2025年CORE価格予測:普及拡大に向けた成長ポテンシャルおよび市場要因の分析

2025年から2030年にかけてのCore DAO(CORE)の成長可能性を、過去の価格推移、市場動向、投資戦略の観点から分析します。COREの供給の仕組み、機関投資家による導入、マクロ経済要因がどのように影響するかも分析します。はじめに:COREの市場的地位と投資価値

Core DAO(CORE)はEVM互換のL1ブロックチェーンとして、設立以来大きな進展を遂げてきました。2025年時点でのCOREの時価総額は454,730,841ドル、流通供給量は約1,012,087,338トークン、価格は0.4493ドル前後で推移しています。同資産は「Satoshi Plus」コンセンサスメカニズムを特徴とし、EVMチェーンのコンポーザビリティとBitcoinの分散性・セキュリティを融合する上で、ますます重要な位置付けとなっています。

本記事では、2025年から2030年にかけてのCOREの価格動向を、過去の傾向、市場の需給バランス、エコシステムの発展、マクロ経済要因などを網羅的に分析し、投資家の皆様に専門的な価格予測および実践的な投資戦略を提供します。

I. COREの価格推移と現状分析

COREの過去価格推移

- 2023年:2月8日にCOREは史上最高値14.48ドルを記録し、重要な節目を迎える

- 2023年:市場全体の下落に伴い、11月3日に史上最安値0.2995ドルまで下落

- 2025年:価格は安定し、現在は0.4493ドルで推移。安値からの回復傾向を示す

COREの現状

2025年09月20日時点、COREは0.4493ドルで取引され、時価総額は454,730,841ドルです。過去24時間で0.79%の小幅な下落を記録し、短期的なボラティリティが見られます。過去1週間では6.31%とより大きな下落となり、中短期的には弱含みの展開となっています。

COREの流通供給量は1,012,087,338.42トークンで、総供給量2,100,000,000 COREの48.19%を占めます。この流通比率の低さは、今後追加供給による価格変動の余地を示唆しています。

24時間の取引高は194,585ドルと時価総額に対し低水準で、短期的な流動性や投資関心が限定的である可能性を示しています。

最近の下落基調にもかかわらず、現在価格は過去最安値0.2995ドルから大幅に回復しています。一方、史上最高値14.48ドルからは大きな乖離があるため、市場回復時には再度の成長余地があると考えられます。

現在のCORE市場価格はこちら

CORE市場センチメント指標

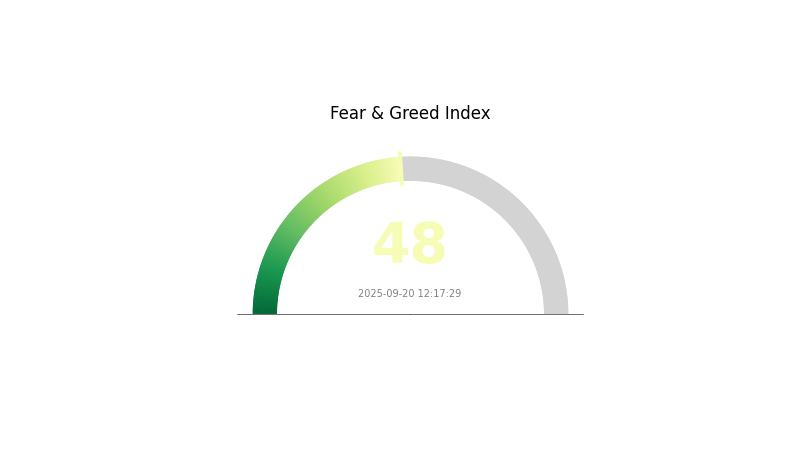

2025年09月20日 フィア&グリード指数:48(中立)

最新のフィア&グリード指数を見る

暗号資産市場のセンチメントは本日、フィア&グリード指数48と中立を維持しています。これは投資家の心理が過度に悲観的・楽観的のいずれにも偏っていないことを意味します。慎重な姿勢は依然必要ですが、中立的状況下では戦略的な取引判断の余地も広がります。必ずご自身で十分な調査とリスク評価を行い、暗号市場の価格変動リスクを理解したうえで投資判断を行ってください。

