Dự báo giá JST năm 2025: Đánh giá xu hướng thị trường sắp tới và khả năng tăng trưởng của JUST Token

Giới thiệu: Vị thế thị trường và giá trị đầu tư của JST

Just (JST) đã định vị là một dự án trọng yếu trong lĩnh vực tài chính phi tập trung (DeFi) kể từ năm 2020, hướng đến xây dựng một hệ thống tài chính công bằng cho người dùng toàn cầu. Đến năm 2025, vốn hóa JST đạt 335.214.000 USD, nguồn cung lưu hành khoảng 9.900.000.000 token cùng giá giao dịch quanh mức 0,03386 USD. Token này, được xem là "token quản trị DeFi", giữ vai trò ngày càng quan trọng trong hoạt động cho vay stablecoin và quản trị cộng đồng hệ sinh thái TRON.

Bài viết sẽ phân tích toàn diện xu hướng giá JST giai đoạn 2025-2030, dựa trên dữ liệu lịch sử, cung cầu thị trường, tiến triển hệ sinh thái và yếu tố kinh tế vĩ mô, nhằm cung cấp dự báo giá chuyên sâu và chiến lược đầu tư thực tiễn cho nhà đầu tư.

I. Tổng quan lịch sử giá và trạng thái thị trường JST hiện tại

Diễn biến giá JST qua các năm

- 2020: Ra mắt, giá khởi điểm 0,002 USD

- 2021: Đỉnh thị trường tăng giá, giá cao nhất lịch sử 0,193254 USD vào ngày 05 tháng 04

