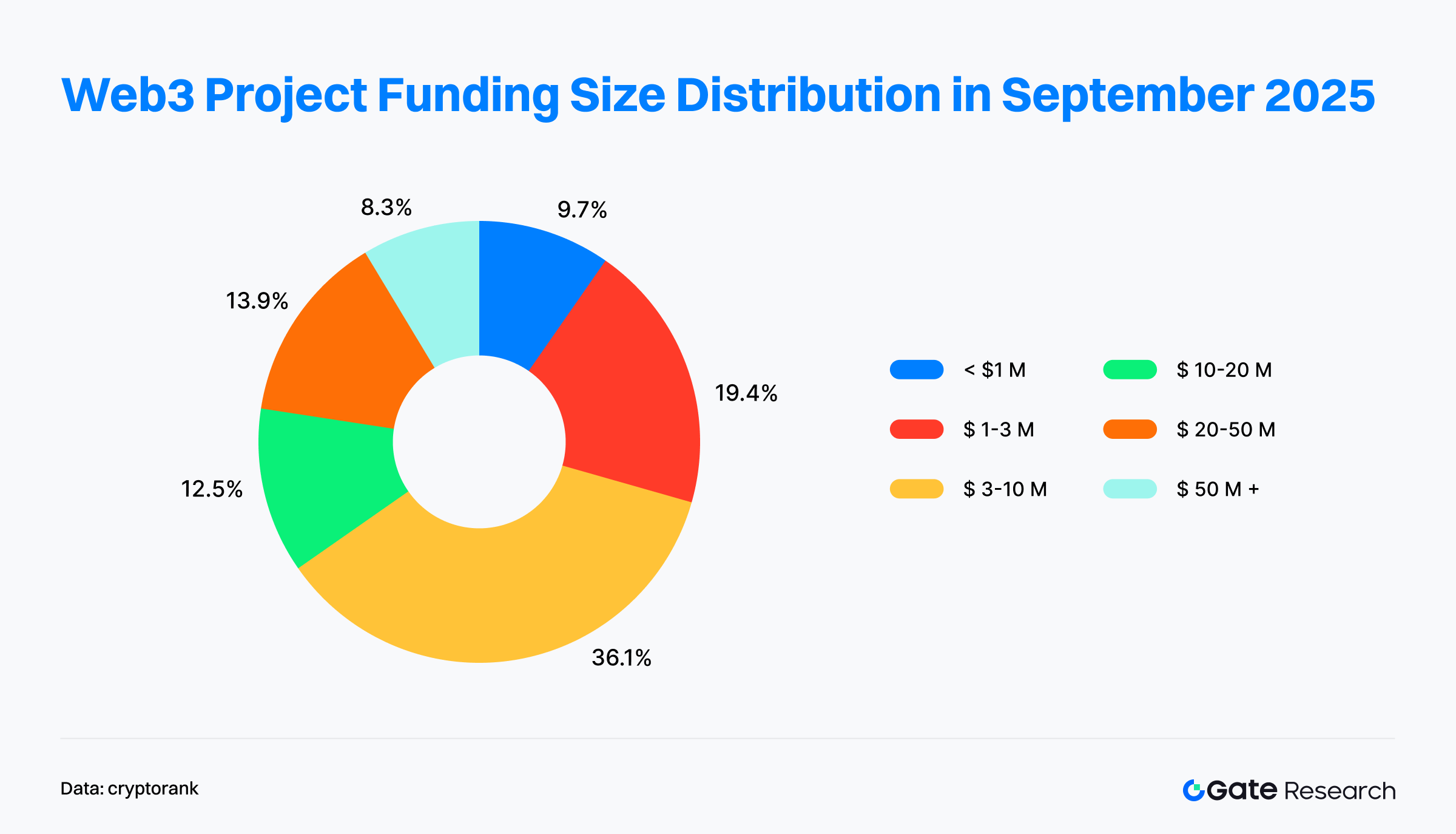

- Về cơ cấu vốn, các vòng gọi vốn quy mô vừa (3–10 triệu USD) vẫn chiếm ưu thế, khoảng một phần ba tổng thương vụ. Các vòng nhỏ (<1 triệu USD) giảm từ 15% xuống 9,7%, trong khi các vòng lớn (>50 triệu USD) tăng lên 8,3%, đóng góp phần lớn tổng vốn — minh chứng cho hiệu ứng tập trung vốn vào những dự án đầu ngành.

