Previsão de Preço FIR para 2025: Análise Abrangente das Tendências de Mercado e Perspetivas Futuras para a Tecnologia FIR

Introdução: Posição de Mercado e Valor de Investimento da FIR

Fireverse (FIR), enquanto plataforma descentralizada para criação musical baseada em IA e tecnologia blockchain, tem consolidado progressos significativos desde o seu lançamento. Em 2025, a capitalização bolsista da Fireverse atingiu 14 416 308 $, com uma oferta circulante de cerca de 174 110 000 tokens FIR e um preço a rondar os 0,0828 $. Este ativo, reconhecido como o "catalisador da revolução musical Web3", assume um papel cada vez mais central na transformação da produção e monetização musical.

O presente artigo apresenta uma análise abrangente da evolução do preço da Fireverse entre 2025 e 2030, combinando padrões históricos, dinâmica de mercado, desenvolvimento do ecossistema e fatores macroeconómicos, com o objetivo de fornecer aos investidores previsões profissionais e estratégias de investimento concretas.

I. Revisão Histórica do Preço da FIR e Estado Atual do Mercado

Evolução Histórica do Preço da FIR

- 2025: Lançamento inicial a 8 de agosto; preço de arranque em 0,05 $ (mínimo histórico)

- 2025: Alcançou o máximo histórico de 0,13662 $ a 19 de agosto, um acréscimo de 173%

- 2025: Mercado estabilizado, com o preço a oscilar entre 0,08 $ e 0,09 $ nos meses recentes

Situação Atual de Mercado da FIR

A 7 de outubro de 2025, a FIR transaciona-se a 0,0828 $, com um volume de negociação nas últimas 24 horas de 158 893,27 $. O token registou uma ligeira correção de 1,8% nesse período. A capitalização bolsista da FIR é atualmente de 14 416 308 $, posicionando-a em 1248 a nível global no universo das criptomoedas. A oferta circulante é de 174 110 000 FIR, representando 17,41% da oferta total de 1 000 000 000 tokens. Apesar da recente descida, a FIR evidenciou resiliência, com uma valorização de 22,13% ao longo do último ano, o que demonstra potencial de crescimento sustentado.

Consulte o preço de mercado da FIR em tempo real

Indicador de Sentimento de Mercado da FIR

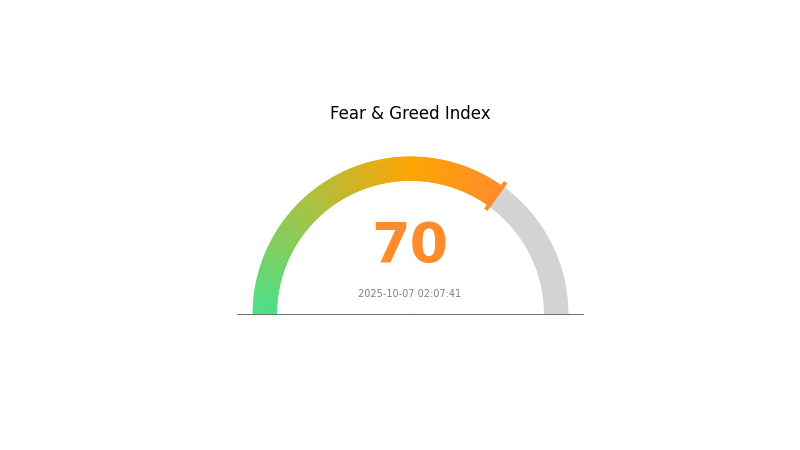

2025-10-07 Índice Fear and Greed: 70 (Ganância)

Consulte o Fear & Greed Index atualizado

O mercado das criptomoedas atravessa atualmente uma fase de otimismo acentuado, com o Índice Fear and Greed nos 70 pontos, refletindo "Ganância". Este valor indica confiança e postura bullish dos investidores quanto às perspetivas do setor. No entanto, importa recordar que níveis extremos de ganância podem originar sobreavaliação e volatilidade mais elevada. Recomenda-se cautela e diversificação de carteira para uma gestão de risco eficaz. Como sempre, é fundamental realizar uma análise rigorosa e tomar decisões informadas em função dos objetivos individuais e do perfil de risco.