- 2022-2023: Mùa đông tiền mã hóa, giá giảm về quanh 0,02-0,03 USD

Tình hình thị trường JST hiện tại

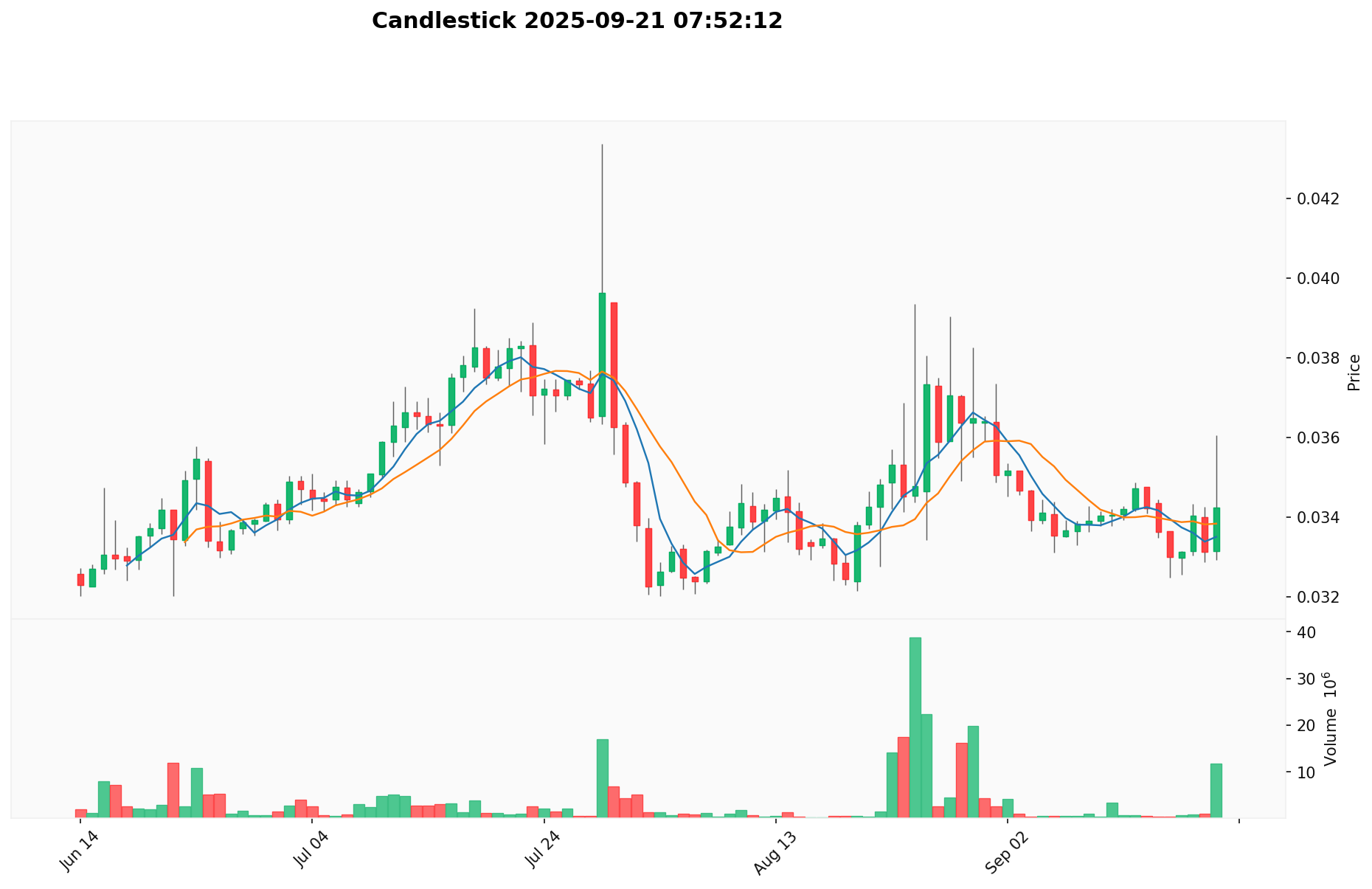

Ngày 21 tháng 09 năm 2025, JST giao dịch ở mức 0,03386 USD, vốn hóa thị trường đạt 335.214.000 USD. Token giảm nhẹ 0,81% trong 24 giờ, nhưng tăng trưởng 17,41% so với cùng kỳ năm trước. Giá hiện tại thấp hơn đỉnh lịch sử, cho thấy dư địa tăng trưởng còn lớn. Nguồn cung lưu hành trùng với tổng cung 9.900.000.000 JST, phản ánh không có áp lực lạm phát mới. JST chiếm 0,0078% thị phần tiền mã hóa, vẫn ở quy mô nhỏ trong tổng thể thị trường.

Bấm để xem giá JST mới nhất

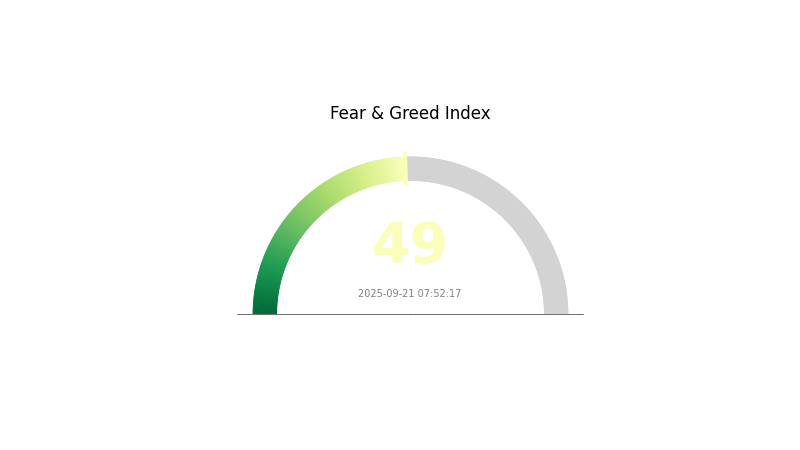

Chỉ báo tâm lý thị trường JST

Chỉ số Fear and Greed ngày 21 tháng 09 năm 2025: 49 (Trung lập)

