Pendahuluan: Posisi Pasar dan Nilai Investasi SYND

Syndicate (SYND) menghadirkan inovasi fundamental dalam rollup pintar dan penyusun urutan transaksi, mendefinisikan ulang skalabilitas blockchain sejak peluncurannya. Hingga 2025, kapitalisasi pasar SYND mencapai USD 468.939.840, dengan suplai beredar sekitar 591.200.000 token dan harga stabil di kisaran USD 0,7932. Dijuluki “solusi lapisan blockchain generasi berikutnya”, aset ini kini berperan krusial dalam efisiensi biaya dan mendorong inovasi di lapisan aplikasi-jaringan.

Artikel berikut menyajikan analisis menyeluruh tren harga SYND periode 2025-2030. Analisis ini memadukan data historis, dinamika permintaan-penawaran, kemajuan ekosistem, serta variabel makroekonomi. Tujuannya adalah menyediakan prediksi harga profesional beserta strategi investasi aplikatif bagi investor.

I. Tinjauan Riwayat Harga dan Status Pasar Terkini SYND

Evolusi Harga Historis SYND

- 2025: Peluncuran token SYND, harga menembus rekor tertinggi di USD 1,2733

Kondisi Pasar SYND Saat Ini

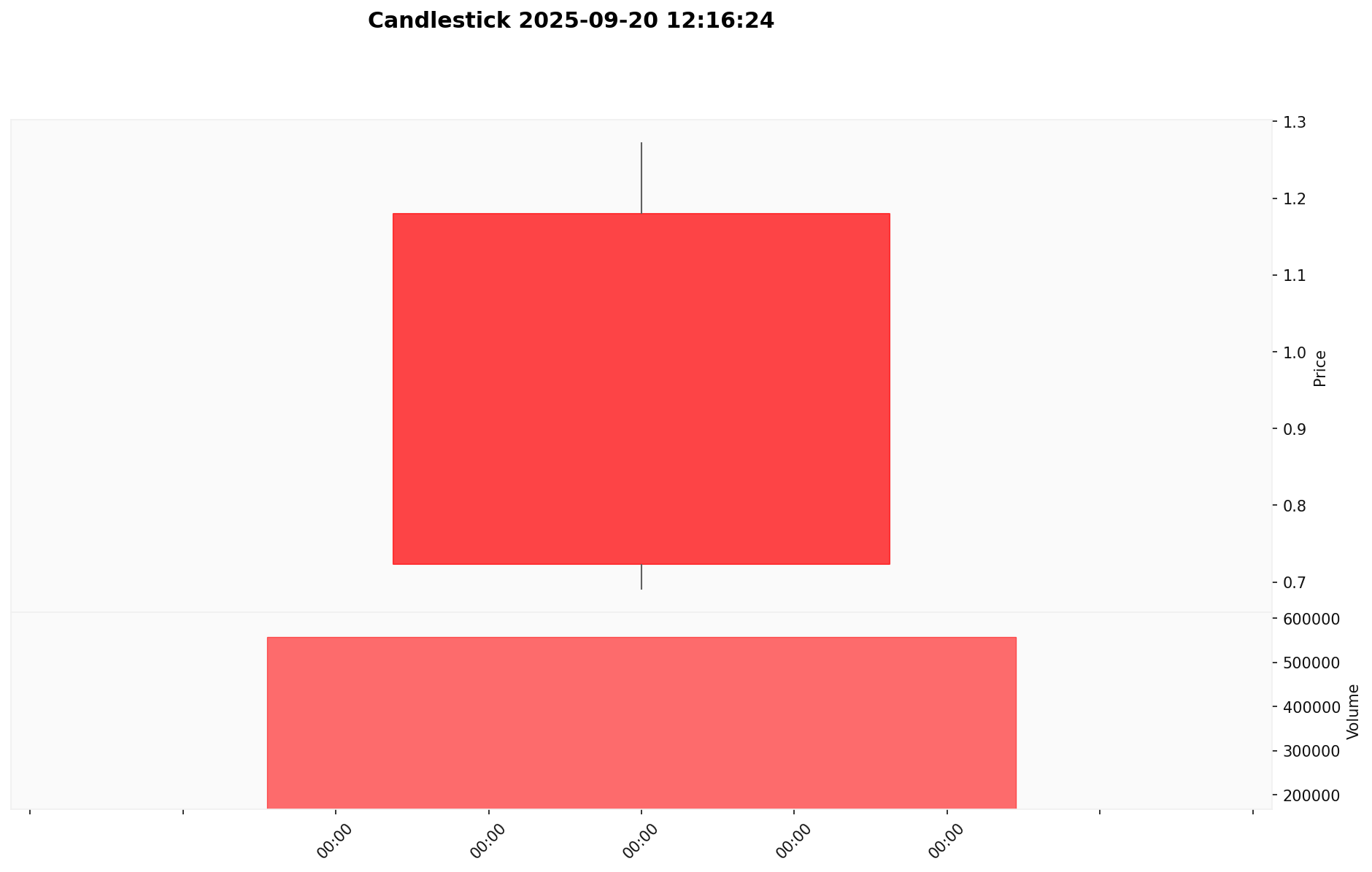

Pada 20 September 2025, harga perdagangan SYND berada di USD 0,7932, turun tajam 33,4% dalam 24 jam terakhir. Kapitalisasi pasar SYND bernilai USD 468.939.840, menempatkannya di posisi ke-183 secara global. Suplai beredarnya sebanyak 591.200.000 token—59,12% dari total suplai 1.000.000.000.

