توقعات سعر LDO لعام 2025: توقعات إيجابية مدفوعة بازدياد اعتماد DeFi وتوسع الإيداع في Ethereum

مقدمة: مكانة LDO في السوق وقيمته الاستثمارية

رسّخ رمز Lido DAO (LDO) مكانته كلاعب أساسي في منظومة التخزين السائل منذ انطلاقه عام 2020، إذ كان رائداً في تقديم حلول التخزين اللامركزي لإيثريوم. بحلول عام 2025، بلغت القيمة السوقية لـ LDO نحو 825,379,877 دولار أمريكي، مع عرض متداول يُقدّر بنحو 895,788,884 رمزاً، وسعر يراوح حول 0.9214 دولار أمريكي. غالباً ما يُطلق على هذا الأصل لقب "مُمكّن السيولة لـ ETH 2.0"، ليؤدي دوراً محورياً متزايد الأهمية في قطاع التمويل اللامركزي (DeFi).

يستعرض هذا المقال تحليلاً متكاملاً لمسار سعر LDO بين 2025 و2030، مع دراسة الأنماط التاريخية، واتجاهات العرض والطلب، وتطورات المنظومة، والعوامل الاقتصادية الكلية، بهدف تقديم توقعات سعرية دقيقة واستراتيجيات استثمار عملية للمستثمرين.

I. مراجعة تاريخ سعر LDO والوضع الراهن للسوق

تطور سعر LDO عبر التاريخ

- 2021: سجل LDO أعلى مستوى له عند 7.3 دولار في 20 أغسطس، ما شكل نقطة تحول للرمز.

- 2022: تعرض السوق لتراجع، إذ بلغ LDO أدنى سعر له عند 0.40615 دولار في 19 يونيو.

- 2025: أظهر السوق علامات تعافٍ، ويتم تداول LDO حالياً عند 0.9214 دولار.

الوضع الحالي لسوق LDO

في 16 أكتوبر 2025، يُتداول LDO عند 0.9214 دولار أمريكي، بقيمة سوقية تبلغ 825,379,877 دولار. شهد الرمز انخفاضاً بنسبة 5.7% خلال الأربع وعشرين ساعة الماضية، ما يعكس تقلباً قصير المدى. وخلال أسبوع واحد، تراجع LDO بنسبة 22.91%، في مؤشر على اتجاه هبوطي متوسط الأجل. أما تغيرات السعر على مدار 30 يوماً وسنة كاملة فكانت -21.65% و-19.42% على التوالي، ما يؤكد المسار التنازلي على المدى الطويل. ومع ذلك، يظل LDO أعلى بكثير من أدنى سعر تاريخي له، ما يدل على قدر من الصمود في السوق. العرض المتداول الحالي يبلغ 895,788,883 رمزاً من LDO، أي ما يمثل 89.58% من إجمالي العرض البالغ مليار رمز.

اضغط للاطلاع على سعر LDO الحالي

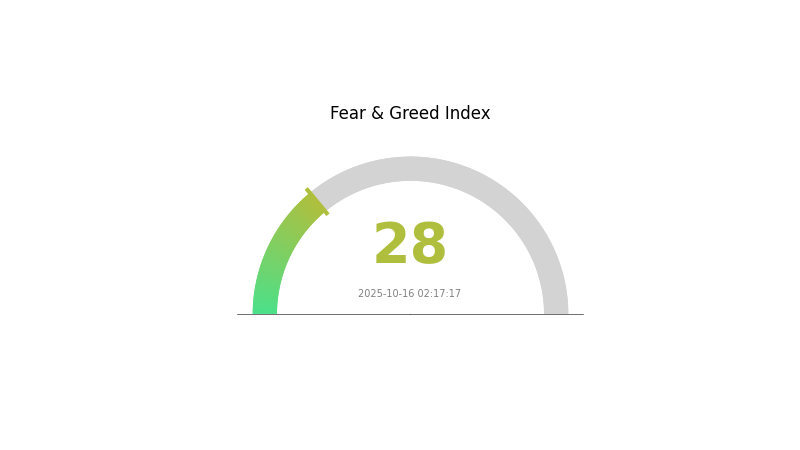

مؤشر معنويات سوق LDO

2025-10-16 مؤشر الخوف والجشع: 28 (خوف)

اضغط للاطلاع على مؤشر الخوف والجشع الحالي

تشير معنويات سوق العملات الرقمية لـ LDO حالياً إلى منطقة "الخوف" برصيد 28 نقطة، ما يعكس حالة من الحذر بين المستثمرين. في مثل هذه الظروف، قد يعتبر البعض ذلك فرصة للشراء، وفقاً لاستراتيجية الاستثمار المعاكسة "كن حذراً عندما يكون الآخرون جشعين وكن جشعاً عندما يخاف الآخرون". ومع ذلك، يبقى من الضروري إجراء دراسة معمقة ومراعاة عوامل متعددة قبل اتخاذ أي قرار استثماري في سوق العملات الرقمية المتقلب.