Bấm xem chỉ số Fear & Greed hiện tại

Tâm lý thị trường tiền mã hóa hôm nay ở mức cân bằng, chỉ số Fear and Greed 49 phản ánh trạng thái trung lập. Nhà đầu tư không thiên về lạc quan hoặc bi quan. Tuy vẫn cần thận trọng, mức chỉ số này mở ra cơ hội giao dịch chiến lược. Nhà giao dịch trên Gate.com nên theo dõi sát diễn biến thị trường và nghiên cứu kỹ trước khi đầu tư trong bối cảnh ổn định nhưng tiềm ẩn biến động.

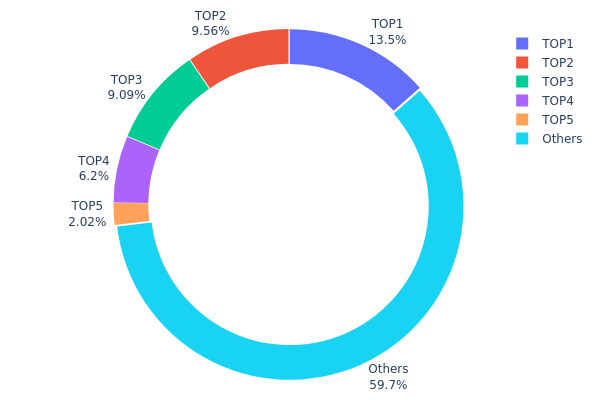

Phân bổ sở hữu JST

Dữ liệu phân bổ JST cho thấy cấu trúc sở hữu tập trung ở mức vừa phải: 5 địa chỉ lớn nhất nắm giữ 40,32% tổng cung JST, địa chỉ lớn nhất chiếm 13,45%. Nhóm người nắm giữ lớn này tạo ảnh hưởng đáng kể với thị trường mã thông báo JST.

Dù không quá tập trung, sự phân bổ này có thể tác động đến biến động giá, khi người nắm giữ lớn thực hiện giao dịch quy mô lớn. Đồng thời, nguy cơ thao túng giá cũng cần được giám sát, dù chưa đến mức ảnh hưởng tới minh bạch thị trường.

Tổng cộng, phân bổ JST cho thấy mức phi tập trung trung bình, cân bằng giữa các nhà đầu tư lớn và đông đảo người nắm giữ nhỏ. Hệ sinh thái trên chuỗi JST khá ổn định, nhưng vẫn cần theo dõi sát hoạt động của nhóm người nắm giữ lớn để kiểm soát rủi ro biến động giá.

Bấm để xem phân bổ sở hữu JST mới nhất

| Top | Địa chỉ | Số lượng nắm giữ | Tỷ lệ nắm giữ (%) |

|---|---|---|---|

| 1 | TPyjyZ...kgNan5 | 1.332.133,32K | 13,45% |

| 2 | TDw3sd...7L4x2p | 946.802,33K | 9,56% |

| 3 | TXk9Ln...9M4ZD6 | 900.011,77K | 9,09% |

| 4 | TASUAU...F4NKot | 613.936,45K | 6,20% |

| 5 | TSFUtq...WuT6h9 | 200.000,01K | 2,02% |

| - | Khác | 5.907.116,12K | 59,68% |

II. Các yếu tố chính ảnh hưởng giá JST trong tương lai

Cơ chế nguồn cung

- Tổng cung: JST có nguồn cung cố định là 9.900.000.000 mã thông báo.

- Tác động hiện tại: Nguồn cung cố định tạo khả năng khan hiếm và duy trì ổn định giá dài hạn.

Động lực tổ chức và cá mập

- Tiếp nhận doanh nghiệp: JUST Network, nền tảng phát triển JST, được cộng đồng DeFi quan tâm rộng rãi.

Yếu tố kinh tế vĩ mô

- Tính phòng ngừa lạm phát: Nhiều nhà đầu tư xem JST là công cụ phòng ngừa lạm phát tương tự các mã thông báo DeFi khác.

