Прогноз ціни COMP на 2025 рік: чи зможе токен Compound Finance встановити нові рекорди на ринку DeFi?

Вступ: Ринкова позиція COMP та його інвестиційна привабливість

Compound (COMP) — децентралізований протокол грошового ринку, створений на основі блокчейна Ethereum, який із 2020 року демонструє впевнене зростання. Станом на 2025 рік ринкова капіталізація Compound досягла 420 021 716 доларів США, в обігу перебуває приблизно 9 468 478 токенів, а ціна становить близько 44,36 долара. Цей актив, який називають «піонером DeFi», стає дедалі вагомішим гравцем у сфері децентралізованих фінансів.

Матеріал пропонує комплексний аналіз динаміки цін Compound у період із 2025 по 2030 роки, враховуючи історичні тенденції, ринкову пропозицію та попит, розвиток екосистеми й макроекономічні чинники, щоб надати професійний прогноз курсу й практичні стратегії для інвесторів.

I. Огляд історії ціни та поточного стану ринку COMP

Еволюція ціни COMP

- 2020: Старт COMP, початкова ціна — 244,5 долара

- 2021: Історичний максимум — 910,54 долара, досягнутий 12 травня

- 2023: Історичний мінімум — 25,74 долара, зафіксований 11 червня

Поточна ситуація на ринку COMP

Станом на 20 вересня 2025 року ціна COMP становить 44,36 долара. За останні 24 години токен знизився на 0,96%. Ринкова капіталізація — 420 021 716 доларів, а за обсягом ринку проєкт посідає 195 місце. Кількість токенів в обігу — 9 468 478, це 94,68% від загальної емісії у 10 мільйонів токенів.

Динаміка ціни COMP у різних часових періодах є неоднозначною. За годину — падіння на 0,02%, за тиждень — зниження на 7,58%. За 30 днів токен подешевшав на 2,55%. Водночас, за рік COMP продемонстрував позитивне зростання на 0,89%.

Історичний максимум — 910,54 долара був у травні 2021 року, мінімум — 25,74 долара у червні 2023 року. Зараз COMP торгується на рівні приблизно 4,87% від максимуму та на 172,34% вище мінімального значення.

Перегляньте актуальну ринкову ціну COMP

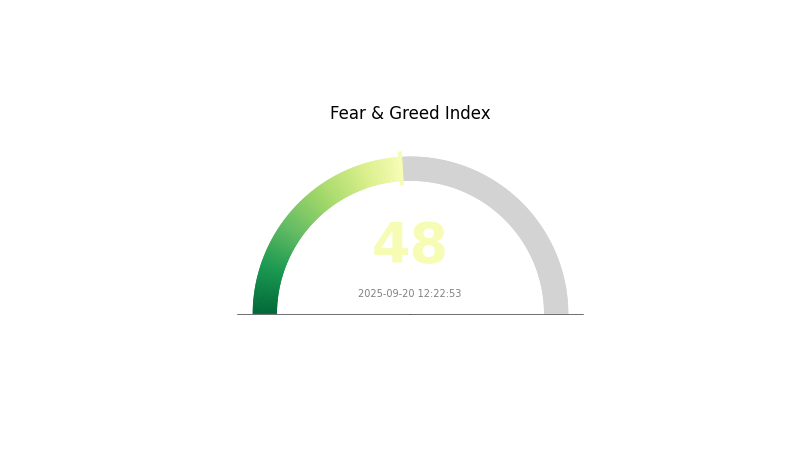

Індикатор ринкових настроїв COMP

20 вересня 2025 року: Індекс страху та жадібності — 48 (нейтральний)

Перегляньте поточний Індекс страху та жадібності

Станом на сьогодні ринкові настрої щодо COMP залишаються нейтральними — Індекс страху та жадібності становить 48. Це свідчить про баланс між стриманістю та оптимізмом серед інвесторів. Ринок не демонструє надмірного ентузіазму чи паніки. Трейдерам варто зберігати обачність і диверсифікувати портфель, уважно відстежуючи ринкові події та новини, що здатні вплинути на настрої. Перед будь-якими інвестиційними рішеннями слід ретельно аналізувати ринок.