Distribuição de Detenções FIR

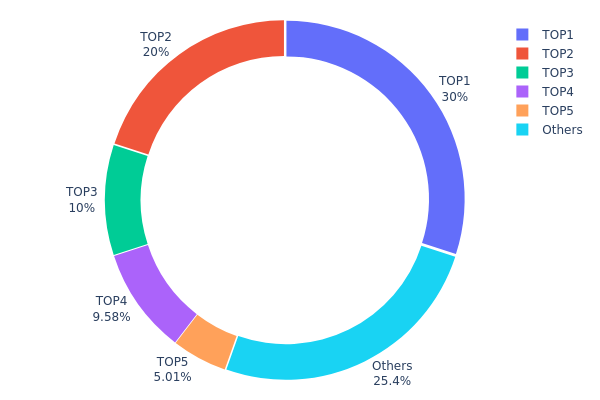

Os dados da distribuição por endereços revelam uma forte concentração dos tokens FIR em poucas carteiras. O maior detentor controla 30% da oferta total, enquanto os três principais endereços concentram 60% do total de tokens FIR. Esta concentração acentuada levanta preocupações sobre potencial manipulação de mercado e centralização de poder no ecossistema FIR.

Uma distribuição tão concentrada pode aumentar a volatilidade dos preços, pois os principais detentores conseguem influenciar significativamente o mercado com as suas movimentações. Além disso, tal concentração pode comprometer os objetivos de descentralização do projeto, dado que poucas entidades poderão exercer influência desproporcionada nas decisões de governação e funcionamento da rede.

Apesar destas reservas, destaca-se que 25,42% dos tokens estão distribuídos por "Outros", refletindo alguma participação mais abrangente. No entanto, o padrão global de distribuição sugere que a estrutura on-chain da FIR é menos robusta e mais vulnerável a movimentos de grande escala por parte dos principais detentores.

Consulte a Distribuição de Detenções FIR atual

| Top | Endereço | Quantidade em posse | Percentagem em posse (%) |

|---|---|---|---|

| 1 | 0x04f7...47c2ec | 300 000,00K | 30,00% |

| 2 | 0x1804...6bf7a1 | 200 000,00K | 20,00% |

| 3 | 0x278f...1f659c | 100 000,00K | 10,00% |

| 4 | 0x21c8...22aecd | 95 833,33K | 9,58% |

| 5 | 0x4bcb...5f2b6e | 50 056,67K | 5,00% |

| - | Outros | 254 110,00K | 25,42% |

II. Principais Fatores que Influenciam o Preço Futuro da FIR

Mecanismo de Oferta

- Tendências de Mercado: Os movimentos do preço da FIR apresentam elevada correlação com as tendências globais do mercado cripto.

- Impacto Atual: A dinâmica de oferta deverá condicionar a evolução dos preços no curto prazo.

Dinâmica Institucional e de Grandes Detentores

- Detenções Institucionais: Instituições de referência e grandes investidores detêm posições relevantes em FIR.

- Principais Endereços: As movimentações dos grandes detentores nos endereços principais influenciam diretamente as oscilações de preço.

Contexto Macroeconómico

- Impacto da Política Monetária: As decisões de taxas de juro da Reserva Federal deverão afetar o preço da FIR.

- Características de cobertura contra a inflação: A FIR pode ser considerada um potencial ativo de cobertura contra inflação.

- Fatores Geopolíticos: O panorama económico global e os eventos geopolíticos poderão impactar o desempenho de mercado da FIR.

Desenvolvimento Técnico e Construção do Ecossistema

- Integração de IA: A integração da IA no universo Web3 terá impacto estrutural no ecossistema da FIR nos próximos 3 a 5 anos.