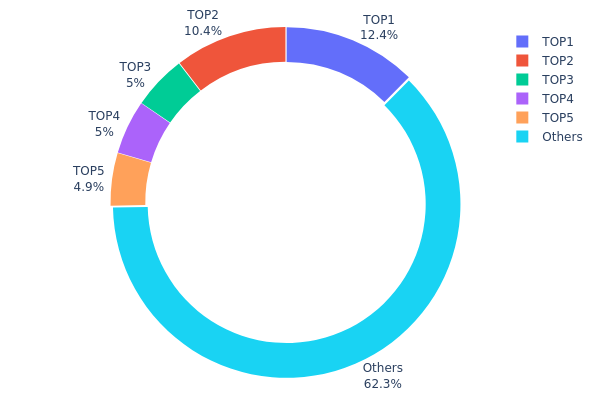

توزيع ملكية LDO

توفر بيانات توزيع العناوين رؤى مهمة حول مدى تركّز رموز LDO. وبحسب البيانات المقدمة، يتضح وجود تركيز كبير بين كبار الحائزين، إذ يمتلك أكبر عنوان 12.41% من إجمالي الرموز، يليه آخر بحصة 10.42%. في حين يمتلك الثالث والرابع 5% لكل منهما، والخامس 4.90%.

يشير هذا النمط إلى مستوى متوسط من التركيز، حيث تسيطر أكبر خمسة عناوين على 37.73% من إجمالي رموز LDO. ورغم أن هذا التركيز ملحوظ، إلا أنه لا يُعد بالضرورة مقلقاً لمشروع بلوكشين. لكنه يعني أن هؤلاء الحائزين الكبار قد يكون لهم تأثير واضح على ديناميكيات السوق وحركة الأسعار في حال قيامهم بصفقات ضخمة.

أما الـ 62.27% المتبقية فتوزع بين عناوين أخرى، ما يعكس درجة معقولة من اللامركزية خارج كبار الحائزين. هذا التوزيع الأوسع يساهم في استقرار السوق ويحد من مخاطر التلاعب. ومع ذلك، ينبغي للمستثمرين والمحللين متابعة حركات الحيازات الكبرى، إذ قد تؤثر أي تغييرات كبيرة على هيكل سوق LDO وتقلب الأسعار.

اضغط للاطلاع على توزيع ملكية LDO الحالي

| الأعلى | العنوان | كمية الحيازة | نسبة الحيازة (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 124133.33K | 12.41% |

| 2 | 0x3e40...6e9c8c | 104211.12K | 10.42% |

| 3 | 0x695c...917740 | 50000.00K | 5.00% |

| 4 | 0x9457...72168b | 50000.00K | 5.00% |

| 5 | 0xad4f...8b42da | 49000.00K | 4.90% |

| - | أخرى | 622655.56K | 62.27% |

II. العوامل المؤثرة في سعر LDO مستقبلاً

آلية العرض

- مكافآت التخزين: تؤثر طريقة توزيع مكافآت التخزين بشكل مباشر على مكانة LDO والطلب عليه.

- النمط التاريخي: تاريخياً، ارتبطت زيادة مكافآت التخزين بارتفاع سعر LDO.

- التأثير الحالي: من المتوقع أن يؤدي نمو الطلب على تخزين Ethereum 2.0 إلى زيادة استخدام خدمات Lido، مما يعزز قيمة LDO.

ديناميكيات المؤسسات وحيتان السوق

- حيازات المؤسسات: أبدت شركات الاستثمار الكبرى في DeFi والعملات الرقمية اهتماماً متزايداً بـ LDO، ما يوحي بتبني مؤسسي متنامٍ.

- تبني الشركات: قد تلجأ مؤسسات قائمة على Ethereum إلى حلول التخزين، ما يؤثر بشكل غير مباشر على الطلب على LDO.

- السياسات الوطنية: الوضوح التنظيمي حول خدمات التخزين في الاقتصادات الكبرى قد يكون له أثر كبير على عمليات Lido وأداء LDO في السوق.

البيئة الاقتصادية الكلية

- تأثير السياسة النقدية: سياسات البنوك المركزية، خاصة المتعلقة بسوق العملات الرقمية، تؤثر على سعر LDO عبر معنويات السوق.