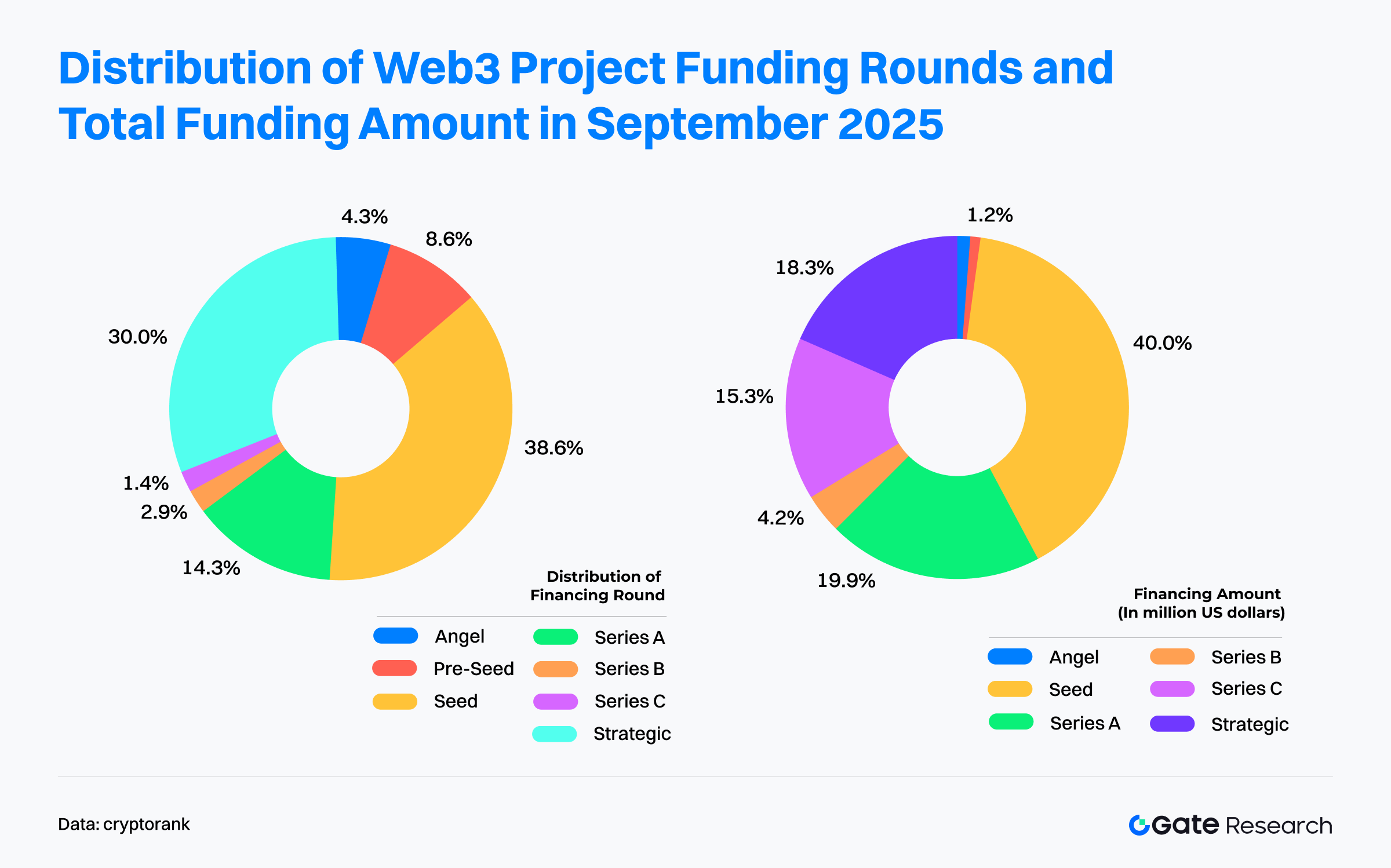

- Phân bổ vòng gọi vốn cho thấy xu hướng “vòng hạt giống chiếm ưu thế, giữa và cuối chọn lọc”. Vòng hạt giống là trọng tâm tháng 9, chiếm 38,6% tổng số thương vụ và 40% tổng vốn, dẫn đầu cả về số lượng lẫn quy mô vốn.

- Về phía nhà đầu tư, Coinbase Ventures vẫn là đơn vị hoạt động tích cực nhất, đầu tư đa lĩnh vực gồm Blockchain Services, CeFi, DeFi và Social.

Tổng quan huy động vốn

Theo Cryptorank Dashboard ngày 9 tháng 10 năm 2025, ngành Web3 ghi nhận 100 thương vụ gọi vốn trong tháng 9 năm 2025 với tổng giá trị 2,2 tỷ USD【1】. Lưu ý, do khác biệt phương pháp thống kê, con số này chênh lệch nhẹ so với tổng hợp các thương vụ riêng lẻ (khoảng 6,803 tỷ USD). Chênh lệch chủ yếu xuất phát từ các khoản dự trữ crypto chiến lược, phát hành riêng lẻ và các thương vụ liên quan IPO chưa được Cryptorank ghi nhận. Báo cáo này sử dụng dữ liệu gốc từ Cryptorank Dashboard làm chuẩn phân tích để đảm bảo nhất quán.

So với tháng 8 (114 thương vụ, 2,05 tỷ USD), tháng 9 ghi nhận số thương vụ giảm 12,28% nhưng tổng vốn tăng 7,3%. Xu hướng “ít thương vụ, giá trị lớn” này chủ yếu nhờ một số thương vụ quy mô lớn. Ví dụ, Fnality (công ty thanh toán blockchain) huy động 136 triệu USD ở vòng Series C, và quy mô trung bình các thương vụ vòng hạt giống cũng tăng mạnh — nổi bật là Flying Tulip gọi vốn 200 triệu USD ở vòng hạt giống, nâng tổng quy mô vốn lên đáng kể.