- Aplicações no Ecossistema: A evolução das DApps e dos projetos associados será determinante para a valorização da FIR.

III. Previsão de Preço FIR para 2025-2030

Perspetiva para 2025

- Previsão conservadora: 0,05958 $ - 0,07 $

- Previsão neutra: 0,07 $ - 0,09 $

- Previsão otimista: 0,09 $ - 0,0993 $ (dependente de contexto de mercado favorável)

Perspetiva para 2027-2028

- Expectativa de fase de mercado: Potencial ciclo de crescimento com volatilidade acrescida

- Intervalo de preço previsto:

- 2027: 0,05707 $ - 0,14418 $

- 2028: 0,0965 $ - 0,12582 $

- Principais catalisadores: Tendências globais do mercado cripto, progresso do projeto e taxa de adoção

Perspetiva de Longo Prazo para 2030

- Cenário base: 0,11 $ - 0,14 $ (assumindo crescimento estável do mercado)

- Cenário otimista: 0,14 $ - 0,17832 $ (com desempenho robusto do projeto e contexto favorável)

- Cenário transformador: 0,18 $+ (em condições extremamente favoráveis e adoção ampla)

- 2030-12-31: FIR 0,12647 $ (previsão média, evidenciando forte potencial de valorização)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,0993 | 0,08275 | 0,05958 | 0 |

| 2026 | 0,10923 | 0,09103 | 0,07646 | 9 |

| 2027 | 0,14418 | 0,10013 | 0,05707 | 20 |

| 2028 | 0,12582 | 0,12216 | 0,0965 | 47 |

| 2029 | 0,12895 | 0,12399 | 0,11903 | 49 |

| 2030 | 0,17832 | 0,12647 | 0,08979 | 52 |

IV. Estratégias de Investimento Profissional e Gestão de Risco para FIR

Metodologia de Investimento FIR

(1) Estratégia de Detenção Prolongada

- Indicada para: Investidores de perfil de maior tolerância ao risco e convicção no ecossistema musical Web3

- Recomendações operacionais:

- Acumular tokens FIR em períodos de correção

- Acompanhar o desenvolvimento da plataforma Fireverse

- Armazenar tokens em carteira não custodiante

(2) Estratégia de Negociação Ativa

- Ferramentas de análise técnica:

- Médias móveis: Identificar tendências e potenciais pontos de inversão

- RSI: Monitorizar situações de sobrecompra/sobrevenda

- Pontos-chave para operações de swing trading:

- Definir pontos de entrada e saída com base em indicadores técnicos

- Acompanhar notícias do ecossistema Fireverse para antecipar catalisadores de preço

Estrutura de Gestão de Risco FIR

(1) Princípios de Alocação de Ativos

- Investidores cautelosos: 1-3% da carteira cripto

- Investidores mais agressivos: 5-10% da carteira cripto

- Investidores profissionais: Até 15% da carteira cripto

(2) Soluções de Cobertura de Risco

- Diversificação: Equilibrar FIR com outros ativos digitais e investimentos tradicionais

- Ordens de stop-loss: Implementar para limitar perdas potenciais

(3) Soluções de Armazenamento Seguro

- Carteira quente recomendada: Gate Web3 Wallet

- Armazenamento frio: Carteira hardware para conservação prolongada

- Medidas de segurança: Ativar autenticação de dois fatores, utilizar palavras-passe robustas e atualizar regularmente o software

V. Riscos e Desafios Potenciais para FIR

Riscos de Mercado FIR

- Volatilidade: As oscilações do mercado cripto podem originar variações expressivas de preço

- Concorrência: Plataformas concorrentes de música alimentadas por IA podem surgir

- Adoção: Uma adoção limitada pode comprometer o valor do token

Riscos Regulatórios FIR

- Regulamentação incerta: Alterações na legislação cripto podem afetar o funcionamento da Fireverse

- Questões de direitos de autor: Possíveis litígios relacionados com música gerada por IA