Volume transaksi 24 jam SYND mencapai USD 775.452,78, menandakan aktivitas pasar yang moderat. Harga harian bergerak di rentang USD 0,6899 hingga USD 1,2733, menunjukkan volatilitas yang tinggi. Dalam satu jam terakhir, harga terkoreksi 8,11%.

Saat ini, harga SYND 37,7% di bawah rekor tertinggi USD 1,2733 yang tercapai sehari sebelumnya, 19 September 2025. Koreksi ini menunjukkan aksi ambil untung atau penyesuaian harga setelah peluncuran dan lonjakan harga awal.

Klik untuk melihat harga pasar SYND terbaru

Indikator Sentimen Pasar SYND

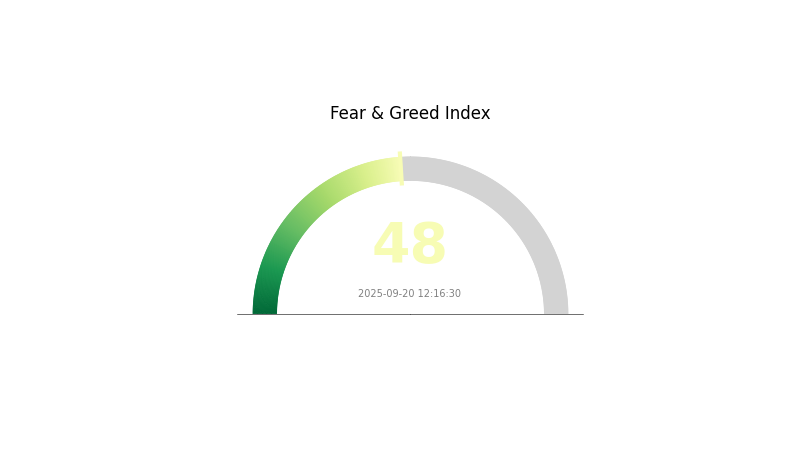

20-09-2025 Indeks Ketakutan & Keserakahan: 48 (Netral)

Klik untuk melihat Indeks Ketakutan & Keserakahan terkini

Sentimen pasar kripto hari ini seimbang dengan indeks di angka 48, mencerminkan sikap netral investor. Kondisi ini menandakan tidak ada dominasi rasa takut maupun euforia di pasar. Keseimbangan ini sering menjadi prolog bagi pergerakan besar di pasar. Investor perlu tetap disiplin dan melakukan riset mendalam sebelum mengambil keputusan dalam dinamika pasar yang cepat berubah.

Distribusi Kepemilikan SYND

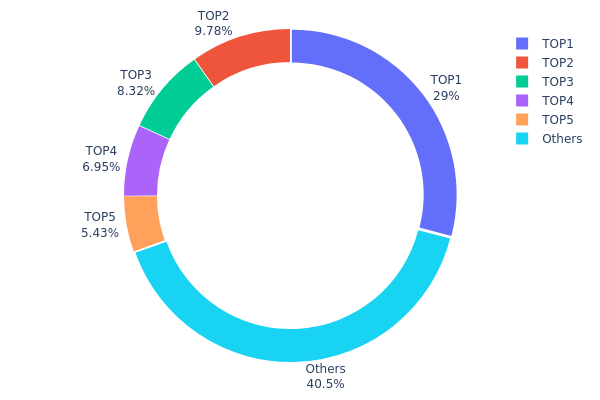

Data distribusi alamat SYND menyoroti tingkat konsentrasi token pada dompet tertentu. Analisis menunjukkan konsentrasi tinggi di kelompok pemegang utama—alamat teratas menguasai 29,03% total suplai, dan 5 alamat teratas memegang 59,49% token SYND.