Về diễn biến từ đầu năm, đỉnh gọi vốn rơi vào tháng 3 năm 2025 (5,79 tỷ USD), chủ yếu nhờ các thương vụ siêu lớn. Hoạt động giảm trong tháng 4–5, nhưng phục hồi vào tháng 6 và 7, tạo đợt tăng trưởng giữa năm với 4,81 tỷ USD và 4,06 tỷ USD. Đáng chú ý, số thương vụ đạt đỉnh tháng 12 năm 2024, trước khi quy mô vốn đạt đỉnh, cho thấy các vòng nhỏ và vừa chiếm ưu thế ở giai đoạn đầu thị trường.

Nửa cuối năm 2025, tốc độ gọi vốn chậm lại nhưng tháng 8 và tháng 9 đều duy trì mức trên 2 tỷ USD mỗi tháng — phản ánh niềm tin mạnh mẽ của nhà đầu tư vào đổi mới Web3 và nền tảng dài hạn. Bất chấp biến động về số lượng thương vụ, Web3 vẫn liên tục hút hàng tỷ USD vốn đầu tư mạo hiểm trong năm qua, cho thấy sự chuyển dịch từ “đầu cơ tần suất cao” sang “triển khai vốn chọn lọc, hướng chất lượng”. Nhà đầu tư tập trung vào các dự án có mô hình kinh doanh rõ ràng và giá trị hệ sinh thái dài hạn, đánh dấu bước chuyển sang giai đoạn trưởng thành và phân hóa.

Một số thương vụ lớn qua kênh vốn truyền thống không được ghi nhận đầy đủ trong thống kê hàng tháng, nhưng dữ liệu Fundraising Rounds của Cryptorank cho thấy công cụ tài chính truyền thống chiếm ưu thế trong Top 10 thương vụ lớn【2】. Đa số các thương vụ này thực hiện qua PIPE, IPO và nợ sau IPO — các cơ chế đặc trưng của thị trường vốn truyền thống. Xu hướng này cho thấy các dự án Web3 trưởng thành đang hội nhập sâu với hệ thống tài chính truyền thống, tận dụng kênh tuân thủ để thu hút vốn tổ chức. Ngành bước vào giai đoạn hội nhập và phân bổ vốn tinh vi hơn.

Xét theo lĩnh vực, CeFi chiếm ưu thế tuyệt đối trong Top 10, với 7 vị trí và phần lớn tổng vốn. Điều này phản ánh dòng tiền đang quay về các tổ chức tập trung với mô hình lợi suất thực và tiềm năng tuân thủ pháp lý. Đáng chú ý, khi “tài sản hóa ngân quỹ on-chain” nổi lên như một chiến lược mới, một số công ty đại chúng và tổ chức tài chính đã công khai ý định dùng vốn huy động để xây dựng ngân quỹ chuyên biệt trên blockchain, tạo mô hình triển khai vốn quy mô lớn mới.

- Forward Industries (1,65 tỷ USD) và Helius Medical Technologies (500 triệu USD) dùng PIPE để xây ngân quỹ hệ sinh thái Solana (SOL).

- ETHZilla (350 triệu USD) tập trung vào phân bổ tài sản trên Ethereum, cho thấy token chuỗi công khai đã được tích hợp vào bảng cân đối doanh nghiệp.

- Figure (787 triệu USD, IPO) và StablecoinX (530 triệu USD, PIPE) tập trung vào dịch vụ tài chính blockchain và hạ tầng giao thức Ethena, củng cố xu hướng tổ chức hóa và tài chính hóa CeFi.

Bên ngoài CeFi, các dự án dịch vụ và hạ tầng blockchain như Rapyd, AlloyX, Fnality cũng thu hút vốn lớn, khẳng định đà tăng trưởng ở mảng thanh toán và thanh toán xuyên biên giới. Lĩnh vực DeFi cũng có điểm sáng: Flying Tulip gọi vốn kỷ lục 200 triệu USD ở vòng hạt giống, đánh dấu sự trở lại của niềm tin nhà đầu tư với các sản phẩm phái sinh và lợi suất cấu trúc.

Tóm lại, Top 10 thương vụ tháng 9 năm 2025 phản ánh sự chuyển dịch mạnh mẽ của dòng vốn Web3:

- Vốn truyền thống dẫn đầu các thương vụ lớn.

- CeFi là cửa ngõ chính cho dòng vốn tổ chức.

- Hạ tầng và thanh toán duy trì đà tăng trưởng.

- Đổi mới DeFi lấy lại sức hút.

Logic triển khai vốn chuyển từ “đuổi theo công nghệ mới” sang cân bằng giữa tuân thủ, lợi suất bền vững và đồng bộ hệ sinh thái — đánh dấu chu kỳ vốn mới của Web3.