- Classificação do token: Risco de a FIR ser considerada valor mobiliário

Riscos Técnicos FIR

- Vulnerabilidades dos smart contracts: Possibilidade de exploits ou falhas no código base

- Desafios de escalabilidade: A Fireverse pode enfrentar limitações com aumento do número de utilizadores

- Limitações da IA: A qualidade e originalidade da música gerada por IA pode ser contestada

VI. Conclusão e Recomendações Práticas

Avaliação do Potencial de Investimento FIR

Fireverse (FIR) representa uma abordagem disruptiva à produção e monetização musical no contexto Web3. Apesar do potencial a longo prazo para transformar a indústria, existem riscos de curto prazo como a volatilidade dos mercados, incerteza regulatória e necessidade de adoção massificada.

Recomendações de Investimento FIR

✅ Iniciantes: Iniciar com posições reduzidas e focar no conhecimento do ecossistema Fireverse ✅ Investidores experientes: Adotar uma estratégia equilibrada, alocando de acordo com o perfil de risco do investidor e convicção nas soluções musicais de IA ✅ Investidores institucionais: Realizar uma análise rigorosa e ponderar FIR numa carteira cripto diversificada

Formas de Participação na Negociação FIR

- Negociação à vista: Comprar e vender tokens FIR em Gate.com

- Participação em programas de staking: Participar em programas de staking, se disponíveis, para obter recompensas adicionais

- Participação no ecossistema: Interagir com a plataforma Fireverse para conhecer o seu potencial e contribuir para o crescimento

Os investimentos em criptomoedas envolvem riscos muito elevados e este artigo não constitui aconselhamento financeiro. Os investidores devem tomar decisões ponderadas em função do seu perfil de risco e é recomendada a consulta a profissionais qualificados. Nunca invista mais do que aquilo que está preparado para perder.

FAQ

A Filecoin pode atingir 1 000 $ hoje?

Não, é altamente improvável que a Filecoin alcance 1 000 $ hoje. Um aumento tão significativo num só dia seria excecional e não corresponde ao atual contexto de mercado.

A FET pode chegar aos 5 $?

Segundo as projeções atuais, a FET deverá atingir um máximo de 1,74 $ em 2024. Atingir os 5 $ poderá ser possível a longo prazo, mas previsões para além de 2024 são bastante especulativas.

Até onde pode subir a FLR?

A FLR pode atingir 0,05 $-0,10 $ em 2025, com possibilidade de crescimento adicional no futuro. No entanto, os mercados cripto são caracterizados por elevada volatilidade e imprevisibilidade.

Que criptomoeda tem a previsão de preço mais elevada?

O Bitcoin apresenta a previsão de preço mais elevada, podendo alcançar 139 045 $ em 2025, face ao valor atual de cerca de 124 798 $.

Previsão do Preço do WLD em 2025: Análise das Tendências de Mercado e dos Potenciais Fatores de Crescimento para a WorldCoin

A Agenda 47 News Network (A47) é uma boa opção de investimento?: Análise dos retornos potenciais e dos riscos associados a investimentos em plataformas de media

Foxsy AI (FOXSY): será uma opção de investimento adequada?: Avaliação do potencial e dos riscos associados a esta criptomoeda de inteligência artificial emergente

A Agenda 47 News Network (A47) constitui uma boa oportunidade de investimento?: Análise do potencial e dos riscos associados a um projeto mediático polémico

Será ARAI (AA) uma opção de investimento recomendável?: Análise do potencial e dos riscos desta ação emergente de Inteligência Artificial

Pump.Fun (PUMP) Token: Nova Oportunidade de Jogos Web3 na Gate em 2025

Guia simplificado para a implementação de Account Abstraction: compreender o EIP 4337

Passos Detalhados para Integrar a Rede Polygon na Sua Carteira Web3

Reforce a proteção da sua carteira no ecossistema Web3

Plataformas de referência para negociação em redes descentralizadas

Compreender Zero-Knowledge Proofs: Guia aprofundado para inovadores Web3