Phát triển kỹ thuật & hệ sinh thái

- Tích hợp hệ sinh thái TRON: Sự phát triển mạnh mẽ của TRON giúp JST hưởng lợi.

- Ứng dụng DeFi: JUST Network cung cấp dịch vụ cho vay stablecoin và nhiều tiện ích DeFi, thúc đẩy giá trị JST.

III. Dự báo giá JST 2025-2030

Triển vọng 2025

- Dự báo thận trọng: 0,01865 - 0,03391 USD

- Dự báo trung lập: 0,03391 - 0,03662 USD

- Dự báo lạc quan: 0,03662 - 0,03934 USD (yếu tố tích cực từ tâm lý thị trường và hệ sinh thái JST)

Triển vọng 2027-2028

- Giai đoạn tăng trưởng kỳ vọng, số người dùng tăng nhanh

- Dự báo giá:

- 2027: 0,03172 - 0,04526 USD

- 2028: 0,02977 - 0,05691 USD

- Yếu tố thúc đẩy: Mở rộng tiện ích JST, phục hồi thị trường crypto

Triển vọng dài hạn 2029-2030

- Kịch bản cơ bản: 0,04179 - 0,05639 USD (hệ sinh thái phát triển ổn định)

- Kịch bản lạc quan: 0,05639 - 0,06618 USD (JST được mở rộng và thị trường thuận lợi)

- Kịch bản đột phá: Trên 0,06618 USD (JST đổi mới vượt trội và được chấp nhận rộng rãi)

- Ngày 21 tháng 09 năm 2030: JST trung bình dự báo đạt 0,05337 USD, tiềm năng tăng trưởng mạnh.

| Năm | Giá dự báo tối đa | Giá dự báo trung bình | Giá dự báo tối thiểu | Biến động (%) |

|---|---|---|---|---|

| 2025 | 0,03934 | 0,03391 | 0,01865 | 0 |

| 2026 | 0,04798 | 0,03662 | 0,02637 | 8 |

| 2027 | 0,04526 | 0,0423 | 0,03172 | 24 |

| 2028 | 0,05691 | 0,04378 | 0,02977 | 29 |

| 2029 | 0,05639 | 0,05035 | 0,04179 | 48 |

| 2030 | 0,06618 | 0,05337 | 0,04376 | 57 |

IV. Chiến lược đầu tư và quản trị rủi ro JST chuyên nghiệp

Phương pháp đầu tư JST

(1) Chiến lược nắm giữ dài hạn

- Phù hợp với nhà đầu tư thận trọng muốn tăng trưởng ổn định

- Khuyến nghị:

- Tích lũy JST khi thị trường giảm sâu

- Xác định thời gian nắm giữ từ 2-5 năm

- Lưu trữ JST ở ví phần cứng an toàn

(2) Chiến lược giao dịch chủ động

- Công cụ phân tích kỹ thuật:

- Đường trung bình động (MA): Sử dụng MA 50 và MA 200 ngày nhận diện xu hướng

- RSI: Theo dõi trạng thái quá mua/quá bán

- Lưu ý khi giao dịch ngắn hạn:

- Thiết lập lệnh cắt lỗ hạn chế thua lỗ

- Chốt lời theo giá mục tiêu

Khung quản trị rủi ro JST

(1) Nguyên tắc phân bổ tài sản

- Nhà đầu tư thận trọng: 1-3% danh mục tiền mã hóa

- Nhà đầu tư mạo hiểm: 5-8%

- Nhà đầu tư chuyên nghiệp: 10-15%

(2) Giải pháp phòng ngừa rủi ro

- Đa dạng hóa: Phân bổ vào nhiều mã thông báo DeFi khác

- Lệnh cắt lỗ: Chủ động để hạn chế rủi ro

(3) Giải pháp lưu trữ an toàn

- Ví nóng: Gate Web3 Wallet

- Ví lạnh: Ví phần cứng cho lưu trữ dài hạn

- Bảo mật: Bật xác thực 2 lớp, dùng mật khẩu chuyên biệt

V. Rủi ro và thách thức tiềm ẩn đối với JST

Rủi ro thị trường JST

- Biến động giá lớn đặc trưng thị trường crypto

- Rủi ro thanh khoản: Khó giao dịch quy mô lớn

- Cạnh tranh: Dự án DeFi mới nổi có thể ảnh hưởng thị phần JST

Rủi ro pháp lý JST

- Thiếu ổn định pháp lý: Chính sách toàn cầu biến động ảnh hưởng JST

- Khó khăn tuân thủ: Yêu cầu pháp lý liên tục thay đổi ở các thị trường

- Vấn đề thuế: Chính sách thuế DeFi chưa rõ ràng ở nhiều quốc gia

Rủi ro kỹ thuật JST

- Lỗ hổng hợp đồng thông minh: Nguy cơ bị khai thác hoặc lỗi

- Vấn đề mở rộng: Khó xử lý khi tải mạng tăng cao

- Giới hạn tương tác: Hạn chế chức năng liên chuỗi

VI. Kết luận và khuyến nghị hành động

Đánh giá giá trị đầu tư JST

JST có tiềm năng dài hạn trong DeFi, nhưng đối mặt với biến động ngắn hạn và rủi ro pháp lý. Hệ sinh thái TRON là nền tảng hỗ trợ JST phát triển vững chắc.

Khuyến nghị đầu tư JST

✅ Người mới: Bắt đầu bằng đầu tư nhỏ định kỳ để xây dựng vị thế ✅ Nhà đầu tư nhiều kinh nghiệm: Kết hợp nắm giữ và giao dịch chủ động để tối ưu lợi nhuận ✅ Tổ chức: Xem xét hợp tác chiến lược và tham gia gửi staking quy mô lớn

Phương thức tham gia giao dịch JST

- Giao dịch giao ngay: Mua bán JST tại thị trường giao ngay Gate.com

- Gửi staking: Tham gia chương trình gửi staking JST nhận thu nhập thụ động

- Tích hợp DeFi: Sử dụng JST trên JUST để vay và cho mượn tài sản

Đầu tư tiền mã hóa rủi ro cực kỳ cao. Bài viết không mang tính tư vấn đầu tư. Nhà đầu tư cần tự đánh giá khả năng chịu rủi ro. Nên tham vấn chuyên gia tài chính trước khi quyết định. Không nên đầu tư vượt quá khả năng chấp nhận thua lỗ của cá nhân.

FAQ

Dự báo giá JST năm 2030 là bao nhiêu?

Phân tích dữ liệu lịch sử cho thấy JST có thể đạt khoảng 0,3849 USD vào năm 2030, tiềm năng tăng trưởng dài hạn mạnh mẽ.

Đồng tiền mã hóa nào được dự báo tăng 1000 lần?

Các đồng dự báo tăng trưởng 1000 lần năm 2025 gồm: $HYPER, $PEPENODE, $MAXI. Dự báo dựa trên xu hướng thị trường và các yếu tố tăng trưởng tiềm năng.

Jupiter Coin có thể đạt 1 USD không?

Jupiter Coin có thể đạt mốc 1 USD nếu thị trường thuận lợi và được nhà đầu tư duy trì quan tâm. Chuyên gia dự báo kịch bản này khả thi. Xu hướng hiện tại cho thấy mục tiêu này có thể đạt được.

Hamster Coin có thể đạt 1 USD không?

Khả năng này rất thấp. Theo dự báo hiện tại, giá cao nhất của Hamster Coin đến năm 2050 chỉ khoảng 0,0000000009538 USD, thấp hơn hẳn mức 1 USD.

Mời người khác bỏ phiếu

Nội dung