Dữ liệu Cryptorank Dashboard cho thấy, bức tranh huy động vốn Web3 tháng 9 năm 2025 thể hiện rõ mô hình “hai động lực”, với Blockchain Services và CeFi nổi lên dẫn đầu. Blockchain Services dẫn đầu với 889 triệu USD, vượt qua CeFi, cho thấy dòng tiền đang chảy về các dự án nền tảng cho hệ sinh thái Web3 như nền tảng công nghệ, dịch vụ dữ liệu, giải pháp. Những “đơn vị hạ tầng” này được xem là yếu tố then chốt để mở rộng ngành và tăng hiệu quả hoạt động.

CeFi theo sát với 806 triệu USD, thể hiện năng lực hấp thụ vốn mạnh. Hai lĩnh vực dẫn đầu này chiếm hơn 1,6 tỷ USD vốn gọi, phản ánh niềm tin chiến lược của thị trường vào hạ tầng tài chính và hệ thống dịch vụ.

Tầng ứng dụng, DeFi duy trì ổn định với 298 triệu USD, xếp thứ ba. Dù sức hút chung đã giảm, trọng tâm đầu tư chuyển từ dự án rủi ro cao sang sản phẩm tạo lợi suất thực và cơ chế vững chắc như phái sinh on-chain, giao thức cho vay, nền tảng tổng hợp lợi suất, thể hiện niềm tin vào đổi mới tài chính bền vững.

Ngược lại, Blockchain Infrastructure chỉ huy động khoảng 70,95 triệu USD, tiến độ đổi mới nền tảng vẫn ổn định. GameFi (58,86 triệu USD) và Social (45 triệu USD) có mức phân bổ vốn thấp hơn, phản ánh tiêu chuẩn đầu tư cao hơn cho dự án ứng dụng trong môi trường vốn hạn chế. Ngành Chain chỉ huy động 31,4 triệu USD, cho thấy câu chuyện về chuỗi mới đã hạ nhiệt.

Tổng thể, dữ liệu gọi vốn tháng 9 minh họa sự thay đổi logic phân bổ vốn Web3: dòng tiền chuyển từ dự án ứng dụng rủi ro cao sang các lĩnh vực dịch vụ và tài chính ổn định, hình thành mô hình “dịch vụ dẫn đầu, tài chính làm chủ”. Hạ tầng và nền tảng dịch vụ ngày càng thay thế các câu chuyện tài chính đơn lẻ, trở thành tâm điểm của chu kỳ vốn tiếp theo.

Trong 72 vòng gọi vốn Web3 công bố tháng 9 năm 2025, các vòng quy mô vừa (3–10 triệu USD) vẫn chủ đạo, hơn một phần ba tổng số thương vụ, cho thấy dòng tiền vẫn ưu tiên các dự án giai đoạn đầu có tiềm năng tăng trưởng. Các vòng 1–3 triệu USD chiếm 19,4%, tăng so với 12,5% tháng trước, chứng minh sức bền của dự án ươm tạo và hạt giống trong môi trường vốn thắt chặt, với nhà đầu tư ưu tiên startup có đột phá công nghệ hoặc ứng dụng rõ ràng. Ngược lại, các vòng nhỏ dưới 1 triệu USD giảm từ 15% xuống 9,7%, phản ánh sự thận trọng với dự án thuần ý tưởng.

Với các vòng trung - cuối, dự án gọi vốn 10–50 triệu USD giữ tỷ trọng ổn định, dòng tiền tập trung vào dự án hạ tầng và dịch vụ tài chính có mô hình kinh doanh trưởng thành, đồng bộ hệ sinh thái. Đáng chú ý, tỷ trọng các vòng lớn 20–50 triệu USD và trên 50 triệu USD đều tăng. Dù các dự án trên 50 triệu USD chỉ chiếm 8,3% số vòng, nhưng đóng góp phần lớn tổng vốn, thể hiện hiệu ứng hút vốn của dự án đầu ngành và xu hướng tập trung hóa dòng tiền.

Tóm lại, bức tranh gọi vốn tháng 9 cho thấy “phân cực nhưng cấu trúc vững”: một cực liên tục hút vốn vào dự án sáng tạo giai đoạn đầu có tiềm năng đột phá, cực còn lại tập trung vào doanh nghiệp trưởng thành đã xác thực thị trường và có doanh thu rõ ràng. Dòng vốn thị trường ngày càng ưu tiên dự án “gần kỳ lân” với năng lực bảo vệ dài hạn, khả năng mở rộng mạnh.

Trong 67 vòng gọi vốn Web3 công bố tháng 9 năm 2025, thị trường thể hiện rõ mô hình “vòng hạt giống chiếm ưu thế cả về số lượng lẫn quy mô, các vòng giữa - cuối chọn lọc kỹ lưỡng”.

Tập trung cao ở vòng hạt giống: vốn ủng hộ sáng tạo giai đoạn đầu: Vòng hạt giống là trọng tâm gọi vốn tháng này, chiếm khoảng 38,6% tổng thương vụ và 40% tổng vốn, dẫn đầu cả về số lượng lẫn quy mô. Tập trung này chủ yếu nhờ các vòng lớn như Flying Tulip gọi 200 triệu USD ở vòng hạt giống. Dòng tiền vẫn ưu tiên dự án đầu giai đoạn tiềm năng lớn, nhưng chọn lọc hơn, tập trung vào dự án có cơ chế đổi mới, mô hình lợi suất thực hoặc mở ra câu chuyện mới, sẵn sàng giải ngân lớn để nắm bắt cơ hội tăng trưởng sớm.