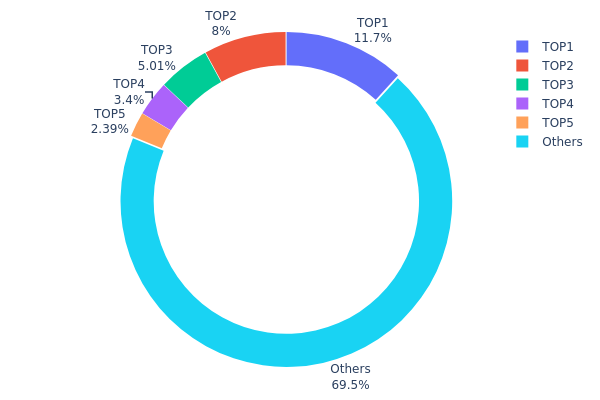

Розподіл володінь COMP

Аналіз розподілу токенів COMP за адресами свідчить про помірну концентрацію серед найбільших власників: топ-5 адрес контролюють 30,5% від усього обсягу COMP, а найбільший власник — 11,72%. Така концентрація характерна для крипторинку, але не є надмірною.

Важливу частку зосереджено на найбільших адресах, але 69,5% токенів розподілені між іншими учасниками, що забезпечує достатню диверсифікацію. Подібна структура володіння відображає баланс між впливовими інвесторами та широким ринком. Однак активність великих власників може посилювати волатильність чи впливати на управління Compound.

Поточний розподіл є достатньо децентралізованим, що сприяє стабільності та стійкості екосистеми COMP. Домінування окремих гравців не є критичним, а ринок залишається достатньо стійким до маніпуляцій.

Дивіться актуальний розподіл COMP

| Топ | Адреса | Токенів у власності | Частка (%) |

|---|---|---|---|

| 1 | 0x73af...54d935 | 1 172,70K | 11,72% |

| 2 | 0xf977...41acec | 800,00K | 8,00% |

| 3 | 0x3d98...c9cd3b | 500,80K | 5,00% |

| 4 | 0x0872...0eca80 | 340,48K | 3,40% |

| 5 | 0x841e...f13a34 | 238,73K | 2,38% |

| - | Інші | 6 947,28K | 69,5% |

II. Визначальні фактори, що впливають на майбутню ціну COMP

Механізм пропозиції

- Модель cToken: Користувачі отримують cToken, що відображає їхню долю при депонуванні активів.

- Сучасний вплив: Модель cToken стимулює використання та попит, впливаючи на вартість COMP.

Динаміка інституційних інвесторів та «китів»

- Корпоративна участь: Compound — ключовий гравець у DeFi-кредитуванні, що стає дедалі цікавішим для інституційних інвесторів.

Макроекономічна ситуація

- Захист від інфляції: COMP як DeFi-актив може виступати інструментом хеджування інфляційних ризиків.

- Геополітичні чинники: Регуляторні зміни у різних юрисдикціях істотно впливають на вартість та впровадження COMP.

Технологічний розвиток та зміцнення екосистеми

- Апгрейди управління: Власники COMP голосують за ключові параметри, безпосередньо впливаючи на розвиток платформи.

- Екосистемні застосування: Кредитний ринок Compound — основа його цінності, зростання депозитів і обсягів транзакцій позитивно впливає на курс COMP.

III. Прогноз ціни COMP на 2025–2030 роки

Прогноз на 2025 рік

- Консервативний: 35,03–40,00 доларів

- Нейтральний: 40,00–50,00 доларів

- Оптимістичний: 50,00–63,85 долара (за умови потужного розвитку DeFi та відновлення ринку)

Прогноз на 2027–2028 роки

- Можливий період «бичачого» ринку

- Ціновий діапазон:

- 2027: 31,09–66,70 долара

- 2028: 38,82–80,10 доларів

- Головні драйвери: зростання DeFi-екосистеми, інституційна участь, загальні настрої крипторинку

Довгостроковий прогноз на 2029–2030 роки

- Базовий сценарій: 70,86–86,09 долара (стабільне зростання DeFi та криптоіндустрії)

- Оптимістичний: 86,09–101,33 долара (прискорена інтеграція DeFi, сприятлива регуляторна політика)

- Трансформаційний: 101,33–107,62 долара (COMP стає лідером DeFi)

- 31 грудня 2030 року: максимальний прогноз — 107,62 долара

| Рік | Максимальна ціна | Середня ціна | Мінімальна ціна | Зміна (%) |

|---|---|---|---|---|

| 2025 | 63,8496 | 44,34 | 35,0286 | 0 |

| 2026 | 58,96333 | 54,0948 | 40,5711 | 21 |

| 2027 | 66,7043 | 56,52907 | 31,09099 | 27 |

| 2028 | 80,10169 | 61,61668 | 38,81851 | 38 |

| 2029 | 101,33 | 70,85918 | 55,97876 | 59 |

| 2030 | 107,62 | 86,09391 | 61,98761 | 94 |

IV. Комплексні інвестиційні стратегії та управління ризиками COMP

Підходи до інвестування в COMP

(1) Довгострокове зберігання

- Підійде довгостроковим інвесторам і прихильникам DeFi

- Стратегії:

- Нарощуйте позицію у COMP під час корекції ринку

- Участь у голосуваннях протоколу Compound для додаткових бонусів

- Зберігайте токени у надійних некостодіальних гаманцях

(2) Активна торгівля

- Інструменти аналізу:

- Ковзні середні — для виявлення тренду й можливих точок розвороту

- RSI — для оцінки перекупленості чи перепроданості

- Рекомендації для свінг-трейдингу:

- Слідкуйте за DeFi-новинами та оновленнями Compound

- Встановлюйте стоп-лосс для обмеження втрат

Система управління ризиками для COMP

(1) Принципи розподілу активів

- Консервативний портфель: 1–3%

- Агресивний портфель: 5–10%

- Професійний DeFi-портфель: до 15%

(2) Хеджування ризиків

- Диверсифікуйте вкладення між різними DeFi-протоколами

- Звертайтеся до фармінгу: використовуйте COMP у пулах ліквідності для додаткового доходу

(3) Безпечне зберігання активів

- Рекомендація для гарячого гаманця: Gate Web3 Wallet

- Апаратний гаманець — оптимальний варіант для довгострокового зберігання

- Обов’язково підключайте двофакторну автентифікацію та складні паролі

V. Основні ризики та виклики для COMP

Ринкові ризики Compound

- Висока волатильність: DeFi-токени характеризуються значними ціновими коливаннями

- Конкуренція: Нові DeFi-протоколи можуть знижувати частку Compound на ринку

- Ліквідність: У періоди ринкового стресу ймовірне падіння ліквідності

Регуляторна невизначеність

- Можливе посилення контролю над DeFi-сектором

- Потреба у постійній адаптації до нових глобальних вимог

- Юридичні ризики: ймовірність судових розглядів щодо DeFi-протоколів

Технічні ризики COMP

- Вразливість смарт-контрактів: ризики багів та експлойтів

- Масштабованість: перевантаження мережі Ethereum може ускладнювати користування протоколом

- Збої оракулів: некоректні цінові дані можуть порушити процеси кредитування та запозичення

VI. Висновки та дії

Оцінка інвестиційної привабливості COMP

COMP — один із ключових активів DeFi-кредитування з довгостроковим потенціалом. Водночас у короткостроковій перспективі слід враховувати підвищену волатильність і регуляторні ризики.

Інвестиційні поради щодо COMP

✅ Новачкам: Почніть із невеликих сум, приділяйте увагу вивченню механіки роботи DeFi

✅ Досвідченим: Виділіть частину портфеля для COMP у межах диверсифікації

✅ Інституційним: Додайте COMP до стратегії як один із диверсифікованих DeFi-активів

Способи взаємодії з COMP

- Холдинг: Придбати та тримати COMP з розрахунком на зростання ціни

- Участь в управлінні: Стейкати COMP для голосування щодо змін у протоколі

- Фармінг: Надавати ліквідність на ринках Compound та отримувати винагороду у COMP

Інвестиції у криптовалюти супроводжуються високими ризиками. Цей матеріал не є інвестиційною рекомендацією. Приймайте рішення обережно, враховуючи власну толерантність до ризику, та консультуйтеся з професійними фінансовими радниками. Не вкладайте більше, ніж готові втратити.

FAQ

Яким буде курс COMP у 2030 році?

За підсумками технічного аналізу та ринкових прогнозів, до кінця 2030 року ціна COMP може наблизитися до 426,78 долара.

Чи варто вкладати у COMP?

COMP є потенційно цікавим інструментом, але і ризикованим. Вартість токена залежить від темпів розвитку DeFi, волатильності ринку та регуляторних змін. Рекомендується диверсифікувати портфель для ефективного управління ризиками.

Чи є майбутнє у COMP?

COMP має сприятливі перспективи — експерти прогнозують значний приріст до 2030 року завдяки поточним ринковим тенденціям. Довгостроково цей цифровий актив виглядає привабливо.

Чи зможе COMP відновитися?

Токен COMP має потенціал для відновлення. Незважаючи на минулі складнощі, він демонструє ознаки зростання. Поточна ринкова ситуація сприяє обережному оптимізму, а подальший розвиток залежатиме від прозорості регулювання та масштабування впровадження.

Поділіться

Контент