yasirAlitrader

🚀💎| Unlocking Wealth Potential: How RWA Index Futures Empower Crypto Traders !

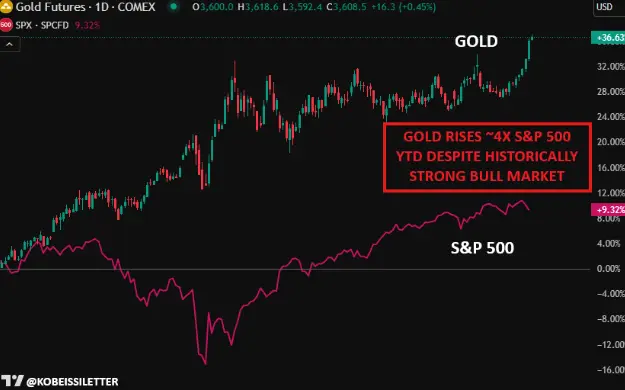

The fusion of Real-World Assets (RWA) with crypto trading has opened a groundbreaking frontier for investors. Among the most powerful tools leading this shift are RWA Index Futures — a bridge between traditional asset value and digital innovation. For traders, this isn’t just a trend — it’s a potential wealth revolution.

---

🌍✨ What Are RWA Index Futures?

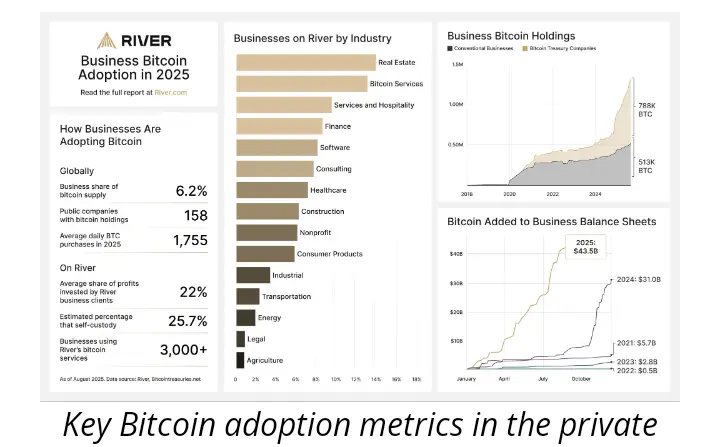

RWA Index Futures are derivative contracts that allow traders to speculate on the performance of tokenized real-world assets — such as commodities, real estate,

The fusion of Real-World Assets (RWA) with crypto trading has opened a groundbreaking frontier for investors. Among the most powerful tools leading this shift are RWA Index Futures — a bridge between traditional asset value and digital innovation. For traders, this isn’t just a trend — it’s a potential wealth revolution.

---

🌍✨ What Are RWA Index Futures?

RWA Index Futures are derivative contracts that allow traders to speculate on the performance of tokenized real-world assets — such as commodities, real estate,