Đồng bộ chiến lược, giữa - cuối chọn lọc: Các vòng chiến lược duy trì hoạt động mạnh, chiếm khoảng 30% dự án, thể hiện đồng bộ hệ sinh thái sâu giữa dự án trưởng thành và tổ chức lớn, với vốn tham gia qua đầu tư chiến lược hướng tới phát triển hệ sinh thái và tích hợp chiều sâu. Khác các tháng trước, Series A/B không còn chiếm ưu thế về vốn, tháng 9 Series A và B cộng lại chiếm 24,1% tổng vốn, thể hiện mô hình “duy trì ổn định”. Đáng chú ý, Series C dù chỉ 1,4% số dự án nhưng đóng góp 15,3% tổng vốn (ví dụ Fnality), nhấn mạnh quy mô vốn mỗi vòng ở giai đoạn cuối.

Cẩn trọng với ươm tạo giai đoạn sớm: Ngược lại, các vòng angel và pre-seed khá hạn chế, chiếm khoảng 12,9% thương vụ nhưng chưa tới 2,5% tổng vốn, thể hiện sự thận trọng với dự án rất sớm. Thị trường chuyển sang chu kỳ đầu tư tinh lọc, tập trung xác thực kinh doanh.

Tổng thể, cấu trúc gọi vốn tháng 9 phản ánh mô hình mới “tập trung đầu giai đoạn, giữa - cuối chọn lọc, đồng bộ chiến lược”: đổi mới giai đoạn đầu vẫn là trọng tâm, nhưng mức tập trung cao hơn; gọi vốn giữa - cuối hợp lý, hỗ trợ dự án đầu ngành có doanh thu bền vững, đồng bộ hệ sinh thái. Xu hướng này cho thấy thị trường Web3 chuyển từ “chu kỳ thử nghiệm vốn” sang “chu kỳ chọn lọc giá trị”, bước vào giai đoạn hướng chất lượng và tăng trưởng bền vững.

Theo Cryptorank ngày 9 tháng 10 năm 2025, các nhà đầu tư tổ chức hoạt động mạnh nhất tháng 9 gồm Coinbase Ventures, Mirana Ventures và Paradigm, dẫn đầu về số lượng dự án đầu tư và tiếp tục chiếm ưu thế ở lĩnh vực giai đoạn sớm. Coinbase Ventures là tổ chức đầu tư nhiều nhất, đa lĩnh vực gồm Blockchain Service, CeFi, DeFi và Social, thể hiện chiến lược đầu tư hệ sinh thái, hệ thống hóa. Mirana Ventures và Paradigm tập trung vào hạ tầng blockchain và DeFi, duy trì chiến lược hai động lực xoay quanh đổi mới công nghệ, phái sinh tài chính.

DeFi và Blockchain Service vẫn là mục tiêu đầu tư chủ đạo, cho thấy thị trường dịch chuyển trọng tâm từ đổi mới tài chính đơn tầng sang phát triển bền vững kết hợp cả dịch vụ và lợi suất. Ngược lại, Social, GameFi và NFT có tỷ lệ gọi vốn thấp hơn, phản ánh dự án ứng dụng phải vượt rào cản xác thực kinh doanh, tăng trưởng người dùng cao hơn trong môi trường vốn hạn chế.

Tổng thể, đầu tư tổ chức tháng 9 cho thấy logic phân bổ vốn dịch chuyển từ “dẫn dắt bởi câu chuyện” sang “dẫn dắt bởi cấu trúc”. Tổ chức hàng đầu tăng đầu tư vào hạ tầng và dịch vụ, tổ chức trung bình ưu tiên liên kết hệ sinh thái, đổi mới ứng dụng, và logic đầu tư thị trường tiến đến giai đoạn trưởng thành, phân hóa.

Dự án nổi bật của tháng

Flying Tulip

Tổng quan: Flying Tulip là sàn giao dịch on-chain cung cấp giao dịch giao ngay, hợp đồng vĩnh viễn, cho vay, quyền chọn và sản phẩm lợi suất cấu trúc. Nền tảng kết hợp AMM tự động với sổ lệnh, hỗ trợ cho vay điều chỉnh biến động và nạp tiền xuyên chuỗi, mang lại trải nghiệm DeFi thống nhất.【3】

Ngày 30 tháng 9, Flying Tulip hoàn tất vòng hạt giống riêng tư trị giá 200 triệu USD, token FDV đạt 1 tỷ USD. Dự án sắp mở bán công khai token FT, mục tiêu huy động 800 triệu USD ở mức định giá 1 tỷ USD.【4】

Nhà đầu tư / Backer angel: Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, Sigil Fund, Susquehanna Crypto, Tioga Capital, Virtuals Protocol và các đơn vị khác.

