Penerapan Pola Moving Average Array - Short Pattern

Apa itu larik rata-rata pergerakan pendek?

Sebuah array rata-rata bergerak pendek termasuk grafik Candlestick, serta rata-rata bergerak jangka pendek, menengah, dan panjang, yang diurutkan dari atas ke bawah dan semuanya menunjuk ke bawah. Misalnya, jika Anda menemukan grafik Candlestick, MA5, MA30, MA60, dan MA120 tersusun dari atas ke bawah dan menuju ke bawah dalam grafik Candlestick harian, Anda dapat menentukan bahwa garis-garis tersebut tersusun dalam bentuk pola pendek.

Ketika muncul array rata-rata bergerak yang panjang, itu berarti semua posisi mengalami kerugian dalam setiap periode rata-rata bergerak, dan pasar berada dalam tren bearish.

Identitas singkat array rata-rata bergerak

- Ini muncul di pasar yang sedang menurun;

- Grafik lilin dan rata-rata bergerak jangka pendek, menengah, dan panjang disusun dari atas ke bawah dan menunjuk ke bawah. Dalam kebanyakan kasus, semua rata-rata bergerak, terlepas dari periode, bergerak dalam jalur lengkung ke bawah.

Indikasi dari array rata-rata bergerak pendek

Implikasi dari array rata-rata bergerak pendek:

munculnya pola ini sering diikuti oleh pasar yang negatif, sehingga menjadi sinyal bagi para trader untuk melakukan posisi pendek. Prosesnya adalah sebagai berikut: harga naik untuk jangka waktu tertentu lalu turun untuk membentuk larik rata-rata bergerak pendek. Pasar beruang akan segera menyusul, dan pasar akan anjlok secara signifikan. Investor harus segera mengambil tindakan untuk menutup posisi jika melihat larik rata-rata bergerak pendek.

Penggunaan

array rata-rata bergerak pendek

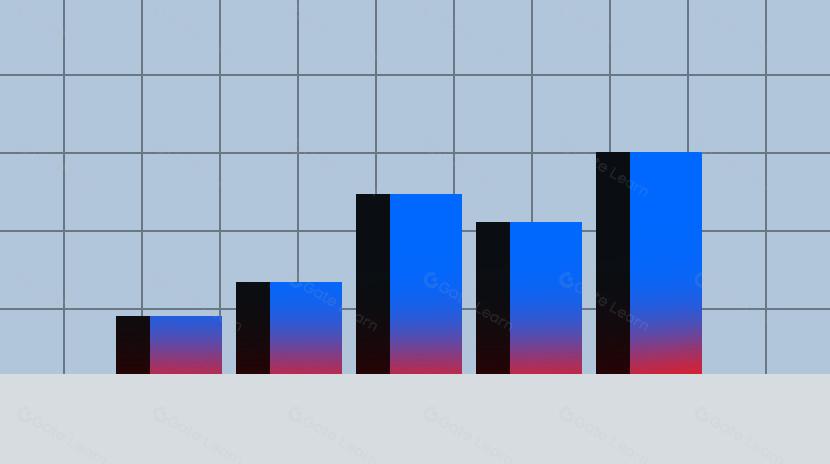

Di atas adalah grafik tren harian kontrak BTC Gate.com. Menunjukkan bahwa pasar sedang mengalami tren penurunan jangka panjang, di mana MA5, MA30, MA60, MA120, dan MA180 disusun dari bawah ke atas dan menunjuk ke bawah. Selama tren bearish lebih dari 12 bulan ini, BTC turun dari $69,000 menjadi sekitar $16,000, penurunan lebih dari 70%, memberikan pukulan berat bagi seluruh pasar enkripsi.

Masalah perhatian

Investor harus melakukan posisi short ketika melihat rangkaian rata-rata bergerak pendek, tetapi mereka tidak harus menunggu sampai pola tersebut terbentuk sepenuhnya. Perlu dicatat bahwa kriteria untuk memutuskan kapan melakukan posisi short berbeda dari kriteria untuk memutuskan kapan melakukan posisi long. Sebelum membuka posisi, investor harus menunggu semua kondisi yang diperlukan terpenuhi sementara posisi shorting harus dilakukan dengan tegas setelah tanda penurunan terlihat.

Jika Anda mulai membuka posisi pendek setelah rangkaian rata-rata bergerak pendek sudah terbentuk, itu akan sedikit terlambat. Sebaliknya, Anda seharusnya memikirkan untuk menjual dan keluar saat tanda pertama dari tren penurunan, seperti sinyal puncak garis K, mata uang yang melanggar garis tren turun, pola teknis yang berbalik di puncak, dan pembentukan garpu mati rata-rata bergerak. Prinsip umumnya adalah “berhati-hati saat membuka posisi dan tegas saat menutupnya.”

Ringkasan

Rata-rata bergerak berperforma terbaik saat dikombinasikan dengan alat teknis lain karena memiliki kelemahan reaksi yang tertunda terhadap pergerakan pasar. Pengguna dapat memilih kapan membuka posisi dengan mempelajari grafik Candlestick, garis tren, atau indikator teknis, dan kemudian dapat memantau pergerakan rata-rata bergerak untuk memilih waktu trading yang optimal.

Silakan klik untukdaftardi platform kontrak Gate.com untuk memulai perdagangan!

Penyangkalan

Artikel ini hanya untuk tujuan informasi dan tidak merupakan saran investasi, dan Gate.com tidak bertanggung jawab atas investasi Anda. Konten terkait analisis teknis, penilaian pasar, keterampilan perdagangan, dan berbagi para pedagang tidak dapat digunakan sebagai dasar investasi. Investasi dapat melibatkan risiko potensial dan menghadapi ketidakpastian. Artikel ini tidak mengandung atau menyiratkan jaminan atas pengembalian investasi apa pun.

Artikel Terkait

Bagaimana Menggunakan API untuk Memulai Perdagangan Kuantitatif

Bagaimana Cara Menggunakan Perdagangan Kontrak untuk Hedging

Perdagangan Leverage dan Risiko Saldo Negatif: Panduan Bertahan yang Harus Dimiliki oleh Investor

Bagaimana Harga Bitcoin Spot dan Futures Saling Berhubungan

Pengenalan pada Dana Kuantitatif Arbitrase Tingkat Pendanaan