CORE保有分布

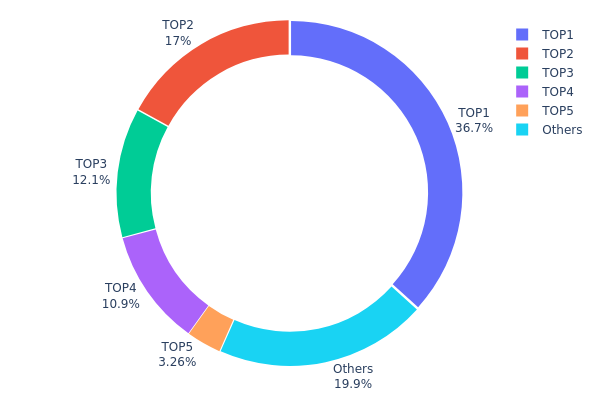

COREのアドレス保有状況を見ると、かなり集中した分布となっています。トップアドレスが36.08%を保有し、上位5アドレスで総供給量の78.73%を支配しています。こうした集中は、分散性や市場安定性への懸念材料です。

少数アドレスによる大口保有は、市場へのインパクトが大きく、ウォレットの動向ひとつで需給バランスと価格が急変するリスクを孕んでいます。また、こうした集中度は市場操作や価格コントロールのリスクも高めます。

現段階のCOREのオンチェーン状況は、分散性が低く不安定であることは否めません。今後トークン分布が広がることで改善される可能性もありますが、現時点では一部アドレスの行動がエコシステムや市場全体に過度な影響を与えるリスクが高いため、投資や取引の際には十分な注意が必要です。

最新のCORE保有分布状況はこちら

| 順位 | アドレス | 保有数量 | 保有比率(%) |

|---|---|---|---|

| 1 | 0x0000...001000 | 757,712.51K | 36.08% |

| 2 | 0x8605...f94f52 | 351,500.00K | 16.74% |

| 3 | 0x0000...001011 | 250,690.21K | 11.94% |

| 4 | 0x3073...e21838 | 226,000.00K | 10.76% |

| 5 | 0xedd1...916de0 | 67,381.47K | 3.21% |

| - | その他 | 411,378.21K | 21.27% |

II. CORE価格に影響を与える主な要因

供給メカニズム

- トークンバーン:COREはバーン(焼却)メカニズムを導入し、供給量の抑制による価格維持策を講じています。

- 価格への影響:バーンによるデフレ圧力は、長期的な価格上昇を後押しする可能性があります。

機関投資家・大口勢の動向

- 企業による採用:加盟店でのCORE導入が進めば需要増となり、価格上昇要因となります。

マクロ経済環境

- インフレヘッジ機能:インフレ環境下では、他の暗号資産同様、COREも価値保存手段として注目される可能性があります。

技術・エコシステム拡充

- エコシステムアプリケーション:多数のDAppやプロジェクトが普及し、ユーティリティ・価値向上につながっています。

III. 2025~2030年のCORE価格予測

2025年予測

- 保守的:0.32814~0.4495ドル

- 中立:0.4495~0.55ドル

- 強気:0.55~0.65178ドル(市場回復と採用拡大が条件)

2027年予測

- 市場局面:ボラティリティを伴いつつ成長フェーズ入りを想定

- 価格レンジ予測:

- 2026年:0.31937~0.74887ドル

- 2027年:0.41584~0.90965ドル

- 主な要因:業界全体のトレンド、プロジェクト進捗、提携の進展など

2030年長期予測

- ベース:0.92886~1.00ドル(市場成長と普及が前提)

- 強気:1.00~1.06819ドル(好条件&プロジェクト成功時)

- 変革的:1.06819~1.20ドル(画期的なイノベーション・市場状況による)