Điểm nổi bật:

- Flying Tulip cho phép nhà đầu tư cá nhân hoặc tổ chức đốt token FT bất kỳ lúc nào để nhận lại gốc bằng tài sản ban đầu (ví dụ ETH). Cơ chế này tạo “sàn bảo vệ rủi ro” vẫn giữ tiềm năng tăng giá — bảo hiểm chưa từng có trên DeFi.

- Nền tảng tích hợp giao dịch giao ngay, hợp đồng vĩnh viễn, quyền chọn, cho vay, bảo hiểm và stablecoin gốc (ftUSD) trong một hệ sinh thái duy nhất. Sử dụng đường cong điều chỉnh biến động, AMM thích ứng, định tuyến thông minh tối ưu hóa thực thi lệnh giới hạn. Hợp đồng vĩnh viễn được tất toán nội bộ, không phụ thuộc oracle ngoài, duy trì phi tập trung và giảm rủi ro thanh lý.

- Flying Tulip tránh mô hình thưởng thiếu bền vững. Vốn ban đầu triển khai vào DeFi rủi ro thấp, duy trì hoạt động đến khi sản phẩm tự cân bằng. Doanh thu từ phí giao dịch, chênh lệch cho vay, thanh lý, bảo hiểm sẽ mua lại token, tạo chu kỳ giảm phát tự nhiên, khuyến khích nắm giữ lâu dài và hỗ trợ nền kinh tế token bền vững.

Aria

Tổng quan: Aria là nền tảng token hóa tài sản IP xây dựng trên blockchain Story, chuyển đổi nhạc, nghệ thuật, phim và IP khác thành tài sản giao dịch on-chain. Phát triển bởi Aria Protocol Labs Inc. và Aria Foundation, Aria giải quyết vấn đề thanh khoản, minh bạch định giá trên thị trường IP truyền thống.【5】

Ngày 3 tháng 9, Aria hoàn tất vòng hạt giống và chiến lược trị giá 15 triệu USD, định giá sau đầu tư đạt 50 triệu USD. Vốn này dùng mở rộng sang các phân khúc IP mới như nghệ thuật, phim và thúc đẩy triển khai hệ sinh thái token hóa IP toàn cầu.【6】

Nhà đầu tư: Polychain Capital, Neoclassic Capital, Story Protocol Foundation và các đơn vị khác.

Điểm nổi bật:

- Aria không chỉ token hóa IP mà còn xây dựng hệ sinh thái tài chính hoàn chỉnh, cho phép phân mảnh, thanh khoản và tài chính hóa IP. Quyền sở hữu được bảo vệ qua hợp đồng thông minh, đảm bảo sở hữu rõ ràng, tự động phân phối doanh thu. Xây dựng trên Story blockchain, tích hợp quản lý bản quyền, chi trả tự động, quản lý toàn bộ vòng đời và luân chuyển giá trị IP nhạc, phim, nghệ thuật, đảm bảo tuân thủ, mở rộng.

- Aria ra mắt token IP nhạc đầu tiên - APL, đại diện quyền nhận royalty cho nghệ sĩ hàng đầu như Justin Bieber, BLACKPINK, BTS. Qua Stakestone’s LiquidityPad, Aria huy động 10,95 triệu USD mua quyền nhạc. Chủ token stake APL nhận royalty thời gian thực, minh chứng năng lực vận hành, dòng tiền. Hợp tác với Story Protocol, Contents Technologies mở rộng sang thị trường nhạc Hàn Quốc (hơn một nửa phân phối nhạc toàn cầu), tạo nguồn IP lớn, tiềm năng thương mại cao.

- Doanh thu hiện tại đến từ phát hành IP, giao dịch, phí quản lý. Để thúc đẩy hệ sinh thái, một số khoản phí tạm miễn nhằm thu hút nhà sáng tạo, người dùng. Về lâu dài, Aria xây dựng hệ doanh thu đa tầng gồm phí giao dịch, quản lý tài sản, cấp phép, dịch vụ hệ sinh thái, đảm bảo tăng trưởng bền vững.

Wildcat Labs

Tổng quan: Wildcat Labs là giao thức cho vay trên Ethereum cho phép người vay tự thiết lập thông số khoản vay, triển khai hạn mức tín dụng thế chấp thấp phù hợp nhu cầu. Người cho vay hưởng cơ chế lãi suất, rút tiền đổi mới.【7】

Ngày 5 tháng 9, Wildcat Labs gọi vốn thành công 3,5 triệu USD ở vòng hạt giống do Robot Ventures dẫn dắt, nhằm mở rộng ứng dụng cho vay thế chấp on-chain.【8】

Nhà đầu tư: Robot Ventures, Triton Capital, Polygon Ventures, Safe Foundation, Hyperithm, Hermeneutic Investments, Kronos Research và các đơn vị khác.

Điểm nổi bật:

- Wildcat không trực tiếp thẩm định khoản vay; người vay tự thiết lập thông số (tỷ lệ dự trữ, lịch rút tiền, danh sách trắng), tạo thị trường tín dụng linh hoạt “cá nhân hóa”. Khác mô hình thế chấp cao như Aave, Compound, Wildcat hỗ trợ khoản vay thế chấp thấp hoặc một phần, tối ưu hiệu quả sử dụng vốn.