Konsentrasi semacam ini meningkatkan risiko volatilitas harga dan potensi manipulasi pasar. Dengan penguasaan signifikan oleh segelintir alamat, risiko penjualan massal atau akumulasi mendadak yang dapat mengguncang harga SYND menjadi besar. Selain itu, hal ini memperlihatkan tingkat desentralisasi yang masih rendah, berimplikasi pada tata kelola dan stabilitas jaringan.

Di sisi lain, 40,51% token terdistribusi ke kategori “Lainnya”, menandakan adanya penyebaran token lebih luas. Walau demikian, dominasi pemegang utama tetap membuat sebaran token condong sentralisasi, yang bisa memengaruhi keberlanjutan ekosistem dan keadilan dalam jangka panjang.

Klik untuk melihat Distribusi Kepemilikan SYND terkini

| Top | Alamat | Jumlah Kepemilikan | Kepemilikan (%) |

|---|---|---|---|

| 1 | 0x8806...0529d8 | 267.162.160 | 29,03% |

| 2 | 0x6311...7ab046 | 90.000.000 | 9,78% |

| 3 | 0xde60...f54f14 | 76.500.000 | 8,31% |

| 4 | 0x83d2...a199ec | 63.928.500 | 6,94% |

| 5 | 0xa517...049dd1 | 50.000.000 | 5,43% |

| - | Lainnya | 372.409.340 | 40,51% |

II. Faktor-Faktor Kunci Penentu Harga SYND di Masa Depan

Mekanisme Pasokan

- Eksposur Pasar: Peningkatan eksposur dan likuiditas pasar SYND diproyeksikan mendorong penguatan harga.

- Dampak Saat Ini: Peluncuran token berikutnya diyakini akan memperkuat visibilitas dan likuiditas pasar SYND sekaligus memperbesar potensi kenaikan harga.

Dinamika Institusi dan Paus

- Adopsi Korporasi: Integrasi dan adopsi SYND di korporasi besar dapat memengaruhi arah harga secara signifikan.

Konteks Makroekonomi

- Dampak Kebijakan Moneter: Kebijakan suku bunga Federal Reserve sangat berdampak pada pemulihan aset berisiko seperti kripto.

- Sifat Lindung Nilai terhadap Inflasi: Performa SYND dalam situasi inflasi dapat turut menentukan nilai token.

- Faktor Geopolitik: Situasi internasional dan dinamika geopolitik berpengaruh pada pasar kripto, termasuk SYND.

Pengembangan Teknologi dan Ekosistem

- Aplikasi Ekosistem: Pengembangan DApps dan proyek pendukung di jaringan SYND berperan penting dalam menambah nilai token.

III. Prediksi Harga SYND Tahun 2025-2030

Proyeksi 2025

- Proyeksi konservatif: USD 0,60622 – 0,7873

- Proyeksi netral: USD 0,7873 – 0,89359

- Proyeksi optimistis: USD 0,89359 – 0,99987 (memerlukan kondisi pasar sangat mendukung)

Proyeksi 2027–2028

- Fase pasar: Pertumbuhan bertahap disertai peningkatan adopsi

- Rentang prediksi harga:

- 2027: USD 0,66912 – 1,03156

- 2028: USD 0,53924 – 1,14712

- Katalis utama: Kemajuan teknologi dan penerimaan pasar lebih luas

Proyeksi Jangka Panjang 2029–2030

- Skenario dasar: USD 1,06378 – 1,19143 (dengan asumsi pasar stabil)

- Skenario optimistis: USD 1,19143 – 1,66801 (jika pasar sangat bullish)

- Skenario perubahan besar: Di atas USD 1,66801 (dalam kondisi sangat menguntungkan)

- 31-12-2030: SYND pada USD 1,66801 (potensi harga puncak)

| Tahun | Prediksi Tertinggi (USD) | Prediksi Rata-rata (USD) | Prediksi Terendah (USD) | Perubahan (%) |

|---|---|---|---|---|

| 2025 | 0,99987 | 0,7873 | 0,60622 | 0 |

| 2026 | 0,96507 | 0,89359 | 0,67912 | 12 |

| 2027 | 1,03156 | 0,92933 | 0,66912 | 17 |

| 2028 | 1,14712 | 0,98044 | 0,53924 | 23 |

| 2029 | 1,31909 | 1,06378 | 0,67018 | 34 |

| 2030 | 1,66801 | 1,19143 | 0,67912 | 50 |

IV. Strategi Investasi SYND dan Manajemen Risiko Profesional

Metodologi Investasi SYND

(1) Strategi Menyimpan Jangka Panjang

- Strategi ini cocok bagi investor jangka panjang dan pengadopsi teknologi blockchain

- Saran operasional:

- Akumulasi token SYND saat harga turun

- Pantau harga menggunakan notifikasi untuk mendeteksi pergerakan signifikan

- Simpan token pada dompet perangkat keras untuk keamanan jangka panjang

(2) Strategi Perdagangan Aktif

- Alat analisis teknikal:

- Moving Average: Mengidentifikasi tren dan area pembalikan potensial

- Relative Strength Index (RSI): Pantau kondisi jenuh beli dan jenuh jual

- Poin utama swing trading:

- Monitor sentimen pasar dan berita terkait inovasi smart contract

- Terapkan order stop-loss untuk membatasi risiko kerugian

Kerangka Manajemen Risiko SYND

(1) Prinsip Alokasi Aset

- Investor konservatif: 1–3% dari portofolio kripto

- Investor agresif: 5–10% dari portofolio kripto

- Investor profesional: Sampai 15% dari portofolio kripto

(2) Solusi Lindung Nilai Risiko

- Diversifikasi: Sebar investasi ke beberapa aset kripto lain

- Order stop-loss: Terapkan untuk membatasi potensi kerugian besar

(3) Solusi Penyimpanan Aman

- Dompet panas: Rekomendasi Gate Web3 wallet

- Penyimpanan dingin: Manfaatkan dompet perangkat keras untuk kepemilikan jangka panjang

- Langkah keamanan: Aktifkan autentikasi dua faktor dan gunakan kata sandi kuat

V. Risiko dan Tantangan yang Dihadapi SYND

Risiko Pasar SYND

- Volatilitas tinggi: Fluktuasi harga ekstrem adalah karakteristik pasar kripto

- Kompetisi: Proyek lain dapat menghadirkan teknologi smart contract kompetitor

- Sentimen pasar: Kinerja SYND sangat dipengaruhi tren pasar kripto secara keseluruhan

Risiko Regulasi SYND

- Regulasi belum pasti: Kebijakan kripto yang berubah dapat berpengaruh pada adopsi SYND

- Tuntutan kepatuhan: Potensi kebutuhan kepatuhan tambahan

- Pembatasan lintas negara: Regulasi internasional yang bervariasi membatasi penggunaan lintas batas

Risiko Teknis SYND

- Celah smart contract: Potensi bug atau eksploitasi yang belum teridentifikasi

- Tantangan skalabilitas: Meningkatnya beban jaringan saat adopsi bertambah

- Isu interoperabilitas: Kompatibilitas dengan blockchain dan protokol lain

VI. Kesimpulan dan Rekomendasi Tindak Lanjut

Penilaian Nilai Investasi SYND

SYND menghadirkan teknologi disruptif di ranah smart contract, memberi nilai tambah jangka panjang lewat efisiensi biaya dan inovasi, namun tetap berisiko tinggi akibat volatilitas pasar dan ketidakpastian regulasi.

Rekomendasi Investasi SYND

✅ Pemula: Mulai investasi kecil secara berkala untuk memahami mekanisme pasar

✅ Investor berpengalaman: Alokasikan sebagian portofolio tergantung profil risiko

✅ Investor institusi: Lakukan penelitian menyeluruh dan nilai potensi jangka panjang

Metode Partisipasi Perdagangan SYND

- Perdagangan spot: Beli dan simpan token SYND di Gate.com

- Program staking: Ambil bagian dalam program staking bila tersedia

- Integrasi DeFi: Maksimalkan peluang desentralisasi finansial menggunakan token SYND

Investasi kripto sangat berisiko tinggi. Artikel ini bukan merupakan saran investasi. Seluruh keputusan investasi harus disesuaikan dengan toleransi risiko pribadi. Konsultasikan dengan penasihat keuangan profesional dan jangan berinvestasi melebihi kapasitas menanggung kerugian Anda.

FAQ

Apakah sync crypto layak dijadikan investasi?

Sync crypto memiliki prospek pertumbuhan yang menjanjikan. Prediksi harga tahun 2025 menargetkan potensi peningkatan hingga USD 562.972. Namun, sebaiknya lakukan riset mandiri sebelum berinvestasi.

Berapa prediksi harga saham Synergia Energy di tahun 2025?

Prediksi saat ini memperkirakan harga Synergia Energy sekitar USD 0,0534 pada Oktober 2025 dan USD 0,0000126 pada November 2025.

Berapa prediksi harga Synapse crypto di 2030?

Berdasarkan analisis data historis, Synapse crypto diperkirakan dapat mencapai USD 6,99 di 2030 jika pasar sangat bullish.

Berapa kisaran harga SHIB pada tahun 2030?

Dengan mempertimbangkan tren saat ini, harga SHIB diproyeksi bergerak antara USD 0,0000489951 hingga USD 0,000059994 pada 2030.

Bagikan

Konten