- التحوط من التضخم: ارتباط LDO بتخزين Ethereum قد يمنحه خصائص تحوط ضد التضخم شبيهة بأصول العملات الرقمية الأخرى.

- العوامل الجيوسياسية: الاضطرابات الاقتصادية العالمية قد تدفع نحو حلول التمويل اللامركزي، ما يعود بالنفع على LDO.

التطوير التقني وبناء المنظومة

- تقدم Ethereum 2.0: ترقيات Ethereum المستمرة والانتقال لإثبات الحصة يؤثران مباشرة في أعمال Lido وقيمة LDO.

- التوسع متعدد السلاسل: توسع Lido إلى سلاسل بلوكشين أخرى يعزز قاعدة المستخدمين ويزيد من استخدامات LDO.

- تطبيقات المنظومة: نمو بروتوكولات DeFi التي تعتمد حلول التخزين السائل من Lido يدفع الطلب على رموز LDO.

III. توقعات سعر LDO للفترة 2025-2030

توقعات 2025

- توقع محافظ: 0.51 - 0.70 دولار

- توقع حيادي: 0.70 - 0.92 دولار

- توقع متفائل: 0.92 - 1.20 دولار (يتطلب تعافياً قوياً للسوق وارتفاع طلب تخزين Ethereum)

توقعات 2027-2028

- توقع مرحلة السوق: نمو محتمل مع توسع الاستخدام

- نطاق التوقعات السعرية:

- 2027: 0.82 - 1.59 دولار

- 2028: 1.17 - 2.05 دولار

- محفزات رئيسية: توسع منظومة Ethereum، حلول تخزين محسنة، تكامل أوسع مع DeFi

توقعات 2029-2030 طويلة الأجل

- السيناريو الأساسي: 1.75 - 1.98 دولار (مع استمرار نمو تبني Ethereum)

- السيناريو المتفائل: 1.98 - 2.20 دولار (مع ترقيات كبيرة لـ Ethereum وهيمنة أكبر في السوق)

- السيناريو التحولي: 2.20+ دولار (في حال تبني مؤسسي واسع النطاق وظروف شديدة الإيجابية)

- 2030-12-31: متوسط سعر متوقع لـ LDO عند 1.98 دولار، دلالة على نمو كبير منذ عام 2025

| السنة | أعلى سعر متوقع | متوسط السعر المتوقع | أدنى سعر متوقع | التغير (%) |

|---|---|---|---|---|

| 2025 | 1.20481 | 0.9197 | 0.51503 | 0 |

| 2026 | 1.52965 | 1.06225 | 0.70109 | 15 |

| 2027 | 1.59402 | 1.29595 | 0.81645 | 41 |

| 2028 | 2.05188 | 1.44498 | 1.17044 | 57 |

| 2029 | 2.20302 | 1.74843 | 0.97912 | 90 |

| 2030 | 2.05475 | 1.97573 | 1.77815 | 115 |

IV. استراتيجيات الاستثمار وإدارة المخاطر لـ LDO

منهجية الاستثمار في LDO

(1) استراتيجية الاحتفاظ طويل الأجل

- مناسبة لـ: المستثمرين الراغبين في الانكشاف على منظومة تخزين Ethereum

- اقتراحات التنفيذ:

- تجميع LDO أثناء تراجعات السوق

- الاحتفاظ لمدة 1-2 سنة على الأقل للاستفادة من النمو المحتمل

- تخزين الرموز في محفظة غير حضانية آمنة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة: استخدم MA لمدة 50 و200 يوم لرصد الاتجاهات

- RSI: متابعة حالات التشبع الشرائي والبيعي

- نقاط التداول:

- تحديد نقاط دخول وخروج واضحة

- استخدام أوامر وقف الخسارة لإدارة المخاطر

إطار إدارة المخاطر لـ LDO

(1) مبادئ توزيع الأصول

- المستثمر المحافظ: 1-3% من المحفظة

- المستثمر المغامر: 5-10% من المحفظة

- المستثمر المحترف: حتى 15% من المحفظة

(2) حلول التحوط

- تنويع المحفظة: توزيع الاستثمارات على عدة أصول رقمية

- الخيارات: استخدام خيارات البيع للتحوط من تراجع الأسعار

(3) حلول التخزين الآمن

- توصية محفظة ساخنة: Gate Web3 Wallet

- التخزين البارد: محفظة أجهزة للحيازة طويلة الأمد

- إجراءات الأمان: تفعيل المصادقة الثنائية، استخدام كلمات مرور قوية، الاحتفاظ بنسخة احتياطية للمفاتيح الخاصة