- Tất cả dữ liệu khoản vay, chỉ số rủi ro minh bạch on-chain, đảm bảo niềm tin cho người cho vay. Phiên bản V2 trên Ethereum mainnet chi phí chỉ 0,06969 ETH (~180 USD), hiệu quả kỹ thuật cao. Giao thức thu phí 5% trên lãi suất để tạo doanh thu ổn định.

- Nền tảng đã cung cấp hạn mức tín dụng cho Wintermute, Amber Group, Keyrock, hỗ trợ vay cầu nối sau sự cố bảo mật. Cơ chế bán token Plasma (XPL) giúp nhà đầu tư sớm nhận lãi suất cố định, arbitrage giá trước khi token niêm yết.

- Giao thức hiện quản lý 150 triệu USD dư nợ, tổng vốn cho vay đạt 368 triệu USD từ khi ra mắt V2 tháng 2 năm 2025, tăng trưởng mạnh. TVL hiện khoảng 13 triệu USD, phản ánh nhu cầu thị trường cao, mở rộng liên tục.

Share

Tổng quan: Share là ứng dụng giao dịch xã hội on-chain cho di động trên Solana, Base, Ethereum. Người dùng hiển thị giao dịch cá nhân, theo dõi ví bất kỳ, xem biểu đồ thời gian thực, tương tác trực tiếp với ví on-chain, tạo trải nghiệm “xã hội + giao dịch” liền mạch.【9】

Ngày 25 tháng 9, Scott Gray (sáng lập Genie) ra mắt Share và gọi vốn thành công 5 triệu USD.【10】

Nhà đầu tư / Backer angel: Coinbase Ventures, Collab+Currency, Palm Tree Crypto và các đơn vị khác.

Điểm nổi bật:

- Share tích hợp nền tảng xã hội, khám phá blockchain, ví crypto trong một ứng dụng, là ứng dụng giao dịch xã hội on-chain bản địa đầu tiên trên iOS. Ứng dụng index toàn bộ giao dịch trên Solana, Base, Ethereum, biến dữ liệu on-chain thành dòng thông tin xã hội trực quan, tương tác.

- Mỗi địa chỉ ví có hồ sơ cá nhân riêng trên Share. Người dùng không cần đăng ký vẫn được tạo danh tính on-chain. Người dùng xem biểu đồ, theo dõi ví khác, giao dịch token, chia sẻ giao dịch dưới dạng bài đăng xã hội.

- Tầm nhìn cốt lõi là “biến mọi giao dịch thành thông tin tài chính chia sẻ”. Chuyển giao dịch on-chain thành dòng nội dung, Share hé lộ niềm tin, kỳ vọng sau dòng vốn, biến giao dịch thành trải nghiệm xã hội, biểu đạt nội dung. Cách tiếp cận này tăng minh bạch, tạo gắn kết cho giao dịch và mở ra phương thức biểu đạt xã hội mới cho người dùng Web3.

Perle

Tổng quan: Titan là nền tảng tổng hợp giao dịch phi tập trung (DEX aggregator) thế hệ mới xây dựng trên Solana, cung cấp cho người dùng trải nghiệm giao dịch hiệu quả, minh bạch qua tổng hợp thông minh thanh khoản, tối ưu hóa thực thi, tăng cường bảo mật. Titan tích hợp nhiều DEX aggregator hàng đầu trên một nền tảng, so sánh báo giá thời gian thực, tự động định tuyến giao dịch tối ưu, đảm bảo người dùng luôn giao dịch ở giá tốt nhất.【11】

Ngày 19 tháng 9, Titan gọi vốn thành công 7 triệu USD ở vòng hạt giống do Galaxy Ventures dẫn dắt, thúc đẩy Titan thành cổng trung tâm cho thị trường vốn internet.【12】

Nhà đầu tư: Galaxy Ventures, Frictionless, Mirana, Ergonia, Auros, Susquehanna và các đơn vị khác.

Điểm nổi bật:

- Đổi mới cốt lõi của Titan nằm ở thuật toán Talos Gateway Routing. Khác DEX aggregator truyền thống, Titan không chỉ tổng hợp nhiều nguồn thanh khoản mà còn cam kết thực thi tối ưu không phí cho người dùng. Thuật toán này vượt trội hơn 80% trường hợp, tối ưu giảm trượt giá do chậm thực hiện, đặc biệt trong thị trường biến động.

- Titan là meta-aggregator đầu tiên trên Solana. API Titan Prime là API giao dịch on-chain hiệu suất cao nhất Solana, hỗ trợ nền tảng, trader toàn hệ sinh thái. API kết nối toàn bộ router lớn, so sánh báo giá, xử lý tính toán phức tạp, tiêu tốn tài nguyên lớn.

- Titan phát triển router aggregator riêng — Argos, thành phần cốt lõi Titan Prime API. Argos vượt trội đối thủ 70–75% trường hợp, đảm bảo kỹ thuật để người dùng nhận giá giao dịch tốt nhất trên Solana.