- 2030年12月31日:CORE 1.06819ドル(現時点予測ピーク値)

| 年 | 予想最高値 | 予想平均 | 予想最安値 | 騰落率 |

|---|---|---|---|---|

| 2025 | 0.65178 | 0.4495 | 0.32814 | 0 |

| 2026 | 0.74887 | 0.55064 | 0.31937 | 22 |

| 2027 | 0.90965 | 0.64975 | 0.41584 | 44 |

| 2028 | 0.84988 | 0.7797 | 0.45223 | 73 |

| 2029 | 1.04293 | 0.81479 | 0.54591 | 81 |

| 2030 | 1.06819 | 0.92886 | 0.59447 | 106 |

IV. CORE向け投資戦略・リスク管理

CORE投資手法

(1) 長期保有戦略

- 対象:長期投資家・Core DAOの技術力を信頼する層

- 運用アドバイス:

- 市場下落局面で積極的にCOREを積み増し

- トークンを安全なウォレットに長期間保管

- Gate Web3ウォレットを活用しセキュリティ確保

(2) アクティブ運用戦略

- テクニカル分析:

- 移動平均線:トレンド転換点の把握

- RSI:過熱感のチェック

- スイングトレード要点:

- 明確なエントリー・イグジット戦略を設定

- ストップロス注文でリスク管理を徹底

COREリスク管理フレームワーク

(1) 資産配分基準

- 保守:暗号資産全体の1~3%

- 中庸:3~5%

- 積極:5~10%

(2) リスク分散・ヘッジ

- 分散投資でリスク低減

- ストップロスで損失限定

(3) セキュリティ対応

- ホットウォレット:Gate Web3ウォレット推奨

- コールドウォレット:大口保有はハードウェアに保管

- セキュリティ対策:2段階認証・強固なパスワード設定

V. COREのリスクと課題

COREの市場リスク

- ボラティリティ:価格変動幅が大きい

- 流動性:市場ストレス下で流動性が低下する可能性

- 競争:新規L1チェーンによるシェア侵食

COREの規制リスク

- 規制不透明:各国規制動向により市場環境が変化

- コンプライアンス:将来的な規制基準への適応リスク

- 地政学リスク:国際的緊張による市場影響

COREの技術リスク

- スマートコントラクト脆弱性:バグや悪用リスク

- スケーラビリティ:利用増加時のネットワーク混雑

- 合意形成メカニズム:「Satoshi Plus」実装に伴う不確実性

VI. 結論・アクションプラン

COREの投資価値評価

COREはEVM互換性とBitcoin由来の高セキュリティを両立しており、独自の価値を持ちます。一方、短期的な価格変動や規制動向には十分注意が必要です。

COREへの投資推奨

✅ 初心者:少額から始め、Core DAO技術への理解を深めましょう

✅ 経験者:COREと他主要コインとのバランス投資を推奨

✅ 機関投資家:入念なデューデリジェンスを行い、分散投資の一部として検討

COREの参加方法

- 現物取引:Gate.comでCORE売買

- ステーキング:各種ステーキングプログラムへの参加

- DeFi:Core DAO上の分散型金融サービスの利用

暗号資産投資は極めて高リスクです。本記事は投資アドバイスではありません。ご自身のリスク許容度に応じて十分にご判断ください。専門家の助言を推奨します。余剰資金以上の投資は絶対に避けてください。

FAQ

2025年のCORE価格は?

市場予測では、2025年のCORE価格は0.43~1.06ドルの範囲に収まり、最大144%の上昇が見込まれます。

2030年のCORE価格は?

年平均5%成長なら2030年時点でCore価格は0.5899ドル到達が見込まれます。

1000倍になる仮想通貨は?

Bitcoin Hyper($HYPER)が1000倍になると予想されています。これはBitcoinのレイヤー2として、取引速度と拡張性の大幅な向上を目指しています。

COREコインはいくらになる?

市場動向を踏まえた場合、2025年にはCOREコインが1.50~2.00ドルの価格に達する可能性があり、成長が期待されています。

共有

内容