V. المخاطر والتحديات المحتملة لـ LDO

مخاطر سوق LDO

- التقلبات: تغيرات سعرية حادة شائعة في أسواق العملات الرقمية

- السيولة: احتمالية صعوبة تنفيذ عمليات تداول ضخمة

- المنافسة: ظهور بروتوكولات تخزين سائل منافسة

المخاطر التنظيمية لـ LDO

- تشريعات غير واضحة: احتمالية صدور تنظيمات غير ملائمة

- قضايا الامتثال: تغير البيئة القانونية لمشاريع DeFi

- الآثار الضريبية: غموض بشأن المعالجة الضريبية لمكافآت التخزين

المخاطر التقنية لـ LDO

- ثغرات العقود الذكية: إمكانية وجود أخطاء أو ثغرات

- مخاطر ترقية Ethereum: اعتماد المشروع على نجاح تحول Ethereum

- مخاوف المركزية: ارتباط القرار بحوكمة Lido

VI. الخلاصة وتوصيات العمل

تقييم القيمة الاستثمارية لـ LDO

يمنح LDO المستثمر فرصة فريدة للانكشاف على منظومة تخزين Ethereum، إذ ترتبط الإمكانات طويلة الأجل بنجاح Ethereum ونمو DeFi، بينما تبرز المخاطر قصيرة الأجل في تقلب السوق والغموض التنظيمي.

توصيات الاستثمار في LDO

✅ للمبتدئين: خصص جزءاً صغيراً من محفظتك ضمن تنويع العملات الرقمية ✅ للمستثمرين المحترفين: طبق استراتيجية متوسط تكلفة الشراء ✅ للمؤسسات: ادخل LDO ضمن استراتيجية استثمارية شاملة في DeFi

طرق المشاركة في تداول LDO

- التداول الفوري: اشترِ واحتفظ بـ LDO عبر Gate.com

- التخزين: شارك في بروتوكول التخزين السائل الخاص بـ Lido

- الزراعة الربحية: استكشف فرص توفير السيولة المعتمدة على LDO

الاستثمار في العملات الرقمية ينطوي على مخاطر مرتفعة للغاية، وهذه المقالة ليست نصيحة استثمارية. يجب على المستثمرين اتخاذ قراراتهم بحذر بناءً على مدى تحملهم للمخاطر وينصح باستشارة خبراء ماليين. لا تستثمر أبداً أكثر مما يمكنك تحمل خسارته.

الأسئلة الشائعة

ما توقع سعر رمز LDO في 2030؟

وفقاً لتحليل السوق الحالي، يُتوقع أن يصل رمز LDO إلى متوسط سعر 44.69 دولار في 2030، ضمن نطاق يتراوح بين 43.05 و48.09 دولار.

هل LDO خيار جيد للشراء؟

LDO مناسب للراغبين في الاستثمار بمنظومة Lido. وبصفته رمز حوكمة، ترتبط قيمته بنمو المشروع واعتماده في قطاع DeFi.

ما توقع سعر سهم LDOS؟

من المتوقع أن يتراوح سعر سهم LDOS بين 131 و165 دولار في 2025، وبين 200 و258 دولار في 2030، أما توقع الغد فهو 137.34 دولار.

ما العملة الرقمية ذات أعلى توقعات سعرية؟

Bitcoin (BTC) لديها أعلى توقعات سعرية لعام 2025، تليها Ethereum (ETH) وSolana (SOL).

ما هو LDO: التعرف على منظمات انخفاض الجهد في الإلكترونيات الحديثة

توقع سعر LDO في عام 2025: تحليل فرص النمو واتجاهات السوق لرمز Lido DAO

كيف ينعكس توزيع رمز ZRX على مستويات السيولة في بروتوكول 0x؟

التخزين ETH في 2025: خيارات على السلسلة وأفضل المنصات

ما هو التخزين: دليل المبتدئين للدخل السلبي في الأصول الرقمية

ZKFair Launchpool: دليل شامل لفرص FairStake

مقدمة حول الرموز الرقمية المدعومة بالذكاء الاصطناعي وفرص الوصول المبكر

أفضل رموز العملات المشفرة المدعومة بالذكاء الاصطناعي التي ينبغي مراقبتها في عام 2024

ما هو XTTA: دليل متكامل لفهم آلية التحقق من صحة التجارة العابرة للأقاليم

ما هو TOKE: دليل متكامل لفهم ثورة الرموز الرقمية