- Titan hoàn tất thử nghiệm riêng tư, hiện truy cập công khai qua titan.exchange. Giai đoạn thử nghiệm, nền tảng xử lý hơn 1,5 tỷ USD giao dịch giao ngay.

Kết luận

Tháng 9 năm 2025, ngành Web3 ghi nhận 2,2 tỷ USD vốn huy động qua 100 thương vụ, thể hiện xu hướng “ít thương vụ, định giá cao”. CeFi và dịch vụ blockchain là động lực kép cho dòng vốn, tạo thế cân bằng giữa tổ chức tài chính với mô hình lợi suất thực và nền tảng công nghệ hạ tầng. Sử dụng thường xuyên các công cụ tài chính truyền thống như PIPE, IPO, nợ sau IPO cho thấy tốc độ hội nhập ngày càng tăng giữa Web3 và thị trường vốn truyền thống, với các kênh gọi vốn tuân thủ, trưởng thành.

Về cơ cấu vốn, logic thị trường thể hiện xu hướng “tập trung mạnh ở đầu, cuối chọn lọc bền vững”. Vòng hạt giống chiếm ưu thế số lượng (~38,6%) và vốn (40%), phản ánh sẵn sàng đầu tư lớn vào dự án sáng tạo đột phá như Flying Tulip.

Dự án đổi mới trọng điểm tập trung giải quyết vấn đề cốt lõi ngành, thúc đẩy tăng trưởng bền vững:

- DeFi: Flying Tulip mang đến cơ chế bảo vệ rủi ro “Perpetual Put”, mô hình vận hành lấy lợi suất làm trung tâm; Wildcat Labs nâng cao hiệu quả vốn qua thị trường tín dụng tùy chỉnh, thúc đẩy tổ chức hóa, bền vững DeFi.

- Tầng ứng dụng: Aria tài sản hóa, tài chính hóa IP, khai phá giá trị bản quyền thực tế; Share tích hợp ví, giao dịch, xã hội, nâng trải nghiệm giao dịch on-chain.

- Tầng hạ tầng: Titan tối ưu định tuyến thanh khoản với thuật toán meta-aggregation hiệu suất cao, không phí, tối đa hóa hiệu quả, hỗ trợ ứng dụng quy mô lớn toàn ngành.

Tổng thể, bức tranh gọi vốn tháng 9 phản ánh sự chuyển dịch logic vốn Web3 — từ đuổi theo ý tưởng sang xây dựng giá trị cấu trúc, từ đầu cơ ngắn hạn sang kiến tạo dài hạn. Dòng tiền tái định hướng về niềm tin, lợi suất, tuân thủ. Với tổ chức hóa CeFi, nền tảng hóa dịch vụ blockchain, tinh lọc DeFi, Web3 bước vào chu kỳ vốn mới do tài chính truyền thống đồng kiến tạo, đồng hành cùng lợi suất thực.

Tham khảo:

- Cryptorank , https://cryptorank.io/funding-analytics

- Cryptorank, https://cryptorank.io/funding-rounds

- Flying Tulip, https://flyingtulip.com/

- The Block, https://www.theblock.co/post/372787/andre-cronje-flying-tulip-funding-crypto-token-valuation?utm_source=twitter&utm_medium=social

- Aria, https://ariaprotocol.xyz/

- X, https://x.com/Aria_Protocol/status/1963271027406074217

- Wildcat Labs, https://app.wildcat.finance/lender

- The Block, https://www.theblock.co/post/369453/wildcat-labs-3-5-million-usd-round-robot-ventures

- Share, https://about.share.xyz/

- Blockworks, https://blockworks.co/news/social-trading-app-fundraise

- Titan, https://titan.exchange/

- The Block, https://www.theblock.co/press-releases/371306/titan-raises-7m-seed-from-galaxy-ventures-and-launches-publicly-on-solana

Gate Research là nền tảng nghiên cứu blockchain và tiền điện tử toàn diện, cung cấp nội dung chuyên sâu cho độc giả gồm phân tích kỹ thuật, insight thị trường, nghiên cứu ngành, dự báo xu hướng, phân tích chính sách vĩ mô.

Miễn trừ trách nhiệm

Đầu tư vào thị trường tiền điện tử tiềm ẩn rủi ro cao. Người dùng cần tự nghiên cứu, nhận thức rõ bản chất tài sản, sản phẩm trước khi quyết định đầu tư. Gate không chịu trách nhiệm với bất kỳ tổn thất hoặc thiệt hại nào phát sinh từ các quyết định đầu tư.

Bài viết liên quan

Quantitative Easing (QE) và Quantitative Tightening (QT) là gì?

Hướng dẫn về Bộ Tư pháp Hiệu quả (DOGE)

Nghiên cứu của Gate: bitcoin điều chỉnh sau khi vượt qua mốc 70.000 đô la, số giao dịch trên chuỗi của Solana vượt qua Ethereum

Gate Research: Thị trường Crypto ổn định và phục hồi, Bitcoin thử nghiệm 57.600 đô la, Ethereum gặp khó khăn

Tác động của việc mở khóa Token đến giá cả